Thomson lands a whale as it expands NSW silver-gold hub with Mt Carrington farm-in

Thomson is bulking up its NSW silver-gold hub with its farm-in to White Rock's Mt Carrington project. Pic: Getty Images

Thomson is earning up to 70 per cent of the advanced Mt Carrington gold and silver project that supports its ‘Hub and Spoke’ strategy in New South Wales.

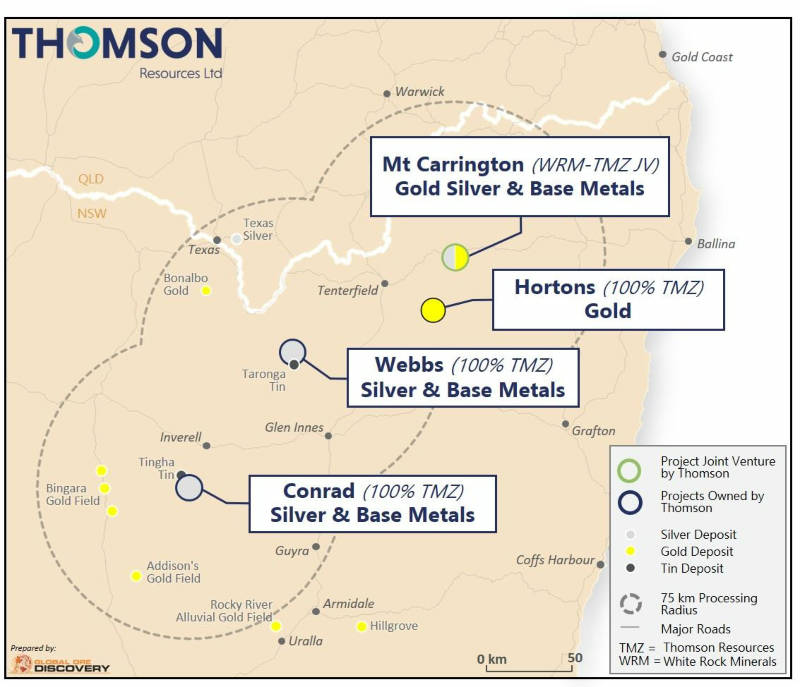

The Mt Carrington deal marks the beginning of Thomson’s ongoing consolidation efforts aimed at building a large silver – gold resource base within a processing halo to support their new centralised “Hub and Spoke” development strategy. Mt Carrington, along with the Thomson recently acquired Webbs and Conrad Silver Projects as well as the Hortons Gold Project will form the core of the centralised processing strategy.

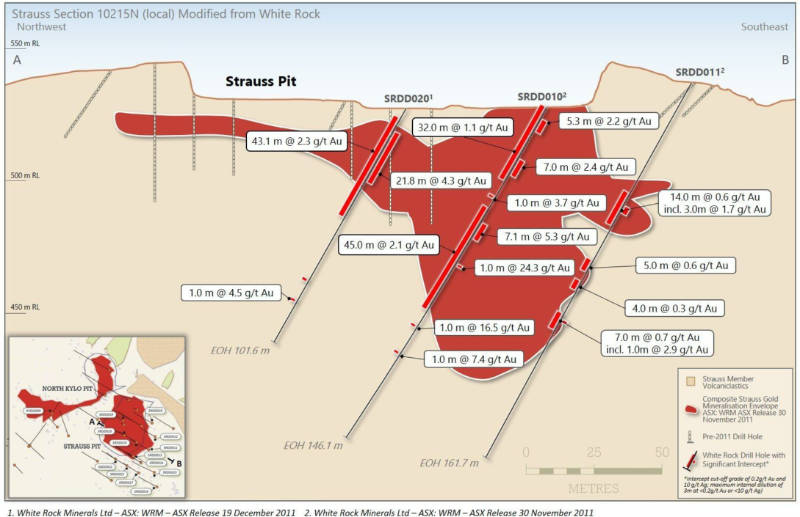

White Rock in their 19 August 2020 announcement confirmed a JORC 2012 compliant mineral resources of 352,000oz gold and 23,247,000oz of silver including an open pit ore reserve of 4.1Mt grading 1.3 grams per tonne gold for 174,000oz of contained gold at Mt Carrington.

The mineral reserve formed the basis of an updated pre-feasibility study on Mt Carrington completed by White Rock in August 2020 and supported average gold sales of 35,500ozpa over the initial Gold Stage One 5-year operation. This initial Gold Stage One was anticipated to generate pre-tax cash flow of $126m over the first five years of operations based on a $2,300/oz gold price.

Net present value and internal rate of return – both measures of a project’s potential profitability – were estimated at $93m and 82 per cent respectively while capital costs are expected to be about $39m with payback of just 14 months from production start.

All-in-sustaining costs are estimated to be a low $1,327/oz.

Thomson Resources (ASX:TMZ) is earning the interest from White Rock Minerals (ASX:WRM) under a binding and exclusive term sheet for a three-stage earn-in that could lead to the development of the Mt Carrington project.

“Thomson is building momentum with its ongoing consolidation efforts focused on its new ‘Hub and Spoke’ silver-gold strategy,” executive chairman David Williams said.

“Mt Carrington is a high quality precious metals project that complements the company’s existing quality silver assets at Webbs and Conrad and adds value to Thomson’s nearby highly prospective Horton gold project.

“Mt Carrington is well advanced down the Feasibility Study path, and with due diligence completed at both Webbs and Conrad, there is an ability to bring together the different resources in these silver–gold deposits to significantly strengthen the economic viability of all the projects.”

Mt Carrington gold-silver project

Mt Carrington is just 5km from the township of Drake and has a long history of gold-silver and copper mining starting in 1853 along with modern small-scale open pit mining by Mt Carrington Mines from 1974 to 1990.

Besides its resources, the project also includes onsite office, accommodation and amenities, a 1.5Mt tailings dam, a 750ML freshwater dam, a reverse osmosis water treatment plant, access to grid power, previous processing plant foundations and a current environmental assurance bond of about $968,000.

Thomson has identified the potential to further expand silver-gold resources in and around Mt Carrington by exploring the potential of its nearby Hortons project where historical drilling has returned hits of up to 27.5m at 7.5g/t gold at an underexplored intrusion-related deposit.

Exploration will also be carried out in the ‘target rich’ Mt Carrington district for high-grade low and intermediate sulfidation gold-silver that is known to occur in similar geological settings globally.

Under its Hub and Spoke strategy, the company is evaluating whether the consolidated portfolio could provide the optionality to centrally process and blend ores for beneficiation purposes and the critical resource scale to justify the use of processing technologies to maximise recoveries of silver-gold, base and technology metals.

Farm-in terms

Thomson has committed to the first stage of the farm-in that includes a minimum spend of $500,000 in the first six months and progressive cash payments of $700,000 over 18 months to earn a 30 per cent stake in Mt Carrington.

This includes the delivery of a definitive feasibility study and the completion and submission of the Environmental Impact Statement.

Should the company elect to proceed with the farm-in rather than exiting entirely, it can earn a further 21 per cent by achieving government decision consent and placing the project in a position to have the mine funded, built and commissioned.

The remaining 19 per cent can then be purchased by paying White Rock $12.5m.

Once Thomson has achieved a 70 per cent stake in Mt Carrington, funding for its development through to commercial production will be on a pro-rata basis.

This article was developed in collaboration with Thomson Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.