Thomson acquires Texas-sized silver ‘jigsaw piece’ near QLD border

Big Tex, the towering mascot of the State Fair of Texas. Pic: Getty Images

Thomson Resources has consolidated its hold on silver in the New South Wales/Queensland border region, acquiring the historic Texas project with substantial infrastructure in place.

The acquisition of Texas for $2.5 million from the in-liquidation MRV Metals Pty Ltd, adds permitted mine infrastructure, mine and exploration leases, JORC 2012 silver-gold resources, and connections to the southern Queensland power grid to Thomson’s (ASX:TMZ) already strong silver project book. Thomson will also replace the existing approximately $3.3M rehabilitation bonds for the mining leases.

The project serves a significant step in Thomson’s Fold Belt Hub and Spoke Silver centralised processing strategy, joining the recently acquired Webbs and Conrad silver deposits in NSW and the earn in of up to 70% and JV on the Mt Carrington silver-gold project in QLD as well as their existing Hortons Gold Project.

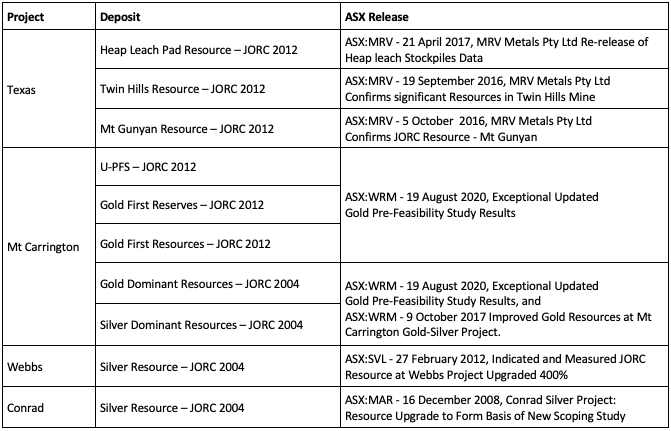

All recently acquired projects have either existing JORC 2004 or 2012 resources and Thomson has begun the process of having existing resources for its Hub and Spoke projects re-estimated to JORC 2012 reporting standard.

This includes the existing reserves & resources which are to be restated or evaluated and, where supported by the historic drilling and adequate quality control data, converted to JORC 2012 resources by Thomson’s resource consultants (for further information on resource figures referenced please refer to announcement table at the end of this article).

The existing combined resources provide Thomson with a huge resource base that has the ability to realise substantial value from their “Fold Belt Hub & Spoke” strategy and as described by Thomson executive chairman David Williams “will take us close to our goal of having at least 100 million ounces of silver equivalent resources available to that facility if required.”

That strategy involves the processing of ore from multiple regional deposits in the one centralised processing facility – both Texas and Mt Carrington have comparable permitted mine infrastructure, though Thomson said initial review suggested the site topography, excellent access and location on the state power grid would likely favour the location of a plant at Texas.

For this reason, Texas is regarded by Thomson as “perhaps the most important jigsaw piece in the TMZ hub and spoke strategy”.

The project’s previous owners have maintained a heap leach circuit and plant in turnkey condition, and previously announced the four existing pads contained a resource of heap leach recoverable silver. Thomson is evaluating an interim restart of the heap leach circuit which could potentially generate cashflow sooner rather than later.

Texas is no one-hit wonder – it also adds significant resources to Thomson’s silver holdings in the region, including a resource that extends beneath the pit floor at the Twin Hills deposit and into the undeveloped Mt Gunyan deposit which outcrops as a prominent on the mining lease.

Twin Hills historically produced about 1.4 million ounces of silver, and Thomson is in the process of restating or converting the resources at its hub and spoke projects. The company will also consolidate the resource and reserve figures overall under the Thomson banner.

Thomson executive chairman David Williams said the company was very pleased to have been successful for its tender on the project.

“This provides a key piece for our implementation of the granite belt hub and spoke strategy,” he said.

“Not only will it provide Thomson with an ideal location for a centralised processing facility that we envisage, but it will also bring the additional resources which will take us closer to our goal of having at least 100 million ounces of silver equivalent resources available to that facility if required.

“The project has also essentially been maintained in a turnkey condition which will enable Thomson to extract existing silver resources from four heap leach pads at an early stage if desired, as well as provide significant in-ground and above ground infrastructure in order to facilitate a ready route to early production with low capital expenditure.”

Thomson said it was reviewing its debt financing options and the feasibility of shareholder distributions of physical metal.

Exploration potential abounds

Williams highlighted the Texas project’s exploration potential for silver, but also for gold, zinc, lead and copper.

The company has engaged Global Ore Discovery to evaluate the exploration prospects of Texas, though a regional scale initial interpretation suggests that the Twin Hills and Mt Gunyan deposits are part of a larger, underexplored silver-gold-base metals district with the potential to deliver further discoveries.

Exploration licence applications have been submitted covering 518km2 to secure extensions to the Texas district surrounding gold and silver occurrences.

On the deposit level, gold intersections towards the base of drilling at both deposits remain open at depth and along strike, providing priority targets for future exploration drilling.

This includes intersections at Mt Gunyan of:

- 5m at 8.8 grams per tonne gold and 65g/t silver from 149m, including 1m at 43.2g/t gold and 300g/t silver;

- 4m at 11.6g/t gold and 34g/t silver from 130m, and;

- 4m at 7.4g/t gold and 55g/t silver from 156m.

The Texas project, on the New England Fold Belt, is 8km east of the township of Texas in Queensland, and around 10km from the border with NSW. The mine sits 165km from the Mt Carrington project and 100km from the Webbs project in NSW.

Thomson has also recently been drilling for tin at the Bygoo project and gold at the Mallee Hen gold prospect in NSW.

Resources Reserves and Resources References:

This article was developed in collaboration with Thomson Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.