‘The last piece’: Thomson completes high-grade silver district with ‘Silver Spur’ acquisition

Pic: Getty

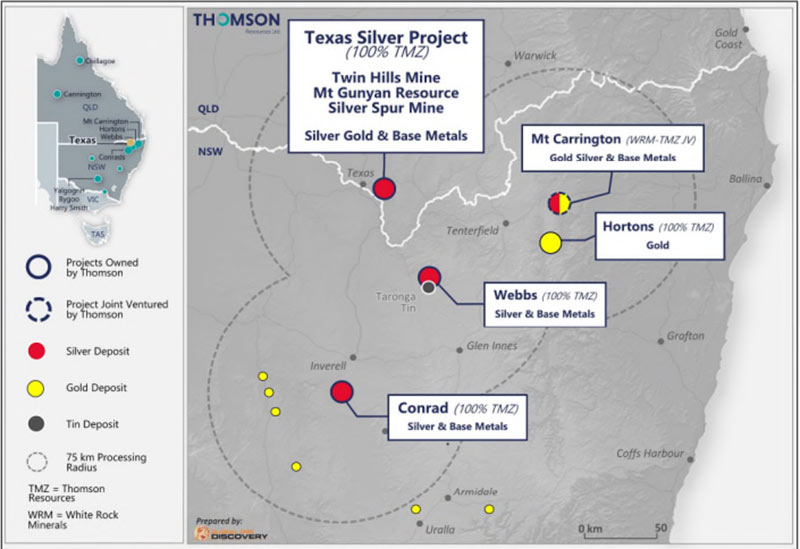

The newly completed ‘Silver Spur’ acquisition gives Thomson Resources total control of the +3.6Moz Texas silver-base metal district in Queensland — a cornerstone asset in the company’s New England Fold Belt ‘Hub and Spoke’ strategy.

Silver Spur is a giant, historically producing 2.19Moz silver at an exceptional average ore grade of 800 g/t silver, as well as 690t of zinc, 1,050t of lead and 990t of copper and by-product gold from ~100,000t of ore.

It is defined by near-vertical mineralised shoots with a projected surface footprint of 100m by up to 85m.

These shoots have been mined to ~150m vertical depth but remain open, with the deepest mineralised intersection to date underneath the base of mine at ~200 m vertically below surface.

Since the mine closed, multiple phases of exploration have been carried out in the area with drilling between 1995 and 2012 reporting significant silver and base metal mineralisation, often starting near surface.

Priority target

Thomson (ASX:TMZ) believes the controlling ‘Stokes Fault’ projects 2.1 km to the northwest into the ‘Twin Hills’ pit, a site which has produced 1.4Moz silver via a heap leach operation since 2008 and also lies within the Texas Silver Project.

This interpretation highlights the underexplored + 2km strike extent of the Stokes Fault as a priority target for further exploration, Thomson says.

“The last piece of the foundation for the New England Fold Belt Hub and Spoke strategy is now within our ownership, which will assist enormously as we continue to work up the central processing facility concept,” Thomson executive chairman David Williams says.

“Much has been happening behind the scenes and we are set to see a busy 2022.”

What is the Hub and Spoke strategy?

The New England Fold Belt “Hub and Spoke” strategy is aimed at consolidating a 100 million ounce silver equivalent resource that will be fed into a central processing facility.

It encompasses the Texas (Twin Hills and Mt Gunyan), Silver Spur, Webbs and 20.7Moz Conrad projects.

Thomson is working with its advisors to systematically review these projects with the goal of delivering a new or re-estimated JORC 2012 resource, with the Texas resource anticipated to be released during the 1st Quarter of 2022.

“Whilst not the subject of announcements to date, considerable progress has been made during the 2nd half of 2021 towards restating the Mineral Resources for Twin Hills, Mt Gunyan and Silver Spur,” the company says.

“The key projects underpinning this strategy have been strategically and aggressively acquired by Thomson in only a 4-month period.

“As part of its New England Fold Belt Hub and Spoke Strategy, Thomson is targeting, in aggregate, in ground material available to a central processing facility of 100 million ounces of silver equivalent.”

Thomson is also progressing exploration activities across its ‘Yalgogrin’ and ‘Harry Smith’ gold projects and the ‘Bygoo’ tin project in the Lachlan Fold Belt in central NSW — which may form another Hub and Spoke Strategy — as well as the ‘Chillagoe’ gold and ‘Cannington’ silver projects in Queensland.

This article was developed in collaboration with Thomson Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.