Up, Up, Down, Down: Everyone’s a winner in an astounding April for major metals

Pic: Getty Images

- Gold and copper lead the winners in a massive month for commodities

- Bulks and battery metals also get in on the act, with only cobalt and graphite down amongst our tracked metals

- Lithium and rare earths bounce of lows in month of recovery

WINNERS

Gold

Price: US$2307/oz

% Change: +4.18%

Gold, gold, gold for the ASX. Appropriately for an Olympic year gold prices are running near record highs (this will not in and of itself make an Olympic Gold substantially more valuable, those are gilded).

In fact as many as 8 record highs have been recorded this year as bullion has run amok.

Whether this continues depends on how US interest rates end up. Recent commentary from the US Fed and its governors has doused hopes for a quick return to rate cuts with inflation still somewhat sticky.

Be on the lookout for quality. At times like these every crummy marginal mine that suddenly looks good at Aussie gold prices above $3500/oz begins to sparkle.

Those worth a damn will be miners who can prove they can maintain strong margins even if prices were to reverse.

UP

- The World Gold Council says first quarter gold production hit a record this year, with recycled supply also up to 3.5 year highs.

- Central bank inflows and strong over the counter investment demand are continuing to keep a floor under near record gold prices.

DOWN

- The end of optimism around rate cuts from the US Fed and a potential truce in Palestine could see gold retreat.

- Gold holdings continued to flow out of ETFs in the West in the March quarter, down 114t, with some analysts saying it shows conviction from traders the rally has overdone itself.

Gold miners share prices today:

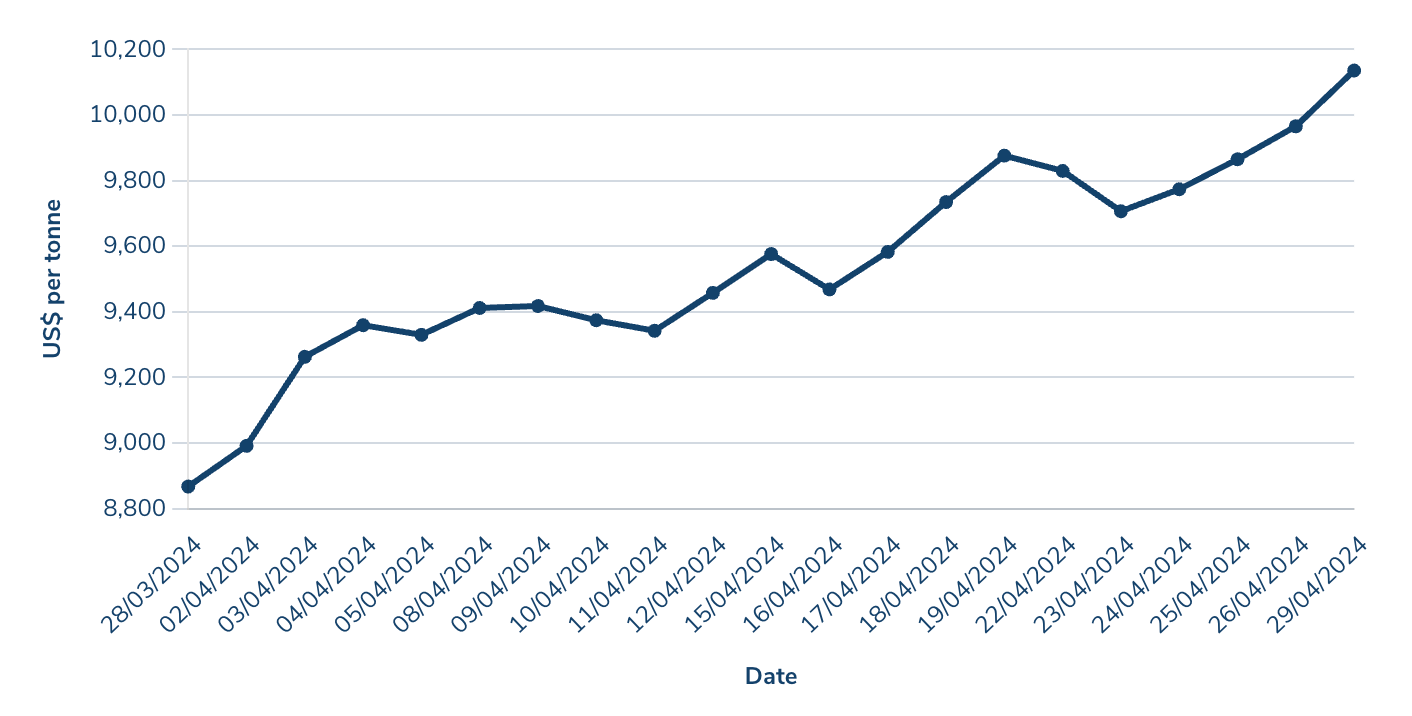

Copper

Price: US$9991/t

% Change: +18.25%

Copper has led the base metals complex on a merry dance, lifting an incredible 18% in a breakout month in April.

Incredibly, zinc rose even faster, with demand for those commodity stoked by renewables and EVs.

Copper has been a story of supply disruptions this year, especially in politically unstable jurisdictions in Latin America.

But it is equally about a lack of major new discoveries and the time it takes to bring even modest finds into production, especially when they are bulky, low grade porphyries with large environmental footprints.

BHP’s (ASX:BHP) $60 billion bid for Anglo American — one which was rejected on first approach — lays bare the lack of discovery from major producers of the red metal, with BHP willing to part with a large chunk of its shareholders’ ownership of the firm to become the world’s largest producer.

Anglo is expected to produce around 750,000t of copper this year (BHP will deliver 1.72-1.91Mt), including from its Tier-1 Collahuasi JV in Chile, and has decades of life left in its top assets.

UP

- The International Copper Study Group knocked down its 2024 surplus forecast from 467,000t to 162,000t after the closure of the 380,000tpa Cobre Panama mine. 2025 will see a 94,000t surplus they say.

- Blackrock World Mining Fund’ Olivia Markham said copper prices will need to hit US$12,000/t to incentivise new sources of production.

DOWN

- Copper and zinc stocks have been weighed down by weak operational performance, with disappointing quarterly updates from Sandfire Resources (ASX:SFR), Aeris Resources (ASX:AIS), Metals Acquisition (ASX:MAC) and 29Metals (ASX:29M).

- Despite a number of supply disruptions, the ICSG thinks production growth at the mine level will rise 3.9% in 2025, with the Malmyzhskoye mine in Russia and Phase 3 expansion of Ivanhoe and Zijin’s Kamoa-Kakula mine in the DRC to significantly bolster global stores.

Copper miners share prices today:

Coal (Newcastle 6000 kcal)

Price: US$142.50/t

% Change: +6.95%

Thermal coal prices rose through April, while coking coal also returned from 2024 lows of around US$230/t through the month, lifting to over US$260/t after a string of production challenges from miners in a wet and woolly Queensland.

They rose in response to broader positivity in the steel supply chain, with iron ore also on the way back up.

But as wet weather eases off, coal could become more available, hitting prices unless steel demand ramps up in China, Japan, Korea and India.

S&P Global analysts now say they don’t expect met coal prices to rise back above US$300/t this year.

“Metallurgical coal exports from Australia were already on the rise in February, up 15% on the month and 58% higher on the year to 15.71 million mt, according to S&P Global Commodities at Sea data,” S&P’s Lizzie Ko and Sumita Layek wrote.

“That met with tepid demand as steelmakers in Europe, India, Southeast Asia and China are thronging the market seeking to offload term contractual cargoes.

“Adding to the oversupply, there was a jump in the volume of spot cargoes being offered by a major Australian prime coal producer that rarely partakes in spot business. The company has floated several Panamax shipments worth of prime coal in March, market sources said.”

UP

- BHP’s met coal guidance downgrade will provide support for premium hard coking coal prices.

- While exports are where it’s at for producers, the NSW Government will throw a lifeline to the domestic thermal coal market, reportedly planning a four year extension of the Eraring plant beyond 2025.

DOWN

- According to Reuters, Indian coal production hit a record 117Mt in March, demonstrating its potential to react to energy demand surges with its own supply. Aussie thermal coal is also struggling to be competitive in India with cheaper product from Indonesia, Russia and South Africa.

- Australian coal producers could face more scrutiny over their emissions after a report from a think tank led by former competition chief Rod Sims that suggested methane emissions from mines could be almost double reported levels.

Coal miners share prices today:

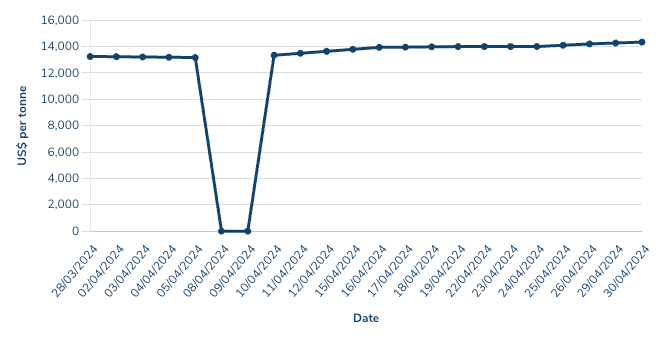

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$14,350/t

% Change: +8.14%

Can we rev up the (battery-operated) engines for lithium again?

The 8% lift in chemical prices in April was the first meaningful rise since a nosedive last year that saw prices collapse from all time highs to cyclical lows in a matter of months.

Reports from price agencies are looking more optimistic, with buyers seemingly willing to accept higher prices — it should be noted Asian commodity movements often have these weird mechanics where lower prices spiral into yet lower prices as buyers wait in hope for worse to come while rising prices begat higher ones due to FOMO.

Spodumene concentrate, the product sold by Aussie producers, has also experienced a rebirth of sorts, up from January lows of US$850/t to US$1215/t, helped by auctions and spot sales run by miners like Pilbara Minerals (ASX:PLS), Albemarle and MinRes.

A 200,000t sale by the Greenbushes mine to Chinese part owner Tianqi will also provide hope that those in the know see higher prices on the horizon, with the world’s biggest spodumene operation (part owned by ASX listed IGO (ASX:IGO) ) expected to return to capacity by the end of the financial year.

Meanwhile, corporate interest in lithium supply remains bullish, evidence by LG’s offtake term-sheet with well brine hopeful Anson Resources (ASX:ASN) and Lithium Energy (ASX:LEL) announcement of the $97m sale of its Solaroz brine project in Argentina to China’s CNGR, a 52% premium to the explorer’s one month VWAP.

UP

- Mineral Resources (ASX:MIN) reported a sale of spodumene concentrate from late March at US$1300/t, well above the US$850/t spot lows seen in January.

- 3.1 million EVs were sold in the March quarter according to Rhomotion, up 21% YoY, with sales rising 12% YoY in the month of March to 1.2 million.

DOWN

- Downstream processing is still a struggle in Australia, with MinRes quietly binning a midstream lithium salts plan and IGO and Tianqi losing $63m in the March quarter on their Kwinana lithium hydroxide refinery.

- MinRes has sought to renegotiate the terms of a deal to acquire the Lake Johnston nickel plant from Poseidon Nickel, putting a roadblock to plans for a flotation plant that could help develop stranded third party lithium deposits in the southern Goldfields.

Lithium stocks prices today:

Nickel

Price: US$19,238/t

% Change: +14.86%

The ugly duckling of the major commodities in 2024 got even harder to look at with First Quantum and POSCO finally throwing the towel in at their Ravensthorpe laterite mine on WA’s South Coast.

The development will shift focus even more intensely to BHP (ASX:BHP), which is expected to make a decision on the potential transition to care and maintenance of its 80,000tpa Nickel West business, where a billion dollar plus upgrade of its Kalgoorlie Nickel Smelter could be a sticking point for whether it invests further.

Nickel prices have recovered somewhat on a general run in base metals, stronger Chinese demand and supply issues out of Indonesia, where mining approvals have been slow this year.

Nickel Industries (ASX:NIC) bore some of these scars in its first quarter report but is now back up and running at its Hengjaya mine and four rotary kiln electric furnace plants in the South East Asian country.

The International Nickel Study Group still sees strong demand growth for the commodity, with usage expected to rise 7.9% from 3.193Mt in 2023 to 3.445Mt in 2024. However, this is lower than previously expected due to competition from non-nickel batteries and the re-emergence of hybrid EVs.

But production will also rise 5.8% from 3.356Mt to 3.554Mt, the market still expected to be in surplus. However, this surplus will be much smaller than previously thought with lower prices knocking producers out of the market.

UP

- Japan’s Sumitomo and Mitsubishi will spend $98.5m on a DFS to claim an eventual 50% stake in Ardea Resources (ASX:ARL) Kalgoorlie Nickel Project.

- Mine closures have prompted the International Nickel Study Group to halve its surplus forecast to 109,000t for 2024 from 239,000t in a previous update last year.

DOWN

- The owner of the Ravensthorpe nickel mine has finally pulled the pin, wrapping the operation up in mothballs. WA Premier Roger Cook said he thought it would return to production when prices rebounded. BUT Ravensthorpe was burning over US$12 for each pound of nickel it produced in the March quarter even without conducting any mining. Hard pass.

- While prices have improved a backlog of mining approvals are starting to be cleared in Indonesia after the 2024 election. S&P Global is projecting a 128,000t surplus in 2024.

Nickel miners share price today:

Uranium (Numerco)

Price: US$89/lb

% Change: +2.3%

Uranium stocks were supercharged yesterday as the US Senate finally approved a bill sent up by the House of Representatives that would ban the import of low enriched uranium from Russia, subject to supply availability.

The US is currently heavily dependent on the belligerent nation to supply upgraded uranium for its nuclear reactor fleet.

But that has emerged as a vulnerability in the aftermath of Russia’s invasion of Ukraine, which has prompted sanctions and forced divestments aimed at Putin-linked companies and oligarchs.

Around a quarter of America’s uranium enrichment services is sourced from Russia, slightly below the domestic market but around double that of the next largest providers Germany and the UK.

Almost half of the yellowcake purchased by US civilian nuclear reactors in 2022 was sourced from Russia, Kazakhstan (the second largest supplier into the States after Canada) or Uzbekistan.

Uranium prices hit a multi-year high of US$107/lb in January before a pullback that has seen them drop to US$89/lb on spot.

UP

- Money is flowing into ASX uranium stocks, with NexGen Energy (ASX:NXG) prepping an ‘upsized’ $250m raise and Deep Yellow (ASX:DYL) nabbing Canadian hedge fund MM Asset Management as a 5.01% substantial shareholder on April 30. Curiously, MMAM dropped below the 5% threshold just one day later.

- Cameco warned the 8.3Mlb production target at the Inkai JV with Kazatomprom was tentative with sulphuric acid pricing and supply posing a risk to production after a 300,000lb YoY fall in the March quarter.

DOWN

- Cameco lost C$7m in the first quarter of 2024, showing the formula is not as simple as price up, uranium boom. Its shares dropped 7% overnight Tuesday.

Uranium share prices today:

Iron ore (SGX Futures)

Price: US$110.91/t

% Change: +9.77%

Iron ore recovered from a threatened move below US$100/t, returning to growth in April.

It came as the traditional peak season for Chinese steelmaking began (admittedly weak by the standards of recent years), though concerns about the strength of the Middle Kingdom’s economy still persist.

The tenuous nature of some iron ore producers around these levels, despite the fact the majors are still sitting on big margins, was highlighted in press that suggested marginal producer Gold Valley Iron was pushing on its margins at the Wiluna West mine in WA.

Tassie magnetite miner Grange Resources (ASX:GRR) also looked marginal in its March report, while the majors struggled getting material on ships in the first quarter due to wet weather and derailments in the Pilbara.

Marginal sources of supply have been growing in recent years, with the majors largely pursuing only incremental growth.

UP

- China’s steel PMIs have been stuck below 45, so their rebound to 47.9 in April (still contractionary) is a minor win for iron ore demand.

- HSBC’s Howard Lau released a new note last week, predicting iron ore would remain above US$100/t for 2024, arguing rising steel output outside China would keep the market in deficit.

DOWN

- Chinese analysts say a projected ramp up in steel output to over 2.3Mt of hot metal a day will not eat into port stockpiles built up in the first quarter.

- The world’s largest steel producer Baowu reported a 2% fall in net profits for 2023 to US$1.65b, with the profitability of the China Iron and Steel Association’s member mills down 12.5% to a combined US$11.81b.

Iron ore miners share prices today:

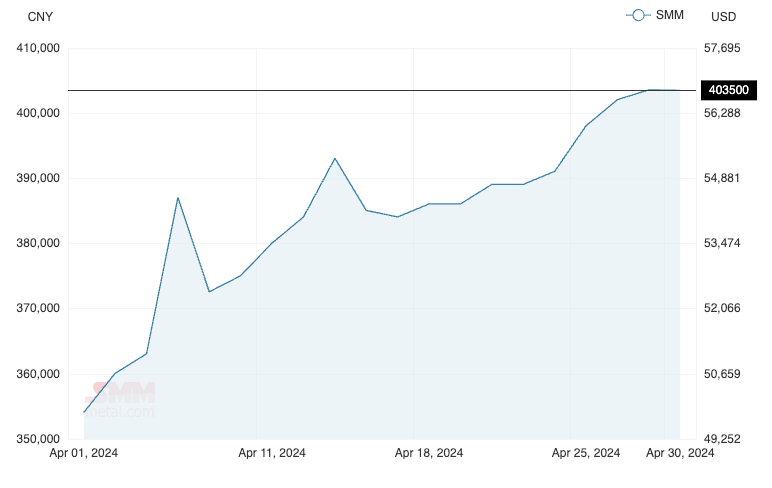

Rare Earths (NdPr Oxide)

Price: US$56.78/kg

% Change: +13.79%

Optimism has finally permeated the rare earths market, with reports that miners have withheld material at low prices, imports of US material into China have risen substantially, and production cuts from Myanmar tightening up the market.

Lynas for one saw large increase in sale prices after holding the bulk of its lower value rare earths and stockpiling NdPr to wait for higher prices.

Supply discipline appears to be working after an unprecedented three Chinese quotas last year flooded the market for magnet metals.

“According to SMM’s research, some large manufacturers have recently launched tenders for PrNd alloy,” the Shanghai Metals Market said.

“In addition, the war in Myanmar may affect the subsequent supply of rare earth mines. Most industry players have positive expectations for the subsequent trend of rare earth prices.

“With the favorable news, rare earth sellers have stronger confidence in the future market and their quotations have increased significantly. The low-priced raw materials in the market have tightened rapidly and the actual transaction prices have also risen.”

Up

- Prices have fallen well into the cost curve, rebounding as Lynas (ASX:LYC) boss Amanda Lacaze suggested only Lynas and China’s Northern Rare Earths were generating positive cashflow in the March quarter. This suggests prices will have to continue rising to keep supply chains running.

- Lynas and MP Materials look more likely to merge and create a major Western rare earths producer after Gina Rinehart emerged as a major shareholder in both stocks.

DOWN

- Iluka Resources is yet to complete negotiations with the Australian Government to increase its support for a refinery in WA which has blown out from $1.2b to $1.7-1.8b in cost.

- It’s the latest blowout for downstream initiatives in Australia, with Lynas’ Kalgoorlie plant capex also increased from $730m to $800m, a total blowout of 60% on an initial $500m estimate.

Rare Earths share prices today:

OTHER METALS

Prices correct as of April 30, 2024.

Silver: US$26.66/oz (+8.64%)

Tin: US$32,566/t (+18.63%)

Zinc: US$2926/t (+19.97%)

Cobalt $US27,830/t (-2.52%)

Aluminium: $2591.50/t (+10.89%)

Lead: US$2217/t (+7.88%)

Graphite (Fastmarkets flake) US$475/t (-3.06%)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.