These are the small caps set to make out like bandits on Territory gas

The Northern Territory could be sitting on 200 years worth of shale gas — and while it’s unlikely East Coasters will see any of it soon, a handful of small caps stand to benefit in the coming years.

Changes to the Northern Territory’s fracking policy and the start of a pipeline connecting the region with Queensland have made gas explorers and producers much more interesting to investors.

But it’s early days yet: while Santos has onshore acreage all over the Territory and major offshore basins are delivering gas to Darwin’s liquified natural gas plant, the other players — almost all small caps — are just getting started again.

Only Central Petroleum (ASX:CTP) in the southern edge of the region is producing gas.

It’s in the Amadeus Basin and has three operating fields, one on hiatus, and a number of exploration tenements.

The explorers are much more speculative in their operations.

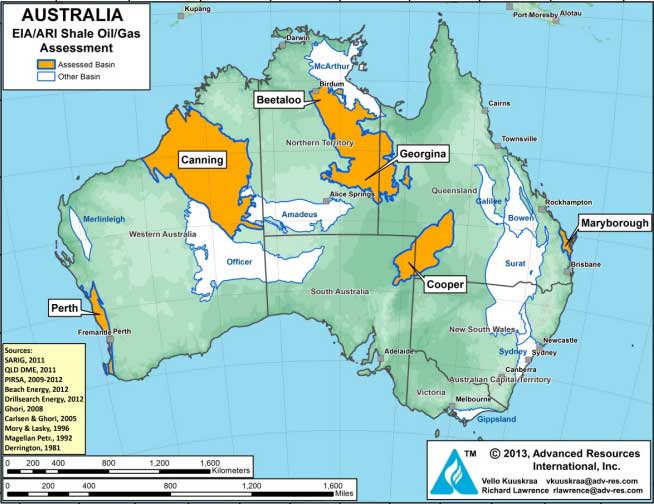

Empire Energy (ASX:EEG) has a resource in the shale-heavy Beetaloo/McArthur Basin which has an estimated range of 786-4783 million barrels of oil equivalent (mmboe) — mostly gas with a little oil.

It’s very early in the exploration stages, planning some desk research first on 2d seismic data followed by drilling a rock core in the Middle Velkerri shale.

Baraka Energy (ASX:BKP) has an exploration licence in the Georgina Basin and was looking at finding a partner to start researching its potential.

But a boardroom coup saw a new board of Africa-focused vanadium and lithium experts enter, and the oil and gas licence is now under review.

Armour Energy (ASX:AJQ) is mostly focused on the Queensland but has leads targeting about 4.9 trillion cubic feet (tcf) of prospective gas in the Beetaloo/McArthur Basin.

They’re looking for a partner to help pay for their Territory exploration.

Blue Energy (ASX:BUL) also has acreage in the Beetaloo/McArthur Basin but says until the government provides detail around which parts of the Territory is off-limits under the new rules, it can’t advance Native Title negotiations.

Shares in all of these companies except for Blue Energy are higher than they were 12 months ago.

What’s driving the sudden interest

Two factors have suddenly made the Northern Territory licences worthwhile: fracking and a new pipeline.

The Northern Territory government ended a two year moratorium on fracturing in April, promising to implement 135 recommendations from an inquiry by the start of the dry season in May 2019.

Fracking or hydraulic fracturing is the process of injecting special fluids into cracks to force them to open further, making oil and gas easier and cheaper to extract.

Opponents of fracking say it wastes water and causes environmental damage and even earth tremors.

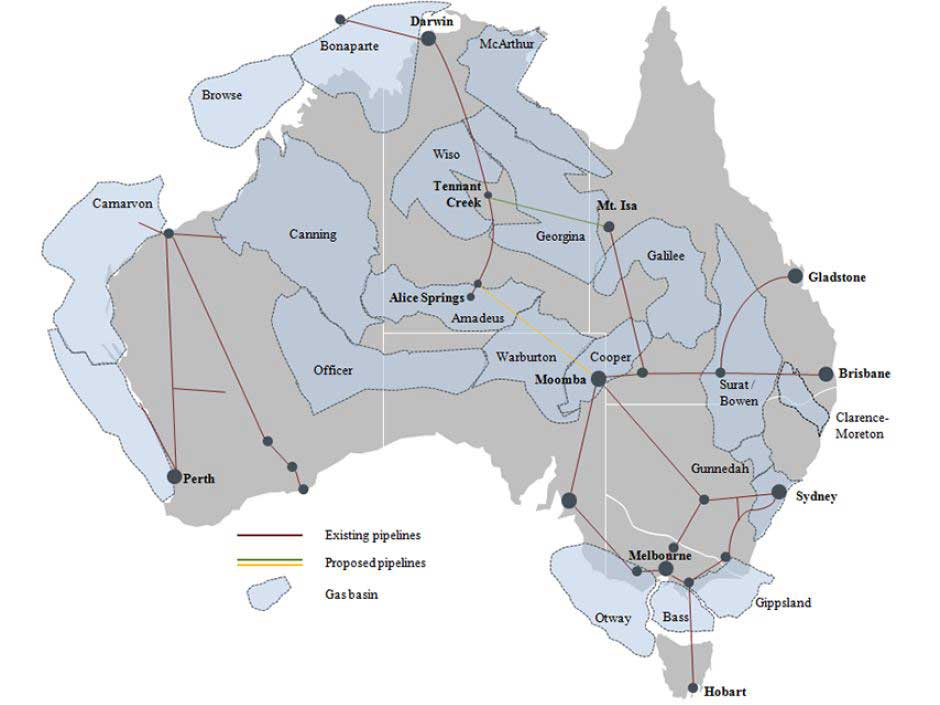

The pipeline is Jemena’s 90 terajoule a day (TJ/d) Northern Gas Pipeline will start by December linking Tennant Creek in the Northern Territory to Mt Isa and the Queensland pipeline network.

It’ll initially carry gas from Eni’s Blacktip gas field in the Timor Sea and from Central Petroleum’s (ASX:CTP) Palm Valley and Mereenie fields to the East Coast. It has just signed a three-year deal with Santos as well, meaning 80 per cent of the pipeline’s capacity has been sold for the first year.

Central Petroleum has already signed a deal to supply Incitec Pivot’s (ASX:IPL) fertiliser plant near Brisbane with gas feedstock.

It says it’ll almost triple gas production in December from 14.9 TJ/d to 41.1 TJ/d as it gears up to sell into the East Coast.

Jemena spokesman Michael Pintabona says they are planning to start expanding the pipeline to a 700 TJ/d pipeline around 2020-21, and add a middle section to connect Mt Isa with the Darling Downs Pipeline in central Queensland.

The long term factors

The Australian Energy Market Operator (AEMO) suggests gas shortages on the East Coast will restart in 2030, but commercial forecasters reckon that could come as early as 2021.

Dr Graeme Behune, head of energy market researcher EnergyQuest, says the pipeline and changes to fracking policy can’t offset shortages on the East Coast.

“There aren’t sufficient resources [in the Northern Territory] at this time,” he said.

- Subscribe to our daily newsletter

- Bookmark this link forsmall cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

While the Territory has substantial gas resources in the Beetaloo/McArthur Basin and potentially more offshore, it is yet to be developed.

The former is at least five to 10 years away and that depends on discovering commercially recoverable volumes of gas, he said.

But with demands on East Coast gas expected to keep rising in the 2020s, as China and India move away from coal and as Australian reserves decline, the albeit far-off potential of new Northern Territory gas could be looking just a bit tempting now they’re back in the game.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.