This list has a history of tipping ressie winners. Can it hit the mark again?

They may not be built yet, but these are the ASX projects Argonaut thinks can ride the cycles. Pic: Getty Images

- Argonaut’s latest Best Undeveloped Projects list was launched this month

- Companies listed in the guide have historically done well, with cumulative gains for key picks of 212% over more than a decade

- Gold, uranium, copper and critical minerals deposits all among the 25-strong list of key picks and special mentions

In a world of AI, quants and passive investing, there are smoke signals to be found that active management and stock picking still matters when it comes to choosing outperformers.

Look no further than the Best Undeveloped Projects list out of Perth brokers Argonaut, the tome from the Wild West that puts guard rails around which future mines have the best prospects for success.

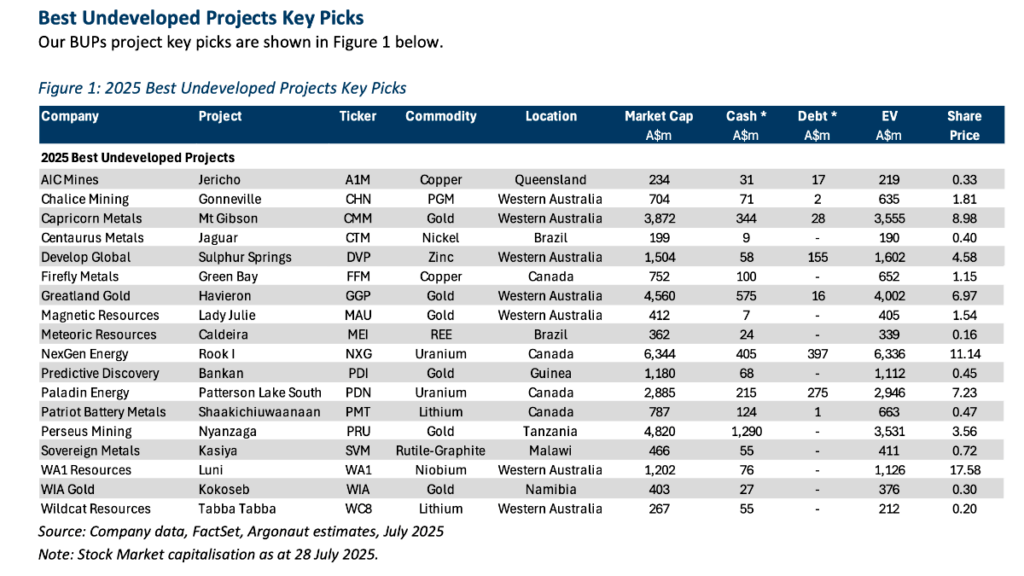

This year’s list is now out, presenting 25 projects yet to enter construction that have the potential to become significant mining operations.

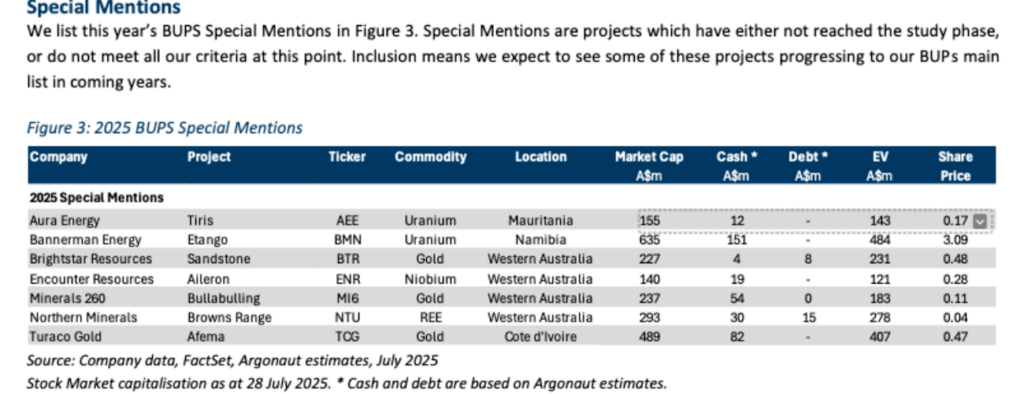

Of those, 18 make the main list with another seven in the special mentions category.

It’s impossible to predict the future with perfect accuracy, but recent history suggests the list can be a good guide for value creation.

Argonaut has drawn up the list each year since 2014. In that time there have been four down years and seven up years for its key picks, with average growth of 14%.

A cumulative investment would have netted 212% for key picks and 94% for special mentions over that period, against just 61% of the ASX 200 and 123% for the small resources index.

Last year was a strong one for Argonaut’s key picks, notching their third best performance in the past decade with average share prices 38% higher. Special mentions underperformed small resources (10% vs 12%), though that came off a massive 58% run in 2023.

The standout performer in 2024’s list was New World Resources (ASX:NWC), up 235% after a bidding war resulted in its $243 million cash takeover by Kinterra Capital – the prize its high-grade Antler copper project in Arizona.

It would be hard to repeat a success like that, with De Grey Mining also a major mover after its scrip takeover by Northern Star Resources (ASX:NST) to end the speculation over who would eventually get to develop the 11.2Moz Hemi gold project.

With that in mind, we felt it was worth a squiz at this year’s book to see which projects Argonaut thinks are the real deal this year.

The list

Before we go onto the list itself, it’s worth noting what criteria Argonaut’s stock pickers use to determine their top selections, giving a sense of what professional analysts look for when they talk about a standout asset.

Geared towards low cost, high margin opportunities, the projects assessed by Argonaut must be development stage, somewhere between a scoping study and pre-commercial production, have an internal rate of return upwards of 25% (large miners typically will develop anything above 15% depending on mine life), profitable through all market conditions and commodity price cycles and highly likely to achieve a project valuation north of $100m within 24 months.

To make the list the project owner must also have a valuation of less than $5bn – no boring, index tracking mega caps here.

This year’s book is a long one. So we’ll roll up the key picks here:

Running through the 18 key picks, and you’ll be surprised to see gold doesn’t totally dominate the ledger – these projects are supposed to work in all commodity cycles after all.

Copper gets two nods, courtesy of AIC Mines’ (ASX:A1M) Jericho and FireFly Metals’ (ASX:FFM) Green Bay. Unloved nickel and resurgent platinum group metals get some love in Centaurus Metals’ (ASX:CTM) Jaguar project in Brazil and Chalice Mining’s (ASX:CHN) Gonneville in WA.

Zinc, rare earths, niobium and rutile all get one mention, with lithium and uranium bagging two a piece.

It’s not everything, but in a sign of the times, gold assets still make up the largest single portion of the list, with six of the 18 names aiming to develop gold assets.

Those include large producers Greatland Resources (ASX:GGP), Perseus Mining (ASX:PRU) and Capricorn Metals (ASX:CMM), who are all looking to build new mines in the coming years at Havieron, near Greatland’s Telfer mine, Nyanzaga in Tanzania and Mt Gibson in WA, respectively.

But there are small caps on the card also: Magnetic Resources’ (ASX:MAU) Lady Julie deposit in WA’s Laverton gold district, Predictive Discovery’s (ASX:PDI) Bankan in Guinea and WIA Gold’s (ASX:WIA) Kokoseb in Cote d’Ivoire are all included, with each shaping as potential M&A targets.

“An improved gold market has fuelled increased exploration across the space, resulting in the emergence of new greenfield and near-mine discoveries,” Argonaut said. “We include nine gold projects, with five located in Western Australia and the remainder across the Africa region.

“We remain firmly committed to our belief that decarbonisation will play an increasingly important role in the global economy. Future facing metals such as lithium, rare earth elements, copper, niobium and uranium are all represented in our project selections.”

Three gold stocks feature on the special mentions, including Brightstar Resources (ASX:BTR) and its soon to be wholly consolidated Sandstone project, where the acquisition of neighbour Aurumin (ASX:AUN) would pump up its inventory from 1.5Moz to 2.4Moz gold.

Tim Goyder’s Minerals 260 (ASX:MI6) and its ripe to be mined Bullabulling mine near Coolgardie also makes the grade along with Diggers and Dealers best emerging company award winner Turaco Gold (ASX:TCG) and its Afema deposit in Cote d’Ivoire.

Rare earths and niobium plays Northern Minerals (ASX:NTU) and Encounter Resources (ASX:ENR) are on the bill, with African uranium opportunities Aura Energy (ASX:AEE) and Bannerman Energy (ASX:BMN) cracking a mention.

Projects to watch

There’s a lot to pore over, but we’ve decided to take a look through some of the key picks and special mentions for a few that piqued our interest.

Aura Energy – Tiris

Aura Energy’s Tiris is among the most advanced uranium assets on the ASX, with first production expected in 2027.

The project lies in the West African country of Mauritania, an off the radar locale for ASX investors which nonetheless is home to major mining operations, especially in gold and iron ore.

Tiris would be its first uranium mine, with Argonaut’s John Scholtz suggesting its 162Mt at 215ppm resource (76.6Mlb) could underpin production of 1.7Mlbpa at all in sustaining costs of US$37.07/lb.

“A DFS on the project was completed in 2021 and has subsequently been updated in 2023 and had a FEED study in 2024 highlighting robust economics. AEE is now focused on funding and is expected to do an FID in the near-term. The project is fully licensed,” Scholtz said.

“Due to current market conditions delaying an FID, AEE’s current target for delivering production is early CY27 rather than their initial estimates in the FEED. Using a 50/50 blend of spot prices and Argonaut forecasts the NPV of Tiris is A$585m.”

That compares very favourably to Aura’s current market cap of $138m.

Magnetic Resources – Lady Julie

Magnetic’s Lady Julie North 4 discovery has grown from 200,000oz to 1.94Moz in just two years, with Argonaut’s Patrick Streater predicting another update could take the resource there to 2.25Moz.

That would add further value to an asset where a feasibility study in July outlined a nine-year mine life producing 114,000ozpa, including 140,000ozpa between years three to eight.

Argonaut has modelled a 10.5 year mine life at 110,000ozpa, with pre-production capex of $375m including working capital, with an initial open pit to be supplemented by an underground from the third year of ops.

“MAU presents both as an attractive standalone development project, whilst also being a compelling M&A target for existing producers in the region looking for a large high-grade ore feed,” Streater said.

The attraction for nearby majors is its locale. Magnetic sits within 15km of both Genesis Minerals’ (ASX:GMD) Mt Morgans mill and Gold Fields’ Granny Smith, both of which have long been regarded as underfed. When deposits outside Lady Julie are included, the broader Laverton project’s resource runs up to 2.32Moz, making it one of the largest undeveloped gold bases in the hot WA Goldfields region.

“MAU continues to progress the Lady Julie project down a standalone development route with a sufficient mining inventory now built to cover pre-production capital costs,” Streater said.

“However, the existing processing infrastructure in the region across various producers makes MAU a compelling M&A target, which could instead be acquired as a bolt-on project for a nearby producer. The LJN4 open pit includes a large high-grade ore reserve of 14.3Mt at 1.6g/t for 726koz, which would be an attractive high-grade feed with scale to supplement existing mill ore feeds or displace lower-grade material.”

Patriot Battery Metals – Shaakichiuwaanaan

Is lithium still sufficiently exciting at spodumene prices of under US$1000/t to warrant best project inclusion?

Argonaut still sees Ken Brinsden’s Patriot as “globally significant” as the largest hard rock lithium deposit in North America, running at 141Mt at 1.39% Li2O.

It bolstered the investment case last month by reporting the world’s largest pollucite hosted caesium deposit also existed on the site, including a high-grade component of 163,000t at 10.25% Cs2O with lithium and tantalum credits.

An exploration target of 146-231Mt at 1-1.5% Li2O means converting drill metres to resources could put the project in league with Pilbara Minerals’ Pilgangoora, MinRes and Albemarle’s Wodgina and the Greenbushes JV in WA for scale.

A feasibility study is due at the end of September.

Predictive Discovery – Bankan

A DFS recently outlined a 12-year operation producing 250,000ozpa at an all in sustaining cost of just US$1057/oz.

Hosting a 2.95Moz reserve, Bankan is one of the largest discoveries made in West Africa in recent years, with the grant of an exploration permit viewed by Argonaut’s Patrick Streater as a key catalyst for the project, expected to cost US$463m to bring into production by 2028.

While wrangling from Guinea’s Government over licences at other projects is potentially throwing some storm clouds over the junta-run jurisdiction, the award of the exploration permit could be a trigger for M&A.

That seems the logical outcome for PDI, which has Perseus, Lundin and Zijin all on its register as significant shareholders.

“We expect the Lundin Group/Zijin to be the most likely owners. Under PDI’s current development timeline, assuming PDI brings Bankan into production, the first gold is targeted for early CY28,” Streater said.

Brightstar Resources – Sandstone

Brightstar is already a small scale gold producer, using toll treatment to deliver between 35-40,000ozpa from a string of gold mines across the Menzies and Laverton gold districts.

An expansion there, using its own plant infrastructure, could enhance that to 70,000ozpa later this decade. But Alex Rovira’s firm’s big opportunity to grow into a 200,000ozpa miner lies in the forgotten Sandstone gold field.

Over the past two years, the firm has delivered on a plan to consolidate the district – the fourth pillar of the Murchison province alongside the Ramelius Resources dominated Mt Magnet and Westgold controlled Cue and Meekatharra – via aggressive M&A.

The latest gambit is its agreed merger with Aurumin, which will take the total inventory to 2.4Moz. FID is due in 2027 with production to start late in 2028 on present ambitions. 100,000m of drilling is planned this financial year.

Argonaut’s Hayden Bairstow has a spec buy rating and $1.60 valuation on 40c BTR. The broker’s 3Mtpa production scenario for Sandstone carries a $200m capex estimate, with average gold production of 105,000ozpa with costs of $3000/oz for the first five years.

A PFS and ore reserve are due in 2026.

Sovereign Metals – Kasiya

Kasiya hosts the world’s largest natural rutile resource of 1.8Bt at 1%, with 1.4% natural graphite a co-product kicker. Natural rutile is the world’s cleanest and most desirable source of titanium dioxide feedstock, with supplies expecting to head into decline over the course of this decade.

Rio Tinto has already read the tea leaves, picking up a 19.9% equity stake in the company, which is expected to deliver a DFS on the Malawi-based project in Q4 2025.

“Rio Tinto (Not Covered/No Rating) holds a 19.9% equity stake in SVM and we anticipate they will ultimately pay a market premium to takeover SVM. The DFS expected in 4QFY25 remains as a key catalyst,” Argonaut’s George Ross said.

Argonaut has a $1.691bn NPV attached to the project, slightly below Sovereign’s optimised PFS estimate. The number is pre-tax, with the application of a 15% Malawian resource rent tax still uncertain.

The project has already attracted the interest of international offtakers, Ross noted.

“The project will produce two critical mineral co-products, rutile and graphite, at a low carbon cost. Kasiya’s rutile concentrate is considered a premium product with good particle size and low deleterious elements,” he said.

“Because of its quality, Kasiya’s rutile is suitable for use as both a titania feedstock and in the high value welding sector. SVM has entered into non-binding MOUs with three major rutile market participants: Mitsui, Chemours and Hascor.”

At Stockhead, we tell it like it is. While Sovereign Metals, Brightstar Resources, Aura Energy and Magnetic Resources are Stockhead advertisers, they did not sponsor this article. The broker’s opinions are not those of Stockhead.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.