These juniors are contenders in the quest to be the next mid-tier ASX copper producer

These juniors are on the quest to be the next mid-tier copper producer. Pic: Getty Images

- ASX juniors are progressing efforts to be the next mid-tier copper producer

- Trail has been blazed by companies such as Aeris Resources and AIC Mines

- Declining copper supply and reserves makes outlook positive for future producers

We all know the copper story: How electrification will drive demand, outstripping production that has faltered due to all the easy stuff being mined and stagnant exploration spending by the big players.

We get that.

Now what we really want to know is who are the small cap resources companies with the gumption (and project) to walk the same path that Aeris Resources (ASX:AIS) and AIC Mines (ASX:A1M) have taken to move in the direction of Australia’s barren copper mid-tier.

AIS currently produces 40,000-48,000t copper equivalent metal from its three producing operations with another three that could be developed, while A1M’s Eloise mine produced 13,412t of copper (and 6669oz of gold) in concentrate during FY2024 and is moving towards 20,000tpa with the development of the adjacent Jericho mine.

Both have positive cash flow and plans in place to ramp up production from their projects.

With 29Metals (ASX:29M) still in the doldrums from the cash flow crisis caused by the flooding of its Capricorn mine in Queensland, there’s plenty of relevance to be found by any pure-play that can step into the $200-500m tier below $5bn ASX sector leader Sandfire Resources (ASX:SFR) and dual-listers MAC Copper (ASX:MAC) and Capstone Copper Corp (ASX:CSC).

And those companies could see big investor interest and become takeover targets.

Looking for the next copper success story

The transition to net zero needs a lot more copper and there are a number of junior resource companies that have a chance of bringing new supply online.

So just which companies on the ASX have the right stuff in terms of resources, location and exploration prospectivity to move into that space or potentially become a takeover target?

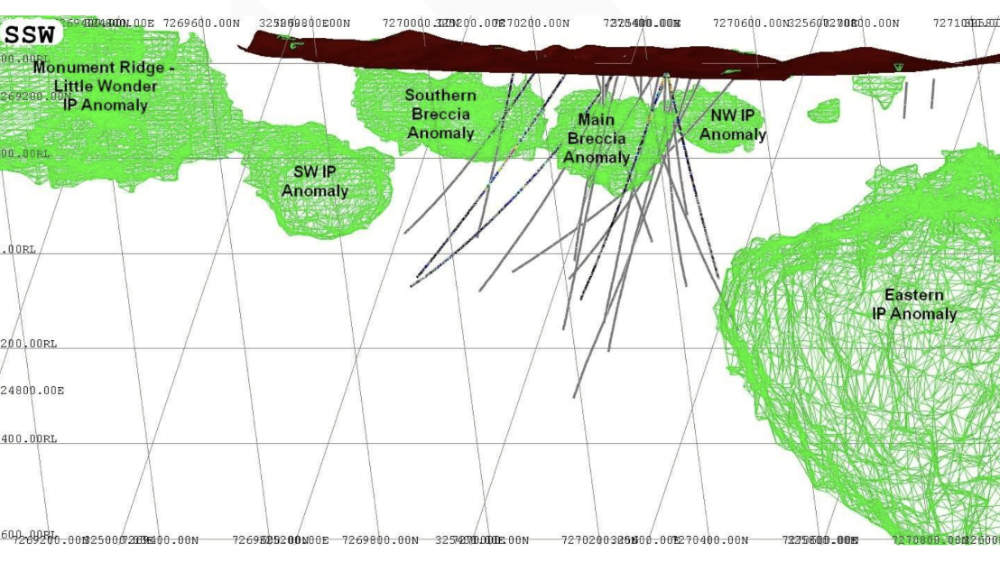

Cannindah Resources (ASX:CAE) dusted off its Mt Cannindah project in central Queensland in early 2021, a decade after it was left idle, following a review that found that it had resources of a scale large enough to interest major companies.

Fast forward to the present day and work conducted since on the porphyry deposit has defined a measured, indicated and inferred resource of 14.5 million tonnes at 0.72% copper, 0.42 grams per tonne gold and 13.7 parts per million silver (1.09% copper equivalent – CuEq). Notably, the resource starts from surface, meaning low-cost mining metrics, and is open in all directions.

The resource definition followed a 183% tonnage upgrade in July 2024. A new drill program is under way after a diamond drill rig arrived on site in November, extending the known resource and then testing a large and intriguing induced polarisation (IP) anomaly 700m to the Southwest, which has potential to reveal a much larger system and potential resource growth.

Adding further interest, state-owned Chilean giant Codelco is undertaking due diligence on what would be its first investment outside the top copper-producing nation and has expressed interest in the deeper, bulk tonnage porphyry potential of the region. Discussions are still underway, with Cannindah to take the multi-national’s data at zero cost in the event of a split.

CAE itself is interested in the potential to establish short to mid-term production through established infrastructure just 100km away from the port of Gladstone.

For now, the company is poised to launch a diamond drilling program aimed at both expanding the known resource area and investigating an excitingly undrilled IP anomaly looming large about 800m away.

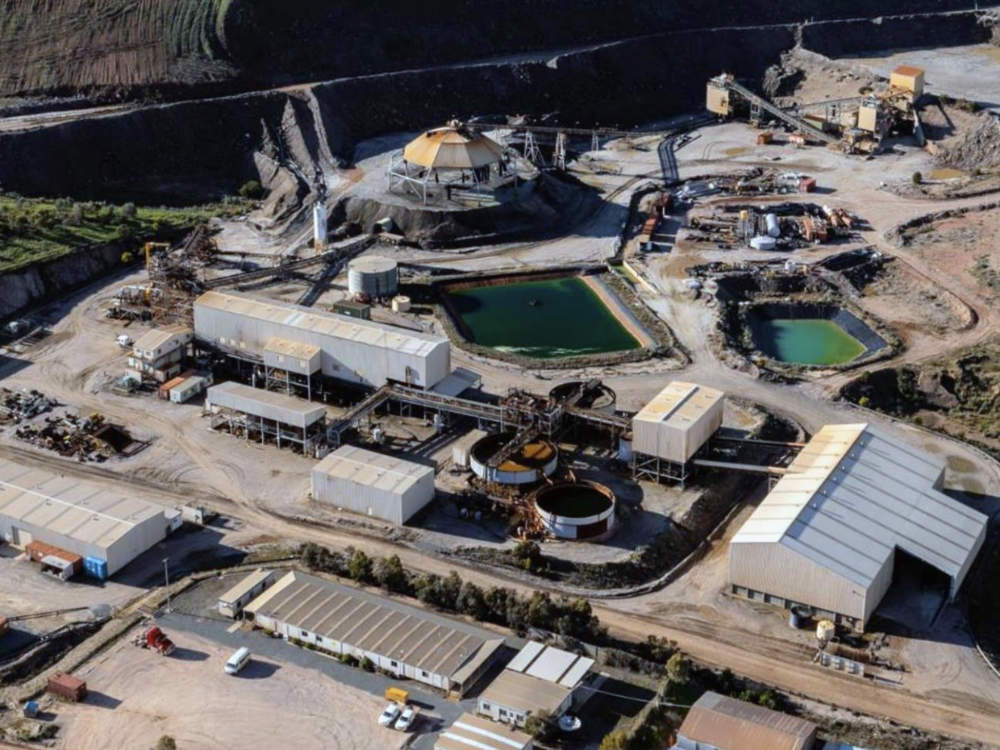

Hillgrove Resources (ASX:HGO) has the distinction of actually having crossed over the finish line into production at its Kanmantoo underground mine in the Adelaide Hills, South Australia.

Originally an open pit mine that operated from 1971 to 1976, the company resumed exploration in 2004 and defined copper-gold-silver deposits around the old pit to underpin an open pit operation from 2010 to 2020 that produced ~137,000t of copper and ~55,000oz of gold before the 3.6Mtpa process plant was placed on ice.

That wasn’t the end of the Kanmantoo story.

Modest exploration carried out post-production to determine just how far the mined lodes extended below the pit quickly found a resource of more than 1Mt that spurred exploration, the development of a four-year mine plan and a final investment decision in June 2023 that resulted in an underground mine starting up in February 2024.

Kanmantoo now has an ore reserve of 2.8Mt grading 0.91% copper and 0.15g/t gold for 26,000t and 14,000oz of contained metal within a broader resource of 19.3Mt at 0.77% copper and 0.14g/t gold.

While operations are still in the process of ramping up, HGO produced 2923t of copper in the September 2024 quarter, up 13% quarter on quarter with all-in-costs of US$3.71/lb being in line with costs in the June 2014 quarter.

Mining rates have been ramping up steadily with company managing director Bob Fulker noting in its September quarterly report that there were still many opportunities to improve production rates and reduce costs as HGO moved closer to steady state production.

Who else has resources to build on?

Back in Queensland, Carnaby Resources (ASX:CNB) is advancing its Greater Duchess project, that has a resource of 21.8Mt at 1.3% copper and 0.2g/t gold for 315,000t of CuEq, discovered near the historical Duchess mine which produced around 205,000t at 12.5% copper from 1900-1940.

It recently reached a binding agreement to acquire the nearby high-grade Trekelano copper deposit – inferred resource of 5.2Mt at 1.6% CuEq – which will take total resources at Greater Duchess up to 27Mt at 1.5% CuEq, or 400,300t equivalent of the red metal.

Trekelano has potential for future expansion with historical drilling below the Inheritance open pit returning a top hit of 93m at 5.2% copper and 1.2g/t gold though this area was unmined due to a historical Mining Lease boundary constraint.

CNB has also started maiden drilling at the Pronuba prospect within Greater Duchess and has received encouraging assays such as 10m at 2.2% copper and 0.3g/t gold from a downhole depth of 142m at the Mohawk prospect.

More importantly, the company has cleared the way to production after reaching a binding tolling and offtake term sheet in late November 2024 with Glencore to process 100% of the fresh sulphide ore and concentrate from the Greater Duchess project.

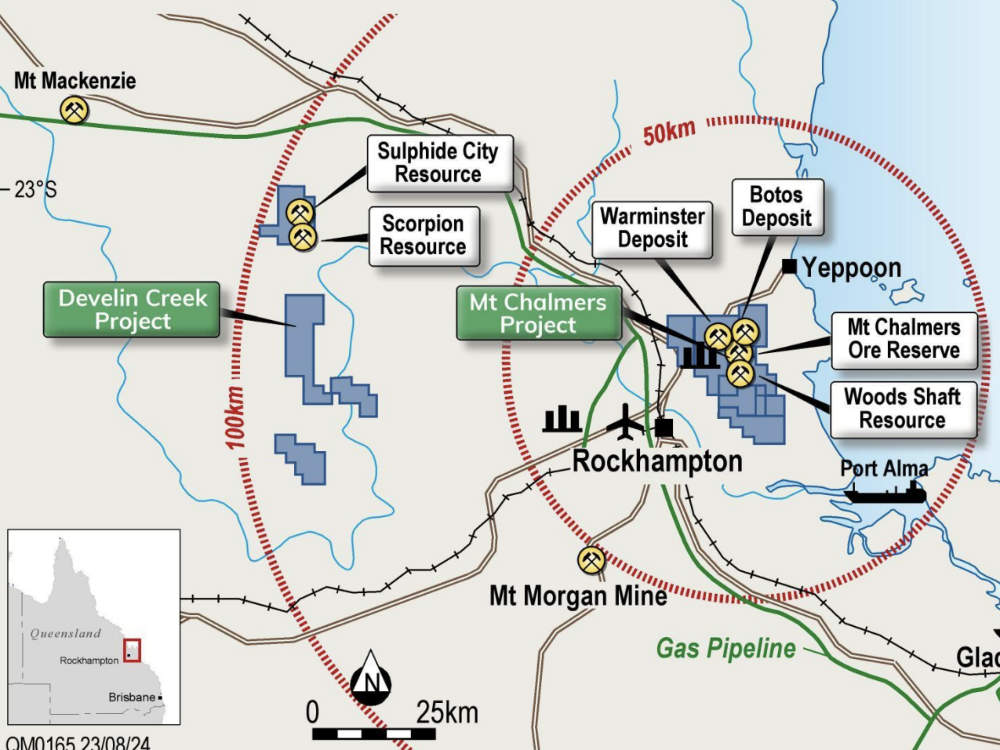

Meanwhile, QMines (ASX:QML) is committed to bringing its flagship Mt Chalmers project, a historical copper-gold mine just 17km northeast of Rockhampton, back into production.

Mt Chalmers has a resource of 11.3Mt at 0.75% copper, 0.42g/t gold, 0.23% zinc and 4.6% silver, with 4.3% sulphur that hosts an ore reserve of 9.6Mt at 0.65% copper along with 0.48g/t gold, 0.27% zinc, 5.2g/t silver and 4.3% sulphur.

It is the subject of an attractive pre-feasibility study that outlined a >10 year mine development with cashflow of $636m to power a NPV and IRR of $373m and 54%, respectively.

Capex is estimated at just $191.9m with payback expected in just 1.84 years.

There is potential for further upside at the 316km2 project as it hosts several known volcanogenic massive sulphide deposits that are not currently included in the resource.

These might have to take a back seat to its Develin Creek copper-zinc project about 90km west of Rockhampton, which it secured full ownership of in late September 2024.

Maiden drilling at the Scorpion deposit here returned jaw dropping hits such as 31m at 2.35% copper, 0.37g/t gold, 20g/t silver, 2.37% zinc and 19% tin from 104m, and 17m at 2.88% copper, 0.61g/t gold, 21g/t silver, 2.06% zinc and 24% tin from 106m.

This has been backed by further drilling that returned hits such as 26m at 1.38% copper, 0.29g/t gold, 11g/t silver and 1.99% zinc from a down-hole depth of 72m.

Metallurgical testing has already confirmed excellent recoveries for copper and gold at Develin Creek.

Moving down to South Australia, Coda Minerals (ASX:COD) is progressing its Elizabeth Creek iron oxide copper-gold project that has – like many other IOCG plays – a big resource of 65.5Mt grading 1.6% CuEq, or a little more than 1Mt of contained copper equivalent metal. IOCG deposits are large in nature and prominent in the State, with BHP’s network of Olympic Dam, Prominent Hill, Carrapateena and the undeveloped Oak Dam all examples.

There is also plenty of upside potential with multiple open pit and underground targets that will be tested by drilling that’s due to start in Q1 2025. This will test the major new target at Emmie East, which has the potential to materially expand the project.

In early December, the company updated the scoping study for the project to reflect improved copper and silver recoveries as well as the inclusion of a new open pit deposit.

This estimated pre-tax revenue at $7.57bn over the life of mine with pre-tax net present value and internal rate of return – both measures of profitability – calculated at ~$1.18bn and 35% respectively.

It also increased post-tax NPV by 57% from ~$509m to ~$802m based on steady state annual production of ~26,700t copper and ~1,300t cobalt and ~1.1Moz silver.

Elizabeth Creek will be developed in two phases with the first consisting of one year of copper-cobalt concentrate production to drive early cash-flow while the second phase involves the construction of a hydrometallurgical plant using the Albion Process to produce higher value saleable end-products copper cathode, battery-grade cobalt sulphate, zinc carbonate and silver doré for ~13 years.

This improvement is at the expense of capex, which has increased by 8% to $331m including contingency.

At Stockhead, we tell it like it is. While Cannindah Resources, Hillgrove Resources and QMines are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.