The East Kimberley is an emerging green energy hub. Here are the ASX critical minerals stocks looking to take advantage

The stars are aligned for the East Kimberley to become a major hub for our clean energy transition. Pic via Getty Images.

The East Kimberley region in WA is establishing itself as a green energy hub, with billions in investment for port upgrades and clean energy options for mineral project developers.

Local communities and explorers in and around Wyndham, Halls Creek and Kununurra could not be better placed for our global transition away from fossil fuels and towards a greener future.

Underdeveloped and vastly underexplored, the East Kimberley is a hotbed of exciting critical minerals projects and ambitious green energy projects.

With consumers and investors becoming extremely focused on ESG-compliant sourcing of minerals, this green energy push bodes well for a bunch of project developers in the region.

Regional Investment: Clean Energy Hub

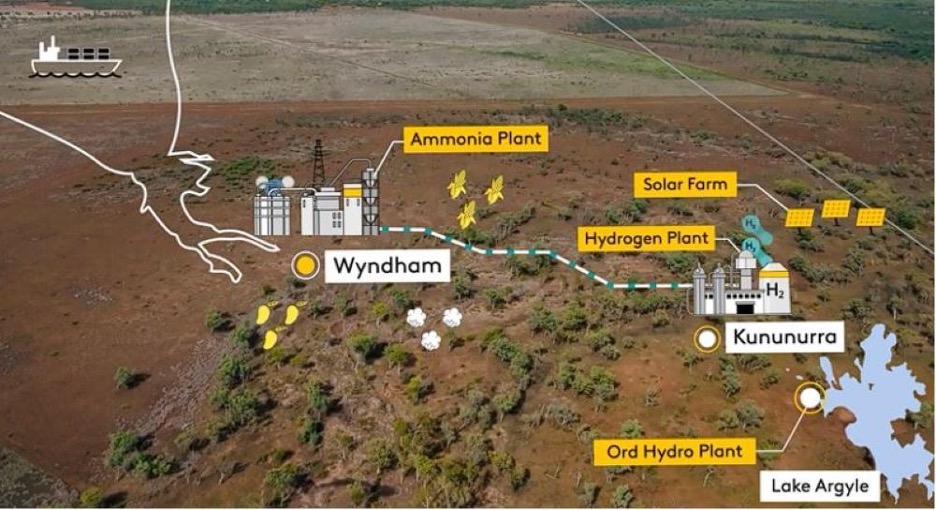

Projects in the region are set to get a huge influx of investment via government funding for upgrades to the port and a $3 billion private development to create a clean energy hub around Lake Argyle and Wyndham.

Access to port is at nearby Wyndham and power in the region can be sourced from the Ord River hydroelectric plant at the northern tip of Lake Argyle, where further renewable energy options such as solar are pegged for development.

The East Kimberley Clean Energy project consists of a 900MW solar farm – the largest in Australia – and a 50,000tpa hydrogen production facility near Kununurra.

Electrolysis will convert fresh water from Lake Argyle into green hydrogen and be transported via a new 120km pipeline to the existing Port of Wyndham.

The project will be planned, created and managed by the Aboriginal Clean Energy (ACE) Partnership, a new company in which equal shares are owned by MG Corporation, Kimberley Land Council, Balanggarra Ventures and investment advisory Pollination.

This hub of activity is a boon for critical mineral explorers in the region which will be able to take advantage of this green energy and infrastructure upgrades – not to mention leveraging off a sizeable influx of workers.

Infrastructure

Upgrading of transport links in the region are already underway. Roads are being sealed through the Tanami and infrastructure at the Port of Wyndham is being upgraded to cater for raw material traffic.

The Tanami Road is a vital 1,035 km long transport connection, linking Alice Springs in the NT to WA’s Great Northern Highway near Halls Creek, WA.

The 313km long section in WA is unsealed, yet that is currently changing. Main Roads WA is in the process of sealing the stretch and once the $542.8m government-funded upgrade is complete, it will provide better transport to and from mine sites in the East Kimberley region.

Projects will be able to access hydroelectric power from the existing Ord hydro plant too, which is even pegged for an upgrade itself with a $3 billion project hydrogen project.

Let’s take a look at who’s out and about in WA’s north-east.

In focus: Cummins Range

Critical minerals explorer RareX’s (ASX:REE) Cummins Range project is focused on the production of phosphate and rare earth elements (REEs), including neodymium and praseodymium (NdPr), which are critical to the manufacture of permanent magnets used in EVs, defence systems and other high-tech manufacturing.

The 519Mt Cummins Range project is set to be developed in three stages to give RareX an operating platform to leverage Stages 2 and 3.

RareX CEO James Durrant says the explorer is fortunate to have both phosphate and REEs with significant grades at Cummins Range and has landed on a three-stage development pathway that will provide early cashflow and de-risk the project.

“The idea that we’ve fleshed out in our scoping study is to use the high-grade phosphate that we have as a large quarry and get the supply chain and operational footprint running and use that platform to enter into the rare earths space,” Durrant says.

“It’s very much risk-based, recognising the potential that if you went into an REE project straight away the complexity would be very large and there would be a lot of risk and costs to manage.

“We want to differentiate ourselves from that space with our Stage 1 direct shipping phosphate project that comes with a low initial capex of $45m.”

Stage 1 – Capex: $45m

This stage is across the first three years of production and involves a simple mining and crushing operation to produce a phosphate DSO that can be used as direct application fertiliser, RareX says. It requires low capex of $45m to deliver robust economics from the production of about 300,000tpa of ore grading 23% phosphate (P2O5).

This, says RareX, will give the miner early doors cashflow to help fund the next two stages of Cummins Range.

Stage 2 – Capex: $304m

A beneficiation operation is planned to produce 550,000tpa of higher value phosphate-rare earth mineral concentrate, containing about 169,000t of P2O5 and 12,000t of total rare earth oxides (TREO) – most notably high grades of NdPr.

Stage 3 – Capex: $63m

This final stage will upgrade the Stage 2 plant in year 13 to produce a concentrate from the unweathered fresh rock. RareX says it will deliver further improvement and optionality in post-beneficiation upgrades due to mineralogy factors.

“This staged development approach has the benefits of initiating early cashflows, building confidence with the regulators on environmental and heritage management, furthering community relationships and social performance, providing greater mineral resource definition, allowing bulk samples for metallurgy and piloting, and establishing a functioning supply chain; all of which substantially de-risk Stage 2 which transitions the project into a rare-earth critical mineral mine,” the company says.

Across all three stages, for the mid-case, RareX envisages EBITDA of $1.45bn, NPV8 of $549m and IRR of 39% (pre tax). Post tax values are $333m and 27% respectively – attractive metrics for the project’s viability.

Who else is looking to tap into the East Kimberly’s green energy?

Boab Metals (ASX:BML) is advancing towards a final investment decision at its Sorby Hills lead-silver-zinc project after completing its 2023 drilling campaign at the Seismic target. This drilling will be incorporated into the current 2.25Mtpa resource for 103Kt lead-silver concentrate and 2.2Moz silver.

Proving up what is currently Australia’s third-largest graphite resource is Green Critical Minerals (ASX:GCM) with its flagship 1.1Mt McIntosh project. GCM is currently undertaking metallurgical test work from recent drilling at the Emperor deposit.

Meanwhile, Tivan Resources (ASX:TVN) and its Speewah vanadium-titanium-iron project which has a resource of 4.7 billion tonnes at 0.3% vanadium, 14.7% iron and 3.3% titanium – making it one of the largest vanadium in titanomagnetite resources in the world.

The company is advancing a pre-feasibility study and is actively looking for offtake partners for capital to accelerate development of the project.

Then there’s Agrimin (ASX:AMN), who’s Mackay potash project is the largest SOP development outside of Africa. The company is currently undertaking advanced Front End Engineering Design (FEED) level studies on key parts of the process flow and design.

This article was developed in collaboration with RareX, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.