Monsters of Rock: Copper’s in the doldrums but its long term appeal still shines for investors and burglars alike

Pic: Gilles Paire/iStock via Getty Images

- Hopes copper prices could hit a new record high in 2023 have been dashed

- Rising inventory levels and weak demand have market in contango and analysts are knocking down 2023 aspirations

- But the energy transition still has them painting a bright long term picture

Copper promised much in 2023 as investors’ eyes got all misty over the thought low inventories and a raging electric vehicle sector would bring brighter days for the red metal.

Mega-bulls like Goldman Sachs et. al. have been proven overenthusiastic thus far. At US$8114/t, prices have barely shifted after an early boost, putting paid to claims from the US investment bank last year it would hit a record US$11,000/t in 2023.

According to ANZ’s Daniel Hynes and Soni Kumari, inventories are now at a 16 month high of 167,800t on the LME, with contango briefly hitting US$70/t this week.

What does that mean? Physical demand is pretty low compared to the level of material available on the market.

A commodity in backwardation — where prices are higher for immediate delivery — is one ripe for sharp spot price rises because customers are so desperate they’re ready to kill you and pry the metal from your cold dead hands.

(Well, maybe if you’re holding copper wire on a deserted street in Johannesburg).

Contango is the opposite. Buyers aren’t that stressed about getting their material right away, suggesting physical shortages aren’t that pronounced and you’re probably safe from the mob … for now.

Where are copper prices going for now?

Fitch unit BMI has a new 2023 forecast out today, cutting its hopes of a US$8800/t copper metal price for this year, slashing the figure down to US$8550/t.

Weaker than expected Chinese demand and the possibility of another rate hike from the US Fed have kept a lid on the outlook for the fourth quarter, BMI says.

“Prices have been on a steady downward trend since mid-January 2023, after peaking at US$9356/t on January 23 on the back of expectations of a strong rebound in Mainland Chinese demand,” its analysts say.

“Prices are hovering around US$8293/t as of September 19, down 11% from the YTD high of US$9356/t. Our forecast of US$8550/t for 2023 means we expect prices to remain under significant pressure in Q4 as weak demand and rising inventory levels hammer prices.”

But the surplus won’t last forever

BMI thinks we’ll see a surplus of 236,500t in 2024, with Peruvian and Chinese output sharply higher, offsetting supply issues in Chile.

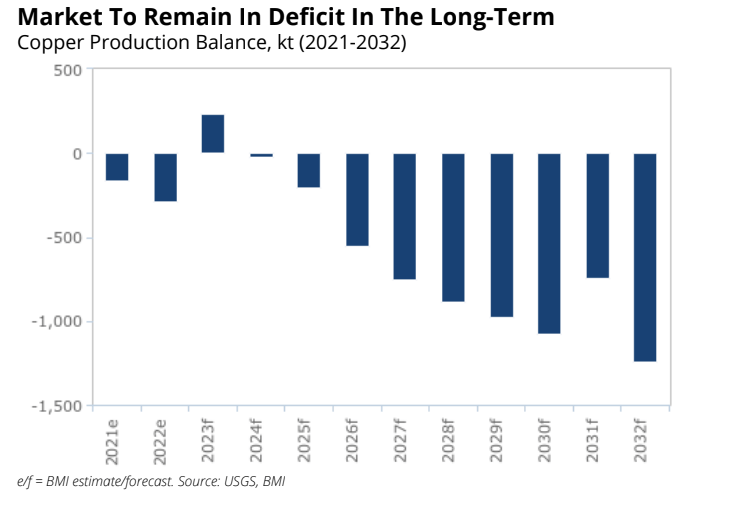

But long term deficits could get very extreme. BMI thinks prices will rise to US$8800/t on stronger demand and a weaker US dollar in 2024, climbing to US$11,500/t long term by 2032, when it sees a market deficit as large as 1.2Mt.

That’s around the output of Escondida, the world’s biggest copper producing mine.

“In the longer term, we expect the copper market to remain in deficit as the green transition accelerates along with the demand for ‘green’ metals including copper,” BMI’s analysts said.

They say copper use is not only 58% higher in electric vehicles compared to internal combustion engine cars, but also is contained in far higher concentrations in renewables compared to coal plants.

“Supply growth will be increasingly outpaced by demand. Copper isrequired in almost every aspect of the green energy transition,” the theory goes.

“According to the IEA, battery electric vehicles require approximately 53.2kg of copper, 58.1% more copper than the 22.3kg needed in the production of internal combustion engine vehicles (ICEs).

“Offshore wind, onshore wind and solar power sources require 8000kg, 2900kg and 2822.1kg of copper respectively, significantly more than the 1150kg required in coal-fired power plants.

“This will push the market into greaterdeficit and drive prices higher towards the end of the decade. We will also continue to see some growth in the global construction industry, a driver of copper demand unrelated to the green energy transition.”

Strong moves across the commodities space led to broad-based support for miners today, as the materials sector rose 1.22%.

Monstars share prices today

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.