High Voltage: The electric revolution has become an unstoppable force in 2021

Pic: Tyler Stableford / Stone via Getty Images

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium.

Data from Benchmark’s Lithium ion Battery Database shows battery demand in Europe – the second biggest market behind China — is set to increase at an annualised rate of 40.1 per cent between 2020 and 2025.

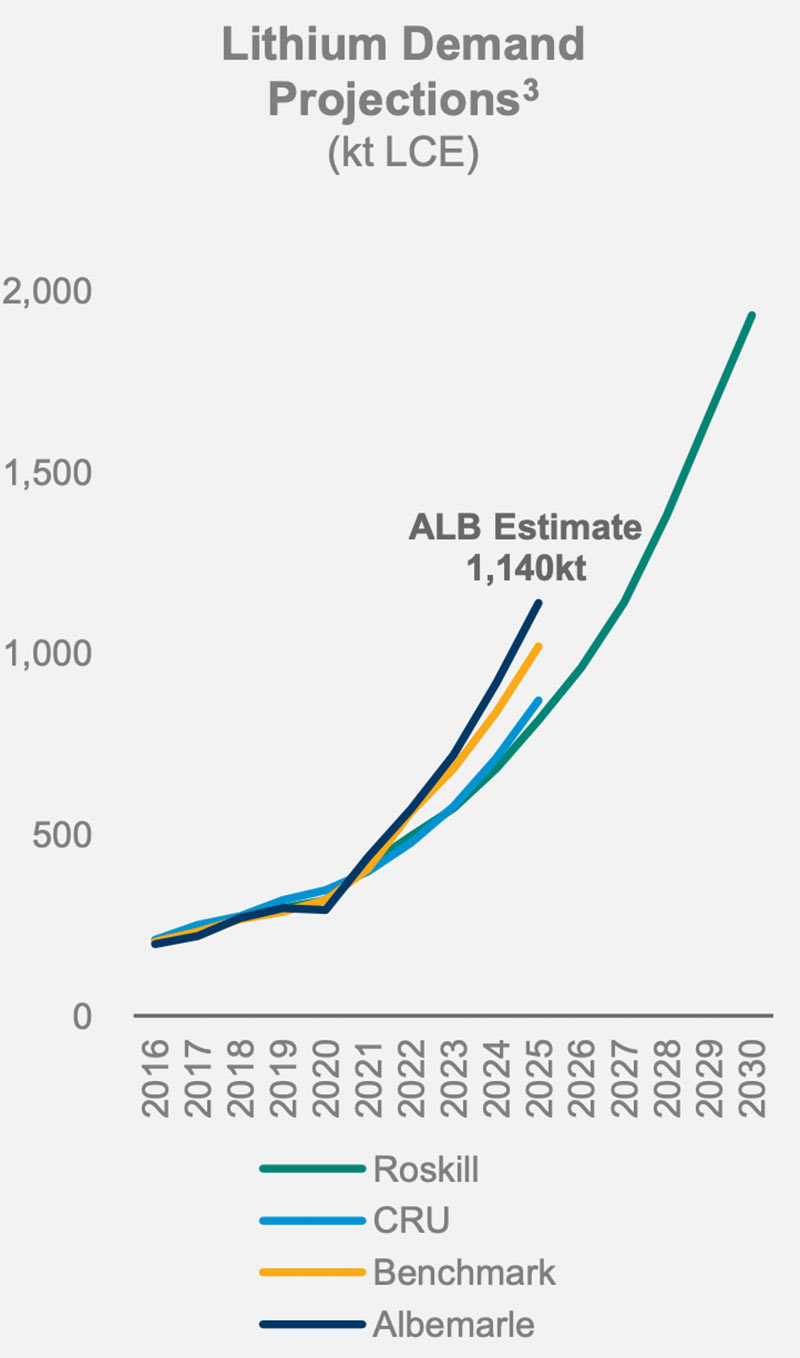

The early resurgence in lithium prices in particular has caught many by surprise. Major producer Albemarle reckons demand is about to go through the proverbial roof:

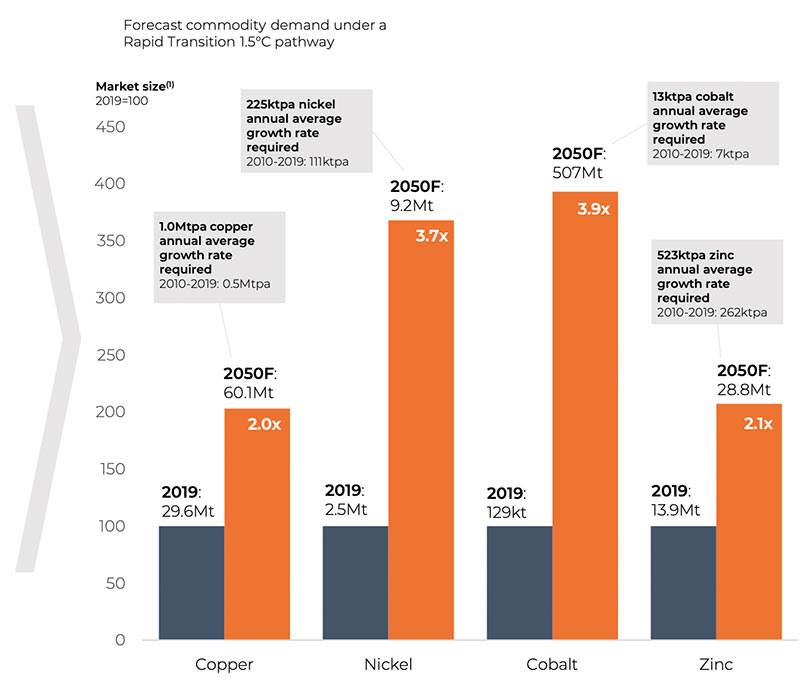

Mammoth commodities producer Glencore also put some bold numbers on the volumes of battery metals needed to supply the world as it moves away from fossil fuels.

By 2050, copper demand will double, while cobalt and nickel will grow 300 per cent, it says.

Where’s it all going to come from?

It’s no wonder manganese, lithium, cobalt, nickel, HPA, rare earths and copper companies on the ASX are going gangbusters.

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium are performing>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| CODE | COMPANY | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| PRL | Province Resources | 254 | 360 | 174 | 1388 | 0.092 | $ 58,938,865.45 |

| QPM | Queensland Pacific | 62 | 74 | 482 | 450 | 0.099 | $ 82,099,386.60 |

| PUR | Pursuit Minerals | 55 | 34 | 265 | 812 | 0.051 | $ 36,043,107.53 |

| AXE | Archer Materials | 54 | 130 | 154 | 521 | 1.2 | $ 180,509,236.80 |

| MLX | Metals X | 31 | 70 | 174 | 135 | 0.23 | $ 195,062,204.41 |

| LKE | Lake Resources | 31 | 170 | 1057 | 995 | 0.405 | $ 359,154,142.55 |

| COB | Cobalt Blue | 28 | 10 | 330 | 231 | 0.43 | $ 89,359,864.92 |

| JRL | Jindalee Resources | 27 | 36 | 272 | 566 | 1.9 | $ 73,926,543.90 |

| HXG | Hexagon Energy | 33 | 0 | 80 | 100 | 0.11 | $ 27,108,479.43 |

| LYC | Lynas Rare Earths | 22 | 38 | 147 | 184 | 6.16 | $ 5,244,277,329.78 |

| RNU | Renascor Resources | 23 | 145 | 227 | 390 | 0.049 | $ 64,962,683.53 |

| IPT | Impact Minerals | 21 | 44 | -8 | 130 | 0.023 | $ 39,179,501.70 |

| HAS | Hastings Tech Metals | 21 | 12 | 57 | 88 | 0.235 | $ 289,034,902.32 |

| OZL | OZ Minerals | 18 | 13 | 55 | 127 | 22.65 | $ 7,016,798,130.75 |

| BKT | Black Rock Mining | 16 | 50 | 246 | 273 | 0.18 | $ 124,980,840.95 |

| PLS | Pilbara Minerals | 16 | -3 | 254 | 277 | 1.13 | $ 3,070,617,650.24 |

| NIC | Nickel Mines | 16 | 13 | 123 | 138 | 1.39 | $ 3,269,537,766.30 |

| IXR | Ionic Rare Earths | 16 | 63 | 373 | 550 | 0.052 | $ 150,265,574.24 |

| SYR | Syrah Resources | 14 | 15 | 216 | 164 | 1.3 | $ 571,654,896.10 |

| REE | Rarex | 13 | -4 | 88 | 271 | 0.13 | $ 46,993,968.46 |

| LEG | Legend Mining | 13 | 4 | -7 | 23 | 0.135 | $ 334,779,465.13 |

| ADD | Adavale Resources | 12 | -20 | 392 | 94 | 0.064 | $ 17,703,025.97 |

| JRV | Jervois Mining | 12 | 4 | 51 | 117 | 0.52 | $ 393,122,604.70 |

| GXY | Galaxy Resources | 11 | 0 | 141 | 169 | 2.8 | $ 1,330,728,653.76 |

| CTM | Centaurus Metals | 11 | 6 | 82 | 324 | 0.89 | $ 288,322,167.76 |

| MIN | Mineral Resources | 10 | 3 | 45 | 105 | 39.69 | $ 7,127,099,562.79 |

| GBR | Great Boulder Resources | 10 | -19 | -19 | 28 | 0.043 | $ 8,086,570.11 |

| BHP | BHP | 9 | 7 | 25 | 27 | 48.92 | $ 139,397,687,964.08 |

| TLG | Talga | 9 | 3 | 172 | 278 | 1.65 | $ 460,909,457.12 |

| IGO | IGO | 9 | -2 | 55 | 21 | 7.03 | $ 5,020,685,600.19 |

| EMH | European Metals | 9 | 12 | 270 | 389 | 1.37 | $ 173,825,716.45 |

| LPD | Lepidico | 9 | 9 | 213 | 111 | 0.025 | $ 124,508,232.53 |

| ORE | Orocobre | 8 | 2 | 81 | 60 | 5.28 | $ 1,747,741,264.48 |

| PLL | Piedmont Lithium | 8 | 44 | 731 | 518 | 0.77 | $ 999,164,740.15 |

| PM8 | Pensana | 7 | -9 | 134 | 622 | 1.66 | $ 201,330,337.76 |

| HNR | Hannans | 7 | -38 | -6 | -6 | 0.0075 | $ 17,699,828.94 |

| POS | Poseidon Nickel | 7 | -1 | 56 | 129 | 0.078 | $ 199,468,454.49 |

| MCR | Mincor Resources | 6 | -6 | 44 | 66 | 1.07 | $ 444,817,680.78 |

| PNN | PepinNini Minerals | 6 | 41 | 406 | 69 | 0.45 | $ 16,547,055.60 |

| VR8 | Vanadium Resources | 5 | -8 | 61 | 96 | 0.045 | $ 17,216,762.15 |

| G88 | Golden Mile Resources | 4 | -10 | -20 | -10 | 0.047 | $ 5,412,806.43 |

| CLQ | Clean Teq | 4 | 6 | 86 | 17 | 0.3 | $ 252,493,315.53 |

| AML | Aeon Metals | 4 | -14 | -27 | -14 | 0.12 | $ 71,144,821.34 |

| ESS | Essential Metals | 4 | -24 | 28 | -11 | 0.13 | $ 24,098,076.00 |

| BSX | Blackstone | 4 | 21 | 15 | 200 | 0.51 | $ 162,525,255.95 |

| LIT | Lithium Australia | 3 | -12 | 178 | 138 | 0.15 | $ 134,321,859.00 |

| WKT | Walkabout Resources | 3 | 19 | -20 | 0 | 0.16 | $ 57,607,051.43 |

| BUX | Buxton Resources | 3 | 14 | -3 | -3 | 0.074 | $ 8,843,603.08 |

| MRC | Mineral Commodities | 3 | -7 | 64 | 44 | 0.41 | $ 187,059,044.11 |

| BOA | Boadicea Resources | 2 | -2 | 48 | 23 | 0.235 | $ 14,604,250.31 |

| ARU | Arafura Resource | 2 | -2 | 210 | 236 | 0.245 | $ 274,914,146.05 |

| TNG | TNG | 2 | -1 | 31 | 20 | 0.099 | $ 119,951,715.84 |

| PAN | Panoramic Resources | 2 | -7 | 128 | -3 | 0.16 | $ 297,382,530.58 |

| ARR | American Rare Earths | 2 | -10 | 155 | 522 | 0.1 | $ 31,632,702.62 |

| TMT | Technology Metals | 1 | -8 | 94 | 192 | 0.35 | $ 50,878,072.60 |

| INR | Ioneer | 2 | 66 | 357 | 159 | 0.48 | $ 767,083,984.49 |

| CXO | Core Lithium | 0 | 16 | 456 | 558 | 0.25 | $ 256,176,210.62 |

| AUZ | Australian Mines | 0 | -20 | 9 | 71 | 0.024 | $ 91,113,438.55 |

| S2R | S2 Resources | 0 | -15 | -19 | 90 | 0.175 | $ 55,105,956.33 |

| LML | Lincoln Minerals | 0 | 0 | 33 | 100 | 0.008 | $ 4,599,869.49 |

| AJM | Altura Mining | 0 | 0 | 0 | 13 | 0.07 | $ 209,037,029.25 |

| ATM | Aneka Tambang | 0 | 0 | 0 | 0 | 1 | $ 1,303,649.00 |

| NMT | Neometals | 0 | 7 | 103 | 109 | 0.375 | $ 212,686,993.74 |

| AVZ | AVZ Minerals | 0 | 3 | 208 | 127 | 0.2 | $ 563,582,209.13 |

| CLA | Celsius Resources | 0 | 7 | 167 | 336 | 0.048 | $ 38,729,595.56 |

| FFX | Firefinch | 0 | 36 | 63 | 188 | 0.245 | $ 195,477,120.25 |

| HWK | Hawkstone Mining | -1 | 52 | 102 | 750 | 0.0425 | $ 64,550,875.44 |

| CZN | Corazon | -2 | -5 | -5 | -26 | 0.057 | $ 9,272,099.14 |

| CHN | Chalice Mining | -2 | -2 | 186 | 1417 | 4.4 | $ 1,466,425,384.71 |

| PGM | Platina Resources | -2 | -4 | 13 | 183 | 0.051 | $ 20,143,031.66 |

| DEV | Devex Resources | -2 | 2 | 7 | 258 | 0.24 | $ 63,597,114.00 |

| MOH | Moho Resources | -2 | -9 | -38 | -14 | 0.08 | $ 7,400,970.35 |

| GAL | Galileo Mining | -3 | 27 | 13 | 106 | 0.35 | $ 49,369,915.73 |

| PSC | Prospect Resources | -3 | -17 | -17 | 2 | 0.17 | $ 54,794,911.22 |

| ARL | Ardea Resources | -4 | 11 | -4 | 14 | 0.545 | $ 72,133,878.83 |

| RLC | Reedy Lagoon | -4 | 23 | 200 | 800 | 0.027 | $ 12,682,812.17 |

| NTU | Northern Minerals | -4 | 16 | 56 | 14 | 0.05 | $ 217,217,034.25 |

| AVL | Australian Vanadium | -4 | -4 | 109 | 100 | 0.024 | $ 70,323,811.54 |

| AQD | Ausquest | -4 | 5 | -28 | 109 | 0.023 | $ 16,933,317.03 |

| GED | Golden Deeps | -4 | -4 | -28 | -36 | 0.0115 | $ 9,298,217.28 |

| ASN | Anson Resources | -4 | 5 | 271 | 197 | 0.089 | $ 75,084,041.93 |

| EUR | European Lithium | -4 | -35 | 38 | -24 | 0.065 | $ 60,181,480.97 |

| LPI | Lithium Power International | -5 | -18 | 64 | 0 | 0.295 | $ 83,919,892.84 |

| VRC | Volt Resources | -5 | 36 | 6 | 46 | 0.019 | $ 36,768,077.72 |

| SYA | Sayona Mining | -5 | -20 | 311 | 215 | 0.037 | $ 138,365,660.61 |

| QXR | Qx Resources | -5 | 6 | -5 | 6 | 0.018 | $ 9,607,721.80 |

| MAN | Mandrake Resources | -6 | -7 | 103 | 427 | 0.079 | $ 26,832,377.51 |

| GME | GME Resources | -6 | -11 | 72 | 13 | 0.062 | $ 33,968,882.73 |

| MNS | Magnis Energy Technologies | -6 | 81 | 35 | 199 | 0.29 | $ 243,111,550.97 |

| VMC | Venus Metals | -7 | -2 | -11 | -7 | 0.21 | $ 31,726,523.43 |

| SGQ | St George Mining | -7 | -15 | 17 | -2 | 0.098 | $ 49,850,794.22 |

| GLN | Galan Lithium | -7 | -9 | 210 | 92 | 0.48 | $ 106,669,932.29 |

| ESR | Estrella Resources | -7 | -15 | 353 | 656 | 0.068 | $ 63,564,321.87 |

| TON | Triton Minerals | -7 | 0 | 10 | 50 | 0.054 | $ 60,126,807.55 |

| BSM | Bass Metals | -7 | 30 | 117 | 30 | 0.0065 | $ 24,130,054.41 |

| VUL | Vulcan Energy | -7 | -31 | 1120 | 2578 | 6.83 | $ 730,756,940.80 |

| RXL | Rox Resources | -8 | -3 | -39 | 20 | 0.036 | $ 73,793,824.67 |

| LTR | Liontown Resources | -8 | 3 | 193 | 215 | 0.41 | $ 724,464,136.40 |

| BAR | Barra Resources | -8 | -12 | -8 | 21 | 0.023 | $ 16,262,594.42 |

| AOU | Auroch Minerals | -8 | 8 | 189 | 318 | 0.28 | $ 69,418,040.55 |

| ARN | Aldoro Resources | -8 | 29 | 135 | 35 | 0.27 | $ 18,219,816.81 |

| SRI | Sipa Resources | -9 | -8 | -31 | 7 | 0.059 | $ 10,313,986.18 |

| CWX | Carawine Resources | -11 | -14 | -9 | -22 | 0.21 | $ 21,777,980.40 |

| RFR | Rafaella Resources | -11 | 5 | 21 | -27 | 0.08 | $ 10,232,445.68 |

| SLZ | Sultan Resources | -11 | -9 | 15 | 117 | 0.195 | $ 13,906,877.80 |

| CNJ | Conico | -12 | 3 | 88 | 275 | 0.03 | $ 24,130,284.10 |

| SBR | Sabre Resources | -13 | -13 | 40 | 250 | 0.007 | $ 11,781,445.54 |

| FGR | First Graphene | -13 | -10 | 93 | 58 | 0.26 | $ 131,183,907.65 |

| ADV | Ardiden | -14 | -22 | 13 | 260 | 0.018 | $ 38,575,113.91 |

| ALY | Alchemy Resources | -15 | 0 | 0 | 34 | 0.017 | $ 12,100,382.15 |

| INF | Infinity Lithium | -18 | -13 | 127 | 251 | 0.205 | $ 60,778,229.80 |

| STK | Strickland Metals | -19 | -37 | -48 | 30 | 0.026 | $ 10,949,939.55 |

| BEM | Blackearth Minerals | -19 | 173 | 285 | 317 | 0.15 | $ 22,517,700.04 |

| MLS | Metals Australia | -20 | -20 | -20 | 100 | 0.002 | $ 8,381,807.15 |

| AGY | Argosy Minerals | -22 | -13 | 118 | 61 | 0.12 | $ 143,781,245.96 |

| TKL | Traka Resources | -22 | -19 | -12 | 323 | 0.021 | $ 10,635,766.43 |

| AZS | Azure Minerals | -27 | -31 | 100 | 154 | 0.33 | $ 103,208,716.54 |

| EGR | Ecograf | -30 | 112 | 734 | 767 | 0.67 | $ 304,838,917.53 |

Small Cap Standouts

QUEENSLAND PACIFIC MINING (ASX:QPM) +62%

The battery metals focused nickel-cobalt play will double the size of its TECH project due to strong offtake interest from big battery makers like LG Chem and Samsung.

QPM, which is targeting first production in 2023, says a larger project “will have lower capital intensity and higher margins”.

PURSUIT MINERALS (ASX:PUR) +55%

Former vanadium explorer Pursuit is up ~400 per cent since picking up the Warrior project near Chalice Mining’s (ASX:CHN) mammoth Julimar discovery in WA late last year.

Now, five strong electromagnetic (EM) conductors — with potential to be platinum group elements, nickel, and copper — have been identified.

The explorer plans to start drill testing high priority targets during the second/third quarter (April–September) this year.

This gravity-defying lithium junior is up +1057 per cent over the past six months.

The company is proposing a revolutionary direct extraction technology to recover high-purity lithium products from its Kachi project and three other lithium brine projects in Argentina.

“At a market capitalisation of around $300m the stock isn’t cheap, but it has the momentum of the “second wave” of lithium interest,” says Guy le Page.

“It has found itself in the right place at the right time with a potentially superior processing technology that could propel the company into the lowest cost quartile of lithium carbonate producers.”

It’s stocks like Cobalt Blue, one of the last remaining pure play cobalt explorers on the ASX, who will benefit the most from a price which is about to breach $US50,000/t.

COB is planning pilot plant cobalt production for Q1 this year. A pilot plant is smaller version of the real thing, designed to test whether the process works in the real world.

COB says it is currently working with 15 global partners who have expressed interest in receiving cobalt samples, including big players like LG International, Mitsubishi Corporation and Sojitz Corporation.

Is there a battery metals stock missing from our list? Email [email protected]

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.