Torian about to kick off major drilling campaign alongside WA’s next big gold mine

Getty:Pic

Special Report: As one of the jewels of the Leonora goldfield in Western Australia looks set to be restored to its former glory, a major drilling campaign is about to get underway right next door in a bid to uncover more treasure.

At the start of the week, Red 5 (ASX: RED) unveiled an impressive final feasibility study for its King of The Hills gold project, a former Sons of Gwalia asset near Leonora, that looks to have all but guaranteed its redevelopment.

The study detailed a 16-year operation producing 2.5 million ounces of gold at an all-in sustaining cost of $1,415 an ounce for a pre-tax NPV (8% discount rate) of $1.1 billion and a pre-tax IRR of 64.3%. With first production forecast for 2022, a final investment decision is expected in coming months.

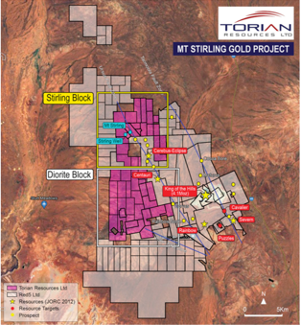

Bordering the King of the Hills tenements to the west is the Mt Stirling gold project, where the geological team from Torian Resources (ASX: TNR) recently conducted a comprehensive review of historical exploration, leading them to conclude that the asset has greater potential than originally thought.

Torian said on Thursday that it would start a drilling program of up to 15,000 metres within days at Mt Stirling, focusing initially on the new Diorite East prospect in the Diorite Block, one of two blocks that make up the project area.

The company has identified three target zones at Diorite East based on historical gold-in-soil anomalies that were never followed up by previous owners as well as other favourable geological features.

Drilling will also be undertaken within the Diorite Block to follow up encouraging high-grade rock chip and soil samples taken from an area adjacent to the historic Kiora and Meteor mines.

The focus is then expected to shift to the Stirling Block in the north, where Torian will resume testing the depth and strike extent of the existing inferred resources at Mt Stirling (33,900 ounces at 1.45 g/t gold) and Stirling Well (16,000 ounces at 2.01 g/t gold).

“The coming program ushers in an exciting phase for our company and shareholders as we embark on one of our largets and most comprehensive drilling campaigns in recent times,” Torian executive director Peretz Schapiro said.

“Our primary objectives for the coming campaign will be to increase the size of our two resources on the Stirling Block and to follow up some of the high-grade rock chip and soil samples encountered on the Diorite Block.”

Project area underexplored

Phase one drilling completed on the Stirling Block earlier this year demonstrated that the project is emerging as a potentially large gold system with results confirming that mineralisation continues more than 100 metres below the existing resources.

The Diorite Block has been subject to minimal modern exploration, but hosted high grade gold production at Diorite King and the Diorite Queen mine around the turn of the 20th century.

According to online mining database mindat.org, Diorite King produced 2,917 ounces of gold at an average grade of 73 g/t from 1897 to 1922. Several other small mines in the area also produced at high grades.

Torian raised $3 million through an oversubscribed rights issue and top-up share placement at the end of July to fund the drilling programs.

Mt Stirling is Torian’s flagship asset but the company also has in its portfolio the Mt Monger-Wombola project and joint ventures with ASX-listed Dampier Gold at Credo and Zuleika.

All of these projects are in the WA goldfields.

This story was developed in collaboration with Torian Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.