Explorer TNT Mines has found high-grade tin in Tasmania

Pic: Schroptschop / E+ via Getty Images

Tin explorer TNT Mines says Tassie is proving to be tin-n’-tungsten rich.

The Perth-based explorer (ASX:TIN) has uncovered grades of up to 4.1 per cent tin at the un-mined Lutwyche-Kookaburra prospect, which is located near the past-producing Aberfoyle tin mine.

It says the project is proving itself to be a “significant tin and tungsten narrow-vein system”.

Tin is primarily used as a solder component for electronic circuit boards and microchips, which accounts for about half of its global consumption.

TNT says Lutwyche-Kookaburra is made up of as many as six narrow, but strongly mineralised veins.

>> Tin could be the king of tech metals and here are the ASX stocks that may benefit

They’re accessible via surface shafts and from existing underground development extending from the Aberfoyle mine, 350m below surface.

The combined vein system is believed to be a comparable target to Aberfoyle, where mineralisation was discovered in 1916.

The deposit operated as an underground mine, producing 2.1 million tonnes at 0.91 per cent tin and 0.28 per cent tungsten, until its closure in 1982.

TNT, which made its debut on the ASX in November, assessed previously unprocessed diamond holes to further evaluate the Lutwyche-Kookaburra system.

One hole was drilled to test a strike extension position of the Johnsons-Pay veins, an oblique structure extending between the sub-parallel Lutwyche and Kookaburra veins.

Multiple narrow veins were intersected, with results including 0.30m at 1.47 per cent and 1.5m at 0.96 per cent tin.

A historical diamond hole that tested the same structure 150m to the south-east returned high grades of up to 8.9 per cent tin.

“We consider the assay results from the two recently logged and sampled unprocessed diamond drill holes as strongly consistent with historical observations in underground and surface mapping and confirms the Lutwyche-Kookaburra vein complex to be a significant narrow-vein tin-tungsten target,” chairman Brett Mitchell told investors.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

Tech to drive tin demand

Tin has not been in the spotlight much, but there is now a renewed interest in the base metal, which was recently ranked as the metal most likely to be impacted by new technology.

While tin demand remains steady at the moment, the growing battery market and other new disruptive technologies are expected to drive an increase in demand for the commodity.

London’s BMI Research says the global refined tin market will remain in deficit until 2021 due to declining reserves and mounting regulations.

Tin consumption is predicted to exceed production by 2600 tonnes in 2018, with the deficit expected to rise to 7800 tonnes in 2021.

This is expected to drive the price of tin up to $US22,500 per tonne by 2021 – up from $US21,125 at the moment.

Here’s a list of ASX stocks with exposure to tin courtesy of leading ASX data provider Mak Corp. (Scroll or swipe for full table)

| ASX Code | Name | One-year change | Price Apr 24, 2018 (intraday) | Price Apr 24, 2017 | Market Cap |

|---|---|---|---|---|---|

| AVW | AVIRA RESOURCES | suspended | 0.009 | 0.14 | 3.4M |

| CMY | CAPITAL MINING | suspended | 0.005 | 0.015 | 5M |

| CSD | CONSOLIDATED TIN | suspended | 0.025 | 0.025 | 22.5M |

| HCO | HYLEA METALS | -0.294117647059 | 0.012 | 0.017 | 30.8M |

| TTW | TOPTUNG | 0 | 0.05 | 0.05 | 7.5M |

| ANW | AUS TIN MINING | 1.5 | 0.02 | 0.008 | 41.2M |

| DTM | DART MINING NL | 0.571428571429 | 0.011 | 0.007 | 7.7M |

| CGN | CRATER GOLD MINI | 0.1 | 0.022 | 0.02 | 6.1M |

| DMI | DEMPSEY MINERALS | 0.803278688525 | 0.11 | 0.061 | 6.3M |

| AGS | ALLIANCE RESOURC | 0.292134831461 | 0.115 | 0.089 | 11.5M |

| SRZ | STELLAR RESOURCE | -0.285714285714 | 0.02 | 0.028 | 8.0M |

| CGM | COUGAR METALS NL | -0.125 | 0.007 | 0.008 | 6.4M |

| KAS | KASBAH RESOURCES | -0.333333333333 | 0.016 | 0.024 | 16.7M |

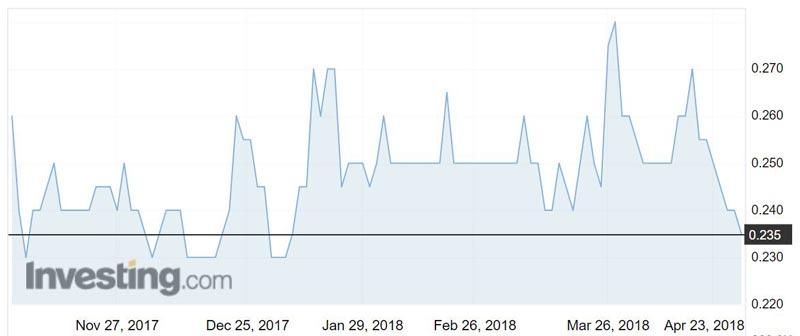

| TIN | TNT MINES (floated Nov 2017) | 0.225 | 0.245 | 0.2 | 7.6M |

| SI6 | SIX SIGMA METALS | -0.291666666667 | 0.017 | 0.024 | 7.3M |

| DKM | DUKETON MINING | 0.2 | 0.24 | 0.2 | 27.7M |

| KSN | KINGSTON RESOURC | 0.05 | 0.021 | 0.02 | 26.7M |

| NAE | NEW AGE EXPLORAT | -0.526315789474 | 0.009 | 0.019 | 4.1M |

| HAV | HAVILAH RESOURCE | -0.650986342944 | 0.23 | 0.659 | 50.2M |

| VIC | VICTORY MINES | 0 | 0.013 | 0.013 | 14.7M |

| ADN | ANDROMEDA METALS | 0.2 | 0.006 | 0.005 | 6.3M |

| APC | AUSTRALIAN POTAS | -0.217391304348 | 0.09 | 0.115 | 23.3M |

| WLF | WOLF MINERALS | -0.238805970149 | 0.051 | 0.067 | 57.7M |

| CLL | COLLERINA COBALT | 5 | 0.12 | 0.02 | 58.5M |

| ADV | ARDIDEN | -0.35 | 0.013 | 0.02 | 15.3M |

| MRR | MINREX RESOURCES | -0.119402985075 | 0.059 | 0.067 | 5.4M |

| VMS | VENTURE MINERALS | 0.272727272727 | 0.042 | 0.033 | 18.6M |

| CHK | COHIBA MINERALS | -0.529411764706 | 0.008 | 0.017 | 4.5M |

| MCT | METALICITY | -0.369565217391 | 0.029 | 0.046 | 17.4M |

| MLX | METALS X | 0.0958904109589 | 0.8 | 0.73 | 520.2M |

| ENT | ENTERPRISE METAL | -0.263157894737 | 0.014 | 0.019 | 5.0M |

| AGR | AGUIA RESOURCES | -0.4375 | 0.27 | 0.48 | 33.5M |

| TKM | TREK METALS | -0.487804878049 | 0.021 | 0.041 | 6.2M |

| AMG | AUSMEX MINING GR | -0.375 | 0.05 | 0.08 | 19.4M |

| CAS | CRUSADER RESOURC | -0.554545454545 | 0.049 | 0.11 | 18.4M |

| LIT | LITHIUM AUSTRALI | 0.0384615384615 | 0.135 | 0.13 | 57.5M |

| AYM | AUSTRALIA UNITED | -0.5 | 0.002 | 0.004 | 2.5M |

| EMH | EUROPEAN METALS | -0.521739130435 | 0.44 | 0.92 | 61.6M |

| BMT | BERKUT MINERALS | -0.309523809524 | 0.145 | 0.21 | 7.9M |

| CXO | CORE EXPLORATION | -0.246376811594 | 0.052 | 0.069 | 30.8M |

| INF | INFINITYITHIUM | -0.596153846154 | 0.105 | 0.26 | 21.8M |

| ELT | ELEMENTOS | 0 | 0.006 | 0.006 | 7.7M |

*Prices are as of April 24 (intraday)

Stockhead is proud to use Mak Corp as a provider of great value, accurate and reliable data on ASX-listed mining stocks. For more information head to Mak Corp’s website.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.