That wave of cobalt supply everyone’s worried about has been benched until 2020 (at least)

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Another significant export delay at one of the world’s largest miners in the Democratic Republic of Congo could inject some life back into the flatlining cobalt market.

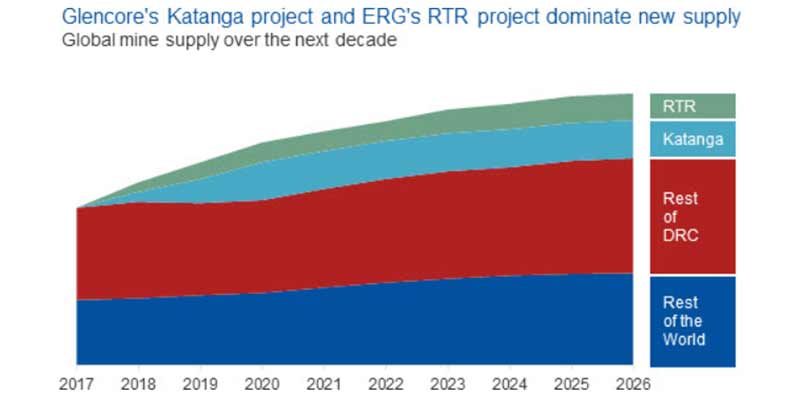

Glencore subsidiary Katanga Mining was in the midst of ramping up to 34,000 tonnes per year of cobalt hydroxide in 2019 – that’s equivalent to 21 per cent of global supply.

The amount of product Katanga now expects to export in 2019? Nada.

In November last year, Glencore announced that 20,000 tonnes of cobalt hydroxide sales would be removed from the market until the third quarter of 2019 after discovering low levels of radioactivity.

Now this wave of supply has been deferred until at least 2020 after the DRC Government wasn’t convinced by Glencore’s plan to remove the radioactive uranium from the cobalt.

Katanga told investors that the DRC Minister of Mines raised concerns, requesting that the miner suspend the radioactivity-removing ion exchange plant project “until further notice”.

Katanga now reckons that IF it gets the green light from the DRC government it can start commissioning the ion exchange plant in the fourth quarter of 2019.

The miner declined Stockhead’s request for additional comment.

Annual production for the 2019 financial year remains unchanged at 26,000 tonnes, but sales of this production are now expected to hit the market sometime in 2020.

READ: Carmakers are talking about buying their own cobalt mines to ensure supply

“The market had been expecting a glut of material to hit the market in the second half of 2019,” Marcel Goldenberg, metals pricing analyst at S&P Global Platts told Stockhead.

“However, the request by the DRC’s minister of mines for Katanga to suspend the Ion Exchange project may delay this material entering the market for even longer.”

This news comes as downstream cobalt sulfate producers in the Chinese domestic market grapple with lower prices, Mr Goldenberg says.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

China, the largest producer of battery-grade cobalt sulfate for use in electric vehicles, has seen prices trickling lower in recent months, leading to some producers being concerned that production may cease to be economically viable if margins decline further.

“The Platts Battery Grade Cobalt Sulfate CIF North Asia assessment shed 4.5 per cent since the beginning of the year alone,” Mr Goldenberg says.

“Yet, the announcement from Katanga and the subsequent loss of expected cobalt supply from the global market in the second half of 2019 may cause the recent price trends to be reversed, according to market sources.”

READ: High Voltage – All the news driving battery metals stocks

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.