Up, Up, Down, Down: Gold does its thing again in February as coal and uranium struggle

If you own gold right now, this is probably how productive you are on your work day. Pic: Getty Images

- Gold remains top of the rocks, hitting another fresh month-end high in February

- Rare earths and copper rack up consecutive monthly gains

- Coal and uranium prices off the boil as energy commodities flounder

WINNERS

Gold

Price: US$2834.55/oz

% Change: +0.8%

Gold closed at another month-end high, but had some serious heat taken out of it in the latter stages of the month.

Bullion has dominated the investment landscape this year, with bets of US$3000/oz from analysts and bank economists becoming commonplace as global geopolitical uncertainty showed no signs of abating in the context of a Trump presidency in the USA.

At least some of the froth came from fears tariffs could be put in place, with a run on vaults at the Bank of England to transfer bars to the premium US market as traders tried to front run any major cost increases.

Some analysts have been even more bullish, with Victor Smorgon Group’s Cameron Judd suggesting US$3600/oz could be on the cards.

While heat was taken out of the market in late Feb, a weaker US manufacturing PMI saw the US dollar drop and gold rally in early March along with fears around the introduction of tariffs on Canadian, Mexican and Chinese products. Bullion surged back to US$2880/oz on Monday.

UP

- Gold demand hit a new peak in 2024 according to the World Gold Council of 4974t as central bank demand remained above 1000t for the third straight year and investment demand surged 25% to 1180t.

- Leading Perth dealmaker Liam Twigger said gold is now the second largest store of value in central banks – above the Euro, Yen and Pound – predicting a 10 year bull run.

- Canaccord’s gold expert Tim McCormack says miners remain undervalued, predicting a move of generalist funds into gold could send equity valuations 50-100% higher.

DOWN

- Aussie dollar gold prices above $4600/oz should float all boats. But performance remains important – mild half year financial results from Bellevue Gold (ASX:BGL) and Westgold Resources (ASX:WGX) are cases in point.

- The last week in February was the worst in three months for gold, showing the volatility that still exists in the market.

READ

Gold Digger: What does a world of US$3000/oz gold mean for the ASX’s new junior gold darlings?

Rare Earths (NdPr Oxide)

Price: US$60.72/kg

% Change: +6.53%

It’s far too early to call a turnaround in the downtrodden rare earths sector.

But we have opened 2025 with two straight months of gains for NdPr, the premier magnet metals product, as China takes fresh steps to restrain its dominant State-sponsored suppliers.

New regulations proposed late in February could see the Middle Kingdom grasp yet more control over supply it already monitors via a production quota system, which has seen it accused by Western governments and miners of using to artificially depress prices as many of its producers operate at a loss.

The flipside is that demand growth has been weak, especially with consumer goods that use rare earths like air conditioners impacted by China’s hampered economy and property market.

Broader interest has come from Donald Trump’s pitch to claim “rare earths” mineral rights from Ukraine in a deal to support reputedly now paused military aid and a peace process amid Russia’s ongoing invasion.

There are, by the way, no known commercial sources of the 17 commodities critical to defence and modern technologies that make up the rare earths table in the embattled country.

We have plenty in Australia though, with Lynas (ASX:LYC) chief Amanda Lacaze and Resources Minister Madeleine King both suggested the Don would be better off looking over here.

“Our view would be very simple: the best way to get guaranteed supply in the West is to buy product from Lynas because we have it,” Lacaze said on an earnings call.

At the same time, Brazilian hopefuls have been looking to demonstrate their high-grade ionic clay projects could enter production and make money even at current depressed prices – with a Brazilian Critical Minerals (ASX:BCM) scoping study a case in point.

UP

- Governments in the west have shown a measure of determination to break China’s hold on the rare earths market, with Benchmark’s assessments showing 84% of the US$3.1bn committed to projects last year came from state sources.

- Andrew Forrest’s Wyloo Metals has salvaged Hastings Technology Metals’ (ASX:HAS) Yangibana project, taking a majority 60% share with an option to increase it to 70% in exchange for cancelling $220m in convertible note debt.

DOWN

- Lynas profits were decimated by lower rare earth prices in the first half, falling 85% to $5.9m.

- Shanghai Metals Market continues to report “wait and see sentiment” in the rare earth metals market, though terbium prices are rising rapidly on tight supply.

READ

High Voltage: Can government cash splash will rare earths mines into existence?

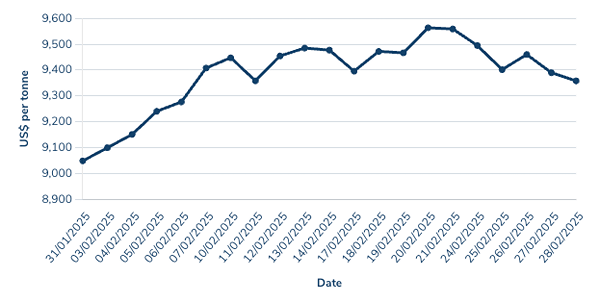

Copper

Price: US$9358/t

% Change: +3.43%

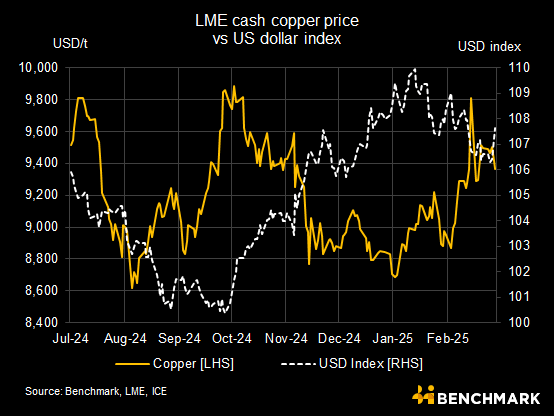

Copper prices lifted across February, but the real action was in the American market, where traders have been frontrunning potential announcements about copper tariffs.

They finally came, with a 270-day investigation launched into the country’s copper supply chain by the US Department of Commerce at the behest of the Trump Administration last week.

But Comex futures had already lifted as high as US$4.80/lb, a major premium to the LME three month price, as arbitrages emerged and the market swung wildly into backwardation (when cash prices exceed futures). Even the London cash price surged to close to US$10,000/t at one point.

They’ve since come under pressure from a stronger US dollar and the imposition of tariffs on Canada, Mexico and China by the US Government, expected to be a net negative for global economic growth, something the red metal thrives on.

Benchmark’s copper experts suggested copper tariffs are less certain than those proposed on other key commodities like steel and aluminium.

“Overall, we certainly cannot rule out prospective copper tariffs given the policy precedent set by President Trump in recent months,” they said in a note.

“However, such tariffs could turn out to be targeted and/or progressive in order to mitigate their inflationary side effects and could merely serve as a supplement to more effective policies aimed at bolstering supply chain security, such as export controls.”

But ANZ Research’s Daniel Hynes and Soni Kumari say demand side improvement, led by China, is actually behind the fundamental lift in copper prices, with two straight monthly gains.

“The ANZ Downstream Copper Demand Indicator shows positive growth, especially in grid infrastructure and electric vehicles, which use significantly more copper. Manufacturers, supported by recent stimulus measures, are ramping up production,” they said in a note last month.

“Our core view remains that the global economy will avoid recession in 2025. We also believe that the Trump presidency will ultimately be disruptive rather than destructive. Trump’s goals, namely a strong US economy and a strong stock market, run counter to any sustained trade war,” Hynes and Kumari added.

UP

- BHP’s (ASX:BHP) share of earnings derived from its copper mines has surged from 25% in H1FY24 to 39% in H1FY25, as the world’s biggest miners position themselves to become dominant suppliers in the red metal. It’s a show of support that the market will become increasingly valuable in an urbanising and electrifying world.

- A major blackout hit copper mines in Chile last week, threatening supply cuts from the top global producer.

DOWN

- Tariffs may stimulate investment in domestic capacity in the United States, but they could also hurt global economic growth, which would be detrimental for the metal known as Dr Copper for the uncanny way it diagnoses macro health.

- It remains slim pickings on the ASX for copper options, but they are out there. Maybe we can help.

READ

Copper explorers see rising tide as prices threaten to breakout

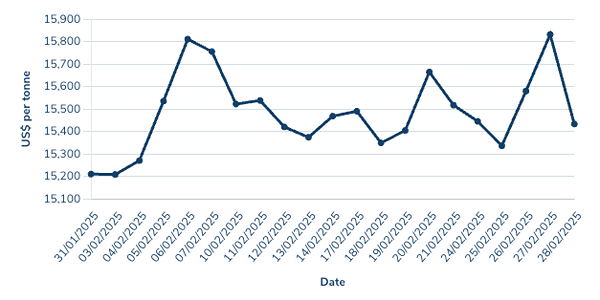

Nickel

Price: US$15,433/t

% Change: +1.47%

Nickel isn’t quite showing signs of life, but there could be reasons for more positivity than we’ve seen in some time.

If last year was annus horribilis for nickel and cobalt markets, major producers are now waking up to the need to restrict supply if they want their industries to profit.

In the DRC, where the country’s west is also riddled with rebel fighting, the cobalt oversupply situation driven by China’s CMOC has been reined in by its government, which has suspended exports for four months.

Indonesia may have to consider similar if not identical measures to protect some of its nickel producers. While its rush to dominate supply of the battery metal crushed prices, Macquarie’s nickel expert Jim Lennon now estimates half of its nickel pig iron furnaces are now under water.

UP

- Nickel producers in Indonesia, where a dramatic industrial expansion backed by Chinese capital has pushed the global market into oversupply, are beginning to struggle amid a prolonged price collapse. A major refinery (PT Gunbuster) linked to a collapsed Chinese entity has already started delaying payments to suppliers but is still reportedly operating.

- Anglo American sold its nickel business in Brazil for around US$500 million to China’s MMG, in a sign some major players see opportunities in the commodity’s long term future.

DOWN

- LFP batteries, which don’t use nickel in their cathode chemistry, captured 56% of the cathode market in 2024 as consumers chased cheaper vehicles which substituted range for affordability in the key Chinese market.

READ

High Voltage: Indonickel production quotas an ingredient in the cocktail for a price rebound

LOSERS

Iron ore (SGX Futures)

Price: US$103.25/t

% Change: -2.32%

All eyes are trained this week on the National People’s Congress in China, the first major meeting of the Communist Party’s leadership for 2025.

Known as the Two Sessions in concert with the Chinese People’s Political Consultative Conference, it sets out key economic targets for the year ahead for the world’s second biggest economy and largest buyer of raw materials like iron ore, coal and copper. Given the sluggish state of the Chinese economy, especially its property sector, this is a big moment each year for iron ore producers and prices.

“We expect that the government will announce an increase in the fiscal deficit target, potentially reaching a record 4% of GDP, up from 3%,” RBC’s Keen Peker predicted.

“According to media reports, there is an expectation for an uptick in the issuance of central government special bonds, potentially tripling to RMB3trn. Additionally, there might be an increase of up to RMB1trn in local government special bonds.”

With iron ore dipping below US$100/t this week, a lot for Aussie miners will depend on the announcements around property support.

“Above all, the slowing urbanisation also points to a structural decline in primary housing demand, which makes a strong recovery of the property sector unlikely in our view,” Peker said. “Nevertheless, policy encouraging the acceleration of the sales could be seen as a positive.” At the same time, Peker said iron ore was expected to be supported in FY25 due to supply issues, predicting average prices for the fiscal year of US$104/t, dropping to US$91/t in FY26.

UP

- There has been plenty of M&A to suggest big miners think we’re going to keep seeing strong (enough) prices in the long term market. Fortescue’s $254m deal for Red Hawk Mining, Mitsui’s US$5.3bn buy up of 40% of Rio’s Rhodes Ridge project off Wright Prospecting and Fenix Resources’ (ASX:FEX) $70m scrip takeover of Mark Creasy’s CZR Resources (ASX:CZR) are cases in point.

- MinRes reduced guidance on its new Onslow Iron mine for FY25. Partly down to cyclone activity and the need to repair a much talked about haul road, it shows how it can be tough for new suppliers to ramp up.

DOWN

- Iron ore markets were roiled late last week on reports from Bloomberg that Chinese steelmakers could trim output by as much as 50Mt in 2025, on account of overseas tariffs that could end the record export run that has shielded struggling Chinese steelmakers from further losses.

- There remain concerns Simandou, a massive new 120Mtpa syndicate out of Guinea which includes Rio Tinto, could lead to a step change in iron ore supply, finally tipping the balance in favour of customers after years of failing to fall sustainably below US$100/t.

READ

Lithium and iron ore prices push MinRes to half-year loss

Lithium (Fastmarkets Carbonate CIF China, Japan and Korea)

Price: US$9750/t

% Change: -2.5%

Lithium remains in purgatory, with miners racking up over $1 billion of cumulative losses in the latest reporting period thanks to capital spending on new projects and lowly prices for both chemicals and spodumene concentrate.

While prices appear to be deep into the cost curve, Morgan Stanley this week reversed a previously positive outlook on the sector after a major supply ramp up in China and foggy US EV demand in the context of a Trump presidency.

Citi was equally bearish, saying more supply discipline is needed as increased African production could lead to a 25% month on month lift in global output in 2025.

Demand continues to lift for the battery metal, with EV sales expected to grow around 15% this year, with Canaccord Genuity’s Tim McCormack suggesting it would be a couple years before demand caught up and the market heads back into balance.

UP

- Rio Tinto is about to sew up its acquisition of Arcadium Lithium, a $10 billion ‘counter cyclical’ move believers hope ushers in the bottom of the current cycle.

- Each month lithium prices remain under water raises the threat of mine closures, strengthening the rebound from a future uptick in the cycle, in theory at least.

DOWN

- Australian lithium hydroxide producers continue to struggle, with IGO booking a major impairment on its share of the Tianqi Lithium Energy Australia refinery in Kwinana as the JV owners canned a second 24,000tpa train.

- CATL’s restart of the Jianxiawo mica mine in China has put a lid on hopes of sustained supply discipline in the Middle Kingdom.

READ

Alternatives to lithium-ion batteries are making their presence known

Uranium (Numerco)

Price: US$64.50/lb

% Change: -9.15%

Uranium spot prices continue to trend downwards, even as experts toast the market’s strong fundamentals.

Morgan Stanley blamed a recent pullback on an overreaction to the revelation of China’s DeepSeek AI app, which suggested it would be able to train its model and generate responses to prompts at a fraction of the cost and energy consumption of traditional models.

That would be disruptive for nuclear power providers, who see a major lift in demand coming from the requirements to supply low carbon power to data centres, especially in the US.

There have also been some negative factors affecting uranium miners, with Paladin Energy (ASX:PDN) recovering from a production downgrade and Boss Energy (ASX:BOE) shares down heavily Tuesday after the sudden departure of the CEO at its JV partner in the Alta Mesa project in the US, enCore Energy.

UP

- Nuclear power generation is set to hit a record level in 2025, with Sprott’s Jacob White saying: “Although there has been ample short-term volatility, the uranium market remains well-supported by rising global nuclear commitments and persistent supply constraints.”

- An election win by Europe’s centre-right Christrian Democratic Union and likely Chancellor Friedrich Merz has been hailed as a victory for pro-nuclear support in Europe, even if there will be roadblocks to prevent the dismantling of the country’s decomissioned power plants.

DOWN

- A house committee conducting an inquiry into the rollout of nuclear power in Australia, proposed by the Coalition Opposition under Peter Dutton, described it as “not a viable investment of taxpayer money”. The Coalition’s dissenting report said the opposite, both accusing the other of underrepresenting the costs of their energy transition plans five times over. We continue to run in place, bring on this silly election.

READ

These juniors are gearing up to reflect uranium’s bright future

Coal (Newcastle 6000 kcal)

Price: US$99/t

% Change: -14.95%

Coal’s in the worst shape it’s been in since the pandemic, with a mild northern winter in Asia and manic buying in previous years leading to large stockpiles that need to be worked through.

High production rates in China and India are also seeing the major industrial powers fill their orders largely from domestic production.

But lower prices for the commodity, which saw few capacity additions despite prices running to US$400/t in 2022 (more than double historic highs), means future price spikes are likely with demand continuing to run at record levels.

““Structurally there are pressures, no doubt about it,” Wood Mackenzie’s Rory Simington told Bloomberg. “But to date, the overall growth of energy demand has meant consumption of coal keeps being able to grow.”

Met coal has been similarly maudlin, though not to the same extent as thermal, ending the month at around US$185/t, having risen as high as US$670/t in the immediate aftermath of Russia’s invasion of Ukraine.

Steelmaking globally fell 4.4% YoY in January to 151.4Mt, while Australian miners’ fastest growing market India was up 6.8% YoY. Chinese steelmaking in January fell 5.6% to 81.9Mt.

UP

- Glencore CEO Gary Nagle, who made an about face to keep coal in the mining and trading house last year under pressure from institutions, told investors on an earnings call the resources giant would shutter loss making thermal coal mines if it needed to exhibit supply discipline.

- Chinese coal plant construction starts hit a nine year high in 2024, according to a joint Centre for Research on Energy and Clean Air and Global Energy Monitor report.

DOWN

- S&P Global chopped its March quarter forecast for met coal prices from US$233/t to US$213/t, saying Indian buying of Aussie coal was largely down to restocking rather than expansionary.

- Morgan Stanley reported that Chinese coal plants have been told to curb imports of lower quality coal to mitigate oversupply hitting prices for domestic miners.

READ

Bulk Buys: Met coal price forecasts slide; M&A shows hunger for iron ore still remains

OTHER METALS

Prices correct as of February 28, 2025.

Silver

Price: US$31.14/oz

%: -1.49%

Tin

Price: US$31,312/t

%: +4.02%

Zinc

Price: US$2793/t

%: +1.86%

Cobalt

Price: $US23,985/t

%:+11.3%

Aluminium

Price: $2605.50/t

%: +0.44%

Lead

Price: $1992.50/t

%: +2.21%

Graphite

Price: US$430/t

%: -1.15%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.