Up, Up, Down, Down: Did we finally press the button in September on the great uranium bull run?

Pic: 3drenderings/iStock via Getty Images

- Uranium prices surge 22% to decade long high in September as equities go nuclear

- Iron ore and rare earths see support with zinc and aluminium also up

- Gold and battery metals hammered as US dollar stays strong and Chinese EV demand slows

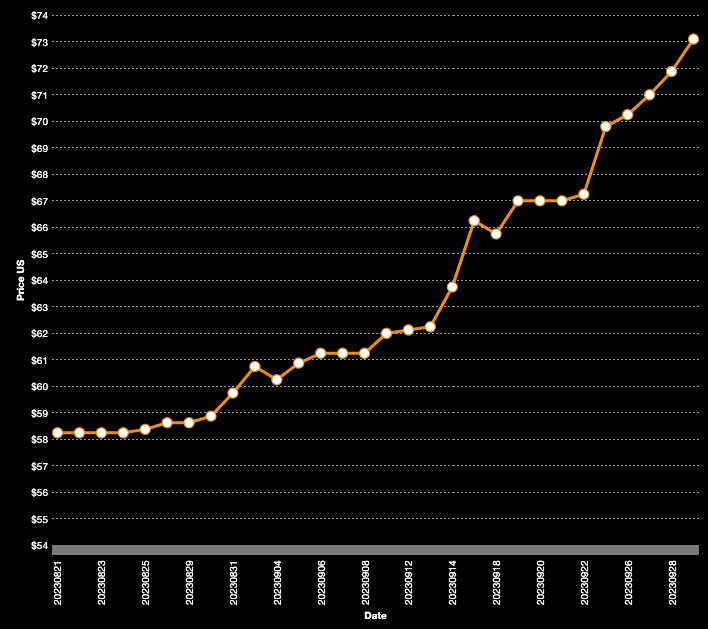

Uranium (Numerco)

Price: US$73.10/lb

% Change: +22.34%

There is no commodity that even comes close to exciting as much as uranium, which has over the past month started to show the promise uranium bulls have been desperately pontificating on for years and years.

The nuclear fuel has been without peer this year, running upwards every month since March.

But the winning record has been a close run thing for most of that run, inching up a couple of per cent at a time.

September could prove the month the breakout really began, with yellowcake recording a quite extraordinary 22% gain.

It is the way with uranium, which tends to really shoot when the starting gun fires.

From 2003 to 2007 prices ran up around 14 times to a record of over US$140/lb.

Could we get there again? Many experts think so.

A risk could come from rebounding supply from incumbents. With prices running sharply, Kazatomprom has flagged plans to ramp up production by 6000t to a full capacity of 30,500-31,500t by 2025.

It has warned inflationary pressures and supply chain issues could yet hamper those plans.

The price run, which has seen uranium move at times by over a dollar a day, was in part prompted by supply failings from the West’s largest producer Cameco, which owns the world’s highest grade mines in Saskatchewan’s legendary Athabasca Basin.

Analysts for major investment banks like Macquarie have also lifted uranium price decks higher to reflect increased demand and higher incentive prices to bring new mines into production, with industry voices like UxConsulting and the World Nuclear Association saying new sources will be needed as governments the world over sanction extensions and expansions to nuclear fleets in the face of the energy transition.

Uranium share prices today:

Iron ore (SGX Futures)

Price: US$120.79/t

% Change: +5.80%

Iron ore has proven ever resilient in the face of threats of production cuts in China, the largest market for Australia’s biggest commodity export.

It’s all good for the Australian Government, with higher than (extremely conservatively) forecast iron ore prices contributing to a final budget surplus of $22 billion last week.

More good times are likely in the 2023-24 wash-up given Canberra sees 62% Fe iron ore falling to a barely believable US$55/t.

“Iron ore traded near USD120/t despite recent turmoil in China’s property markets. Strong steel production and depleted iron ore inventories are supporting prices,” ANZ’s Adelaide Timbrell said in a note yesterday.

At the same time, weak steel mill margins amid high iron ore and coking coal prices saw spreads for high grade iron ore narrow to their lowest level since August 2020 last month.

“With lukewarm production margins keeping demand for high Fe fines on the back burner, as mills pivoted toward lower iron content materials for cost competitiveness, a China-based iron ore trader said ‘Lower Fe fines are in greater demand now, so we see a narrower spread between 65 and 62 [% Fe fines]’,” S&P’s Fred Wang and Chelsea Ye said.

“According to sources, dull HRC and rebar margins have also been reflective of mills’ preferences in moving away from the usage of high Fe fines, with the cost of production remaining a pertinent consideration for their operations.”

At current prices the best performers in the steel supply chain will be the big dogs of the Pilbara, BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG), who should see their strong recent dividend returns continues into the next half-year reporting season (full year for Rio).

Signs of life are emerging among the juniors as well. CZR Resources (ASX:CZR) and Strike Resources (ASX:SRK), took a major step towards the development of a 5Mtpa export facility at the Port of Ashburton, largely known as an oil and gas port, after the Pilbara Ports Authority gave conditional support to the development proposal.

Still requiring EPA, Main Roads and Shire of Ashburton approvals, the development would open a cheaper export route than the distant Utah Point facility at Port Hedland and unlock the potential development of CZR’s Robe Mesa and Strike’s Paulsen East DSO mines.

Iron ore miners share prices today:

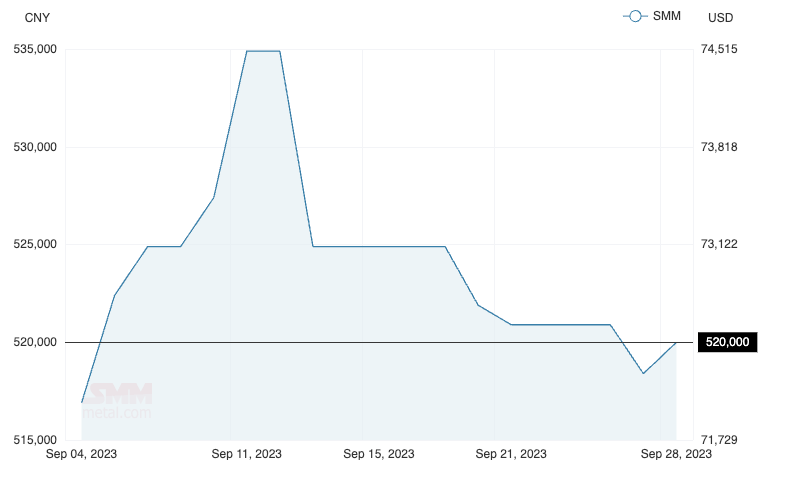

Rare Earths (NdPr Oxide)

Price: US$72.43/kg

% Change: +3.55%

Rare earths continue to recover, recording a second straight monthly gain, albeit from a low base and well south of the record of US$175/kg seen early last year.

The rare earths market has seen some indications of supply disruptions or at least attempts at rerouting, notably from Malaysia, which wants to ban the export of raw materials.

How that effects Lynas Rare Earths (ASX:LYC) is unclear given its Kuantan processing plant delivers separated rare earths oxides, principally from a value perspective the neodymium-praseodymium oxide that goes into magnets used in EV motors and wind turbines.

Higher prices are almost certainly needed to incentivise new large scale producers outside of China alongside Lynas, though the development of a refinery at Eneabba in WA by Iluka Resources (ASX:ILU) could open a new, cheaper route for processing onshore.

It could be the key to unlock the value of mineral sands deposits in Victoria’s Wimmera Mallee region, where a number of companies including Iluka are looking to develop zircon resources which also contain monazite, a formerly waste mineral which can now be processed as a by-product for its rare earth metals.

“This is the most exciting thing that’s happened in the industry, probably ever … to see that stockpile they’ve been accumulating since 1975, can be turned into value,” ACDC Metals (ASX:ADC) executive director Mark Saxon told Stockhead last month.

“It’s really great that we can process that in Australia and not send it to China for processing so a big tick which got money coming from the Australian Government. I don’t think it needs it economically.

“But that’s a great buffer I suppose to show that it’s real and it’s important for Australia and that it’s valuable to have that material processed in Australia.”

READ: Can mineral sands and rare earths help Victoria revive its reputation as a mining state?

Rare Earths share prices today:

LOSERS

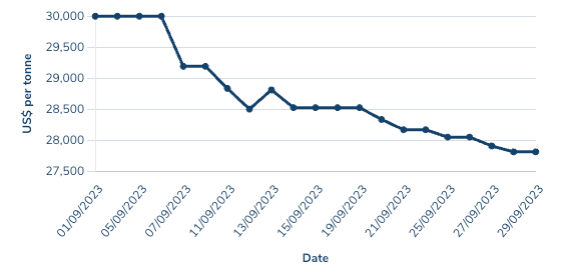

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$27,810/t

% Change: -25.6%

This price is a month average spot price. Taken at spot levels of US$24,500/t, the market for the key battery metal is looking even shakier than it has since prices began falling from record highs of over US$80,000/t at the start of this year.

Despite a massive 25% drop in lithium chemical pricing in September, M & A activity continues virtually unabated.

In one sense lower equity valuations for lithium stocks based on the price drop could open the potential for even more takeover action.

And companies remain less than shy about meeting target aspirations when it comes to price.

Albemarle is near the end of due diligence on its planned $6.6 billion takeover of Liontown Resources (ASX:LTR), which is continuing to see Gina Rinehart’s Hancock Prospecting cause menace in the process.

Its latest pick up take its stake in Liontown last week to 12.4% came with Hancock’s strongest warnings yet about the risks facing the company’s Kathleen Valley development near Leinster.

It came after a cost update that lifted Liontown’s Kathleen Valley costs by $56m to $951m.

“Liontown’s need to debt fund part of its capital costs, and the DSO revenue source that is on hold, has now increased to a minimum of $450 million — which Liontown has indicated may need to be further increased.

“Ultimately, it is the Liontown shareholders that will have to meet the cost of this additional funding.”

You generally catch more bees with honey than vinegar and for now it remains to be seen what the end game all is here. Hancock is largely stating the obvious when it comes to its warnings about project execution, and Albemarle is already under the hood.

What it does show is the majors and established players of the resources market are keeping a keener and closer eye on the formerly niche lithium sector, even if prices are in a spot right now.

READ: Lithium juniors are like Pokemon right now, but can the majors catch them all

Lithium stocks prices today:

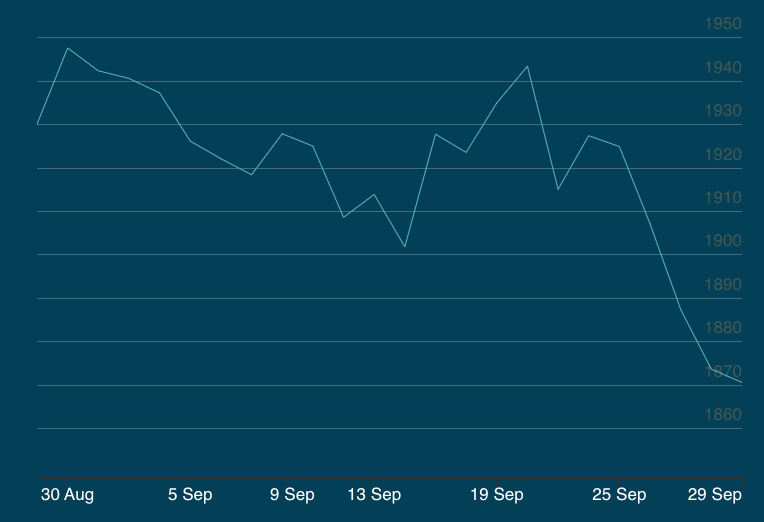

Gold

Price: US$1870.50/oz

% Change: -3.71%

Powered by record demand from central banks and hopes last year’s rate hike pain would cease by year’s end, gold promised at one point to be the star commodity of 2023.

But the last two months have shown just how streaky it can be when everyone has their hopes high.

The rug was pulled from under gold by hawkish commentary from the US Fed, which has delayed expectations for rate cuts and sent the US dollar on a bullish run.

Prices have fallen as far as to US$1850/oz by some spot price monitors, with LBMA PM prices dropping 3.7% on the month to US$1870.50/oz.

But there are some green shoots. Over in China, customers are paying as much as US$100/oz more for their bullion with concerns the Yuan is in trouble playing on investors’ minds.

China has been one of the most boisterous central bank gold buyers out this year.

Over in the ASX market one of the most anticipated gold events of recent times took place in the form of De Grey Mining’s (ASX:DEG) DFS for the Hemi gold mine.

The operation will come with a $1.3 billion price tag, but will be Australia’s third largest gold producer, set to deliver ~530,000ozpa over its initial decade as an open pit at lowest quartile all in sustaining costs.

Gold miners share prices today:

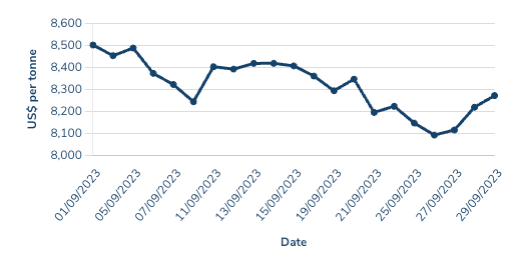

Copper

Price: US$8270.50/t

% Change: -1.8%

Copper is in no man’s land at the moment, trading down on a weak US dollar and concerns about the Chinese economy.

But at least one segment of the Chinese economy is propping up the copper market and giving hope to bulls like Goldman Sachs that their premonitions about copper demand doubling in the energy transition could come to pass.

China’s solar capacity is now up to 228GW, according to analysis from Goldman and a report in Bloomberg.

It means the country’s green demand for copper has risen 71% in a year. Demand from renewables was up 130%, GS reckons.

Overall copper demand has lifted 8% in China this year.

At the same time some analysts have doused their short term expectations for the commodity while the US dollar remains a picture of healthy.

Fitch analysis unit BMI has dialled back its 2023 average price from US$8800/t to US$8550/t, but thinks the long term outlook remains strong.

Copper miners share prices today:

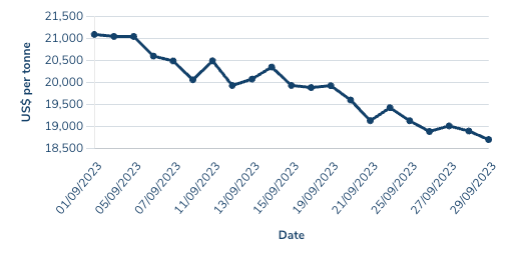

Nickel

Price: US$18,694/t

% Change: -7.86%

The same forces that sent lithium prices lower in September left a residual stain on nickel, the primary metal in the cathode of long range EV batteries.

Prices for nickel sulphate hit a three year low in September, according to Benchmark Mineral Intelligence, reflecting weak downstream demand for the metal from the battery sector.

A shift in China towards LFP cathodes has also impacted the nickel market, with some sulphate producers selling their product for conversion back into nickel metal, a reverse of the market dynamic evident since batteries became the growth engine for nickel demand.

Weak nickel prices have delivered tough times for Australian juniors, with Panoramic Resources (ASX:PAN) struggling with cost pressures and Poseidon Nickel (ASX:POS) forced to delay a restart decision on its Black Swan mine and plant near Kalgoorlie, in part because of delays getting access to grid power.

Shares in Chalice Mining (ASX:CHN) meanwhile continued to fall after the release of a scoping study that contained price assumptions well above current spot levels including for nickel metal.

The $900 million company is still pursuing a strategic partner to deliver a bit of corporate heft for its Julimar discovery, a large low grade nickel and copper sulphide and platinum group metals discovery near Perth which once had the ASX 200 explorer valued at over $3 billion.

Nickel miners share price today:

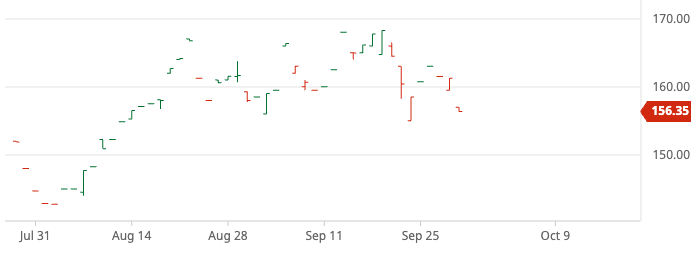

Coal (Newcastle 6000 kcal)

Price: US$156.35/t

% Change: -1.36%

The Port of Newcastle is on track for its leanest year of coal sales, with just 10.95Mt shipped in August and 92.3Mt worth a little over $26 billion shipped through the first eight months of 2023.

That’s even worse than this time last year, when wet weather and labour shortages along with Covid absenteeism crippled exports.

The market threatened a recovery of sorts last month as fears over LNG supplies and prices emerged until a deal was struck to end labour disputes between unions and Chevron in WA.

As LNG prices lift, thermal coal typically rises as well because it is a cheaper switching fuel for power grids.

Prices remains strong though, with New Hope Group (ASX:NHC) recently delivering a record profit.

Coking coal prices on the other hand have been very strong, rising to over US$300/t last month, setting up a very tasty run-in to the end of BHP’s process to sell its Daunia and Blackwater mines in Queensland.

There could be yet more price support for hard coking coal after Coronado (ASX:CRN) suffered a dragline failure at its Curragh mine in Queensland alongside geological issues at its Buchanan mine in the USA.

It means the steelmaking coal miner will cop a hit to its 2023 production, lowering guidance from 16.8-17.2Mt to 16.2-16.4Mt, as well as a massive hit to its production costs, rising from US$84-87/t to US$97-102/t.

Coal miners share prices today:

OTHER METALS

Prices correct as of September 29, 2023.

Silver

Price: US$23.08/oz

%: -5.95%

Tin

Price: US$23,944/t

%: -5.72%

Zinc

Price: US$2649.50/t

%: +9.01%

Cobalt*

Price: US$33,420/t

%: +0.00%

*Cobalt has traded sideways for several months with liquidity virtually at a halt on the LME. Battery cobalt prices are lower.

Aluminium

Price: US$2347/t

%: +6.3%

Lead

Price: US$2171/t

%: -2.12%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.