The right stuff: NickelSearch Carlingup project poised for take-off

NickelSearch's Carlingup project has all the right ingredients. Pic: Getty

Nickel is the rising star of the battery metals sector and NickelSearch says its Carlingup project in Western Australia has the right stuff to help meet growing demand.

Growing nickel demand for use in electric vehicle batteries has seen prices climb to their highest level in more than a decade, though chairman David Royle believes there is one fundamental difference which makes it very different from past price increases.

Speaking to Stockhead, he said unlike past price volatility caused by the commodity cycle, we’re now seeing a firming of nickel prices because of its use in batteries rather than just for electroplating.

“If you think about just how many EV cars are going to be on the roads in the not too distant future, that’s a lot of batteries and it’s going to need a lot of nickel as long as nickel remains an important ingredient for batteries,” he noted.

Hammer and nickel: Red Door Research

“We are pretty encouraged by the whole story, which is why we bothered to embark on this enterprise. We have confidence that nickel will maintain its current levels and go upwards.”

Royle has good reason to be confident. In an interview with Stockhead, Red Door Research nickel expert Jim Lennon said that while the world would need 1.3Mt of nickel for batteries by 2030 – a big jump from the 320,000t used in 2021 – just 700,000t to 750,000t of the new demand would be met by nickel sulphides and production of that type of nickel has not changed for two decades.

This has raised questions about where the required nickel would come from, and NickelSearch (ASX:NIS) – a relative newcomer to the ASX that only listed in October last year – is confident that it can play a significant role in answering it.

So just what is the company’s ‘secret’ weapon that will let it play a role in helping meet the growing demand for the battery metal?

Ticking all the right boxes

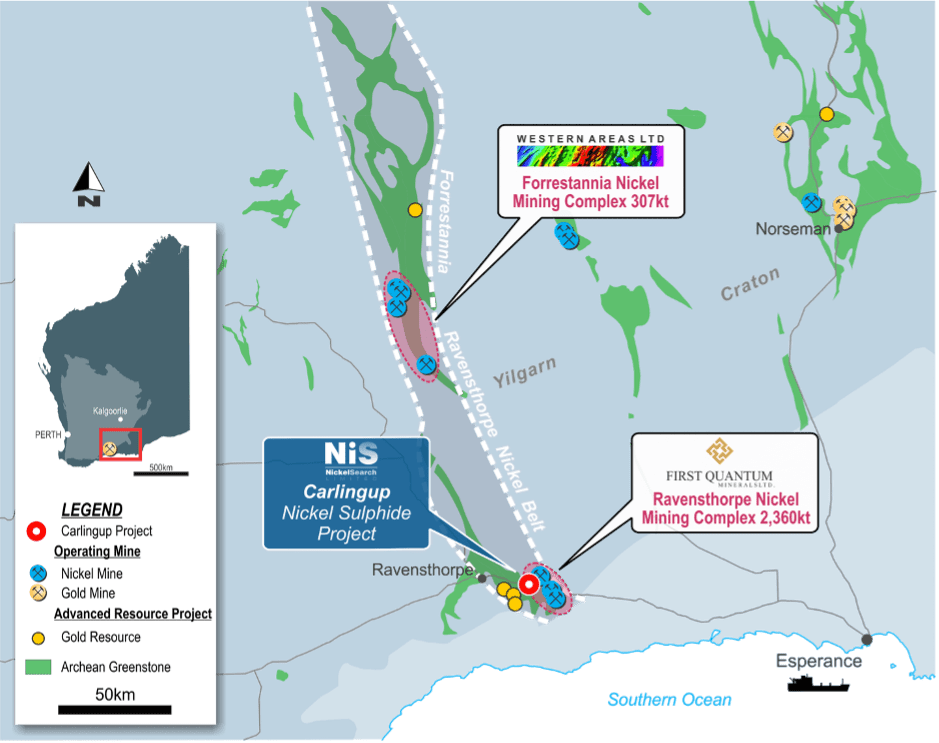

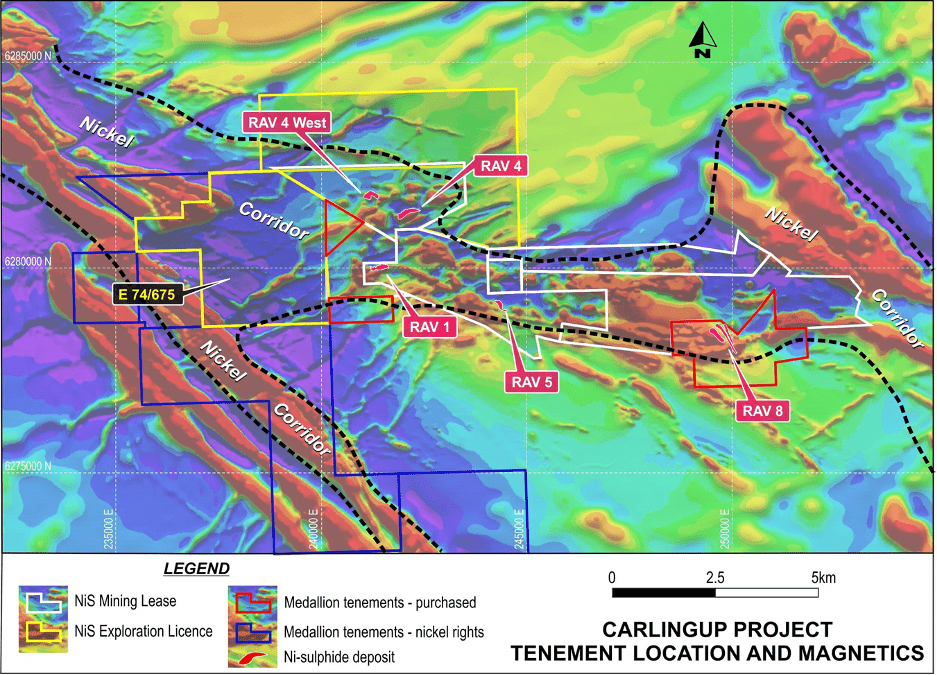

The company is pinning its ambitions on the Carlingup nickel sulphide project – a collection of eight mining licences and seven exploration licences that form a contiguous 108sqkm land package that has been consolidated for the first time under one vehicle.

This covers a 15km strike of the highly prospective and proven Ravensthorpe Greenstone Belt within a stone’s throw of the town of the same name and near established nickel mining and processing operations like First Quantum Minerals’ Ravensthorpe operation and Western Area’s (ASX:WSA) Forrestania nickel mine to the north.

Carlingup also features historical high-grade nickel production of 16,100t of nickel at a grade of about 3.45% from the RAV-8 mine.

Confidence

This still hosts a resource of 13.2Mt grading 0.6% nickel, or 75,000t of contained nickel, a not insignificant part of the project’s current resource of 171,000t.

Importantly for NickelSearch, these factors combine to provide the confidence to forge ahead with exploring its extensive pipeline of high priority drill-ready targets whether they be brownfield and greenfield.

So much so that Royle is firmly of the belief the greenfields potential of Carlingup is rated very highly.

“What happened historically is that there were a lot of anomalies that were generated through different programs but a lot of them remained to be drill tested because companies came and went. They didn’t really persevere,” he told Stockhead.

“We think we have secured arguably the most prospective part of the Ravensthorpe greenstone belt for nickel sulphides and we are pretty confident there’s going to be a discovery there somewhere.

“The knowledge that we have from RAV-8, that is precisely what we want to find, high-grade nickel somewhere out there in that belt.”

Exploration bearing fruit

NickelSearch already has some evidence to back up Royle’s confidence.

Just two days after listing on the ASX, the company kicked off its maiden reverse circulation drill program over the RAV-8, RAV-5 and RAV-4 West deposits that was completed in early December.

While most of the assays are still pending thanks to the long backlog at assay laboratories, the one result that the company has received so far has been encouraging to say the least, returning an intersection of 5m grading 2.6% nickel including 2m at 4.5% nickel.

“But what was really significant about that was we had very good platinum group metals (PGM) and copper credits indicated,” Royle said.

“We’re very excited about that because I don’t think the previous producers actually got the credits, or at least we don’t know if they did.

“It certainly adds a lot of value to the ore having those other elements there.”

Should the remaining assays also return significant credits, it will certainly go a long way towards improving the economics of any future development.

Driving forward with experienced leadership

To drive Carlingup towards development, NickelSearch has gathered an experienced team with relevant nickel exploration and production experience.

While Royle himself is taking a step back from his previous position as executive chairman to being its non-executive chairman, he still offers the company extensive international exploration experience from more than 40 years of work in mineral exploration project feasibility.

“I’m happy to say that my teams have recorded a number of very significant discoveries in gold and base metals in Australia and the Pacific Rim,” he noted.

New managing director Nicole Duncan also brings her wealth of experience as a founding member of the executive leadership of South32 following an extensive career with BHP.

She has over 20 years of experience in mining and oil and gas, starting as a lawyer before moving into commercial roles and then into broader executive portfolios.

Other notable members of the management team include the manager processing Tamsin Senders, one of Australia’s leading scientists in the field of bacterial leaching who most recently consulted at Western Areas, and Senior Technical Advisor Leo Horn, a geologist who has more than 20 years of experience in exploration, across most commodities including nickel both in Australia and abroad.

Senders is also a co‐developer and patent holder of the BioHeap™ bacterial heap leach process and is named as co-inventor on 13 granted international patents.

“We are definitely looking at bioleach as a low cost, environmentally friendly, good way to go with processing our ores,” Royle added.

Offtake and production royalties

Royle notes NickelSearch was demerged from Alpha Fine Chemicals and still has many shareholders in common with its former parent.

Importantly, there’s an existing agreement between the two companies that could see nickel sulphide produced from Carlingup be supplied to Alpha Fine Chemicals for further processing into high purity nickel sulphate, the precursor for EV batteries.

To top it off, the project hosts shallow nickel laterite deposits that are effectively part of the Ravensthorpe package.

“Because of previous wheeling and dealing, half the laterite nickel deposits are actually now owned by FQM,” Royle noted.

“We have the rights to anything underneath that and we also hold the other half of the nickel laterite deposits.

“We haven’t decided what we will do with it, but it’s probably going to be toll treated through FQM’s plant or we could just collect a production royalty on it.”

He added that the company would also receive a production royalty on the material owned by FQM, though he emphasised that the nickel laterite resources are not a priority for the company.

Upcoming exploration

While the bulk of results from last year’s drilling are still pending, the company is certainly not standing still.

It recently completed a helicopter-supported airborne electromagnetic survey that had also captured good magnetic data.

“When we get the processed data, which will be any week now, we will then integrate that for target generation,” Royle noted.

“We can already see some very interesting features come out of that survey, but you have to level the data and model it and so forth before you can actually deal with it properly. But we are excited about it.”

“It gives us really in a way, a very important additional data set that we can implement in our targeting studies.”

The company also expects to shortly commence an aircore and diamond drilling program that will start on the known deposits – RAV-4 West, RAV-4 and RAV-1.

“We also have Programs of Work completed for some of the exploration targets, which is fantastic as that will allow us to do some aircore work over some of those targets and where appropriate we might even put a diamond hole,” Royle added.

All this work is expected to allow the company to upgrade its existing resources as well as defining a resource at RAV-5.

Looking further ahead, Royle expects the company to get a RC rig back in the middle of the year to carry out more extension and infill drilling as well as further testing of regional greenfields targets.

On the production front, the company will do test work on some of the diamond intersections that it will get back in the next round of drilling.

This will help inform the company on the processing options that it is considering.

“We will likely have a central processing facility and pull ore from a number of pits into that, assuming the material can be blended,” Royle explained.

“We will definitely be looking at ore sorting, upgrading, if that’s possible, so we might be able to get smart about the volume that we have to deal with.

“In a nutshell, we have great ground position, we have a really good team to implement a sensible strategy and plan, we already have resources and ultimately our product will go directly to a company that is going to produce high purity nickel sulphate that goes into EV batteries.”

This article was developed in collaboration with NickelSearch, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.