The 18 small cap stocks revving Tolga Kumova’s engine right now

Pic: Tyler Stableford / Stone via Getty Images

Tolga Kumova’s taste in high-powered cars reflects his status as one of Australia’s highest profile investment success stories – it’s probably little surprise the man drives a Ferrari.

What may surprise you, however, is the recent revelation in conversation with Stockhead of Tolga’s appreciation for a quiet drive. The sort of drive EVs are renowned for.

“The push towards electric vehicles is being driven politically around the world, but the reality is that in many ways they’re a better drive,” Kumova revealed.

“People talk about how they miss the sound when they sit in one of these new Teslas, but I must confess, I drive a Ferrari and it’s almost refreshing when the noise isn’t there.

“You can talk on the phone; you can talk to the person next to you – it’s a more relaxing experience.”

Our conversation had little to do with the mechanics of the auto industry and everything to do with resources stocks, but it didn’t take long to bridge the two given the enormous impact the world’s commitment to a greener future has had on commodity demand.

It’s a trend with ramifications for several market sectors, each which stand to benefit from global momentum towards a vision for change. To build an EV, you need batteries. To power an EV, you need energy.

The recent entry of Sprott Asset Management into the physical uranium market is a great example of this in practice, according to Kumova.

For so long maligned, uranium has celebrated a renaissance of recent times as the world wakes up to its potential as a clean source of energy. Sprott’s buying spree has driven the price to multi-year highs – it’s a space Kumova is watching with interest.

“I am a little cautious on the fact that as the spot prices go higher a number of operations will come back on and fill in the spot trust void,” he said.

“But there is a lot of reactors coming online in China and around the world at the moment, so it could well balance itself out – I am bullish on this commodity in the short term.”

Uranium’s draw is clear but like a phone call in a Ferrari, Kumova suspects another, lower profile commodity’s potential may be drowned out in some of the louder mineral noise.

“I actually think silica sands is a bigger opportunity with less risk than uranium,” he said.

“It goes back to the energy thematic for me – low iron silica sand is needed for the glass they use in solar panels, and when you’ve got a resource it’s almost a quarry operation.

“It’s not a large capex, high-tech process like it is with some other commodities.”

On the battery metals side of the coin is the nickel story, which alongside the booming lithium narrative and cobalt’s allure is showing plenty of signs of enduring for the long term.

Kumova said the actions of BHP in the nickel space, particularly its battle for Canadian company Noront Resources with Andrew Forrest’s Wyloo Metals, were well worth watching.

“Noront’s bidding hundreds of millions right now for what is a smallish resource in northern Ontario, but it is effectively exploration ground they’re after,” he said.

“That tells me they’re desperate for it with their nickel division – it shows the market just how passionate they are about the sector and what they’re thinking going forward.

“There’s a lot of opportunity across the battery metals space.”

The benefits of talking out loud

With much of the nation locked down in recent months, investment chatter on Twitter has reached new levels.

A prolific Twitter user, Kumova said his experience polling on the platform led him to believe that not all small cap investors were doing their due diligence before making financial commitments.

“There’s a reason I don’t use CommSec or any online broker services,” he said.

“I think it’s really important to talk to people about my ideas – actually running it past people and saying things out loud.

“Sometimes when you’re thinking about something, when you say it out loud you ether realise you look really silly – if you can’t explain something properly then it’s probably not worth doing.”

Kumova also stressed the importance of incorporating the opinions of people with experience on the board.

“In my experience if you’re getting specific information about a sector or industry from someone, you should always ask yourself what they’ve achieved before, or what they’ve seen before, or what they’ve done in the space,” he said.

“If you’re speaking to a broker, speak to one who has been successful before. If you’re speaking to a director of a company, speak to someone that’s done it; whether they’ve succeeded or failed at least they’ve tried.

“What I’m finding is people are listening to those who have very little experience in our sector and blindly accepting their information. It doesn’t really make much sense to me.

“People should only be taking advice from a licensed financial broker.”

Tolga’s top tips

As someone with runs on the board all of this begs the question – what does Tolga like on the ASX right now? The man himself ran through a series of small cap companies he believes are poised to make an impact over the next little while.

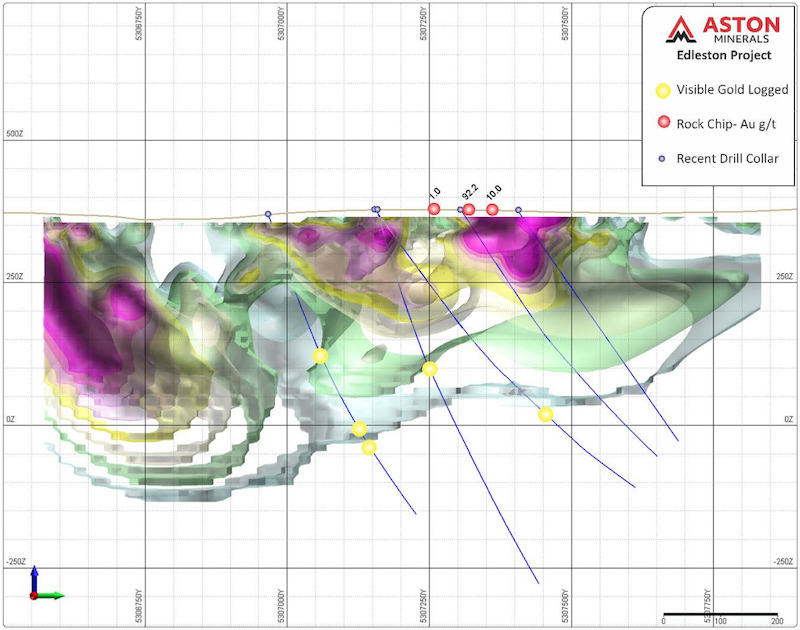

Aston Minerals (ASX:ASO)

Aston’s inclusion on this list should come as no surprise to those in the know. Not only is the Canadian explorer making waves with its yellow metal hits at its Edleston gold project in Ontario, Kumova is its executive chairman.

That should take little away from the company’s recent successes following up historical drill results, which have included numerous hits of visible gold in core.

“There’s one hole we drilled which had 35m with gold speckled through it,” Kumova said.

“It’s been frustrating because the labs have been incredibly slow – one of our biggest issues has been drilling holes but not getting the assays back, and not really knowing where the lodes are.

“But we have been guided by visible gold.”

Exploration has been furthered by drilling at the Sirola zone, 1.5km east of Edleston Main, where visible gold has been hit over a width of 500m.

“The deposits on this belt are not small,” Kumova said.

“This is definitely elephant country. You’ve got Timmins 60km to the north of us, which is 71 million ounces, and Kirland Lake to the east is 24Moz. Kerr Addison is 12Moz on this belt.

“Val D’or, to the other side of the Abitibi belt, is 20Moz. When this belt mineralises, and there’s an event deposit, it’s usually very large.”

It’s not just gold potential that excites Kumova about Edleston.

As BHP and Wyloo battle it out for control of Noront in Ontario, Aston has identified a magnetic high structure at Edleston which management believes may be nickel-PGE-cobalt bearing.

The anomaly is more than 5km long and 1.5km wide, and geophysics tracks it to 800m deep. Early drilling is underway.

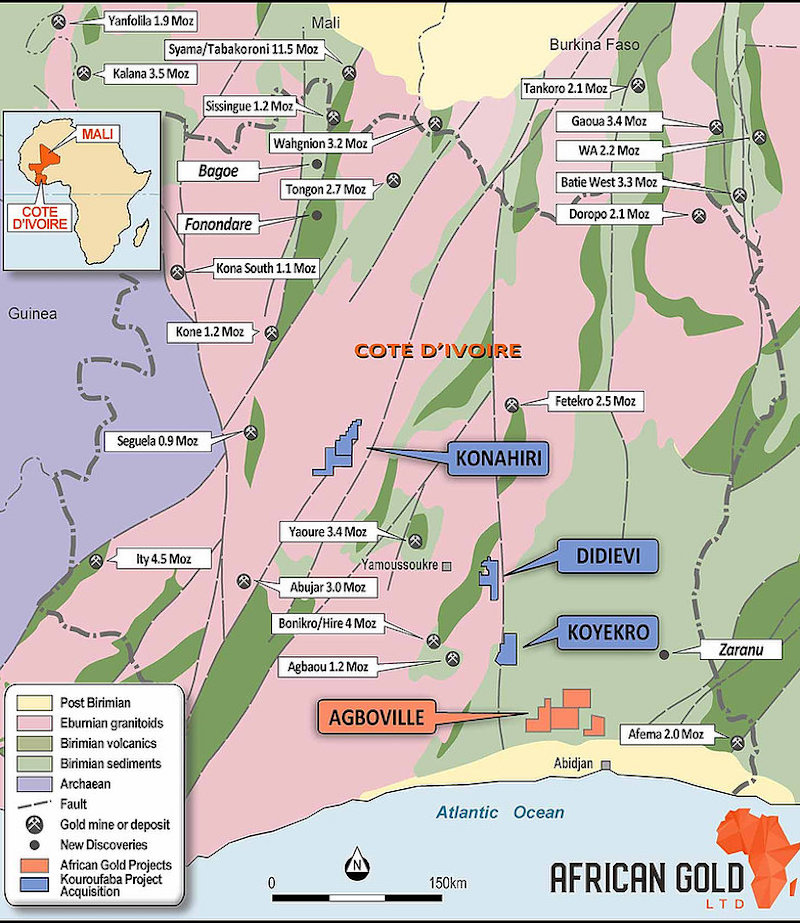

African Gold (ASX:A1G)

African Gold made headlines this week when it reported bonanza gold in screen fire assays from the Didievi gold project in Cote D’Ivoire, including 10m at 123g/t (!!) from 66m.

That assay included 2m at 613g/t gold – astounding stuff.

Kumova is a board member at A1G, where drilling has confirmed the presence of a large gold system over an area of at least 1.5km by 1km and open in all directions.

“This project has had some really large hits lately,” Kumova said, before this week’s news dropped.

“This thing had some standout hits including 83m at 3.3 grams per tonne, 89m at 3g/t, 17m at 6.3g/t, 17m at 5.4g/t, 43m at 4.3g/t, 37m at 7.7g/t – big numbers.”

Add to that 17.4m at 17g/t from 244m, including 1m at 216g/t, also announced in Wednesday’s release.

On top of the impressive width of mineralisation in the assays, Kumova highlighted the project’s proximity to the nearby Agbaou and Bonikro projects.

“Those projects are about 2-3Moz tonne per annum processing plants each, but Agbaou actually runs out of ore late next year so it will need feed,” he said.

“Our project doesn’t have a resource yet, but our first campaign has come back with some really nice numbers – it looks high grade, it looks large, and it may well have a natural home without having to build a plant.”

Firebird Metals (ASX:FRB)

A recent spinout of Firefly Resources, Firebird’s flagship is the Oakover manganese project in Western Australia which stands to gain from commodity’s battery demand.

The project has a mineral resource of 64 million tonnes at 10% manganese – a solid technical base on which the company plans to build through infill and extensional drilling, with ore sorting and gravity testwork also underway.

“One of the main reasons why I like this is the direct comparison with E25’s Butcherbird project, which is in the same region,” Kumova said.

“E25’s market capitalisation today is around $340 million, and Firebird, which has a comparable deposit, is $30 million.

“It will be a matter of going through the process. You’d expect it to be similar processing to E25, a similar market, but the best thing about it is E25 has already shown the proven path to get into operation and production – it’s a case of following those steps.

“They’ll probably get to use similar consultants, who know what works and what doesn’t. It’s a matter of following that path.”

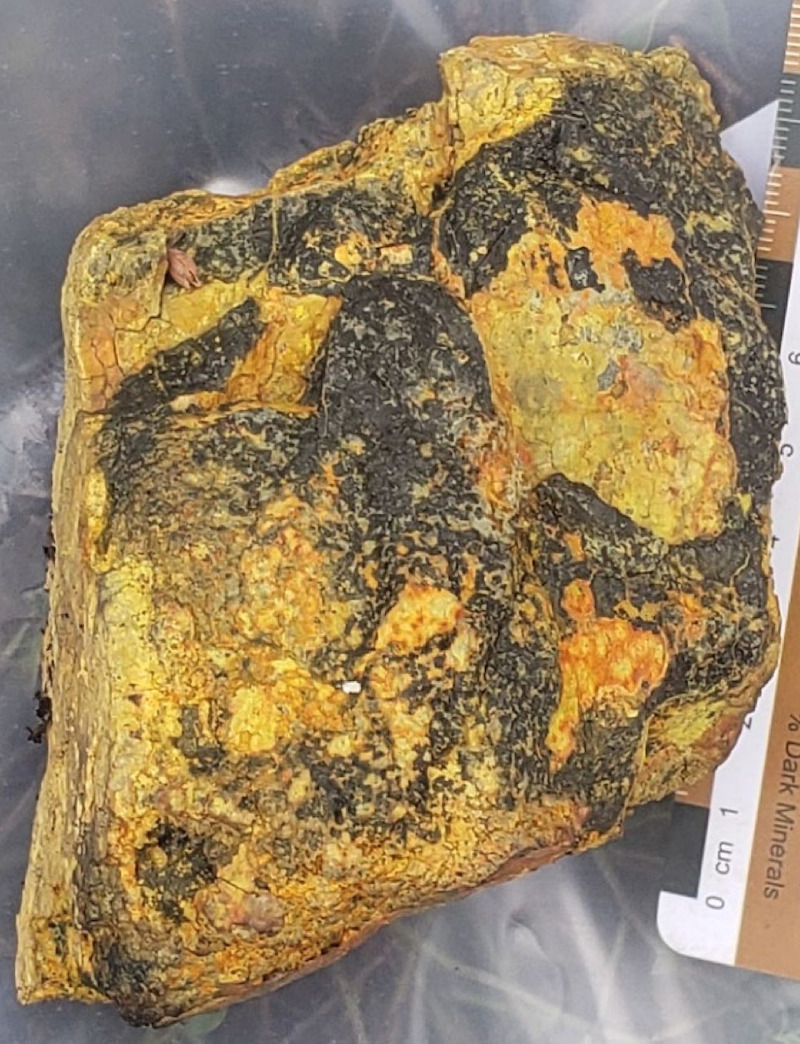

Valor Resources (ASX:VAL)

An exploration play with a copper-silver project in Peru and uranium opportunities in Saskatchewan, Canada’s Athabasca Basin.

It’s the latter of these two which has recently caught the attention of investors. Valor dropped some serious rock chip samples from the Hook Lake uranium project at the end of August, with uranium oxide grades as high as 59.2% with rare earths, lead and silver potential to boot.

Kumova said the mineralisation combination was unique.

“To have all of those minerals in the same place is incredibly exciting,” he said.

“I’ve been looking to find analogous deposits and I just can’t, I haven’t seen it and I couldn’t find anything like it.

“When it comes to these types of grades, especially in uranium, normally you’re going for parts per million mineralisation – 59% is enormous.

“With that sort of grade you don’t need kilometres of mineralisation – 200m could be a deposit.”

Kumova said if drilling defined any kind of strike extent or thickness it could be one to take off.

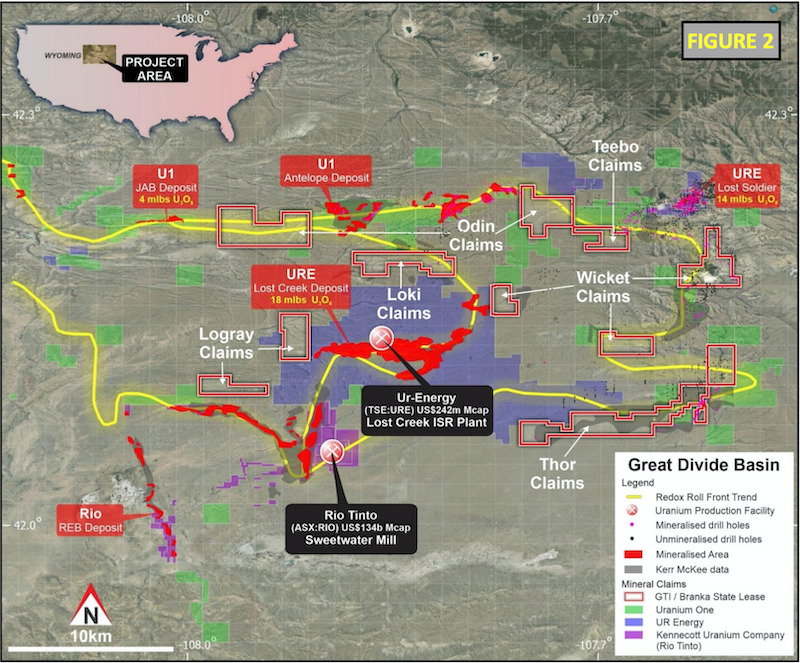

GTI Resources (ASX:GTR)

Another in the uranium stable is GTI, which recently acquired in-situ recovery (ISR) uranium projects in Wyoming to complement its Henry Mountains hard rock assets near the White Mesa Mill in Utah.

The recently acquired projects give GTI the largest non-US, Russian or Canadian owned uranium exploration landholding in the prolific Great Divide Basin.

ISR accounts for around 90% of US uranium production and has accounted for 100% of Wyoming’s uranium production since 1993.

“With all that’s happening in uranium at the moment this thing will be another to keep an eye on,” Kumova said.

As well as the ground, the company has engaged senior Wyoming uranium experts to assist with its exploration efforts in the region.

Raiden Resources (ASX:RDN)

A dual-listed company, Raiden has identified the Arrow gold and Mt Sholl nickel-copper-PGE projects in the Pilbara as its key strategic priorities over the next two years.

That comes with good reason – a program of work was recently approved for Arrow with contractors engaged to tender on an initial RC program to test early targets.

“Arrow is literally abutting De Grey’s (ASX:DEG) Mallina gold project – 35km from Hemi, and it has multiple intrusives,” Kumova said.

“There’s gold anomalies in the soils, and now it’s got to a point where they’re about to start drilling with a market cap around $20 million or thereabouts.

“It also has some nickel interests in that part of the world at Mt Sholl, and there’s some interesting things happening up with its copper-gold projects in Serbia and Bulgaria.”

Alderan Resources (ASX:AL8)

Not the planet (that’s spelled Alderaan). Alderan is a US focused copper-gold explorer with projects in Utah.

The company’s flagship is the Detroit project, south of Rio Tinto’s Bingham Canyon/Kennecott copper mine, which it says has strong potential for porphyry related and Carlin-like copper and gold deposits. Surface exploration results have been promising so far.

“There was one hole drilled near the target previously, which came back with all the hallmarks of copper-gold porphyry mineralisation,” Kumova said.

“That was just off the structure, and then they stopped drilling. A recent placement will fund the next program, which is being drilled in a couple of weeks to test those targets.”

Perpetual Resources (ASX:PEC)

PEC is currently updating the ore reserve for its Belharra project, following a phase of aircore infill drilling results which confirmed high grade white silica sand at the project.

The company is also undertaking bulk representative composite metallurgical testwork on white sand samples from the project, after releasing a compelling PFS in March.

“They’re just going through the process right now to confirm their white sands, so the low iron content material,” Kumova said.

The company has an eye to offtake once the tests are completed. Results are expected this month.

Industrial Minerals (ASX:IND)

Also in the sand game is IND, with a number of assets including the Gingin, Stockyard, Unicup and Quins projects.

“IND is earlier stage than PEC but at Stockyard doesn’t have to go through the same permitting processes though the EPA as some other players in the region,” Kumova said.

“IND doesn’t have that issue because the deposit is actually partly on farmland.

“It was a paddock but now it’s effectively just white sand, which isn’t very good for farmland either.”

An aircore rig was recently secured for up to 10,000m across the projects, designed to test new targets and validate historical drilling on each.

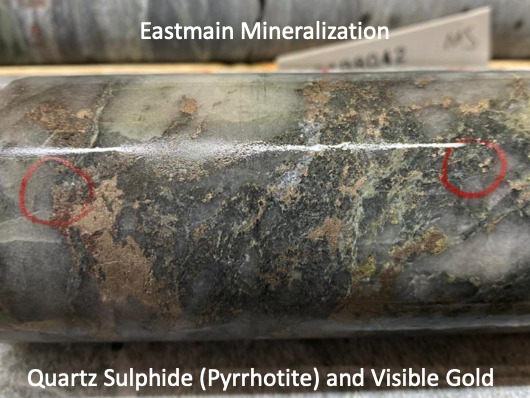

Benz Mining Corporation (ASX:BNZ)

A Canadian gold play, Benz’s flagship is the Eastmain gold project, which spans the upper Eastmain greenstone belt 320km northwest of Chibougamau and 800km north of Montreal.

The company recently completed a placement to raise C$10 million at an 80% premium to its prior TSXV closing price, with funds to be used to advance exploration and build on the project’s 376,000oz resource at 7.9g/t gold.

“They’re exploring what is essentially an entire belt,” Kumova said.

“It’s like exploring the entire Wiluna. It’s quite amazing that it was open to be pegged and acquired for the price it was once upon a time.

“There’s also lithium there; there’s an outcrop of 60m by 25m where they’ve taken samples up to 4.7% lithium from surface.

“There’s historical copper hits there as well, as well as historical nickel.”

Meteoric Resources (ASX:MEI)

An old pit, Meteoric’s Palm Springs project resource has gone from 0oz to 355,000oz in its first year with successful drilling ongoing.

“There’s a plant close by, about 40km away, that would love its feed to extend its life,” Kumova said.

One recent drill hole hit multiple zones of visible gold over 79m, with assays pending.

Meanwhile, significant molybdenum and copper sulphides have been observed over 600m of core at the company’s Juruena project in Brazil.

“They know they’re in the porphyry, they just need to understand how mineralised it is,” Kumova said.

Firefly Resources (ASX:FFR)

Firefly is in the process of merging with Gascoyne Resources (ASX:GCY).

That’s a move which will strategically consolidate FFR’s higher-grade Melville mineral resource of 196,000oz at 1.54g/t and the Dalgaranga production hub just 100km away by road.

The move will allow the combined company to leverage the sunk capital spend at Dalgaranga’s processing facility while accelerating the development of Melville.

The ground around Melville and the broader Yalgoo gold project includes more than 100 targets, with 30 at untested historical working with recorded gold production.

“Mining the Melville ore will make a significant difference to their profit,” Kumova said.

Plays for the watchlist (ASX:CVS, BNR, GGE, FME, KFM, GLV)

Kumova also flagged a mixed bag of stock tickers worth keeping an eye on, from smaller shells to those with interesting exploration assets.

- Cervantes Corporation – CVS

- Bulletin Resources – BNR

- Grand Gulf Energy – GGE

- Future Metals – FME

- Kingfisher Mining – KFM

- Global Oil & Gas – GLV

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.