This crack team plans to unlock the copper and nickel potential of WA’s Yamarna Belt

Pic: Getty

Amid the rush of junior explorers heading to the ASX these days not many can lay claim to having the most highly accomplished exploration expert to have ever worked in the district on their side.

That is a clear point of difference for base metals explorer Cosmo Metals (ASX:CMO), with Ziggy Lubieniecki on board as a non-executive director.

If that name seems familiar it’s because he is renowned for his discoveries in the WA mining industry, notably the 6.7Moz Gruyere mine currently spitting out a decent 300,000oz of gold a year for Gold Road Resources and Gold Fields.

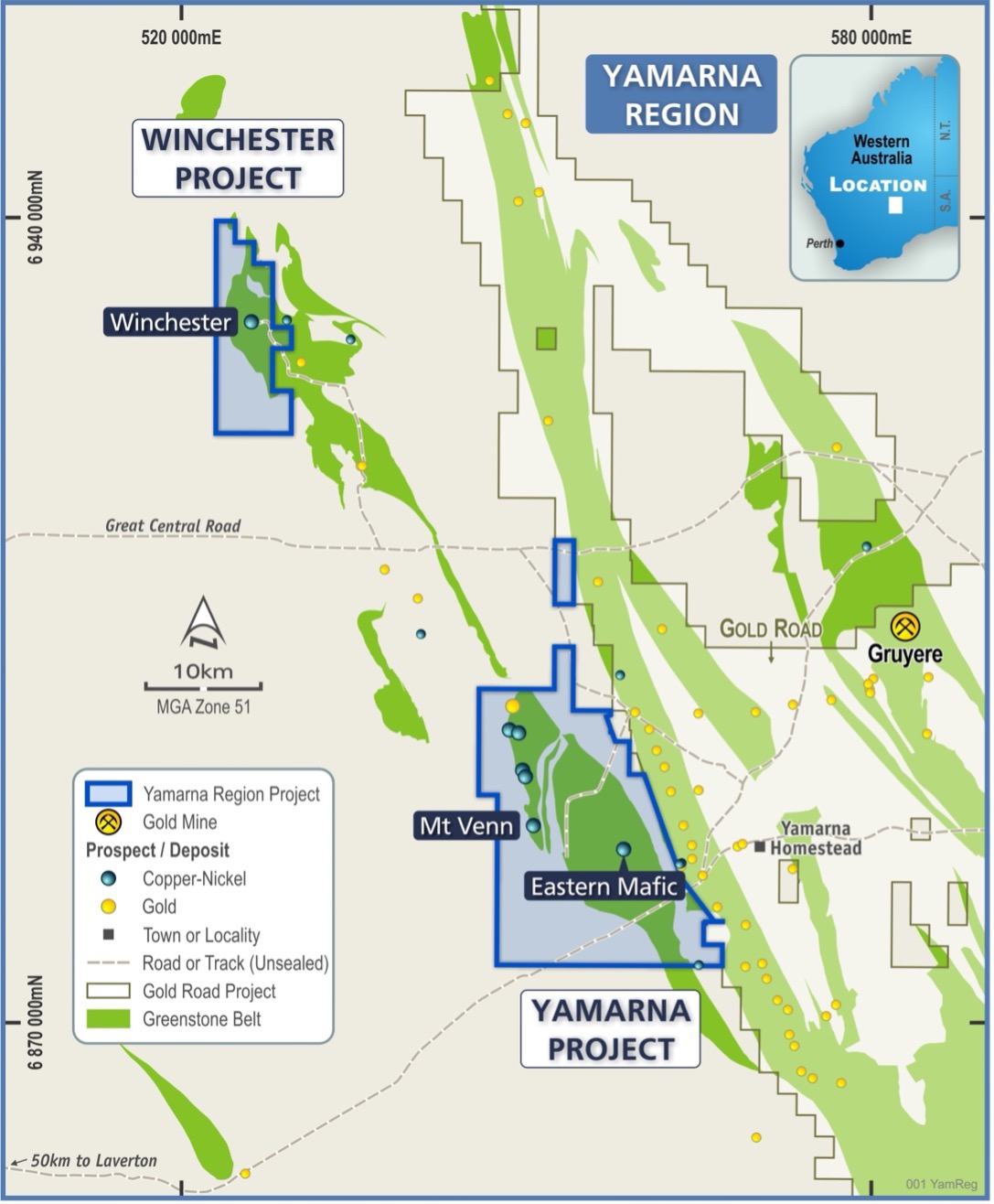

Cosmo Metals, a spinoff of gold explorer Great Boulder Resources (ASX:GBR) has another related string to its bow – the plan to drill just a few kilometres west of Gruyere in WA’s underexplored and highly prospective Yamarna Belt. Lubieniecki is the best man to have in your corner.

“Ziggy is probably not as well known outside of the industry, but his knowledge of the geology of the Yamarna Belt is absolutely incomparable,” said Cosmo MD James Merrillees, himself an experienced geologist with stints as a managing director at Cygnus Gold and Golden Mile Resources under his belt.

“The Gruyere gold discovery is a great story of persistence.

“It is one of those ‘overnight success stories’ that was 10-15 years in the making, built on the back of strong technical work by Ziggy and his team.

“He is a great asset to Cosmo.”

While the Yamarna Belt may be best known up to this point for its gold endowment, it is the future facing metals of copper, nickel and cobalt that stokes Cosmo’s interest.

The company will list today with a clear-eyed vision about the base metals discoveries they believe will turn the company into the next ‘overnight success story’.

Third time’s a charm

Cosmo’s three Yamarna projects – Mt Venn, Eastern Mafic and Winchester – have been explored before, most recently by Great Boulder.

GBR, which still holds a 49.5% chunk of Cosmo after its $5 million IPO, saw the opportunity to pass the project onto a copper-nickel focused explorer that could give the projects the time and investment they deserve while allowing GBR to focus on its flagship high-grade Side Well Gold Project and the shallow, large scale Whiteheads Gold Project which are returning outstanding results and have created shareholder value over the past 12 months

Great Boulder’s shareholders are already excited by the prospects of exposure to the investment thematic, sending GBR stock 8% higher on Friday when it confirmed the listing would take place at 12.30pm AEDT today.

As most major greenfields discoveries over the past decade demonstrate, it’s often the second, third, fourth or fifth explorer that comes along that turns the hint of something good into a company maker.

To Cosmo’s great advantage, it already boasts a swag of high-grade copper and nickel sulphide hits to follow up across its 460km2 land package. With exploration activity and drilling having commenced in December 2021 Cosmo has a platform to provide strong newsflow upon listing”

Like water for copper

Great Boulder famously captured the excitement of the market in 2017 when a hole drilled looking for water returned grades of 1.7% copper and 0.2% nickel.

“The nice synchronicity here was that Ziggy was actually responsible for drilling that water borehole,” Merrillees said.

“So Gold Road as part of developing the Gruyere deposit was looking for process water for the mine and flew a geophysical survey over what’s now become Cosmo Metals’ Mt Venn project.

“Being a typical explorationist he knew this system could also be explored for base metals in the basement rocks.”

While Gold Road knew they had conductors with potential for massive sulphides – a kind of mineralisation known for hosting high grade base metals occurrences – Gold Road didn’t analyse their samples for base metals at the time.

Great Boulder did. It led to one of many intercepts that give Cosmo confidence it can turn Mt Venn into a resource level project relatively quickly.

“The Mount Venn discovery is a copper rich system and Cosmo Metals’ strategy post IPO is to take that advanced project through to a resource in the near term,” Merrillees said.

An embarrassment of riches

Cosmo comes to the party in the Yamarna belt, around 130km east of the northern Goldfields mining town of Laverton, armed with a database of over 70 RC and diamond holes drilled by Great Boulder for more than 13,700m of drilling.

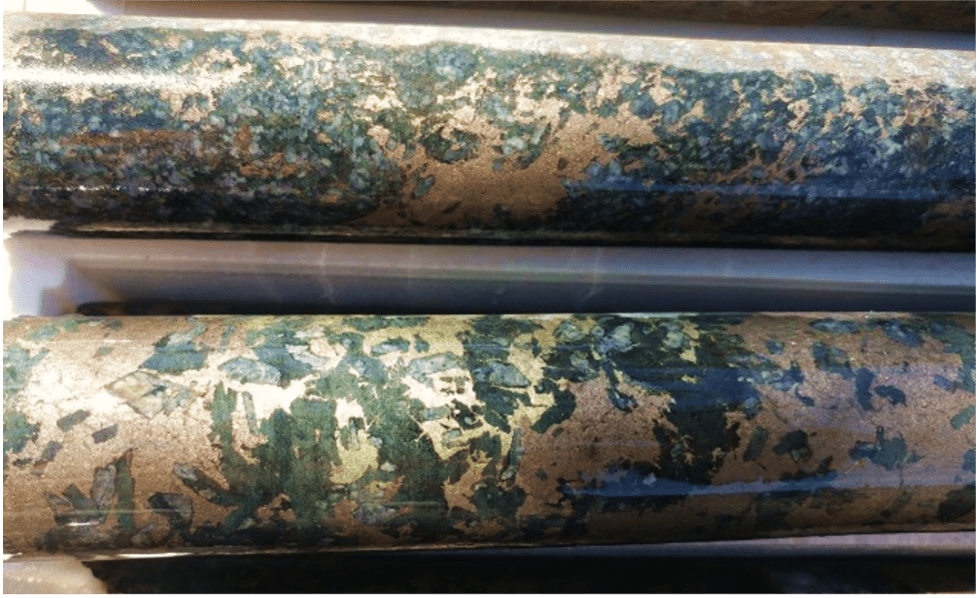

Those results have confirmed multiple broad lenses of shallow sulphides over several kilometres along the west contact of the Mt Venn igneous complex.

Some of the impressive copper-nickel-cobalt results from Mt Venn include:

- 48m at 0.8% copper, 0.2% nickel and 0.07% cobalt from 103m (17MVRC015)

- Including 3m at 1.3% Cu from 105m

- 26.2m at 0.5% Cu, 0.2% Ni and 0.06% Co from 12m (17MVDD002)

- 18m at 0.8% Cu, 0.1% Ni 0.02% Co from 187m (17MVRC001)

- Including 2m at 3% Cu from 190m

- 4.4m at 1.7% Cu from 142.4m (17MVDD003); and,

- 9.5m at 1% Cu from 178m (18MVDD002).

Mt Venn has significant potential for extensions along strike and at depth.

Just 7km to the east, the Eastern Mafic project, believed to be formed from the same magmatic event but closer to the source of the intrusion related to the sulphide mineralisation in the region, is believed to have potential for higher grades of nickel.

Grades of up to 1.3% copper and 0.4% nickel have been assayed in drilling there.

Winchester, a JV with fellow WA explorer Ausgold, has seen around 5000m of drilling, including thick copper and nickel hits with the highest nickel tenor as well as platinum group elements (PGEs) in the sulphide mix, making it a strategically valuable asset given the current record prices for theses battery metals.

There is more to come. Merrillees says the highest-grade copper and nickel strike in the district came on a new tenement currently under application by Cosmo at Mt Venn North.

“It was drilled by Helix in the early 2000’s, and in terms of grades it was 1.4-1.5% copper over four or five metres with 0.7% nickel,” he said.

“The interesting thing about these projects is that they all have quite different metal profiles, Mt Venn’s quite copper rich, relatively low in nickel.

“Eastern Mafic is similar but with potential to find higher grades with more than a percent copper intersected in parts of that system.

“And then Winchester and the new Mt Venn North application with higher grade more nickel and particularly at Winchester where there are PGEs, as well as gold potential.”

Copper-Nickel now, forever

It could be argued the Cosmo listing has come at just the right time as base metals destined for use in electric vehicles, renewable energy and lithium-ion batteries hit decade high prices.

Nickel is up more than 10% this year to prices not seen since 2011, while copper is hovering only a few hundred dollars shy of last year’s record highs.

Supply shortages are projected to grow in the next decade as EV demand explodes.

Goldman Sachs forecasts within 12 months copper will hit a new all time high of US$12,000/t and nickel will be sitting pretty at US$24,000/t.

“Today nickel’s at 10 year highs copper’s at all time highs or thereabouts, that’s all important, in terms of the ability to raise money for a junior explorer”, Merrillees said.

“But what I’d also add is a copper-nickel discovery in any market is going to be phenomenal for a company like Cosmo Metals, a tightly held junior explorer with an enterprise value of around $5 million on the day we list.”

Merrillees says having a strong technical team and management is even more important.

Along with Merrillees and Lubieniecki, Cosmo also boasts the mining nous of Non-executive Chairman Peter Bird, a respected industry executive and geologist with experience in Managing Director and Chair roles at numerous mining companies including as Executive Chairman at Zenith Minerals.

He also served in senior and executive roles at Western Mining, Newmont, Normandy and Newcrest and was named Australia’s best gold analyst while at Merrill Lynch Equities.

Respected rock kicker and Great Boulder MD Andrew Paterson is also on board as a Non-executive director.

More than copper and nickel

While it is base metals the Cosmo team is primarily chasing, don’t discount its gold potential with the 6.7Moz Gruyere mine just 20km away.

Its land package also contains the paleochannels that host the nearby Thatcher Soak uranium deposit, as well as potential for vanadium and chrome.

“The bottom line is with greenstone rocks generally that host the copper-nickel we’re talking about also have potential to host large gold deposits such as Gruyere,” Merrillees said.

“The part of the belt that we’re in and certainly the Cosmo Metals ground has rocks that look very much like gold bearing rocks elsewhere in the Yilgarn, and the area hasn’t been explored for gold, certainly not in the last 10 or 15 years.

“We recognise the gold potential there, Winchester itself, the best copper nickel intersection has over 0.18g/t gold.”

Cosmo’s immediate focus will be getting out on the ground over the next month at Mt Venn to prepare for drilling and work towards a resource to set the stage for the major discoveries it believes will follow.

This article was developed in collaboration with Cosmo Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.