The Explorers: St George Mining’s John Prineas on why BHP has no chance of getting its ‘freakish’ nickel belt back

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

In 2015/2016, an ailing BHP Nickel West sold its Mt Alexander nickel tenements to young explorer St George Mining (ASX:SGQ) for just $300,000.

Now, with the nickel price cycle in the upswing phase, we reckon a rejuvenated and nickel-hungry BHP would take the WA-based project back in a heartbeat.

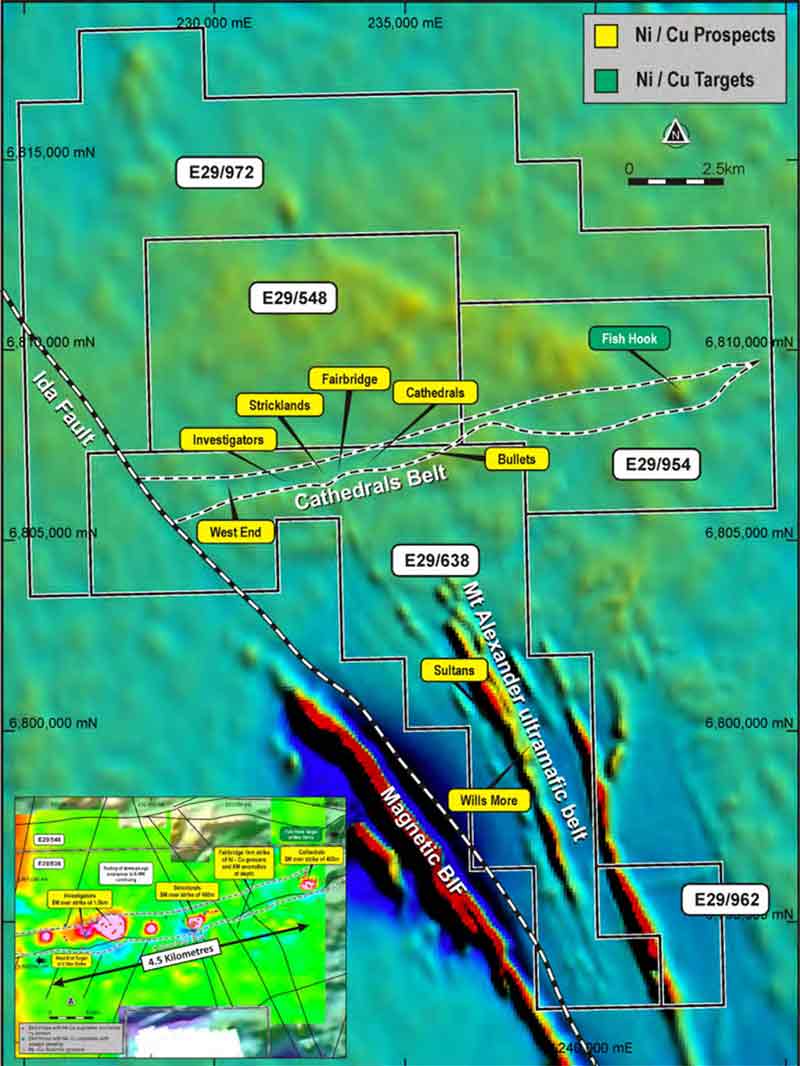

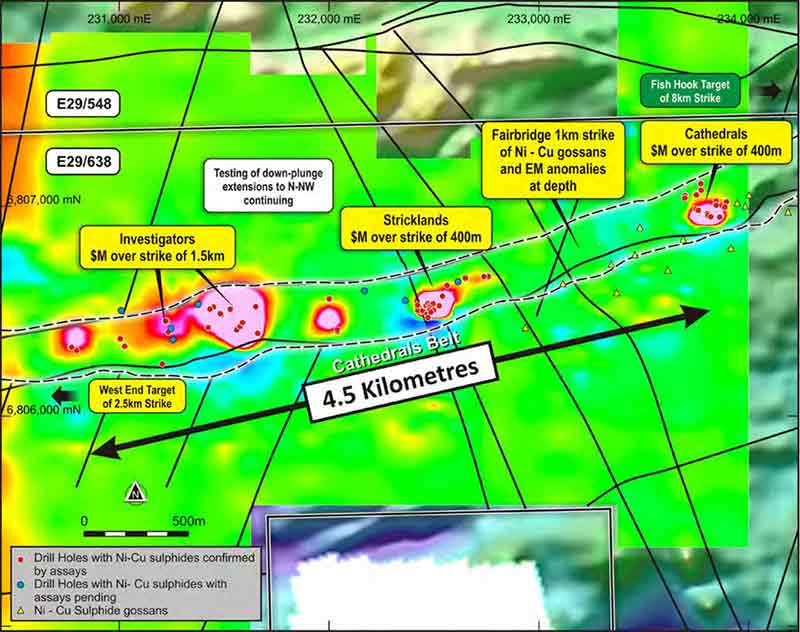

That’s because shallow, high-grade nickel and copper sulphides have now been intersected across a 4.5km strike zone at the project’s 16km ‘Cathedrals Belt’.

But there’s a lot more where that came from, former bank exec John Prineas says — the potential scale of this “freakish” and “bizarre” nickel belt is only just starting to emerge.

Why the career move from banking to mineral exploration?

“Banking was good to me, but it was time for a career change. I seemed like a good time to get into exploration just after the GFC when nickel asset prices were quite low.

“Exploration is very hard, but the rewards are phenomenal. We had [banking] clients who were with explorer Jubilee Mines when they discovered the Cosmos deposit.

“Jubilee had a market cap of about $20m [~1997] and went on to be sold at the peak of the last nickel boom for $3.1 billion.

“We also saw it more recently with Sirius and the Nova discovery.

“Exploration can create amazing shareholder wealth.

“Me and a couple of banking colleagues started St George [in 2009], putting in our own money along the way – probably about $3m each by now.”

So, for St George it’s about buying low, (hopefully) selling high?

“Yes, roughly speaking. When the nickel price is low, it’s a great time to buy assets. But not every exploration project is going to yield the results that you want.

“Our first asset was the East Laverton project. We actually had BHP Nickel West farm-in on that asset.

“They spent $3m on exploration, made a discovery and said ‘Yep, we want to continue the program and earn a 70 per cent interest’. And a few months later then their budget got cut to zero and handed the project back to us.

“Mt Alexander is our second asset, and the one that has really delivered the goods.

“BHP Nickel West were under a cloud and had been divesting non-core projects. There were doubts as to whether they would even survive back in 2015.

“We picked up this Mt Alexander-Cathedrals ground from Nickel West for $300,000 [in early 2016].

“I’d like to say it was a very astute thinking on our part, but we were very lucky. The project has probably added $30m to our market cap so far, and we think much more is coming.”

I’m guessing BHP want those projects back now.

“I’m sure they would take it if we gave it back — but that’s obviously not going to happen. They would certainly love to get the ore.”

St George seem quite methodical to the point of being slow – you haven’t even got a resource estimate out for the Cathedrals Belt yet.

“There are probably a few factors that are driving that. Firstly, this is very, very unique mineralisation in a unique geological setting.

“All the ultramafic belts in the Yilgarn which have nickel sulphides are north-south trending. This particular belt that we are exploring – the Cathedrals Belt – is east-west orientated. Straight away, it’s completely different to anything anyone has ever seen before.

“We even called experienced geologist Dr Roy Woodall, the discoverer of the Kambalda nickel field, to have a look. He said ‘I can’t work out what’s going on here. But what you have is geologically significant, it’s economically significant – keep going, you’ll work it out’.

“So that’s what we’re doing.

“There is no exploration analogue to help us drill this project out quickly. We just have to go along and try work it out as we go.

“But we are very lucky at Cathedrals. It’s a little similar to [Glencore’s] Raglan mine in Canada, which is made up of 140 orebodies, or massive sulphide lenses across a wide strike.

“We don’t have one big ‘blob’ of a deposit, like Nova. We have a lot of electromagnetic (EM) conductors – and every single conductor we pick up in the belt ends up being nickel sulphide mineralisation.”

Is that bizarre? That sounds bizarre.

“Absolutely bizarre. It is freakish. A 100 per cent hit rate. In any other belt you will probably get an almost 99.9 per cent failure rate.

“In the Cathedrals Belt every conductor we’ve picked up – and we’ve drilled 51 so far – has been nickel sulphide mineralisation. It’s a fantastic tool for us here.

“We’ve hit a lot of economic widths at wonderful grades – 6 to 8 per cent nickel, 2-3 per cent copper, 0.2 per cent cobalt, 5-7g/t PGEs – and it starts at 30m below surface. In some areas they are quite large, well defined massive sulphide lenses.

“We know that we can mine that and make money, but we would love to find the bigger stuff as we go deeper.”

There’s more nickel underneath these shallow, high grade lenses?

“We believe this is an intrusive system, which means a lot of the mineralisation hasn’t come to the surface.

“Somewhere along the way it has gone sideways, or just stopped and accumulated. That’s your classic intrusive system.

“The theory is that somewhere – at 500m depth, 800m depth – there could be a far larger accumulation of nickel sulphides. So, while we are drilling the shallow conductors right in front of us, we are also stepping down plunge and testing deeper areas.”

It sounds potentially gigantic.

“There is certainty potential for Cathedrals to be significant. We have done our own internal modelling as to what could be there because we have really only scratched the surface.

“The whole Cathedrals belt is 16km wide on our tenement package. We have only drilled along a 4.5km stretch – we still have to test the down plunge, and we also have to test extensions to the east and west. But the scale is starting to emerge.

“The Investigators prospect, which is the largest one so far, is 1.5km wide. There’s a lot of discontinuity at the moment, but the more we drill, the more nickel we find.

“We’ve extended that so far 380m down plunge – but that is only a fraction of where we think [Investigators] can go.”

Have you been under any pressure from shareholders or potential investors to fast-track a resource or mining study?

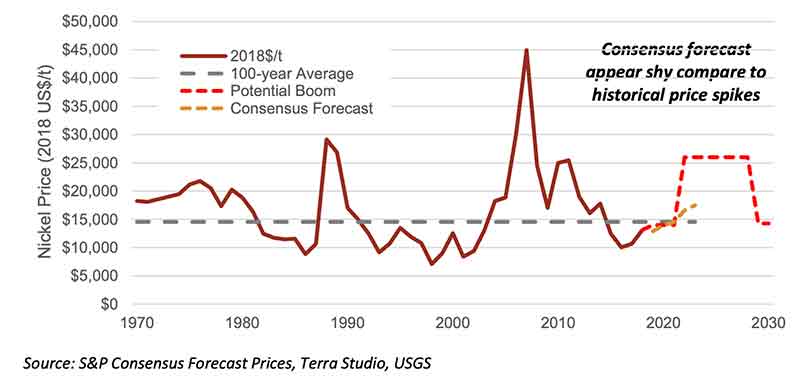

“Seeing a resource will help people value us. But the nickel price is nowhere near where we think it is going to be, so there is no real rush to commercialise this.

“We can take a little bit more time to do this properly.

“It doesn’t necessarily fit in with the timeframe of some of our investors, unfortunately, but it is the best way to maximise the value of this asset.”

Is there a danger a miner could buy you cheaply at your current market cap?

“Very much so. We are being watched by all our peers; I have no doubt about that.

“We would make an obvious bolt-on acquisition for a number of the existing nickel producers.

“They are probably waiting for us to announce a resource so they can responsibly value us, go back to their board and say ‘OK, we can see 100,000t of nickel, that means this company is worth x dollars — let’s bid x dollars’.

“But from a lowball offer, from a hostile offer we are pretty safe. Myself and my business partners that set up St George are still the largest shareholders. Together with friends and family we probably speak for over 20 per cent of the company.”

You appear to have a supportive shareholder base. Even fellow explorers like Moho Resources are on board, and they would know better than most what you’re trying to achieve.

“It’s great support from Moho (ASX:MOH). They have some excellent geologists who know their stuff, and of course they have Terry Streeter as their chairman who has made a fortune – twice – from nickel exploration.

“A very good, intuitive investment from them, I think, and a validation of the project’s potential.

“We also had several institutions come on board in our last capital raising. They could see that we are on the cusp of a re-rating as we continue to prove up the resource’s potential.”

Countless miners and explorers have referenced nickel’s role in the emerging electric vehicle thematic. Was there a moment where you thought ‘this demand is real’?

“There is a lot of forecasts and projections, and some of them you have to be a little sceptical about. But it hit home for me when BHP Nickel West announced that they were going to sell 90 per cent of their nickel production to EV battery manufacturers.

“Five years ago, that would’ve been nothing or a very small fraction; now it’s pretty much all their production.

“We have also had battery manufacturers come to us direct asking ‘can we made an investment in St George; we want to secure long-term supply’. They can obviously see a supply crunch coming.”

They’ve come to you already?

“They’ve come to us already, yes.”

Why should people invest in St George?

“One, we have just made a nickel sulphide discovery; now, it’s a matter of seeing how big it’s going to get.

“I think there is zero downside for our stock at the moment; we have a market cap of $46m, which is only a fraction of where it’s going to be once we prove up the scale of this resource.

“The second reason is that the nickel cycle is most certainly in the upswing phase.

“Experienced predictors like Wood Mackenzie have a long-term price target of $US21,000/t. I’ve got no doubt that will be revised upwards as we go along.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.