Thomson wraps up acquisition of Queensland silver ground

Thomson Resources has completed the acquisition of Caesar Resources, which held a tenement application bordering the producing Cannington silver mine. Pic: Getty Images

Special Report: Thomson has completed the acquisition of highly-prospective exploration ground surrounding the producing Cannington silver mine in Queensland.

With the acquisition of Caesar Resources in the bag, the company can now progress the 90sqkm tenement application (CR tenement) towards grant and develop its exploration strategy in conjunction with the Brumby prospect about 10km to the west that it also applied for.

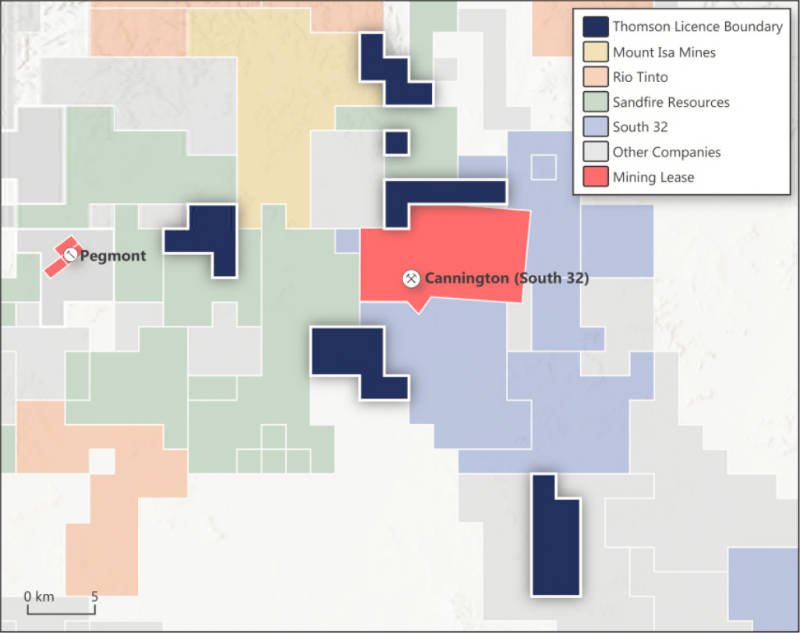

With its location bordering the Cannington mine and amongst tenements held by major and mid-tier companies such as Rio Tinto, South 32 and Sandfire Resources, Thomson Resources (ASX:TMZ) is understandably excited about the new CR tenement application.

The Cannington silver mine, owned by South32 (ASX:S32), is one of the world’s largest producers of silver and lead.

Multiple magnetic and geological structures run through the Cannington mine and continue into the CR tenement.

The new tenement is also on trend and in the same rock types as the Cannington deposit, making it fertile for silver-lead deposits.

South32’s (ASX:S32) world-leading Cannington silver mine processed more than 2.8 million tonnes of ore grading 156 grams per tonne silver, 4.7 per cent lead and 3.3 per cent zinc, for the production of 11.8M oz of payable silver, 110.4kt payable lead and 238kt of payable zinc for the in the 2020 financial year.

Once the CR and Brumby tenements are granted, the company plans to conduct a comprehensive search over the whole area to find Broken Hill-type or iron ore-copper-gold-type deposits under thin cover at exploitable depths with the goal of targeting silver, gold, copper, zinc and lead mineralisation.

Brumby prospect

Ongoing review of historical information on the Brumby prospect has demonstrated that it is analogous to the Osborne and Eloise copper-gold deposits to the north.

Significant historical drill intercepts are 16m at 1.8 per cent copper and 0.5 grams per tonne (g/t) gold, 27m at 0.7 per cent copper and 0.4g/t gold and 33m at 0.4 per cent copper and 0.5g/t gold that includes a high-grade intersection of 1m at 9.1g/t gold.

These holes outline a steeply dipping northwest trending mineralised zone that is at least 350m in length that remains open both to the northwest and southeast, a trending alignment that appears to be a regional magnetic feature.

This article was developed in collaboration with Thomson Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.