Things are looking up for Chinese lithium demand in 2020 despite coronavirus fears: Platts

Pic: Schroptschop / E+ via Getty Images

Industry players say Chinese lithium chemical demand will increase in 2020, despite the growing impact of coronavirus on global markets.

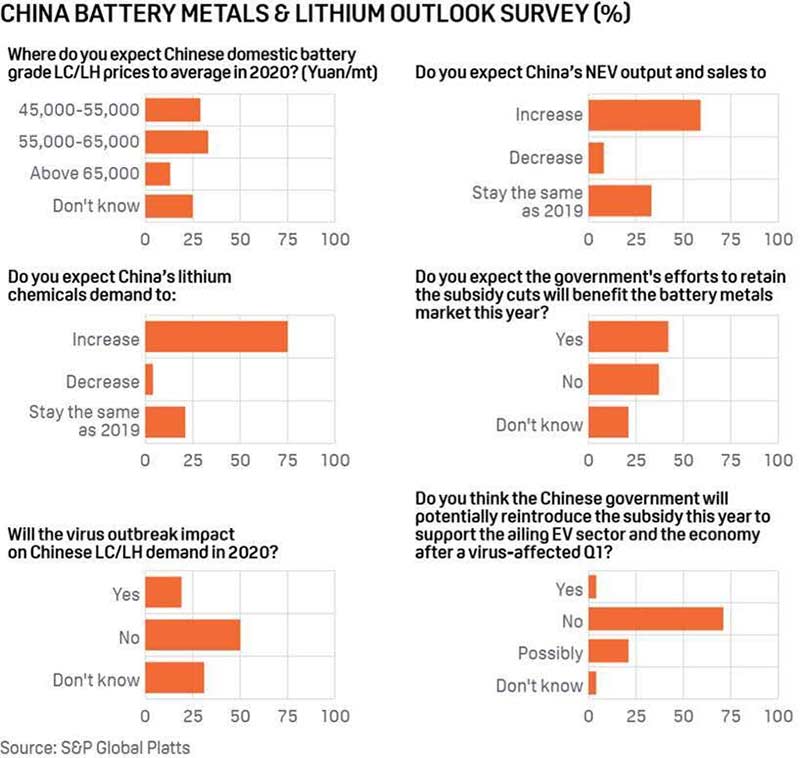

The February 18-22 Battery Metals & Lithium Outlook Survey by S&P Global Platts included 15 battery metals producers, three traders, four consumers and three investors.

About 75 per cent of respondents expected lithium demand to increase in China, the world’s biggest market.

Just 4 per cent believed lithium demand would fall, despite expectations of a softer first quarter due to coronavirus impacts.

That’s good news for the sector. China’s domestic battery metals prices have been in freefall due to overcapacity and a slowdown in the growth of EV output and sales, Platts says.

READ: Lithium — Investors are rewarding the best development stories even as prices tumble

There is now “plenty of optimism” around China’s EV market, Platts says, despite 71 per cent of respondents believing that China will continue with its current policy, which will see all subsidies for NEVs removed by the end of this year.

“Some 59 per cent of respondents expected both NEV output and sales would rise this year, while 33 per cent believed they would be similar to last year,” Platts reports.

“Only 8 per cent thought NEV output and sales growth would be weaker in 2020.”

The outlook for battery grade lithium carbonate prices in 2020 was more divergent.

Opinions ranged from 40,000 Chinese yuan per tonne ($US5,689/t) to as high as 80,000 yuan per tonne ($US11,376/t).

In 2019, average prices for lithium carbonate and hydroxide were 68,471.20 yuan per tonne ($US9,749/t) and 82,384.60 yuan per tonne ($US11,730/t), respectively.

Most respondents expected prices to average between 45,000 yuan per tonne and 65,000 yuan per tonne, the survey found.

NOW READ: Five battery metals trends to keep an eye on in 2020

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.