The growth story that could make Indonickel producer Nickel Mines the battery metal’s answer to Fortescue

Pic: Getty

By any measure Nickel Mines (ASX:NIC) is one of the most arresting stories on the ASX.

It is said necessity is the mother of invention and the Indonickel miner is the prime example.

Back in 2014, then unlisted Nickel Mines was forced to shut its Hengjaya mine only a year after Joko Widodo’s Indonesian Government brought in tough new laws banning the sale of unprocessed ores.

That setback was the making of the Australian company, which started shipping high grade unprocessed nickel from Hengjaya only in February 2013.

It led Nickel Mines to play a major role in the development of Indonesia’s Chinese backed nickel pig iron industry.

While the rise of supply from Indonesian nickel producers has until now been a price threat for Australian producers of the stainless steel and EV battery metal, for Nickel Mines it has been a window of opportunity.

Partnering with Shanghai Decent, part of Tsingshan one of the world’s largest stainless steel and nickel businesses, Nickel Mines leveraged a $200 million IPO in 2018 to build a 60% stake in the Hengjaya rotary kiln electric furnace plant.

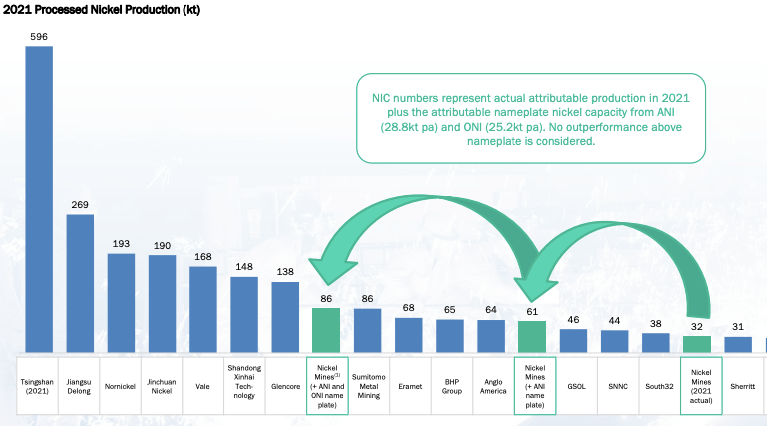

It now owns 80% of Hengjaya and Ranger in the Morowali Industrial Park, with a nameplate capacity of 24,000t of nickel metal in NPI on an equity basis (30,000t 100%), backing regular dividends since mid-2020. They consistently perform above nameplate, delivering 32,328t for NIC in 2021, or 40,410t on a 100% basis.

Growth is coming and fast

Its next growth project, the four line Angel project at Weda Bay Industrial Park is just about up and running, delivering first NPI production in January, while the firm rattled the tin yesterday for US$225 million ($314 million) to fund an initial 30% stake in the Oracle RKEF project, which will grow to 70% before the end of the year with first production due in 2023.

Highlighting the remarkable pace of its growth, Nickel Mines could be a top 10 global nickel producer once Oracle is in full flight, producing as much or more of the metal as BHP’s Nickel West, a business that dates back to the first nickel boom during the Vietnam War.

While Australian miners produce the scarcer “class 1” nickel sulphide, the nickel of choice for EV batteries, experts say rising electric vehicle demand means we could need as much as 2Mt of additional production this decade.

That means Indonesia’s nickel laterite mines could be needed to help fill the shortfall by selling both “class 2” NPI into the stainless steel industry and “class 1” nickel matte and mixed hydroxide into the battery space.

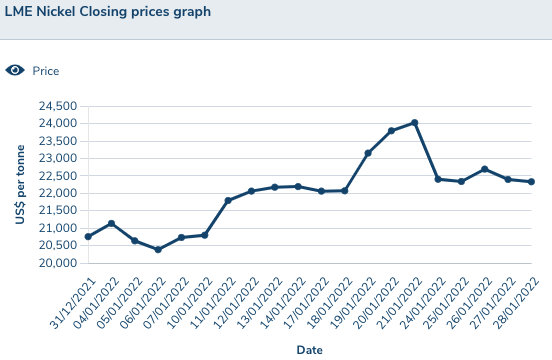

Nickel Mines represents a rare form of exposure to this thematic on the ASX, especially with nickel prices touching 11 year highs of US$24,000/t last month.

We spoke to Nickel Mines MD Justin Werner about just how the company has grown so fast and why he thinks it could be the Fortescue (ASX:FMG) of the nickel market.

Being an Australian company you have sort of bet on the other horse going to Indonesia. The rise in production there seems to strike so much fear in the Australian miners over here, but it looks like it was the right choice.

“Indonesia is well endowed with nickel laterite resources, you know, it contains the largest known resources globally.

“It’s on track in the next five years to producing sort of 40% of the world’s nickel output, close to 50% will be coming out of Indonesia.

“So if you look at all of the new nickel capacity that’s come online, pretty much all of that has coming from Indonesia, and quite rapidly. You’ve seen since 2013 around 400,000-500,000t of capacity that’s come online in Indonesia. It has the resources, it has the support of the government, you may have seen our most recent announcement.

“We get a 10 year tax holiday, zero tax for 10 years, and then a further two years at about 11 or 12%.

“So that’s obviously fostering the development (of the industry). Because of the relationship we have with Tsingshan, who’s the world’s largest stainless steel producer, and has a lot of experience in in the nickel space we’re able to do deals where they provide us with capex guarantees.

“And we’re more of an industrial nickel producer rather than a mining story. So we don’t have large sustaining capex. We don’t have mine life considerations or geological complexity that drives our decision making.

“We really are an industrial business that produces low cost nickel units for the stainless steel market.”

Nickel Mines share price today:

Before Nickel Mines listed there was the initial export ban that complicated things for the business. Now, we’re a few years on from that and soon you could actually be a larger nickel metal producer than BHP. It’s quite an incredible transition in only eight or nine years since those bans came into place.

“It’s been a meteoric rise and look I think it’s still set to continue. We have obviously a very strong relationship with our largest shareholder Shanghai Decent.

“If you look at the size of the deals they continue to get larger and larger. We’re unique, there’s nowhere else in a world where the nickel units we bring on come with a CapEx guarantee and a nameplate guarantee in terms of nickel production.

“So it’s completely derisked, low cost nickel units that we can bring on just by writing out a cheque.”

How does that process work in terms of how you can get into development so quickly?

“Shanghai Decent has built up around 70 to 80 of these RKEF lines. So it’s a cookie cutter, they’ve built so many of them they in fact pre-fabricate all of the equipment in China, put it on their boats, which they own and send it to Indonesia.

“They have a full time construction team of a couple thousand just working around the clock to erect these things.

“There’s just no one else that can do it on the scale, and at the speed and the cost of these guys. And also in terms of just the operating efficiency that these guys operate at as well, we’re sitting right down the very end of the cost curve.”

So at the moment you’re a $3.65 billion dollar company, you’re around record highs. In your mind, could you potentially be even higher if you were producing the same amount of nickel elsewhere?

“I do think we are discounted to some degree. But, I think over time, as we continue to consistently deliver, continue to grow, continue to be a material dividend payer, I would expect that sort of valuation discount is going to tighten as the track record continues to grow.

“If you look at Fortescue in the early days, there was a lot of skepticism and it took a lot of time. But you know, now it’s a material dividend payer, it’s just a cash cow. I think we’ll be in a similar position only in the nickel industry.”

You’re focused on Indonesian nickel pig iron production. Will you miss that demand from the battery space?

“We announced an MOU to diversify into production of nickel matte. So that’ll create some diversity, I think we’ll be the only company that has that diversity of producing class one and class two nickel.

“And then off the back of the sort of MOU that we signed with Shanghai Decent at the end of the year is sort of contemplates future HPAL development down the track, which gets us even further into that nickel battery metals market.

“Where there’s obviously clearly a lot of growth is being seen and a large drawdown on primary nickel stocks, which obviously is driving a strong LME nickel price at the moment.”

We’ve seen the projections for nickel that we might need a million tons of extra nickel metal for batteries over the next 10 years. The commentary from a lot of the Australian producers is about the advantage of nickel sulphides, but the reality is there’s not that much out there. Will the world have to turn to Indonesia for nickel for batteries?

“Absolutely and it’s already started. I mean, you’ve got LG and other groups that have broken ground on billion dollar battery plants.

“And there are many others that are already in planning. So it will become an electric vehicle battery hub. You have the first HPAL which has been successfully commissioned (by Tsingshan), or three out of the four trains.

“That started construction in March of 2020, when COVID first kicked off and they commissioned their first line in November of 2021. You just wouldn’t see that project execution of a HPAL that produces 60,000 tons of nickel in MHP and 8000-12,000 tons of cobalt anywhere else in the world.

“And we believe the commissioning is going smoothly, that should be ramped up second half of next year. Once that’s proven, which I think it’s looking like it will be, I think you’ll see significant growth in HPAL plants in Indonesia producing an MHP perfect for the electric vehicle battery market.

“So I think you’ll see increasingly, the nickel and cobalt sulphate coming from laterite sources rather than sulphide.”

Is it something a lot of investors just don’t understand, how flexible the Indonesian nickel space is? There’s definitely a school of thought that there’s a big divergence between class two nickel which is Indonesian nickel (NPI) and then class one nickel which is the sulphides.

“Vale-Inco’s been producing class one nickel metal for many, many years successfully. So Indonesia produces class one and class two nickel. And if you look at Ramu in Papua New Guinea, I mean, that’s a successful HPL operation, their costs are US$2 per pound.

“That’s an incredibly low cost. So when HPAL delivers, which it has in recent years, it’s proven that it can work so I expect you will see a big push in Indonesia.

“At those sort of costs, that’s more cost competitive than a sulphide mine. And the main driver for that is you’re obviously, getting all of the cobalt credits, which bring the cost right down significantly, but not only that you can also recover chrome, you can recover some of the manganese and other elements that are in there.

“So it’s certainly an exciting time in terms of the next wave of nickel growth in Indonesia, which as I said I think will be HPAL producing a concentrate, class 1 nickel for the battery market.”

The prices that we’re seeing now, is that going to help support those laterite projects around the world to come into production, particularly focused on the more expensive HPAL pathway?

“Absolutely, the first plant that was commissioned in Indonesia, I don’t know what the final numbers are, but the original headline numbers were less than a billion dollars US.

“No one’s built HPAL capacity at that sort of capital intensity, but I was there on site 10 days ago, and it’s impressive, it’s operating, it’s commissioned three out of four lines, and it should be at full nameplate capacity second half of next year.

“So I think if you look at HPAL examples in the West, many of them are still legacy sort of projects, that have burnt billions and billions of dollars and failed to ever reach nameplate capacity.

“(The advantage is) really in resources, Indonesia has the world’s largest and highest grade laterite resources. And so that’s why it makes sense that all of the growth is occurring here.

“It’s also much easier to deliver. A laterite resource expresses itself at surface over a large area. Exploration wise, it’s much easier, much cheaper, much quicker than trying to discover a hard rock sulphide deposit which can take many years of drilling and has a lot higher geological complexity too.”

The nickel price from here, it’s recently been about US$24,000/t on the LME, and the NPI price has been a bit of a discount to that. Where do you see those prices going?

“You have LME and SHFE stocks at all time lows, I think they are at the lowest levels since 2011-2012. So that’s obviously driving higher LME prices.

“We’ve seen continued strong growth in electric vehicle sales in China, but also in Europe and North America. We had a deficit last year in nickel, depending on which analyst you follow 130-260,000 tonnes.

“That deficit is sort of forecast to continue into at least the first half of this year. And even with all of the new Indonesian capacity coming on, I still don’t think it’s fast enough to replace what’s being consumed and what is forecast to be consumed. And so I think the nickel market, probably out of all the base metals, probably has the best outlook, at least for the next couple of years.

So you don’t think that new supply from Indonesia is coming on fast enough to actually bring down prices with the way demand is growing?

“People perhaps lose sight of the fact that all of this new NPI capacity that’s coming on in Indonesia, that’s just simply replacing older capacity in China that is no longer competitive and safe.

“Chinese NPI production has declined significantly over the last few years.

“So it’s not going to create an oversupply of NPI, in fact the reason Tsingshan is building so much of this capacity is they’re seeking to become self sufficient. They’re still a long way from achieving that.

“Then obviously class one nickel, you only have to look at the stocks to see that there’s not a lot in stock, and in terms of new class one production coming online, there’s nothing really on the horizon either.

“Then you have what’s going to happen in Ukraine and any possible sanctions in terms of (Russia’s) Norilsk which is one of the world’s largest class one nickel producers.”

One of the questions that’s been raised about the Indonesian nickel market is how carbon intensive it is. What’s being done at the moment to reduce that carbon intensity so that it is a greener supply chain for batteries?

“We’ll be releasing a sustainability report around about May. So we’ve measured our carbon footprint, it’ll be benchmarked against all global nickel producers.

“And I think we sit quite favorably, sort of around the 50th percentile.

“We’ve engaged Hatch to undertake a decarbonisation roadmap, and I think if you see our most recent announcement, we have an MOU for a 200MW peak solar project, which will supply up to potentially 20% of the power for our existing four RKEF operations.

“We’re commissioning this quarter our first small solar project, it’s 450kW peak, which will reduce the usage of a diesel generator by about 31 million litres over the life of the solar project.

“And we’re looking at other opportunities such as LNG and other forms of renewable and clean energy.

“There’s a strong commitment there and Tsingshan has also made a commitment that they will not build any more coal fired power plants in Indonesia, and they’ve come out with their ambition for up to 8GW of renewable energy over the coming years, and that’s starting to happen already.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.