Top of the Line: GCX appoints new boss ahead of exploration onslaught at Dante, a large cap project in a small cap stock

Dante already has multiple targets lined up for a maiden drilling campaign at Dante. Pic via Getty Images.

- Acquisition of Dante nickel-copper-PGE project in West Musgrave region complete

- Thomas Line appointed CEO and MD to drive the project forward

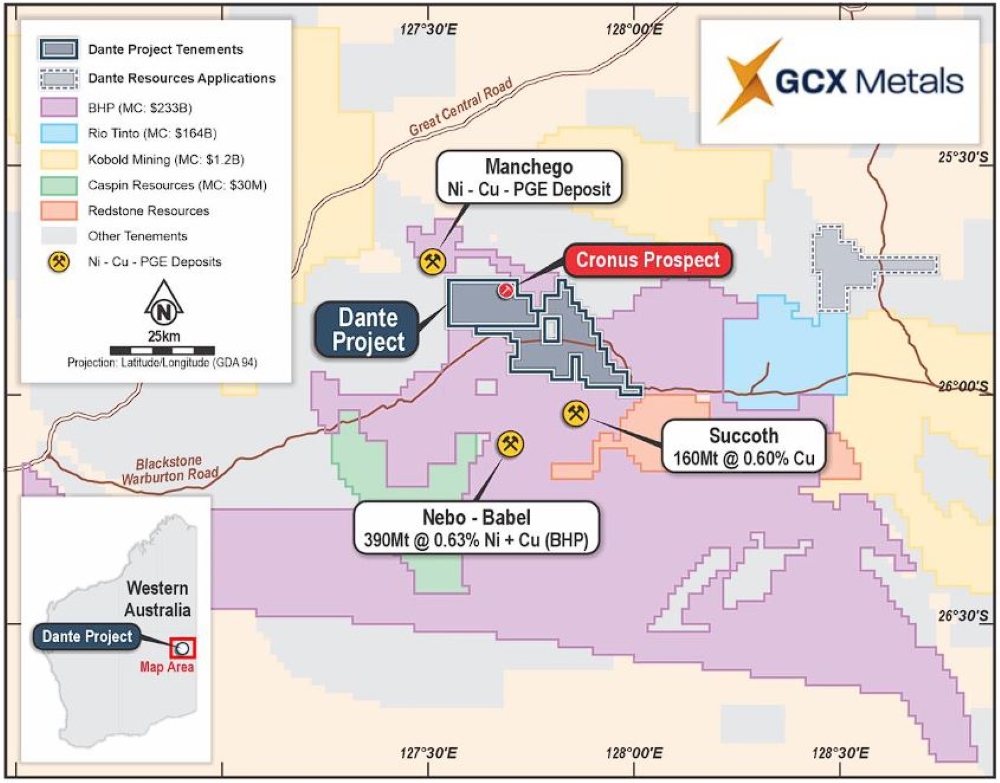

- Dante is just 15km from BHP’s $1.7bn Nebo-Babel development

- $20m of historical drilling to be unpacked, multiple targets will be drilled next year

GCX Metals has appointed a new CEO and MD in Thomas Line after completing the acquisition of the Dante project in WA’s emerging West Musgrave mining hub – just 15km from BHP’s $1.7bn 390Mt Nebo-Babel Ni-Cu-PGE project.

August marked the month that GCX Metals (ASX:GCX) decided to make a foray into the prolific West Musgrave critical minerals mining hub with the acquisition of the Dante project.

Dante shares the same geological complex as Nebo-Babel, a mine tipped to deliver 28,000tpa Ni and 35,000tpa copper over a 24-year mine life.

The West Musgrave province also sits on the Giles Complex, which has all the same hallmarks of South Africa’s whopping 2.2 billion-oz platinum group elements (PGE) Bushveld Complex.

The Dante project comes with large, delineated and advanced targets that include ~23km of outcropping strike at grading averages of 1.1g/t PGEs, 1.13% vanadium, and 23.2% titanium.

The company is concentrating on the promising 7km-long Cronus prospect, which has “remarkable” combined element anomalism. Drilling is planned for in March next year.

A new driver at the wheel

As soon as the acquisition was completed GCX appointed experienced geologist and mining executive Thomas Line to the dual role of CEO and MD of the company to drive the company forward.

“I am pleased to have the opportunity to lead the exploration and growth strategy for GCX. With the addition of the Dante project and the appointment of executive management , the company is now well positioned to deliver an exciting exploration program which will commence immediately.” CEO and MD Thomas Line told Stockhead

Dante already has a lot of exploration work completed, and with up to $20m worth of historical exploration datasets, Line and his team have a lot of juicy targets already before they’ve even hit the ground running.

“We’re bringing this project to market in a company which has a very low market cap, but the scale and quality of our targets are exceptional for a company our size,” Line said earlier this month.

“We’ve got backing from major investment group Tribeca Partners who have around 20% of the company, we’ve also got the support of the Apollo Group and we also have institutional shareholders such as Australian Super Fund.

“It’s a unique scenario. We’ve got the kind of backing that normally only companies in production or going into production would have.”

This article was developed in collaboration with GCX Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.