The electric vehicle revolution: Where does Africa fit in?

Pic: Getty/Stockhead

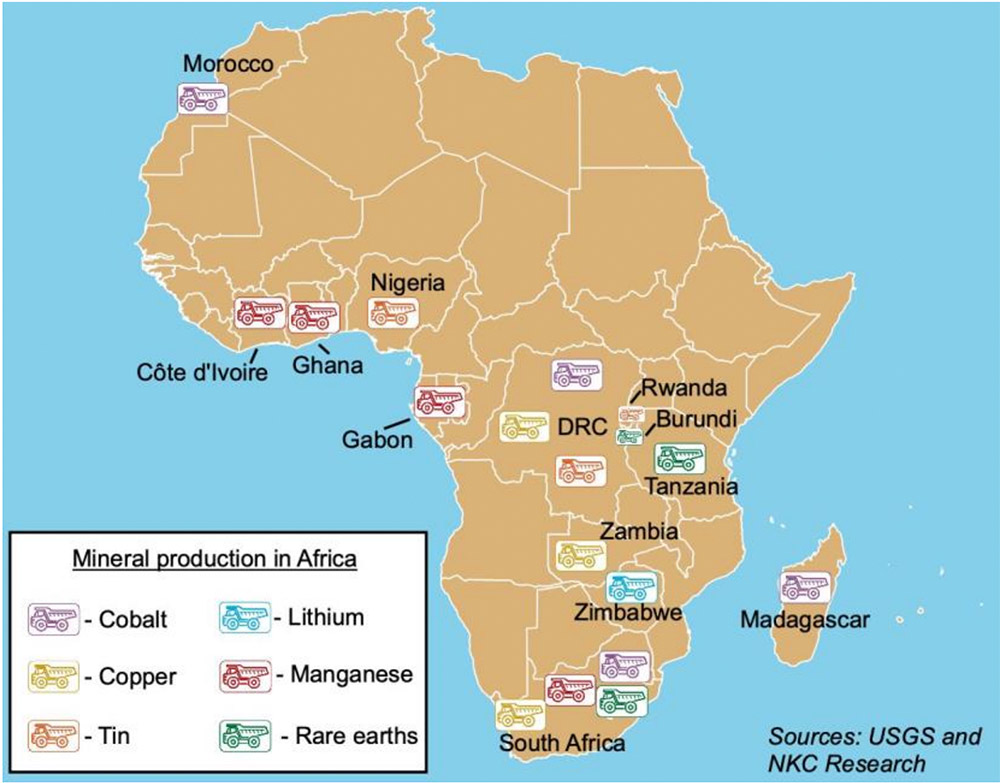

Commodities earmarked for the green transition – like cobalt, lithium, copper, tin, and manganese – will likely benefit from intensified demand in the medium-to long term.

That’s well established.

Africa, with its rich mineral reserves, will be pivotal to meeting demand in this shift towards greener energy, says Oxford Economics’ Leeuwner Esterhuysen in a research note.

“Various countries across the African continent are poised to participate in the green drive as commodities such as copper, lithium, cobalt, tin, and manganese are bountiful,” he says.

Although the continent’s participation in the drive towards a greener future is all but certain, “adequate investment and effective regulation [aka managing corruption and other jurisdictional risk] are required to ensure that Africa shares in the spoils over the next 30 years”.

(The research note doesn’t mention fellow battery metals nickel, graphite and rare earths , which are also well represented in Africa.)

COBALT

The Democratic Republic of Congo (DRC) is a global giant when it comes to production of the battery metal cobalt.

According to the United States Geological Survey (USGS), the DRC produced 95,000 tonnes of cobalt in 2020, accounting for 68% of global output.

Other producers on the continent include Morocco, South Africa, and Madagascar.

“In May 2021, Reuters reported that Glencore intends to restart operations at its Mutanda mine in the Katanga Province of the DRC as early as 2022,” Esterhuysen says.

“The mine, which has been on care and maintenance since 2019, is the world’s largest cobalt mine that also produces significant amounts of copper.

“The decision to suspend operations in 2019 was based on soft cobalt prices, rising costs and high taxes. However, the recent recovery in cobalt (and copper) prices has revived the mine’s economic viability.”

COPPER

Copper is a key input in everything from electric vehicles (EVs) to solar panels and power grids.

The DRC is also the largest copper producer in Africa, accounting for 6.5% of global output last year. Zambia followed with 4.2%.

“Invanhoe Energy’s Kamoa-Kakula project recently started mining copper in the DRC with the initial aim of producing 200,000 tonnes a year,” Esterhuysen says.

“However, [Founder Robert] Friedland believes that continued exploration could potentially lead to output increasing tenfold as much of the country’s mineral wealth remains undiscovered.”

ASX copper stocks in Africa:

Orion Minerals (ASX:ORN) (South Africa), Sandfire Resources (ASX:SFR) (Botswana), Golden Deeps (ASX:GED) (Namibia), Castillo Copper (ASX:CCZ) (Zambia).

ORN, SFR, GED, CCZ share price charts

LITHIUM

In March, Fitch Solutions said it expects to see an increase in lithium development projects in Africa, amid a bullish outlook for a sustained recovery in prices.

“We estimate there are eight lithium mining projects currently in development in Africa – in Zimbabwe, Namibia, Mali, Ghana and the DRC – which is still small relative to the number of projects being developed in the Americas, Australia and Europe, for example,” it says.

“Efforts to diversify lithium sources will attract foreign investment into Africa in the coming years as major economies look to secure lithium for their battery supply chains.”

ASX Lithium Stocks in Africa:

Prospect Resources (ASX:PSC) (Zimbabwe), Lepidico (ASX:LPD) (Namibia), AVZ Minerals (ASX:AVZ) (DRC), Firefinch (ASX:FFX) (Mali) and Arcadia Minerals (ASX:AM7) (Namibia).

PSC, LPD, AVZ, FFX, AM7 share price charts

TIN

While tin has long been used in the production of electronic goods, more recent research has found that the metal serves as a cost-effective way to increase the amount of energy that lithium-ion batteries can hold, Esterhuysen says.

This means tin can significantly increase the driving range of EVs and allow more efficient renewable energy storage.

In 2020, the DRC produced 17,000 tonnes of tin (6.3% of global output), while Nigeria and Rwanda produced 6,000 and 1,200 tonnes (2.2% and 0.4% of global output), respectively.

ASX Tin Stocks in Africa:

AVZ Minerals (ASX:AVZ) (DRC)

MANGANESE

High-purity manganese has become increasingly important in the production of batteries used in EVs, and as backup storage for power harvested from renewable sources such as solar and wind, Esterhuysen says.

“South Africa is the largest producer in the world as the country accounted for over 28% of global manganese production last year,” the report says.

“Gabon, a country that is heavily dependent on oil for growth, revenues and exports, made up roughly 15% of manganese output while Ghana and Côte d’Ivoire accounted for 7.6% and 2.5% of global production, respectively.”

“As manganese’s role in the drive towards green energy should sustain demand over the medium- to long term, there are various investment opportunities in Central and West Africa.”

ASX Manganese Stocks in Africa:

Jupiter Mines (ASX:JMS) (South Africa), South32 (ASX:S32) (South Africa).

JMS, S32 share price charts

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.