Trigg kicks off Drummond gold and antimony drilling with a new acquisition around the corner

Trigg Minerals has entered a trading halt, pending an announcement related to a new acquisition. Pic Via Getty

- Trigg entered a trading halt, pending an acquisition, shortly after beginning drilling over a high-priority gold target

- Several promising IP geophysical targets set to be drilled

- Noted potential for gold and antimony in tenement package

Special Report: Trigg Minerals has entered a trading halt, promising a plunge into a new acquisition just days after beginning drilling over a high-profile prospect considered to be an analogue of one of Queensland’s biggest gold mines.

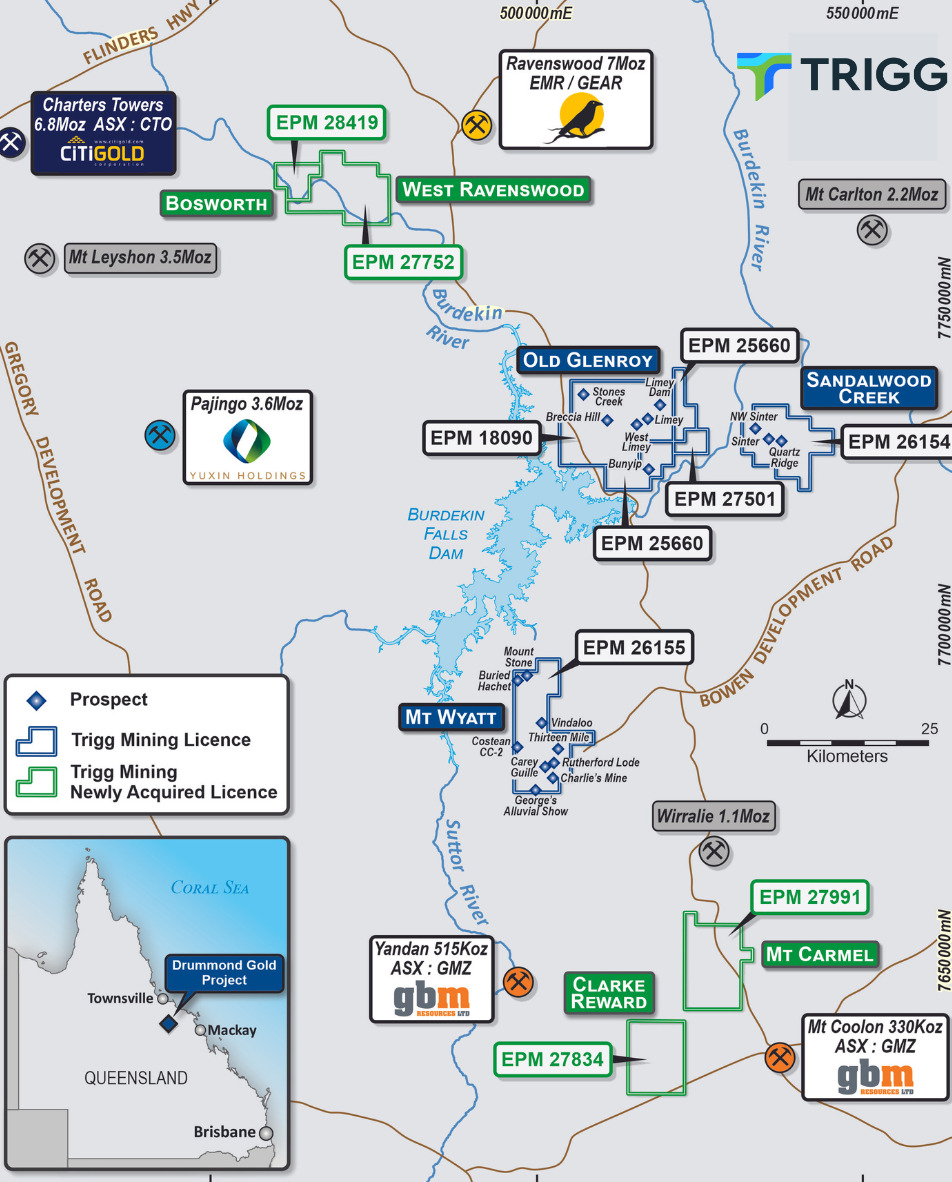

Trigg Minerals (ASX:TMG) has just begun drilling over what is considered to be a high-potential gold target at its Drummond epithermal gold and antimony project in northern Queensland.

The SW Limey prospect, noted for an apparent kinship to privately held Yuxin’s nearby 3.6 million ounce Pajingo gold deposit, once dug up by ASX gold and copper giant Evolution Mining (ASX:EVN), was among several promising IP geophysical targets slated for a month-long campaign over Drummond.

Trigg was fully funded for the program, but tongues will be wagging over the nature of the acquisition to be revealed on Friday according to a trading halt notice issued to the ASX.

Compelling target

The Company’s executive chair Timothy Morrison said on the beginning of drilling that identifying a preserved epithermal system with a signature resembling its renowned neighbour was compelling, and had validated the team’s thorough approach.

The company last expanded the project with the acquisition of 431km2 of tenements, which established Trigg as a prominent player late last year in the Charters Towers Province.

It accounts for nearly half of Queensland’s gold production.

Antimony allure

Tallying ounces in premium locations is hardly a fool’s errand with a gold price now flirting with a US$2600 price tag per ounce, Trigg has previously noted the project’s potential for critical mineral antimony – now under the focus of greater powers than investors in the wake of Chinese export restrictions.

Supplies of the military mineral are largely under the control of The Red Dragon, whose bans have seen the price tag of antimony surge to now be standing over US$25,000 a tonne.

Trigg had previously announced its intentions to explore for antimony at Drummond after the reveal of economic grades at the nearby Police Creek deposit and the discovery of an old antimony mine which validated an exploration concept for the metal.

The company believes further antimony may lie in the periphery of orogenic and intrusion-related gold deposits elsewhere around the sediment covered and still-underexplored Charters Towers Province.

This article was developed in collaboration with Trigg Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.