Bloated inventories to suppress lithium prices ‘for some time’

Pic: Getty/Stockhead

Lithium producer Orocobre (ASX:ORE) is selling product at record-low prices as the battery materials supply chain takes a cautious approach to ramping up operations in a post COVID-19 world.

Orocobre said total sales volume for the June quarter would be ~1,600 tonnes of lithium carbonate at an average price of $US4,015/tonne.

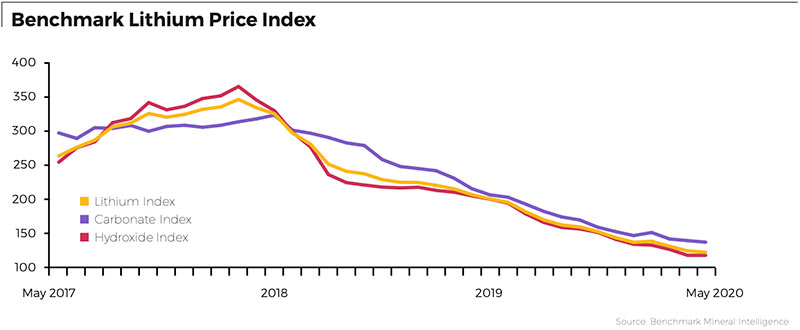

That’s a 72.5 per cent drop from the $US14,699/tonne it received in the September quarter 2018.

Lithium prices have been going downhill for a while and existing supply/demand challenges have just been compounded by the current crisis.

COVID-19 restrictions limited the ability to complete sales during the June quarter, Orocobre says.

“While most logistical issues have now been addressed, delivery of product is yet to return to normal as customers delay shipments due to lower production and excess inventory,” it says.

Bloated inventory levels are expected to limit any visible price improvements for some time.

“Following the phased restart of battery and electric vehicle (EV) production, manufacturers are taking a cautious approach to ramping up operations due to the lack of visibility regarding the economic impact of COVID-19 on consumer purchases of EV and portable electronics.”

In particular, European auto manufacturers have been impacted with April new car sales down 74 per cent on those in January, the company says.

Here’s the good news

The pandemic has also sparked faster investment in some jurisdictions. This will have medium and long-term benefits, Orocobre says.

This echoes Roskill analysts who say COVID-19 has impacted 2020 EV sales but may create a more supportive policy and incentive environment going forward.

“European governments have expressed a clear intention to utilise electric vehicle investment and support as a platform to stimulate their respective economies,” Orocobre says.

“Germany has doubled previous incentives and now provides up to €9,000 for purchasing an EV while France, the UK and other European countries are all implementing specific programs to support the manufacture and use of EV and hybrid vehicles.”

This is good for battery metals plays. In June, Infinity Lithium (ASX:INF) surged after San José became the first lithium project to secure European funding.

Meanwhile, battery anode hopeful Talga (ASX:TLG) says its flagship Vittangi project has now been demarcated as a “mineral deposit of national interest” by the Swedish Geological Survey.

That’s important as the project moves toward financing and development.

In China, subsidisation has grown at the provincial level delivering a modest improvement in EV sales, Orocobre says.

And sales could increase further in 2020 with better availability of highly sought-after international brands, while continuing battery cost reductions are likely to be passed on to consumers through lower EV prices.

READ: The outlook for the next wave of lithium producers remains positive

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.