These ASX small caps could catch fire after fracking ban reversal

Energy

Energy

A handful of ASX small caps stand to benefit from the Northern Territory’s decision on Tuesday to reverse a ban on gas extraction via the controversial practice of fracking.

The benefits flowed immediately to shareholders of one NT-focused gas junior, Empire Energy Group, which jumped 133 per cent after making a (not particularly insightful) comment on the ban reversal.

Other ASX stocks involved in unconventional, fracking-based Territory gas projects have so far stayed quiet. (Scroll down to find out who they are).

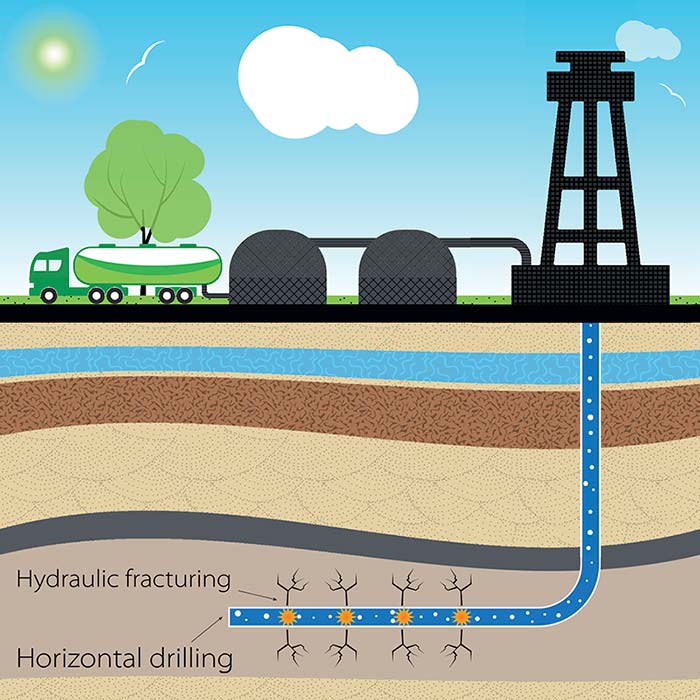

Fracking or hydraulic fracturing is the process of injecting special fluids into cracks to force them to open further, making oil and gas easier and cheaper to extract.

Opponents of fracking (sometimes called fraccing) say it wastes water and causes environmental damage and even earth tremors.

The Territory banned fracking in September 2016 while it weighed up the risks. (Several other States retain bans).

Under new rules announced on Tuesday, about half the Terrritory’s 1.4 million sq km will be opened up to fracking of onshore shale gas reservoirs. (There will be no fracking in areas such as national parks, indigenous protected areas or tourist attractions).

An implementation plan is expected by July.

“A complex regulatory framework will take time and no hydraulic fracturing of unconventional reservoirs will occur until a required regime of recommendations have been implemented,” said Territory chief minister Michael Gunner.

The federal government plans to work with the NT “to develop gas industry in safe and responsible way”, federal resources minister Matt Canavan said on Twitter.

“I’m told by some of the best geologists in Australia that NT could have enough gas to serve Australia for almost 200 years,” Mr Canavan said.

“There could be oil too which would help our national security. It is hard to get a geologist excited but they are excited about this!”

I'm told by some of the best geologists in Australia that NT could have enough gas to serve Australia for almost 200 years. There could be oil too which would help our national security. It is hard to get a geologist excited but they are excited about this!

— Proud Aussie Matt Canavan (@mattjcan) April 17, 2018

Which ASX stocks stand to benefit?

The excitement quickly spread to shareholders of Empire Energy Group (ASX:EEG), which more than doubled in price to 4.2c on Tuesday. The shares closed at 3.9c, up 117 per cent.

Empire owns 14.5 million acres in the Territory’s McArthur and Beetaloo Basins, “both of which are considered highly prospective for large shale oil and gas resources” the company says.

Empire plans to “proactively engage with the appropriate government department and traditional owner groups to define areas which are appropriate for continued development”.

A timetable was “currently unknown”.

Blue Energy (ASX:BUL) owns a number of permits in the Northern Territory’s Greater McArthur Basin where oil and gas discoveries have been made in recent years.

At the end of January, Blue Energy told investors it was waiting on the NT government’s fracking decision.

Blue’s shares rose 2.5 per cent yesterday to 12c — though it made no comment on the decision.

Armour Energy (ASX:AJQ) also has a project in the McArthur Basin which it has described as “a target for a globally important new province that will provide for re-rating of Armour in the future”.

The explorer has previously said it placed “a halt on any Territory-wide activity for Armour until the moratorium is lifted”.

Its shares rose 11 per cent yesterday to 10c. The explorer made no announcements in relation to the ban reversal.

Baraka Energy (ASX:BKP) owns a gas project called EP127 in the Territory’s Southern Georgina Basin which it believes “is one of the most prospective onshore basins in Australia with potential for both very large conventional and unconventional oil and gas deposits”.

The microcap — it’s worth just $2.3 million — has previously carried out fracking at the project but said in December “all potential sits idle until the Northern Territory fracking moratorium is lifted.

“This has significant impact on Baraka finding a potential farm-in partner for EP127.”

Baraka made no announcement on the fracking yesterday and its shares were unchanged at 0.1c.

MEC Resources (ASX:MMR) part-owns unlisted explorer Advent Energy, which holds an early-stage onshore project with unconventional gas assets in the Bonaparte Basin near the Territory’s north-western border.

MEC is in the middle of a huge fight with another ASX-listed stock over allegedly unpaid debts. Its shares fell 9 per cent to 2c on Tuesday.

Central Patroleum (ASX:CTP) is the Territory’s biggest onshore gas producer — but currently operates only conventional (non fracking) operations. Its shares were unmoved at 15c yesterday.

“Being conventional fields, Central’s fields are not caught within the moratoria on fraccing for unconventional exploration announced by the recently elected Northern Territory Government,” the company’s website says.