The ASX lithium junior winning as energy giant Koch targets top spot in emerging DLE market

Industrial titan Koch has inked a deal to test its Li-Pro units at Arizona Lithium’s Prairie lithium brine project in Canada. Pic: Getty Images

- Koch is trialing direct lithium extraction tech at North American projects

- Tech promises cleaner, quicker extraction than brine ponds

- Arizona Lithium signed deal to trial units at Prairie project

Direct lithium extraction technology moved into the spotlight last year with big names like Albemarle and SQM announcing plans to test the tech on their lithium brine projects in Chile and ExxonMobil looking at DLE to extract lithium from old oil fields in the Smackover region of Arkansas.

Even General Motors has made large investments in projects that require and are planning to make use of DLE.

Goldman Sachs is bullish on the potential of DLE compared to traditional pond extraction, stating in a report last year that it “may significantly increase the supply of lithium” (much like shale did for oil), nearly doubling lithium production on higher recoveries and improving project returns.

The big promise is it is cleaner and more environmentally friendly, often recycling the water used, and is a quicker processing option than traditional large evaporation ponds. That could open up lower grade resources for development and be hugely beneficial for projects in arid areas like Chile’s Atacama Desert, where water security is a prime concern.

As advertised, DLE extracts the lithium directly from the brines via adsorbents – binding lithium salts in the brine to the surface of a resin and washing it off with water – along with solvent extraction (using membranes) and ion-exchange (binding lithium at a certain pH which usually requires an acid).

Investment has exploded in the sector, with companies like Lilac Solutions, E3 Lithium and Energy Exploration Technologies among the well-known names jostling for top spot in the emerging field.

But new players are making their mark, with companies that have dominated legacy energy sectors like oil and gas beginning to see the possibilities in new forms of energy like battery metals. Koch Technology Solutions, part of the multi-billion dollar empire led by US rich-lister and industrial titan Charles Koch, is one.

Koch has rolled out a swathe of deals to trial its Li-Pro Lithium Selective Sorption (LSS) units in the last couple of years.

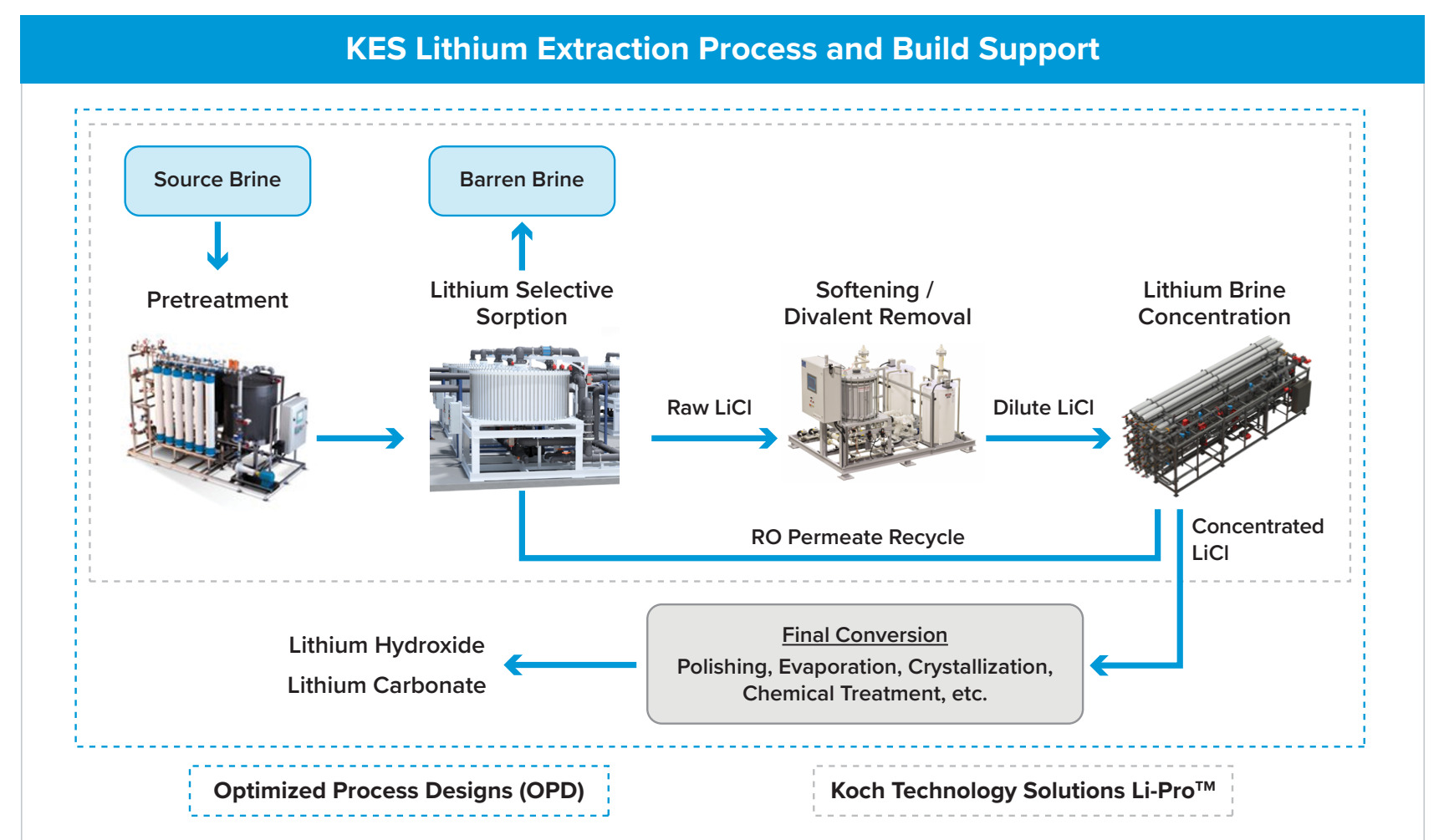

Here’s how the process works:

Investing big bucks in the space

Koch, a subsidiary of America’s second largest privately owned company, has made significant investments in lithium including a US$100m investment in US-based Standard Lithium, a company specialising in innovative lithium extraction technologies.

Not to mention they’re also testing their Li-Pro units for Standard’s Joint Venture with Norway’s state owned petroleum company Equinor at their South West Arkansas project.

Koch has also fronted another US$100m in Li-Cycle, North America’s leading lithium-ion battery recycler, plus a massive US$252m investment in Compass Minerals to support the development of lithium brine resources at Utah’s Great Salt Lake.

In Canada, Koch also has two separate deals with Grounded Lithium and EMP Metals to trial their tech.

AZL trials commercial scale DLE

More recently, Koch has turned its attention to ASX lithium plays with North American projects.

Last year, Anson Resources (ASX:ASN) announced a pilot unit to test at its Green River lithium project in Utah, USA (where they’re also testing an operational sample demonstration plant (SDP) that utilises the existing flow sheet).

And just last month, Arizona Lithium (ASX:AZL) delved into the DLE realm, reaching an agreement to deploy a Li-Pro unit at the Prairie oil field brine project in Saskatchewan, Canada.

The deal represents the largest DLE process ever deployed by Koch, capable of producing 150tpa lithium carbonate equivalent.

It’s also the first commercial-scale production at the project – which is poised to feed battery-grade lithium carbonate into the mature Asian battery market and rapidly developing North American battery sector.

Rather than focus on their own proprietary lithium extraction process, AZL says working with a world-class and establish tech company with the balance sheet to support further technological development and innovation is the way to go to derisk the Prairie project development.

“Koch has put significant resources and funding into their lithium extraction technology, and so it makes strong commercial sense for AZL to partner with Koch and benefit from all the work they have done, rather than fund our own technology development,” AZL executive director Matthew Blumberg said.

De-risking to scale up future production

De-risking the project will allow production to be increased by the replication of additional Li-Pro units at Pad #1, followed by further deployment of commercial facilities at Pad #2 and Pad #3 down the track.

So far so good, with the tech already resulting in recovery rates of 98% lithium retention and an average 99% rejection of impurities.

“The extremely clean brine from the Prairie project in Saskatchewan comes out of the ground and enters into the Koch system, it is pretreated and then the sorbent selectively binds the lithium ions, maximising extraction percentage and impurity withdrawal,” Blumberg said.

“This produces a lithium chloride which is then further treated to create a concentrated lithium chloride.

“From here, the concentrated lithium chloride can be converted to a lithium carbonate or a lithium chloride salt can be created, depending on what offtakers want to buy.”

The DLE tech is expected to arrive on site in Q2 this year, with battery grade samples currently being distributed and tested in Asia.

At Stockhead we tell it like it is. While Arizona Lithium and Anson Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.