This is why Pilbara Minerals boss Ken Brinsden believes miners will keep winning the lithium boom

No this is a boom. Picture: Getty Images

- Pilbara Minerals boss Ken Brinsden says current spodumene prices of US$5000/t are the equivalent of US$6000-7000/oz gold prices

- Raw materials supply is so tight Brinsden says miners will win the lithium boom for a while yet

- Australian Government forecasters say the value of lithium exports will increase almost 600% from $1 billion in 2020-21 to $6.7b by 2027

A lagging investment in new supply will see lithium miners be the winners of the electric vehicle boom for some time to come, Pilbara Minerals (ASX:PLS) boss Ken Brinsden says.

Brinsden says spodumene lithium concentrate prices that have increased 1150% in a little over 18 months from U$400/t to US$5000/t are the equivalent of a gold price at US$6000-7000/oz, three times their all time record from August 2020.

But the outgoing MD of the hard rock lithium miner in WA’s north, which announced a maiden $114 million half-year profit in February four years after opening its Pilgangoora mine, said it would take a long time before demand destruction sends prices down to normal levels with the underinvestment from battery and carmakers in mined supply sending the margin down to the digger.

“Let’s say an average good gold price in the last five to 10 years was about 1500 bucks an ounce US, something like that,” he said at an investor seminar last week.

“The equivalent average good price in the spodumene world would have historically been, let’s say US$500-600 a tonne for our spodumene concentrate.

“To make the direct comparison, you have to take US$1500/oz to about US$6000-7000 an ounce to appreciate how much spodumene has appreciated in about the last 12 months.

“It’s a far cry from the average days in the lithium supply chain world and it’s in response to incredible demand conditions.”

Brinsden attributed much of the astonishing price rise to Covid stimulus measures that have helped fuel mass investment in new energy including renewables, battery storage and electric vehicle subsidies.

“The demand has gone through the roof to the point where it’s a really, really big issue for industry today,” he said. Carmakers paying US$75,000/t for 99.5% pure lithium chemicals that were worth just US$5000/t in September 2020 (spodumene, which now trades at US$5000/t contains just 6% lithia) are now having to suck it up.

“They were not focused on what it meant to create an interconnected supply chain that was going to supply them with enough raw materials as demand came back,” Brinsden said.

“And inevitably it was coming back and today, they’ve been caught short, and they’re going to have to pay through the nose to be able to access raw materials because of that issue for them for quite some time to come.”

Is demand destruction coming? Brinsden doesn’t think so yet.

Lithium carbonate ends 9 months of gains

Prices in China have outpaced the rest of the world due to the rapid expansion of production in the globe’s largest EV market.

But nine months of rises in lithium carbonate prices, spurred by both record EV production and a shift from Chinese carmakers to cheaper lithium-iron-phosphate batteries (LFP) over nickel-cobalt-manganese chemistries came to a halt last week.

“From July 20, 2021 to March 29, 2022, battery-grade lithium carbonate prices have achieved nearly nine months of continuous gains,” Shanghai Metals Market analysts said.

“On March 30, the average price of battery-grade lithium carbonate dropped for the first time this year, down 1,000 yuan/mt compared to the low on March 29, and stood high as a whole.

“The reasons behind the decline include more uncertainties at the terminal end, easing supply tightness, and sentiment to sell off.”

Brinsden, however, sees the price change for carbonate as a breather.

“You can imagine the likes of a CATL and a BYD and maybe one or two others who carry a lot of market power, just saying, ‘hang on let’s just take a breather here’,” he said. “This has all got pretty real and pretty extreme, so in part it doesn’t surprise me.

“However, it’s teased out one more key point, given the extent to which there has been under investment in the raw material supply chain.

“At exactly the same time there’s been huge investment in the midstream value-added chemicals, cellmaking capacity and EV-making capacity.

“You tell me where you think the margin is going to get compressed; it is absolutely going to get compressed downstream.”

Brinsden says even a large drop in carbonate prices would still support super margins for high-flying miners.

“Because the raw materials are so far behind, you’ve got no choice but to lay that incentive price on the table otherwise, material suppliers will not grow,” he said.

“So in my view, whether the headline chemicals price in China is US$75,000 a tonne or whether it’s $50,000 a tonne, does that really materially change the value in the spodumene we’re selling.

“I don’t think so. Honestly, the raw material guys, at least in the foreseeable future are going to keep winning the margin because they are so far behind compared to where demand is today.”

We observed the latest spodumene CIF China is ~US$5000/t; we believe the spot price has room to be much higher, according to China’s current battery-grade lithium carbonate price @US77.8k/t as of today (28 March 2022) #china #spodumene #lithium #batterymetals pic.twitter.com/5l9l6apdUD

— Lili Wu (@lilywu99) March 28, 2022

Miners now getting to spot

While spot prices in Chinese and other Asian markets have skyrocketed, not every miner has been so lucky.

Large scale American producers like Albemarle and SQM have lagged because they have been selling into long-term contracts outside that market.

The owners of the Greenbushes mine in WA’s South West, the world’s largest lithium producer owned by a consortium of Albemarle, Tianqi and IGO (ASX:IGO), has also been well behind rapid rises in spot prices.

Others are enjoying the fruits of their labour though. PLS, which helped set higher spodumene market prices with record sales prices at its Battery Materials Exchange auctions last year, guided receipts of US$2600-3000/t for the March quarter just gone.

Allkem (ASX:AKE), the lithium beast formed from the marriage of hard rock miner Galaxy Resources and brine producer Orocobre, is also onto a winner right now.

One of our expert lists favoured stocks in the battery metals space, Allkem’s Mt Cattlin mine near Ravensthorpe in WA has been selling spodumene for a mine record US$2218/t on a 6% spodumene concentrate basis in the March quarter.

Allkem is now negotiating pricing for US$5000/t for the June quarter. It expects to ship some 50,000t to customers in Asia. Back of the envelope with very much unofficial maths, that’s a potential $330 million (US$250m) in revenue at current exchange rates (though some will come off for things like shipping, tax and product grades).

For reference, Allkem made just $192.1m in revenue in the entire first half of 2021 at both Mt Cattlin and its Olaroz project in Argentina.

And that was a record at the time. With prices for lithium carbonate at Olaroz also rising from US$27,236/t (9% above guidance) in the March quarter to US$35,000/t in the June quarter on projected sales of 3500t, the second half is certain to blow that one out of the water.

That news on Friday supercharged the lithium market, with Allkem up 8.5% to a record $12.40 a share, PLS up 7.2%, and Australia’s next spodumene producer Core Lithium (ASX:CXO) up 11.6% to a record $1.53.

Firefinch (ASX:FFX), which is demerging its 50% share in Mali’s giant Goulamina into new lithium co Leo Lithium and got its US$130 million funding package from JV partner Ganfeng on Friday, was up 13.6%.

Some exploration stocks are going ballistic too. $1.8 billion Sayona Mining (ASX:SYA), which owns a string of hard rock resources in Canada’s Quebec province, is up 78.57% YTD.

You get the gist.

Price reporting from Fastmarkets shows spot market pricing could be pacing even higher.

I think #KOD @KodalMinerals will be revising the DFS numbers on a weekly basis as the price of #Spodumene #Lithium keeps increasing!

Mr Bernard please use latest Spodumene price of

$5750!

That puts Boughini asset at about $12B

MCAP £40M pic.twitter.com/aowRXtCe9E

— @SharesChat (@SharesChat) April 1, 2022

Lithium miners share prices today:

China market still dominates

Brinsden said Chinese prices and market conditions continue to favour miners.

“Our leverage to the China price is pretty much unsurpassed in the Western world,” he said.

“And actually to draw a key anecdote there, our global peers like SQM who are listed in the US, Albemarle, listed in the US, they’re high fiving each other because they’re getting US$15,000/t in the December Quarter.

“Well, the real price in the December quarter was actually triple that, it was US$40,000/t in China. So if I was a shareholder at those companies I’d be seriously motivated to jump on the investor hotline and ask them why they aren’t getting US$40,000, US$70,000 today.

“The reason they’re not getting that price is they don’t participate in the China market in the same way that Pilbara Minerals does. So being a merchant seller of spodumene today is absolutely fantastic business and we represent one of the few stocks globally that is genuinely exposed to that pricing dynamic.”

The reason spodumene miners are in the box seat? Brinsden says converting capacity, factories and chemical plants overseas are getting off the ground in two years. Mines of the scale required to address the supply shortfall take five to seven years.

“So it’s going to take quite some time for the mines to catch up, we have the benefit of a large resource and a large reserve, so we’re going to keep chipping away at expansion capacity,” Brinsden said.

PLS is aiming to scale up by reactivating the Ngangaju plant formerly owned by Altura Mining to take its capacity from 360,000tpa to 580,000tpa by the September quarter, labour issues which have forced recent production downgrades notwithstanding.

Further down the line it plans to capture the tailwinds downstream by ramping up to 1Mtpa and studying both a midstream JV with Calix (ASX:CXL) to produce low emissions lithium salts and a downstream JV in Korea with POSCO.

Both will be projects for the next phase of PLS’ development after Brinsden ends his long stint as MD and CEO at the end of 2022.

Lithium boom to bolster Aussie treasury coffers

Lithium is the name on every investors’ lips but in terms of Australia’s resources exports it is a drop in the ocean compared to the big players coal, iron ore and LNG.

But it’s getting bigger, with the Office of the Chief Economist predicting in its March Resources and Energy Quarterly last week the lithium export sector will rise almost 600% from $1 billion in 2020-21 to $6.7 billion in real terms in 2026-27.

Australia’s lithium carbonate equivalent production is expected to triple from 224,000t to 692,000t over that period, with an additional five lithium hydroxide refineries in operation by then after Tianqi and IGO produced WA’s first onshore lithium hydroxide at their Kwinana plant in August last year.

Combined electric vehicle sales worldwide doubled to hit 6.5 million in 2021 and Department of Industry, Science, Energy and Resources analysts predict EV sales will climb from an estimated 9 million in 2022 to almost 40m by 2040, 40% of all vehicle sales.

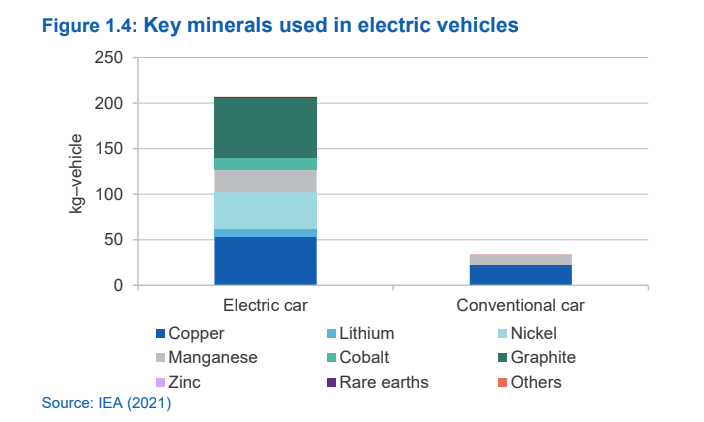

And there are a lot more base metals and of course lithium in battery powered electric vehicles than an internal combustion engine car.

This surge in demand is driving higher prices, Canberra has also noted.

“Total supply from mine and brine operations is currently unable to meet demand. While project development is underway, it will take time to close

the supply gap. Stockpile size is difficult to determine, with some estimates of 4–8 weeks for spodumene,” they said.

“With such tight supply conditions, and given delays associated with shipping times and ongoing supply chain challenges, it is unsurprising that some lithium processors and battery manufacturers are currently securing supplies at record high prices.”

As is normal for government forecasters, the Feds are lowballing forward prices.

They see lithium hydroxide prices surging from US$17,369/t in 2021 to US$27,260/t in 2022 before falling gradually back to US$14,855/t by 2027.

Spodumene prices are expected to rise from an average US$638/t in 2021 to US$1325/t in 2022 before falling gradually to US$915/t in nominal terms and US$809/t in real terms by 2027.

That does include adjustments for the delays sellers on long-term contracts would have getting access to rabid spot pricing.

But it’s worth noting the lithium sector has hit its straps far quicker than the Department boffins ever expected. They now think prices will go from US$1325/t in 2022 to US$1250/t in 2023.

Just three months earlier they predicted spodumene prices would increase to an average of just US$1185/t before falling to US$992/t in 2023.

History tells us to touch wood, but right now prices that low seem barely believable.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.