Resources Top 5: ‘Hi!’ says lithium, ‘I’m still here’… and hunted voraciously in Quebec by Olympio

Lithium is not drowning… it's waving. (Pic via Getty Images)

- Olympio Metals’ exploration activities at its Cadillac lithium project in Quebec is advancing ahead of schedule

- Rare earths hunter Hastings enters a tolling and offtake agreement with China’s Baotou Sky Rock Rare Earth New Material Co

Here are some of the biggest resources winners in early trade, Friday February 16.

Olympio Metals (ASX:OLY)

Yesterday, Olympio jumped on no news, but as is so often the case, it turns out it was imminent news, which has landed on the ASX and various other channels of communication, uh, today.

The minnow gold and lithium exploration and development company is up another 18% or so today.

OLY’s update is pleasing for it, and its investors, but it isn’t exactly earth shattering. Well… in one respect it literally is.

The company notes its diamond drilling is progressing ahead of schedule at its Cadillac lithium project in Quebec, Canada, where it believes there’s scale for a potentially significant LCT discovery.

Per today’s announcement, drilling has been able to move further ahead than originally anticipated, with 22 holes completed to date on four separate pegmatite targets.

Pleasingly, too, pegmatite has been intersected in all drillholes logged to date on the 1.3km long Z-Dyke.

This is a 3,000m drill program that will test several of the 400+ pegmatite targets across the huge 190km2 Cadillac ground, which is strategically located less than 50km from the infrastructure-tastic mining town of Val d’Or.

Diamond #drilling at the $OLY Cadillac Project in Quebec is well advanced & ahead of schedule with 22 holes completed to date on 4 separate pegmatite targets.

Pegmatite has been intersected in all drillholes logged to date on 1.3km long Z-Dyke.https://t.co/vA9LyqqX0R pic.twitter.com/5ICjaLisRl

— Olympio Metals (@OlympioMetals) February 15, 2024

What now? Core cutting. Sampling, too. First assay results from these are expected by the end of March.

Olympio’s MD Sean Delaney said this, among other things:

“Significant widths of pegmatite have been consistently intersected across multiple targets… The drill core has been transported to our nearby exploration base at Val D’Or where it is currently being logged.”

OLY share price

Titan Minerals (ASX:TTM)

(Up on no news)

There’s no obvious needle-moving announcements from Titan Minerals today, although there are some “application for quotation of securities” notices, so there is something afoot to do with performance rights and expiring options.

Regarding its exploration activities, though – a quick recap on Titan and its recent movements.

TTM is gold/copper/silver explorer and development company focused on assets in southern Ecuador – in one of the fastest-growing mining jurisdictions in Latin America.

The company’s main game is the Dynasty gold project, as well as highly prospective activity at the Linderos project, the Copper Duke project, the Jerusalem project and Copper Field prospect.

In November last year, the company confirmed a new major gold vein system at the Dynasty project, specifically within its Papayal deposit.

Dubbed the ‘Julia’ system, the vein was found with two holes intersecting wide zones of epithermal vein hosted mineralisation from shallow depths. It represents one of several targets for resource growth drilling at the flagship 3.1Moz gold, 22Moz silver Dynasty project.

The shallow depth is particularly notable here, with Titan confident the Julia target represents potential high-grade resource additions for the Dynasty project, further validating the company’s strategy of targeting shallow, high-grade, high-margin ounces.

A resource update from TTM is expected in Q2 2024.

TTM share price

Hastings Technology Metals (ASX:HAS)

Once known as Hastings Rare Metals, Hastings Technology Metals is an emerging rare earths producer in WA with some news this morning sending it nicely double digits up and to the right.

The $89m company has signed a binding term sheet for a tolling and offtake agreement with Baotou Sky Rock Rare Earth New Material Co, under which rare earth concentrate from the Yangibana project will be toll treated in China to produce separated rare earth oxides.

Per the agrement, Hastings will receive payment for rare earth oxides, less a capped multi-stage toll treatment fee, which the company says significantly increases its revenue and cash flows.

The pricing structure applies to a minimum of 10,000tpa of concentrate for a term of seven years, with the option to extend for another five years, the company notes.

This arrangement with Baotou Sky Rock supplements the existing offtake contract with thyssenkrupp Materials Trading for two-thirds of annual production from the Yangibana project.

Meanwhile, negotiations are ongoing with other potential customers to conclude similar offtake arrangements for the remaining Yangibana Project volumes within the offtake contract with thyssenkrupp.

HAS share price

Kingsland Minerals (ASX:KNG)

(Up on no news)

Multi-commodity (mainly graphite now, but also uranium, gold, copper, nickel) explorer Kingsland is up on no fresh news of note today. But up it goes, to the tune of 18% at the time of frantically pressing buttons with an extra couple of fingers than usual, in an attempt to meet this article’s lunchtime deadline.

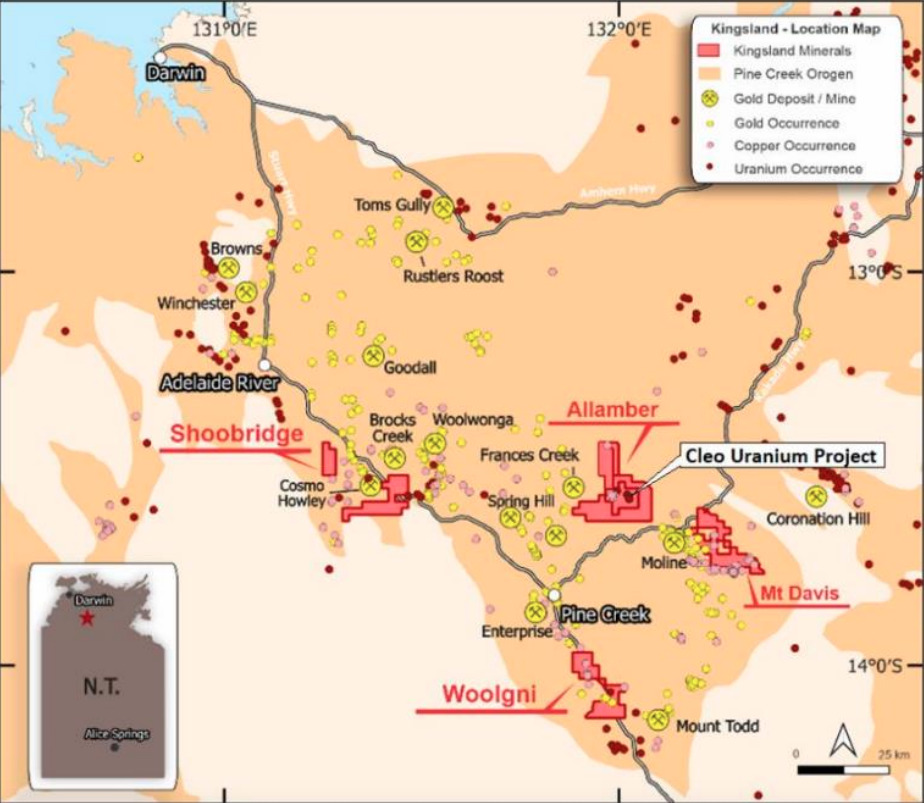

Kingsland is exploring its portfolio minerals across various highly prospective project and targets in the Northern Territory and in Western Australia.

Latest significant news? It was this…

With the company committed to advancing the potential of its potentially world-class Leliyn graphite project, Kingsland is undertaking a strategic review of its Cleo uranium project near Pine Creek in the NT.

Cleo contains an inferred resource of 6.8Mt at 345ppm U3O8 (150ppm U3O8 cut-off grade) for 5.2Mlbs U3O8.

Meanwhile, the Leliyn graphite project has a maiden resource on track for Q1 CY24.

Whilst incredibly prospective, Cleo has essentially become second priority for the company as it continues to progress exploration at Leliyn, which it believes holds the potential to become a globally significant asset in a Tier 1 mining jurisdiction.

Leliyn is home to an exploration target of 200-250Mt @ 8-11% TGC for contained graphite of 16-27Mt, based on a graphitic schist measuring 5km long, 200m deep and 100m wide.

Read > here for more on this.

KNG share price

Galan Lithium (ASX:GLN)

Hang on, what’s going on… another lithium stock having a good day? That’s right, uranium – how do you like them apples?

Galan is up on no fresh company announcements, though, but never mind, it’s got some runs on the bourse today.

Maybe the below comments from GLN’s MD – Juan Pablo Vargas de la Vega – gave things a lift. As reported by our Jessica Cummins out at this week’s mega RIU conference in Perth…

Every now and then investors get a little nervous that the best of the years have gone by, but Galan’s Juan Pablo Vargas de la Vega, commonly referred to as ‘JP’, reassured conference goers at this year’s RIU event in Fremantle that the lithium market will turn around.

Despite many unknowns from elections to cost increases, global conflicts, rates and inflation, JP was confident Galan would come out on top once the market recovers, in growth mode, ready to ramp up exploration and production plans across its flagship Hombre Muerto West (HMW) project in Argentina.

“Everyone is worried asking me about when markets will change… but Galan has existed for the last six years and this is the third time we’ve been faced with difficult market conditions in our history,” he said.

“It is not new, and I can guarantee we will see it happen again, it will repeat itself.”

Galan delivered an investor presentation at the RIU event this week, focusing on “the highest grade, lowest impurity lithium project in Argentina” – the Hombre Muerto West (HMW) project.

The Glencore-backed company is gearing up for production in the first half of 2025, with a world-class 7.3Mt LCE resource at 852 mg/l Li, making it one of the highest-grade, large-scale resources in Argentina and its vaunted Lithium Triangle.

Read more > here.

GLN share price

At Stockhead we tell it like it is. While Galan Lithium and Kingsland Minerals are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.