Top 5 Resources: Infini explodes with 7.5% U3O8 hit and gold hunters boom

Pic: Getty Images.

- Infini posts ridiculously high grades of U3O8 from Portland Creek, up to 74,997ppm from soil samples

- Antipa intersects high grades of near-surface gold at Minyari Dome

- Norwest adds gold and copper targets to its niobium hunt in West Arunta

Here are the biggest small cap resources winners in morning trade, Wednesday, July 10. Prices accurate at time of writing.

Infini Resources (ASX:I88)

Initial results from I88’s soil sampling of its Portland Creek uranium project in Newfoundland, Canada, were too much for the first lab detector to handle, maxing out at 11,792ppm, so off they went again to be re-assayed with a much shinier one.

It probably almost maxed that one out too, as new results from the 17 overcooked samples reached an eye-whopping peak grade of 74,997ppm.

Impressive, since the average background reading in soils is ~8ppm U3O8 (8 times… divided by 14… carry the 2…) a casual 9375 times background.

74,997ppm is almost 7.5% uranium content in a sample – which is gangbusters – and a total seven out of the 17 all re-assayed >3% U3O8.

A field geologist somewhere might be glowing in the dark, but hey, at least they’d be a hit at Halloween parties.

It’s probably best practice then, that they decided to send a UAV drone in to further study the Talus prospect – where the samples were taken from.

“These follow-up assay results confirm Infini has encountered world-class grades of uranium in soil samples at Portland Creek,” Infini CEO Charles Armstrong said.

“I am not aware of any other explorers that have returned results close to what we are seeing here in our maiden fieldwork program.

“We now eagerly wait for processing of the UAV drone magnetic survey that was flown over Talus to see what potential structural controls exist linked to this special anomaly.”

Shares in the yellowcake hunter have gone through the roof, with trades on open hitting a high of 90c before settling to still sit up 51% at 74c per share.

Antipa Minerals (ASX:AZY)

Phase 1 drilling of AZY’s 1.8Moz Minyari Dome gold-copper project in WA’s Paterson Province has identified new, near-surface gold zones along the northern edge of the GEO-01 discovery.

Hits included a highlight intersection of 35m at 3g/t gold from 20m down hole in 24MYC0610, including 16m at 5.6g/t gold from 33m down hole at the GEO-01 prospect.

Results from GP01 intersected 8m at 5.3g/t gold and 0.07% copper from 96m down hole in 24MYC0607, including 4m at 8.5g/t gold and 0.12% copper from 96m down hole.

“We are advancing workstreams designed to deliver a GEO-1 maiden resource and an update to the existing Minyari resource, both scheduled for July while we prepare for the upcoming CY2024 Phase 2 drilling program set to commence later this year,” MD Roger Mason says.

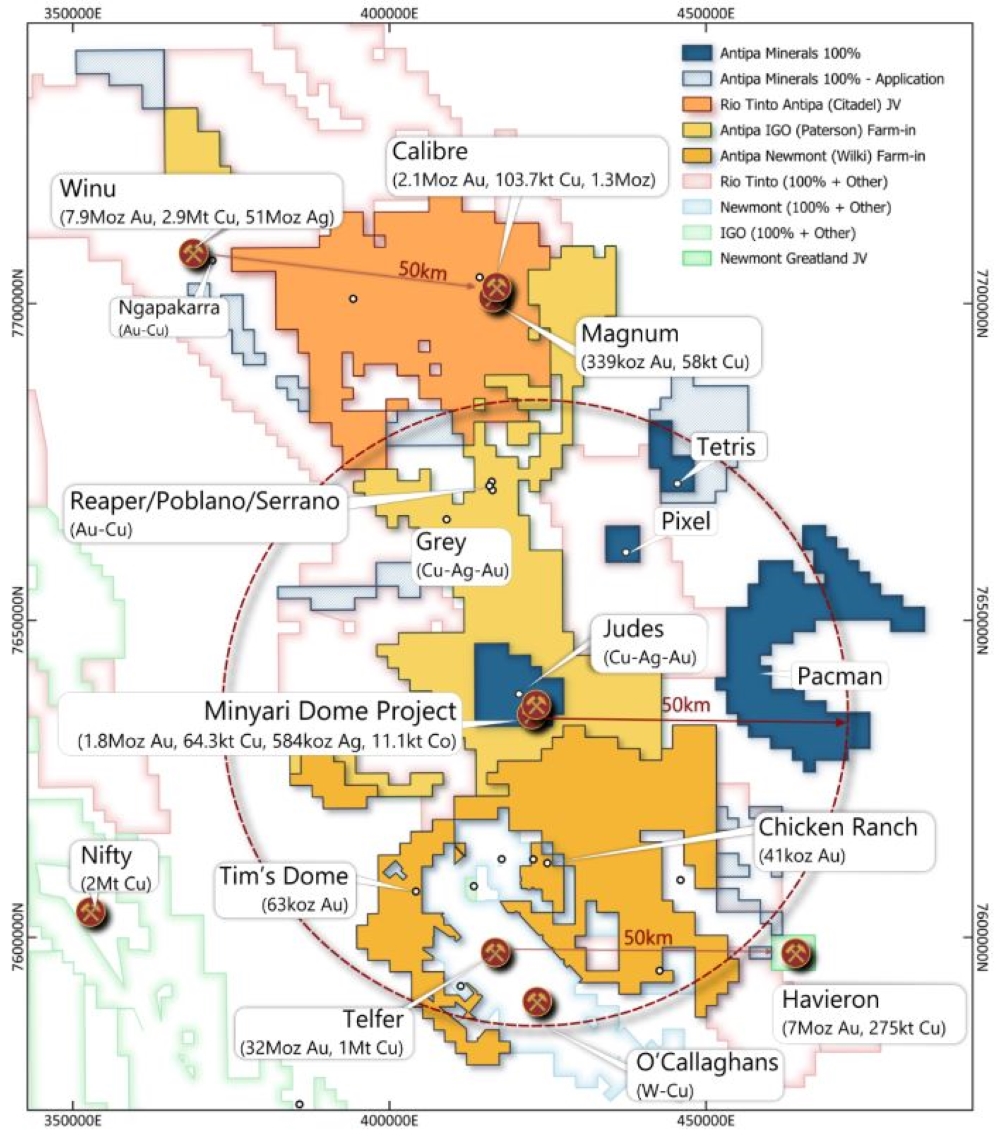

The copper, gold and silver-laden Paterson Province is home to Newmont’s Telfer mine, Rio Tinto’s Winu development and Greatland Gold/Newmont’s Havieron JV.

AZY also has a bunch of other exploration tenements and farm-in JV agreements in the region with IGO, Rio Tinto and Newmont.

The junior’s stock rose 10% on the back of the news, trading at 1.1c per share.

Norwest Minerals (ASX:NWM)

Niobium hunter NWM has added copper-gold drill targets at its Arunta West project… in West Arunta – one of Australia’s latest hotbeds of exploration activity.

The catalyst was WA1 Resources (ASX:WA1) unearthing its super high-grade Luni niobium deposit that recently served up a 200Mt niobium resource – the largest find of its kind in over 70 years.

NWM is in early-doors exploration for the 1500km2 Arunta West, mapping targets for the critical minerals program. And it’s just added the huge 3km x 1.5km Tamba copper-in-soil anomaly to its target list, the likely starting point for upcoming drilling plans.

Shares in the minnow rocketed 18.8% on the news to 3.8c per share.

Mako Gold (ASX:MKG)

The drill bit is spinning at MKG’s Tchaga North prospect, part of the Napié gold project in Côte d’Ivoire.

1500m of scout RC drilling is targeting three high-grade zones that MKG laid eyes on after compiling data from recent mapping and trenching programs.

A deep artisanal (near-surface oldschool digging) mine site, the Discovery zone and Double zone will be worked on.

Testing of the three high-grade prospects is “just the beginning” MKG MD Peter Ledwidge says, of what may unlock further significant gold mineralised zones.

“These zones could contribute towards an increase of the current 868,000oz gold resource on the Napié permit.”

Shares in the West African gold explorer are up 22.22% to 1.1c per share.

Lode Resources (ASX:LDR)

(Up on yesterday’s news)

Focusing on gold, silver and base metals in NSW’s Tier 1 New England Ford Belt, where the Mt Carrington and Webbs silver mines are located, LDR shares have shot up today – perhaps on yesterday’s news of appointing Jason Beckton as exec director of resource development.

Beckton has a wealth of experience in gold and silver project execution, with stints at Gympie Gold, Bolnisi Gold as project manager for the Palmarejo silver-gold mine (acquired for US$1.1bn) and Exeter Resources.

“This is an important appointment for Lode,” LDR exec chair Andrew van Heyst said.

“As we move the Webbs Consol silver project towards a maiden resource, Jason’s expertise and engagement will be critical in delivering a commercial outcome for our shareholders and stakeholders.”

Shares in the junior are up 19.5% to 9.8c per share at time of writing.

Other resources stocks up in early trade:

Killi Resources – still heavily traded today and up another 29%

Arrow Minerals – Up on no news 25%

Dalaroo Metals – Up on no news 45%

At Stockhead we tell it like it is. While Norwest Minerals and Mako Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.