Tin could be the king of tech metals and here are the stocks that may benefit

Could tin be the king of tech metals? Pic: Getty

Tin has not been in the spotlight much, but there is now a renewed interest in the base metal, which was recently ranked as the metal most likely to be impacted by new technology.

Tin is primarily used as a solder component for electronic circuit boards and microchips — which accounts for about half of its global consumption.

While tin demand remains steady at the moment, the growing battery market and other new disruptive technologies are expected to drive an increase in demand for the commodity.

>> Scroll down for a list of ASX stocks with tin exposure, courtesy of leading ASX data provider Mak Corp

Heavyweight Rio Tinto (ASX:RIO) pointed out recently that tin edged out the favoured lithium and cobalt battery metals as the metal most likely to be impacted by new technology.

The technologies that are expected to impact tin demand include autonomous and electric vehicles, advanced robotics, renewable energy, and advanced computing and IT.

Research is showing tin provides cheaper and improved capacity to many alternative battery designs, according to Carnavale Resources (ASX:CAV) – which this week announced it is adding the metal to its portfolio.

The overall volume of batteries required for the electric vehicle industry is expected to drive ongoing demand over the next decade and beyond.

The tin price has jumped 64.5 per cent since January 2016 and is sitting around $US21,800 ($28,640) per tonne. Since the start of this year, the price has rallied more than 9 per cent.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

This has prompted some ASX-listed explorers to revisit previously shelved projects while others are making their foray into the tin sector.

Carnavale Resources announced earlier this week it’s moving to acquire a 70 per cent interest in a Uganda tin project called “Isingiro”.

The company was made aware of the project by high profile mining personality Klaus Eckhof – the man behind market darling AVZ Minerals (ASX:AVZ).

Mr Eckhof has in the past had success with the high-grade Bissie tin project in the Democratic Republic of the Congo for Alphamin Resources.

Carnavale executive chairman Ron Gajewski told Stockhead the Isingiro project will be a priority along with its cobalt project in Kalgoorlie, Western Australia.

“It’s quite a high priority,” he said.

“We just see tin as one of these energy/battery type products that has a dwindling resource, and the price we see is potentially going upwards as well.

“There’s not too many high-grade deposits around the globe. This is one we really see has potential for size and hasn’t been drilled to our knowledge using modern day techniques.”

Meanwhile, Venture Minerals (ASX:VMS) announced earlier in April that it had decided to revisit the development of its Mount Lindsay tin and tungsten project because of the high demand coming from the fast-growing electric vehicle market.

The Mount Lindsay project hosts more thsan 80,000 tonnes of tin metal and 3.2 million tonnes of tungsten trioxide.

Supply deficit to continue

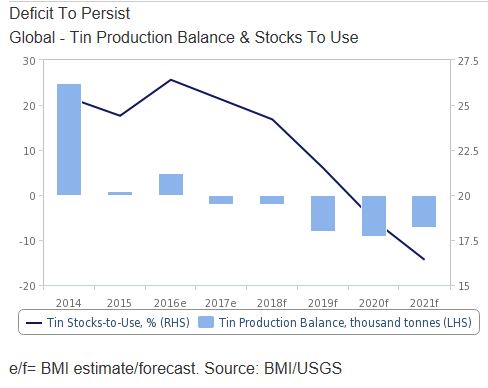

London’s BMI Research says the global refined tin market will remain in deficit until 2021.

The factors that will keep the tin market in deficit for the next few years are declining reserves and mounting regulations.

BMI forecasts tin consumption to exceed production by 2600 tonnes in 2018, with the deficit expected to rise to 7800 tonnes in 2021.

This is predicted to drive the price of tin up to $US22,500 per tonne by 2021.

Market research provider Research and Markets believes the global tin market will be worth $US89.9 billion by 2025, up from $US75.6 billion in 2016.

Is tin “sexy”?

Unlike other commodities like lithium and cobalt, tin hasn’t really caught the eye of investors in recent times.

That’s reflected in the share prices of many junior players.

More than half the ASX-listed companies tracked by Stockhead have witnessed declining share prices over the past 12 months.

But that trend might be reversing.

Here’s a list of ASX stocks with exposure to tin courtesy of leading ASX data provider Mak Corp. (Scroll or swipe for full table)

| ASX Code | Name | One-year change | Price Apr 24, 2018 (intraday) | Price Apr 24, 2017 | Market Cap |

|---|---|---|---|---|---|

| AVW | AVIRA RESOURCES | suspended | 0.009 | 0.14 | 3.4M |

| CMY | CAPITAL MINING | suspended | 0.005 | 0.015 | 5M |

| CSD | CONSOLIDATED TIN | suspended | 0.025 | 0.025 | 22.5M |

| HCO | HYLEA METALS | -0.294117647059 | 0.012 | 0.017 | 30.8M |

| TTW | TOPTUNG | 0 | 0.05 | 0.05 | 7.5M |

| ANW | AUS TIN MINING | 1.5 | 0.02 | 0.008 | 41.2M |

| DTM | DART MINING NL | 0.571428571429 | 0.011 | 0.007 | 7.7M |

| CGN | CRATER GOLD MINI | 0.1 | 0.022 | 0.02 | 6.1M |

| DMI | DEMPSEY MINERALS | 0.803278688525 | 0.11 | 0.061 | 6.3M |

| AGS | ALLIANCE RESOURC | 0.292134831461 | 0.115 | 0.089 | 11.5M |

| SRZ | STELLAR RESOURCE | -0.285714285714 | 0.02 | 0.028 | 8.0M |

| CGM | COUGAR METALS NL | -0.125 | 0.007 | 0.008 | 6.4M |

| KAS | KASBAH RESOURCES | -0.333333333333 | 0.016 | 0.024 | 16.7M |

| TIN | TNT MINES (floated Nov 2017) | 0.225 | 0.245 | 0.2 | 7.6M |

| SI6 | SIX SIGMA METALS | -0.291666666667 | 0.017 | 0.024 | 7.3M |

| DKM | DUKETON MINING | 0.2 | 0.24 | 0.2 | 27.7M |

| KSN | KINGSTON RESOURC | 0.05 | 0.021 | 0.02 | 26.7M |

| NAE | NEW AGE EXPLORAT | -0.526315789474 | 0.009 | 0.019 | 4.1M |

| HAV | HAVILAH RESOURCE | -0.650986342944 | 0.23 | 0.659 | 50.2M |

| VIC | VICTORY MINES | 0 | 0.013 | 0.013 | 14.7M |

| ADN | ANDROMEDA METALS | 0.2 | 0.006 | 0.005 | 6.3M |

| APC | AUSTRALIAN POTAS | -0.217391304348 | 0.09 | 0.115 | 23.3M |

| WLF | WOLF MINERALS | -0.238805970149 | 0.051 | 0.067 | 57.7M |

| CLL | COLLERINA COBALT | 5 | 0.12 | 0.02 | 58.5M |

| ADV | ARDIDEN | -0.35 | 0.013 | 0.02 | 15.3M |

| MRR | MINREX RESOURCES | -0.119402985075 | 0.059 | 0.067 | 5.4M |

| VMS | VENTURE MINERALS | 0.272727272727 | 0.042 | 0.033 | 18.6M |

| CHK | COHIBA MINERALS | -0.529411764706 | 0.008 | 0.017 | 4.5M |

| MCT | METALICITY | -0.369565217391 | 0.029 | 0.046 | 17.4M |

| MLX | METALS X | 0.0958904109589 | 0.8 | 0.73 | 520.2M |

| ENT | ENTERPRISE METAL | -0.263157894737 | 0.014 | 0.019 | 5.0M |

| AGR | AGUIA RESOURCES | -0.4375 | 0.27 | 0.48 | 33.5M |

| TKM | TREK METALS | -0.487804878049 | 0.021 | 0.041 | 6.2M |

| AMG | AUSMEX MINING GR | -0.375 | 0.05 | 0.08 | 19.4M |

| CAS | CRUSADER RESOURC | -0.554545454545 | 0.049 | 0.11 | 18.4M |

| LIT | LITHIUM AUSTRALI | 0.0384615384615 | 0.135 | 0.13 | 57.5M |

| AYM | AUSTRALIA UNITED | -0.5 | 0.002 | 0.004 | 2.5M |

| EMH | EUROPEAN METALS | -0.521739130435 | 0.44 | 0.92 | 61.6M |

| BMT | BERKUT MINERALS | -0.309523809524 | 0.145 | 0.21 | 7.9M |

| CXO | CORE EXPLORATION | -0.246376811594 | 0.052 | 0.069 | 30.8M |

| INF | INFINITYITHIUM | -0.596153846154 | 0.105 | 0.26 | 21.8M |

| ELT | ELEMENTOS | 0 | 0.006 | 0.006 | 7.7M |

Kasbah Resources (ASX:KAS), which is advancing its Achmmach tin project in north Morocco towards production, has dropped by a third in the past year to around 1.6c.

But since the start of this year, the shares have added more than 14 per cent.

Stellar Resources (ASX:SRZ) over the past year has slid nearly 29 per cent — but since the start of 2018 has regained 17 per cent to trade at 2c.

In March, the company was granted the final mining lease for its Heemskirk tin project in Tasmania.

“It’s hard to find any real ASX success stories in the sector,” resources expert Gavin Wendt told Stockhead.

“There aren’t really many producers at the present time and as a result of that, interest in the sector has just typically ground along. It’s not exactly a sexy metal.”

While Mr Wendt sees a place for tin among all of the new age applications, the problem emerging producers face is a flood of mothballed production coming back online.

“As soon as we start to see an uptick in tin prices over any sort of significant period of time, what you typically tend to get is quite a significant supply side response,” he said.

“A lot of mines that have previously been shut down due to lower prices, a lot of that production starts to make its way back into the market.

“Tin isn’t a particularly rare sort of metal, it’s not particularly challenging to find or to mine. So I think what we’re likely to see is that any sustained period of price strength is likely to see new production flushed out.”

Stockhead is proud to use Mak Corp as a provider of great value, accurate and reliable data on ASX-listed mining stocks. For more information head to Mak Corp’s website.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.