These small caps are chasing elephants in the Paterson

The next big one? Pic: Getty Images

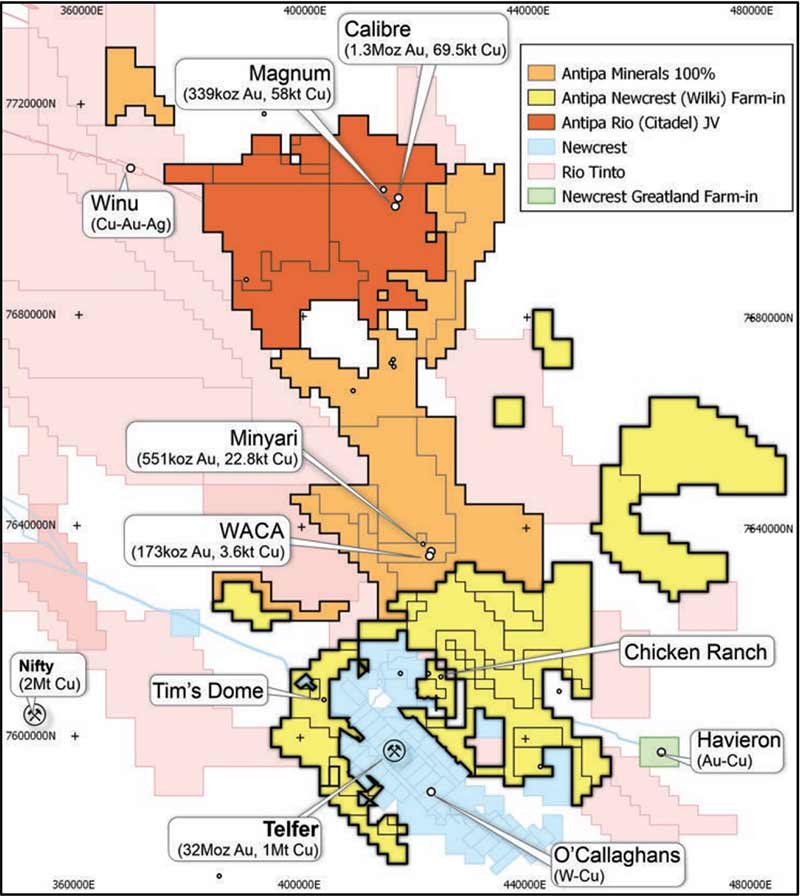

The Paterson Province is one of Australia’s most highly endowed mineral provinces as clearly evidenced by the giant Telfer gold project (32 million ounces of gold) and the Nifty copper project (2 million tonnes of copper).

Recent discoveries such as Rio Tinto’s (ASX:RIO) Winu project and the Havieron joint venture between Greatland Gold and Newcrest Mining (ASX:NCM) have also sparked considerable interest in its potential to host more world-class discoveries.

Rio Tinto is already targeting first ‘staged’ production at Winu in 2023. And the Newcrest-Greatland Gold JV is looking to start an exploration decline at the huge Havieron project this year, ahead of first production in 2022-2023.

To top it off, the province remains underexplored, making it a sought-after exploration address for both large and small-cap companies.

Antipa Minerals (ASX:AZY) has been one of the stalwarts of the Paterson, having picked up its ground at a time when Newcrest was contemplating the sale of Telfer and well before Winu and Havieron brought the province to the market’s attention.

Executive chairman Stephen Power told Stockhead that three factors drew Antipa to the Paterson.

“The first was it is a proven world-class province in that it already hosted the Telfer gold mine. It was also underexplored and thirdly, it is located in a country with low sovereign risk,” he explained.

Since then, Antipa has managed to draw some of the biggest names in the mining sector as partners in its tenements.

The company first reached a joint venture deal with the one of industry’s goliaths and Winu operator Rio Tinto back in 2015. This offered Rio the opportunity to earn up to a 75 per cent in Antipa’s Citadel project by spending up to $60m on exploration.

Since then Rio has earned a 51 per cent stake by spending $11m on exploration to date.

Citadel currently has a contained resource of 1.6 million ounces of gold and 127,000 tonnes of copper.

This was followed by the joint venture reaching another $60m deal, this time with Newcrest for the 2,180sqkm Wilki project that practically surrounds the Telfer mine.

“Antipa finds itself in a great position especially in these times because it has two very large joint venture partners or people who are farming in who are covering the expenditure,” Power said.

“In the north Rio are basically going to carry out an exploration program this year, while in the south Newcrest are required to spend $6m over the next two years.”

Power added that both partners were through-the-cycle explorers and producers that didn’t respond to highs and lows on the market, which was important for exploration and development decisions.

“We are also well capitalised, which in these particular times is very valuable.”

Power added that with Rio proceeding with the Winu development and Telfer expressing interest in toll treating other operators’ resources, there were obvious possibilities for trucking and the like.

Paterson Resources (ASX:PSL) director Brian Thomas told Stockhead that while the Paterson had long been ignored due to the tough conditions that made it difficult to explore at certain times of the year, the presence of Telfer and Nifty along with the more recent discoveries was a “fairly compelling” argument for its prospectivity.

“Winu looks like it is going to be something quite significant and Havieron looks like it is going to be a major discovery, though it is basically under 400m of cover and could be expensive to develop,” he noted.

Paterson is currently in suspension until it completes a rights issue and is deemed eligible for relisting on the ASX.

The company has appointed Baker Young Stockbrokers as its corporate advisor to help raise the money through an underwritten entitlement issue priced at 0.1 cents to raise $1.9m before costs.

Proceeds will be used to drive exploration on its projects, particularly the Grace gold project that is just 25km southeast of Telfer and 50km southwest of Havieron.

Grace hosts outcropping gold mineralisation extending more than 4km along strike and has a current oxide/transitional inferred resource of 1.59 million tonnes grading 1.35 grams per tonne (g/t) gold for 69,000 ounces of contained gold.

Thomas also put the spotlight on the broader prospectivity of the Paterson region.

“It looks like there are other Haverion’s out there and Newcrest knows it, that’s why they did the deal with Antipa, who also got a good deal with Rio,” he added.

Other ASX small cap plays

Antipa is not the only company that has secured lucrative joint ventures.

Encounter Resources (ASX:ENR) has long-term partner and major shareholder Independence Group (ASX:IGO) in its corner, with the latter agreeing in early March to sole-fund about $15m in exploration to earn 70 per cent of the early stage 1,400sqkm Yeneena copper-cobalt project.

While not the typical gold or copper-gold plays pursued by other companies in the region, the deal nonetheless highlights the interest it has piqued.

Encounter also started diamond drilling at its Lamil copper-gold project in early March to test chargeability anomalies identified in the 2019 survey that are adjacent to broad zones of copper-gold mineralisation intersected in shallow historical drilling and an open, broad zone of gold-copper mineralisation at the Gap prospect.

Like Antipa, Carawine Resources (ASX:CWX) has reached two separate deals worth up to $12m with Rio and Fortescue Metals Group (ASX:FMG) to explore its Paterson ground.

Over in the West Paterson JV, Rio has completed an airbone gravity survey over the Baton tenements and plans to start drilling the targets in the second quarter of this year.

Fortescue is required to spend $500,000 on exploration in the first 18 months of their agreement and was last reported to be compiling data ahead of planning field work programs for 2020.

Red Metal (ASX:RDM) has an $8m Discovery Alliance Agreement with copper producer OZ Minerals (ASX:OZL) to fast-track exploration in a number of areas.

This includes the Yarrie project, a collection of five exploration licence applications covering almost 2,000sqkm that is on trend with both Nifty and Winu.

The company noted in its quarterly report for the December 2019 quarter that future exploration funded by OZ Minerals will use modern, deep penetrating, ground electromagnetic surveying methods to map and rank targets for drill testing.

Other companies moving into the province include Firefly Resources (ASX:FFR), which has several tenement applications covering about 1,000sqkm of ground.

These tenements cover existing historical copper-gold prospects around the Kintyre uranium mine, including the Wanderer copper-gold-molybdenum prospect.

Historical drilling at Wanderer during the 1980s returned primary copper grades of up to 6.5 per cent, gold grades up to 1g/t and up to 700 parts per million molybdenum less than 100m from surface. These hits have never been followed up.

St George Mining (ASX:SGQ) recently kicked off early stage exploration at its Paterson project that it secured in December last year.

This includes an airborne magnetic survey over its exploration licence, which covers more than 35km of prospective ground with potential similarities to the stratigraphy that hosts the mineralisation at Winu, Nifty and Telfer.

It added that a review of regional magnetic and gravity data had highlighted a number of key structures and tectonic features within its ground.

The company noted that these features were more prominent in its licence compared to areas like Winu and Havieron, which indicates the depth of cover might be lower than at these other projects.

Executive chairman John Prineas previously told Stockhead the explorer got the jump on major mining companies “that have since approached us to sell or JV the ground”.

At Stockhead, we tell it like it is. While Carawine Resources is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.