These companies are poised to unleash maiden resources for their projects in the next six months

Maiden resources are due out from these companies. PIc: Sayan_Moongklang via Getty Images.

- Resources are an essential snapshot of just how valuable any project might be

- Azure Minerals, Delta Lithium, Future Battery Minerals and Winsome Resources are due to release lithium resource estimates in 1Q 2024

- Kingsland will define resources for its Leliyn graphite project while Riedel will have resources for its Tintic gold-silver prospect

- WA1 Resources is due to release maiden resources for its Luni high-grade niobium discovery in 1H 2024

Whether it be gold, lithium, rare earths or some other commodity, resources are the lifeblood of the mining industry.

Resources tell both the company and investors just how much of a mineral commodity is likely to be present and are an invaluable tool to determine the value of a project.

Both size and quality are important factors to consider, the former because it tells you just how much of said commodity is present and the latter because higher grades will mean that more of the commodity can be recovered for the same effort and cost, which is never a bad thing.

However, a small resource that sits at the surface could potentially be more valuable than a large one at depth as developing the former could be as simple as getting a bulldozer to dig out the material while a deeper deposit might need extensive tunnels – also known as adits – to access them.

As pointed out in the Stockhead article – ‘What the JORC? Why mining jargon is so strange and what it really means’, resources also fall into three categories that determine their level of confidence going from the least (inferred) through to indicated and then measured.

The latter two possess enough certainty about geology and grades to enable mine planning, which in turn sets the stage for feasibility studies to be carried out.

However, even inferred resources can paint a reasonable picture of just what a company could be sitting on.

With that in mind, here are several companies that are poised to release maiden resources for their respective projects within the next six months.

Azure Minerals (ASX:AZS)

Azure Minerals has been the centre of attention in recent weeks thanks to SQM launching in late October a $1.63bn takeover offer that received unanimous endorsement from the company’s board.

While there are doubts about whether the Chilean lithium giant will be able to complete its takeover thanks to Hancock Prospecting and Mineral Resources (ASX:MIN) taking up 18.9% and 12.3% stakes respectively, the company is lining up to deliver another piece of significant news.

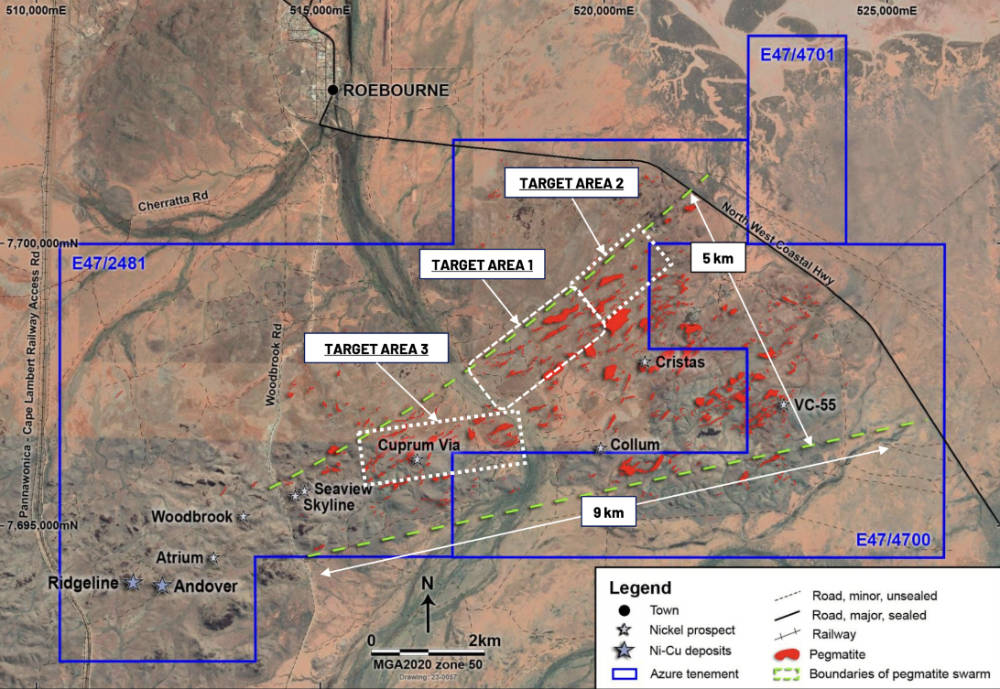

This is of course the maiden resource estimate for its exciting Andover lithium project in the Pilbara, which was the raison d’etre for SQM’s offer in the first place.

Subsequent drilling proved that this was no fluke by returning multiple +100m intersections including a top 209.4m interval at 1.42% Li2O, allowing the company to outline an exploration target of between 100Mt and 240Mt with a grade range of 1-1.5% Li2O.

Recent drilling at Target Area 3 has returned thick intersections of spodumene mineralisation of up to 35.6m, which lends support to the company’s belief that Andover is one of the best lithium exploration projects globally.

Additionally, early testwork has produced spodumene concentrate grading 5.59% Li2O at a recovery of 82.37%.

The maiden resource estimate for Andover is expected in Q1 2024 and thus far all signs indicate that the exploration target is right on the money.

Even if the resource comes in at the lower end of the range, it will still rank amongst the world’s largest lithium deposits.

Delta Lithium (ASX:DLI)

Not many companies can lay claim to making the discovery that opened up a new play. Delta Lithium’s one of them.

The company’s discovery of lithium at the Malinda prospect within its Yinnetharra project proved to be the lever that opened the Gascoyne region in WA up for EV metal exploration.

Exploration at Malinda has defined six pegmatites with mineralisation present from surface to a depth of at least 350m while two of the pegmatites have consistent mineralisation over 1.6km that remain open.

Drilling at the M36 pegmatite – one of the two larger pegmatites – returned thick, high-grade intercepts such as 33m grading 1.9% Li2O from 218m while the M1 pegmatite yielded hits such as 55.6m at 1.12% Li2O from 94m.

In a Q&A session with Stockhead’s Josh Chiat, managing director James Croser said the upcoming resource – expected this quarter – will grant the company “a very good starting point from which to do some engineering on the scale and the scope of Yinnetharra”.

He added that this would cover just Malinda, which is just the company’s first prospect at the project.

“We’ll be able to do some pit optimisations and look at what a very broad mine plan might look like. And as a mining engineer, I’m pretty excited by that, and then next year, we’re going to sink a lot of drill metres into Yinnetharra,” he told Josh.

“At Malinda we’ll probably start to go infill at Malinda and again, lift the confidence in that resource to indicated status to begin to produce a reserve.”

Future Battery Minerals (ASX:FBM)

Over in Nevada, Future Battery Minerals is aiming to define maiden resources at the Long Mountain lithium clay prospect by Q1 2024 and had recently started Phase 3 resource drilling.

Long Mountain sits within the company’s Nevada Lithium Project (NLP) that shares the same mineralisation formation as other notable projects in the region such as Ioneer’s (ASX:INR) Rhyolite Ridge and American Lithium Corporation’s (TSX-V:LI) TLC projects.

It is also 45km east of Albermarle’s Silver Peak mine, the only producing lithium mine in North America.

Adding interest, metallurgical test work by Ioneer has confirmed the ease of extracting lithium (and boron) from Rhyolite Ridge using either heap or leach testing.

The NLP’s lithium prospectivity has already been proven by Phase 2 drilling, which delivered hits such as 179.8m at 766 parts per million (ppm) lithium from just 39.6m and 170m at 764ppm lithium from 67.1m.

Phase 2 drilling also highlighted a 3km by 2km mineralised footprint at the NLP with a further 2km of prospective strike open to the south.

Kingsland Minerals (ASX:KNG)

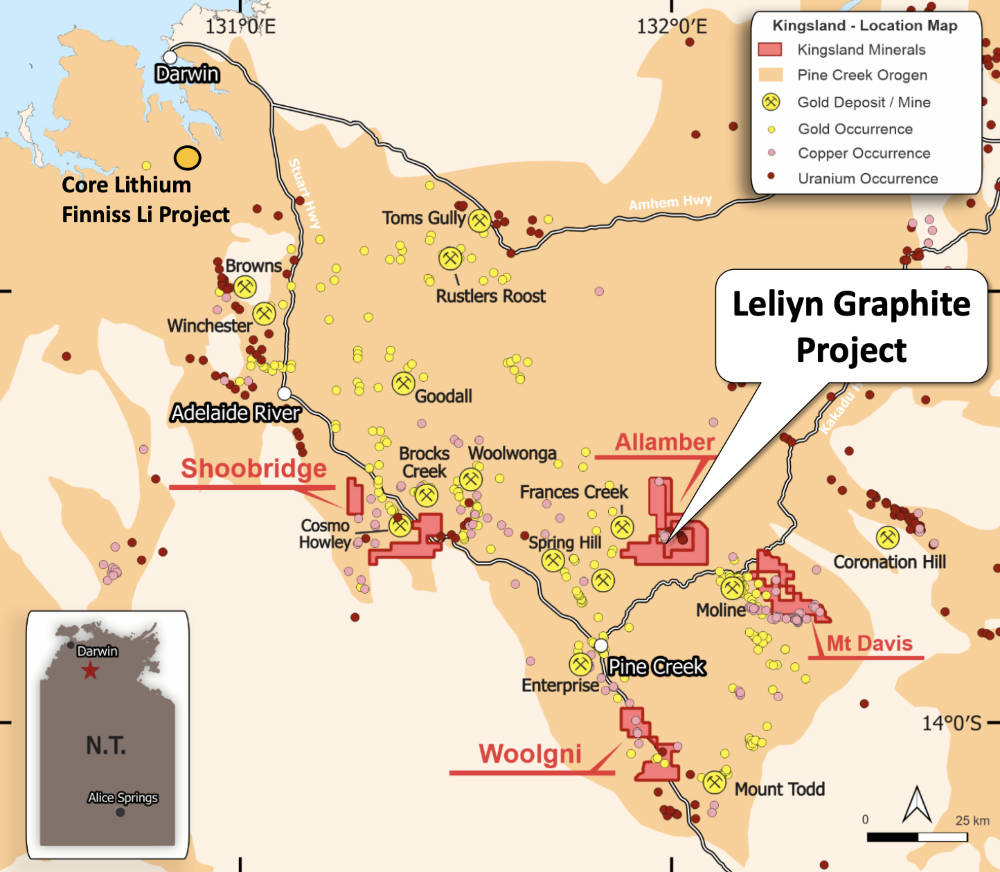

Kingsland Minerals has been actively laying the groundwork to define a maiden resource for its Leliyn graphite project in the NT in the March 2024 quarter.

Drilling at the project, which hosts a 20km outcropping graphitic schist with a conceptual Exploration Target of between 200Mt and 250Mt grading 8% to 11% total graphitic content (TGC), has returned promising intersections topping up at 206m grading 10% TGC.

Recent RC drilling has also returned assay results indicating that the schist contains levels of graphite consistent with the exploration target, which is hugely positive.

A 11-hole diamond drilling program totalling 2,400m is currently underway.

Defining a resource will put the company into position to capitalise on the strong demand for natural flake graphite used in the production of lithium-ion batteries for EVs.

Speaking to Stockhead, managing director Richard Maddocks said having a defined resource would provide the company with a firm platform to progress the project.

“We’ve drilled some world class graphite intersections over the past few months and we are really looking forward to seeing these being part of a significant Resource,” he said.

“Kingsland is aiming at delineating a significant graphite deposit less than 200km from Darwin at a time when demand for graphite is increasing on the back of increased demand for lithium-ion batteries for EV use.”

Maddocks added that the maiden drill program at Leliyn will be completed in the next couple of weeks with remaining assays received in early December.

“This will enable the resource estimation to commence in earnest. We already have metallurgical test-work in progress after submitting a 100kg sample in October.

“We will have these two very important milestones completed within the next six months; a Mineral Resource Estimate and initial metallurgical test-work. The results from these will dictate the progress forward for Leliyn.

“We are planning the next round of drilling which is focussed on upgrading the resource classification and providing material for more advanced metallurgical analysis. The aim is for Leliyn to provide processed graphite for final use in lithium-ion batteries.”

Riedel Resources (ASX:RIE)

While critical and battery minerals have captured the attention of investors, gold still holds a special place in the hearts of resource investors and Riedel Resources could tap into some of this love when it unveils a maiden resource for the Tintic prospect within its Kingman project in Arizona.

Kingman project area was mined predominantly for high-grade gold and silver from the 1880s until the early 1940s.

Exploration in the modern era really took off in late 2019 when 11 diamond holes drilled on the property intersected multiple zones of high-grade gold, silver, and lead from shallow depths, confirming the extensive mineralisation potential of the area.

RIE followed this up with more than 9,000m of reverse circulation drilling in 2021 at Tintic – the largest gold zone within the project – and 20 diamond holes in 2022.

More recently, infill drilling returned shallow hits topping out at 1.52m at 13.8 grams per tonne (g/t) gold, 223g/t silver, 4.6% lead and 0.56% zine from 67.06m.

This also indicated that high-grade mineralisation remains open up-dip to the east while thicker intersections identified in the central zone of the lode added certainty to the position and continuity of mineralisation.

WA1 Resources (ASX:WA1)

With the maiden resource for the Luni carbonatite deposit within its West Arunta project expected for release in 1H 2024, WA1 Resources might just miss the six-month cut-off for this article, but we are going to just overlook that.

That’s because Luni is a shallow, high-grade niobium play that is quickly shaping up to be one of the world’s highest grade niobium discoveries, making it a globally critical project that could break virtual monopoly held by Brazil’s CBMM.

Niobium is traditionally used for steel production but it is finding increased use in lithium ion batteries where it can reduce charge times and extend battery life.

Recent infill drilling has certainly increased WA1’s confidence in Luni with assays from drill holes in the eastern zone demonstrating continuity of the mineralisation, returning a top hit of 30m grading 4.7% niobium that ends in mineralisation.

Further RC and diamond drilling is ongoing with nearly 26,000m completed this year to date.

Winsome Resources (ASX:WR1)

As one of the frontrunners in the exploration for lithium over in the highly prospective James Bay region of Quebec, Canada, Winsome Resources is unsurprisingly following closely behind Allkem (ASX:AKE) and Patriot Battery Metals (ASX:PMT) in defining a maiden resource for its Adina and Cancet projects.

In recent months, the company has completed several key activities across its portfolio in parallel with the recommencement of drilling at Adina that will enable targets to be refined and ranked for drilling during the winter season.

Previous drilling at the Footwall Zone at Adina had returned results up to 23.4m at 1.8% Li2O from 237m, confirming that high-grade mineralisation continues towards the surface.

Likewise, step out drilling at the Main Zone returned results such as 10.3m at 2.66% Li2O over a strike length of 1km.

WR1 has also carried out mapping and sampling programs at its Cancet project, identifying a number of new areas of outcrop.

It previously built a substantial dataset from drilling, mapping and geophysical surveys over the last three field seasons and a detailed targeting exercise is planned to map out the next phase of exploration at Cancet, which has a significant landholding in a highly prospective and strategic location.

Maiden resources for the two projects are expected in Q1 2024.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.