Thomson Resources hits 118m in major tin discovery at Bygoo

What a hit. Picture: Getty

Thomson Resources (ASX: TMZ) could be onto a major new tin discovery at its Bygoo project in New South Wales after striking more than 100m of mineralisation down the road from previous targets.

The silver and base metals explorer is claiming multiple new finds on the back of drilling around the Lachlan Fold Belt prospects.

Located just 300m northwest of its main zone, Thomson hit a new mineralised greisen over 118m at 0.43% tin from a shallow depth of just 57m, including a higher grade sections of 11m at 0.7% tin and 19m at 1.0%Sn.

Thomson also uncovered another new zone 50m to the north of its Main zone, assaying 1.4% over 23m from 141m deep, including an impressive high grade component of 4m at 3.52%Sn.

Thomson’s executive chairman David Williams is bullish about the prospects of building a tin resource on the back of the findings.

“These latest results from the Bygoo Tin Project are highly encouraging and mark a further significant exploration success for Thomson,” he said.

“To come away with two new high quality tin discoveries demonstrates what a quality tin project Bygoo is. I will take 1%+ Sn grades in shallow depths any day!

“The new discoveries themselves provide additional targets for follow up drilling and allow greater opportunity to build out a meaningful tin resource at Bygoo which can incorporate the four mineralised areas.”

There is good reason to assume further drilling by Thomson will find more mineralisation with Bygoo in a proven tin district which was home to the Ardlethan mine.

That was the Australian mainland’s largest tin producer, delivering 31,500t of tin metal up to its closure in 1986.

Featuring an exploration licence that surrounds Ardlethan and covers several kilometres of shallow workings from the early 20th century, Thomson has held Bygoo since 2015 and those workings have proven fertile targets to date.

Tin on the up

If you find an economic resource in tin at decent grades in 2021, you could be in the money.

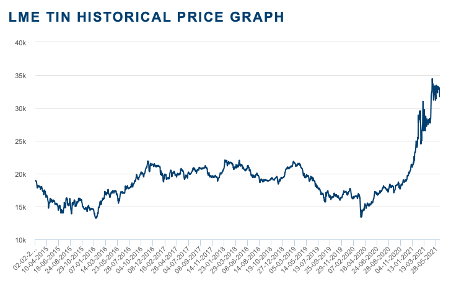

Tin has been listed as a critical mineral in US and China and has seen its price charge past $US30,000 per tonne for the first time since the last mining boom this year as LME warehouses were cleaned out to a day’s worth of supplies.

There are a number of factors in play.

Known colloquially as a packaging metal and more specifically as a coating alloy and component in bronze alongside copper, tin’s primary use has emerged in recent times as a soldering metal in electronic circuits. That accounts for about 50% of the global tin market.

With a shortage of semiconductor components for the booming consumer electronics and EV markets, that has pushed demand for tin through the roof.

On the flipside, weather events in Indonesia and political unrest in Myanmar, the world’s third largest tin producer, have also stoked supply concerns.

The positive market fundamentals are certainly not lost on Williams.

“It has been great to get back to work on the Bygoo Tin Project, given where tin prices are going,” he said.

Follow up drilling

Thomson Resources had been planning to get stuck into some resource definition drilling at Bygoo but the new finds will see it shift the point of attack.

All four zones including the new finds remain open, with drilling now being planned to assess the scope of the mineralisation.

Drilling will also target the existing Main and Dumbrell prospects, both of which were shown to have good extensions in the recent drilling program.

With prime farming season drawing near, the company will have to end its current drilling program but is planning to return after the harvest in November to follow up its new discoveries.

“We have to wait now until the end of 2021 to get back there, but it will be a high priority for a comprehensive program at Bygoo straight up when we can get back on the ground,” Williams noted.

Silver still a major focus

Thomson Resources has been making strides in precious metals exploration with its “hub and spoke” strategy to consolidate several significant silver deposits north and south of the Queensland-NSW border.

Consisting of five tightly-grouped silver and gold projects aggressively acquired over late 2020 and early 2021, Thomson is aiming to build a resource base of 100 million ounces of silver equivalent to underpin a central processing facility to bring the projects together.

Its first cab off the rank is the Conrad Silver Project, a historic producer which delivered 3.5 million ounces of silver at 600g/t up to its closure in 1957.

This article was developed in collaboration with Thomson Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.