Cosmo Metals believes its new Kanowna gold project is the vehicle that will take it to the stars

Cosmo Metals is investigating whether its Kanowna project could host high-grade gold near the producing Kanowna Belle mine. Pic via Getty Images

Special Report: Junior explorers are famed for quick reactions and Cosmo Metals proved this by quickly snapping up a highly-prospective project in the shadow of the major Kanowna Belle gold mine when the opportunity presented itself.

Cosmo Metals (ASX:CMO) was spun-off from Great Boulder Resources (ASX:GBR) at the beginning of January 2022 as a dedicated battery metals-focused exploration company centred around the Yamarna copper-nickel-cobalt project east of Laverton.

Thanks to this connection, the two companies share what Cosmo Managing Director James Merrillees describes as a common DNA, with both Great Boulder and Cosmo being very technically driven, custodians of good exploration projects and completely focused on company-making mineral discoveries.

Both companies also share Great Boulder Managing Director Andrew Paterson, who brings his wealth of knowledge to the table as a Non-Executive Director of CMO.

Yamarna is located on the namesake Yamarna Belt, which is well-known for hosting the 6.7Moz Gruyere gold mine that is operated by JSE-listed Gold Fields and Gold Road Resources (ASX:GOR).

Merrillees told Stockhead his company’s Yamarna project was essentially exploring the same block for base metals – copper, nickel, lead, zinc and silver.

“Since listing on the ASX, we have had some success at Yamarna and were getting some traction there, but we reached the point where it was getting difficult to fund it as the markets weren’t supportive,” he said.

“We have also been on the lookout for new projects across a wide range of commodities and we have a very strong technical group that looked at projects, with a focus on Australia and Western Australia, that could transform the company.”

Going for gold

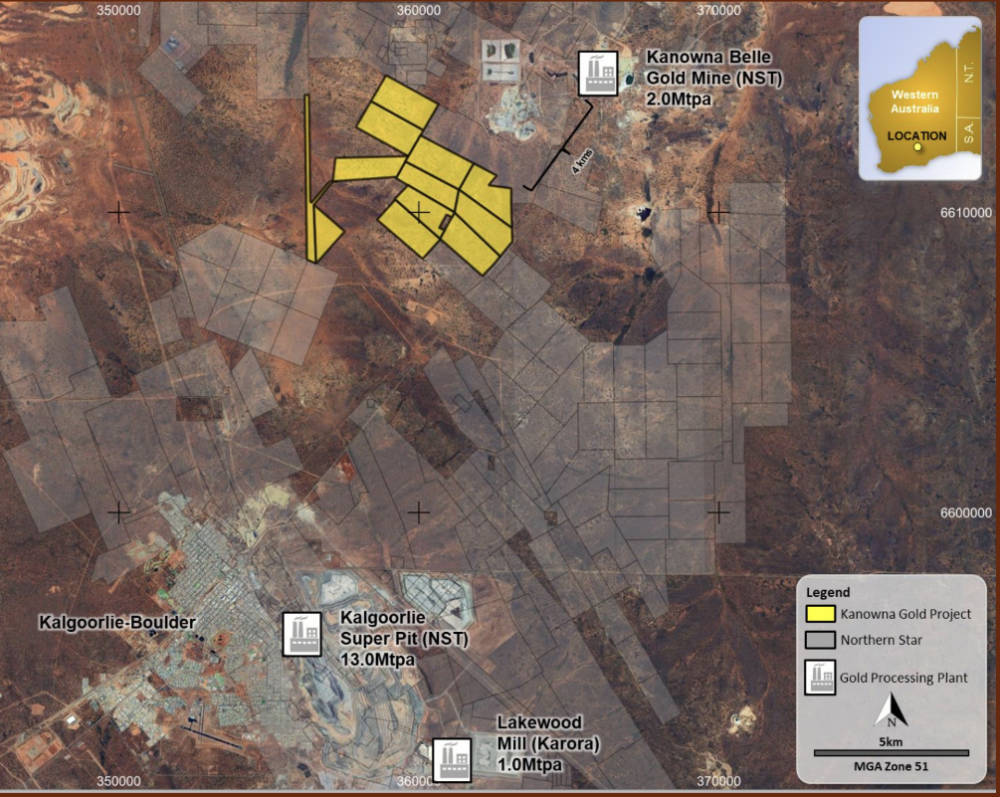

This search led the company to the Kanowna gold project immediately adjacent to Northern Star’s (ASX:NST) Kanowna Belle mine that has produced +5.4Moz of the precious metal since 1993 and just 13km from Kalgoorlie.

Kanowna covers ~20km2 in 12 contiguous prospecting licences with heritage agreements in place and limited but significant historical drilling which includes near-surface hits such as 44m @ 2.4g/t gold from a down-hole depth of 24m, including 18m @ 5.3g/t gold, and 50m @ 1.2g/t gold from 30m to end of hole, including 10m @ 4.7g/t gold from 32m.

Merrillees said a review of the Kanowna project led to the recognition there were some “really nice, high-grade gold hits” at the Don Álvaro and Laguna Verde that require follow-up.

“The project has only been explored in a relatively light fashion – there’s no diamond drilling, for example, and just 12 holes in the entire project area have been drilled deeper than 150m, which is unusual for this part of the world,” he told Stockhead.

“We know that NST have made the Velvet and Joplin discoveries adjacent to Kanowna Belle, and between the mine and our project.

“Those are both deeper than 400m below surface and are currently being mined, so there’s a lot of potential at depth.”

CMO also identified a broad 1.5km by 600m aircore anomaly where shallow drilling to a 20-50m depth intersected gold over a large area which has not seen any deeper drilling.

“That’s an extraordinary area of supergene gold which is very similar to the pre-mining footprint of the supergene anomaly at Kanowna Belle and yet has not been followed up,” Merrillees added.

Promising evidence

While historical exploration certainly provided CMO with the initial impetus to acquire the Kanowna Gold Project, the technical work carried by the company since then has further increased its confidence in the prospectivity.

“We have got some of the top brains – people who got their PhDs on the Kanowna Belt, people who accumulated regional geochemistry over the entire eastern Yilgarn – involved who pointed out some really exciting upside to this project,” Merrillees said.

“We recognised one of the largest pathfinder anomalies – elements that take you down the path to finding a gold deposit and are often associated with the same such as arsenic, antimony and tungsten – in the region over our project.

“These pathfinders may only be tens to hundreds of metres from major gold deposit and we are excited about that.”

He also pointed out that geology and structures at the company’s project mimic Kanowna Belle structures, making the broad gold and pathfinder anomalies exciting targets for follow-up in addition to the existing high-grade intersections.

“The Kanowna Gold Project sits over a basin, these are younger rocks than associated with some of the gold deposits at Kalgoorlie and would typically be overlooked in traditional Eastern Goldfields exploration,” Merrillees added.

“But we also know that there have been some phenomenal discoveries in these younger sediments at Invincible, Agnew and others in the Goldfields region.”

He added that some of names it worked with today were technical personnel involved with the earlier work at Kanowna, making it in a sense an opportunity to wrap up unfinished business.

Leverage to a gold discovery

There are good reasons for the company to be excited.

CMO has a sub $5m market cap, just over 120 million shares on issue and a tight shareholder base, meaning it is leveraged to any discovery where “you can shovel dirt over the back fence” with the potential for gold bearing ore to be processed by one of several mills in the Kalgoorlie region.

Merrillees noted that while 1Moz is typically the size of gold deposit most companies would say is the first step to a meaningful discovery, there are plenty of examples of 100,000oz gold deposits which can be easily developed if they had the right grade and mineability.

That’s not to say that CMO is thinking small though.

“We think that given the size of the supergene anomaly, there is definitely potential for multi-million ounce discoveries that have been overlooked by previous explorers,” Merrillees added.

“That’s why we think the opportunity has real upside for the company.”

Should CMO make a discovery and demonstrate it can be economic, the company will benefit from the nearby infrastructure, including multiple mills within trucking distance.

“From the sublime to the ridiculous here at Kanowna, you can grab a nice coffee in Kalgoorlie and be on site in the morning and get drill companies out for small programs,” Merrillees said.

“That’s important for us as a junior explorer where funds are limited and we really want to maximise those dollars in the ground.

“Contractors are happy to come out and do those small jobs because their drillers can just drive in and out.”

The road to gold

CMO is currently in the middle of a $2.1m capital raise to fund exploration at Kanowna.

Once this is completed, which is expected by the end of this month, the company plans to carry out drill programs in April-May to test the high-grade Don Álvaro and Laguna Verde prospects.

This will be followed by further drilling on the supergene target with results expected to flow once samples are assayed.

Merrillees says the company will concurrently be generating new targets from the new licences it is acquiring which has increased its overall Kanowna footprint by 2km2.

“Our exploration will expand the hypothesis that high-grade gold is present at Kanowna through drilling, further surface sampling and structural interpretation, all the ingredients that will go into making a gold discovery there,” he said.

“It is fair to say that the majority of our time and budget will be on Kanowna but we will also be ticking along exploration on our other projects.”

CMO will look to complete small programs at its Yamarna project, including investigating the VMS lead-zinc-silver-copper potential of Narragene, as well as progressing lithium exploration at Wurnda.

Wurnda has mapped pegmatites though the company has yet conducted sufficient field work to determine detailed mineralogy.

Merrillees says Narragene has all the right geology for a VMS discovery, with those types of systems typically phenomenally-rich like Golden Grove and Teutonic Bore in WA’s Goldfields region.

“We have got this Minjina prospect, which has all the hallmarks of a VMS system, and that discovery has good zinc, lead, silver – there’s over 100g/t silver in one of the intersections, which was drilled last year,” he noted.

“That discovery really opened up the entire Narragene area for VMS exploration, and we plan to get on the ground to map out the mapped felsic volcanics that have never been sampled.

“Previous explorers had really focused on the copper nickel potential of that belt, it is not big expenditure, but it is meaningful exploration that could shift the dial on any of those projects.

“Like any good explorer, we have a pipeline of targets because we recognise it is a high-risk game and we want to have things coming through should any of the other projects fall over or not deliver on what we think might be there.”

This article was developed in collaboration with Cosmo Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.