‘The sky’s the limit’: How big could Azure’s Andover nickel-copper-cobalt discovery get in 2022?

Pic: Getty

The Azure Minerals (ASX:AZS) share price isn’t the only thing to have grown since the WA explorer hit paydirt in its very first drillhole at the Andover project in October last year.

The size and scale of Azure’s company making Andover nickel-copper discovery in WA — 16.2% owned by famous prospector Mark Creasy — increased at a rapid rate in 2021.

The +1km long, +500m deep VC-07 nickel-copper corridor (comprising VC-07 East and VC-07 West) is being drilled ahead of a maiden resource for VC-07 East in Q1 2022.

VC-07 East alone is defined by 4m to 8m high grade zones (2% to 3% nickel) inside an overall 15m to 30m wide mineralised envelope (1% to 1.5% nickel).

A project scoping study — the first proper look at the economics of building a mine — is also progressing well and is set to be unveiled later in the year.

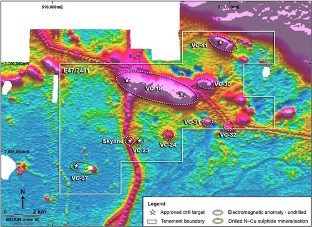

But at Andover, unlike most sulphide discoveries, there are no ‘false positives’ from EM surveys.

That means find an EM conductor, find nickel-copper sulphides.

Azure has already made two additional discoveries, called VC-23 and Skyline.

There are multiple other EM conductors detected by airborne, surface, and downhole surveys; many have yet to be drilled, the company says.

This is exciting stuff.

A healthy +$20m cash balance means the company is well placed to attack these targets with gusto in 2022.

“The sky’s the limit for Azure and our nickel-copper-cobalt-rich Andover project, with new discoveries, substantial mineral resources and positive scoping studies expected to be announced in 2022,” Azure managing director Tony Rovira says.

Metals of the future

Azure’s major focus on the clean and green energy metals of the future – nickel, copper, and cobalt – is also expected to pay dividends, Rovira says.

“There will be a very strong demand for these metals in the future and prices are expected to stay strong and go significantly higher.”

Raw materials like this will be needed in ever greater quantities to build the electric vehicles (EV), batteries and power grids of the future.

Fastmarkets is forecasting copper prices to rise steadily to above US$10,000/t in 2022, despite expectations mined production will increase by 7%.

It also views recent price weakness for nickel, related to Tsingshan’s promise to supply nickel matte from laterites in Indonesia to the battery market, “as a healthy correction within an ongoing bull market”.

Since about December 20, prices have surged back toward recent highs.

Cobalt prices rose for 100 consecutive days in the latter half of the year, recalling the madness of 2018’s charge towards US$100,000/t.

They did not scale those heights this year, but still charged to more than US$70,000/t in December.

A promising gold leg

In July 2021, Azure was awarded the underexplored ‘Barton’ tenement close to several large and growing deposits in WA’s Kookynie gold district.

There’s a flurry of new activity at Kookynie, which has produced more than 1.1 million ounces of gold from open pits and underground mining since the 1890s.

Besides Genesis Minerals’ (ASX:GMD) Puzzle North discovery, Barton is also close to Genesis’ 1.6Moz Ulysses gold project, Saturn Metals’ (ASX:STN) 944,000oz Apollo Hill project and recent high-grade discoveries by explorers like Metalicity (ASX:MCT).

Most historical exploration in the Kookynie district focused on areas of outcrop and shallow soil-covered terrain.

The extensive soil cover within Barton made all previous soil sampling and shallow drilling work ineffective in testing for bedrock-hosted gold.

And yet Barton contains several very exciting gold targets, including Daisy Corner which adjoins Puzzle North.

Limited historical bedrock drilling at Daisy Corner in the ‘90s hit shallow gold including a highlight 18m @ 0.77g/t Au (incl. 7m @ 1.26g/t Au).

An RC drilling campaign will kick off at this priority target early in the new year.

Beyond that, aeromagnetic surveys have identified multiple structural targets for systematic air-core drilling in Q1 2022.

This article was developed in collaboration with Azure, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.