Technology Metals’ Gabanintha continues to kick goals, proving its worth as a large, low-cost vanadium mine

Southampton striker Shane Long has scored the fastest goal in Premier League history, netting after just 7.69 seconds against Watford (Photo by Warren Little/Getty Images)

Special Report: Vanadium hunter Technology Metals Australia (ASX:TMT) has been aggressively pursuing the development of its Gabanintha project and ticking a bunch of boxes in the March quarter.

The company is advancing rapidly towards production and is closing in on the completion of a definitive feasibility study (DFS), which is slated to be delivered mid-2019.

The DFS is an important milestone for potential off-take partners and financiers.

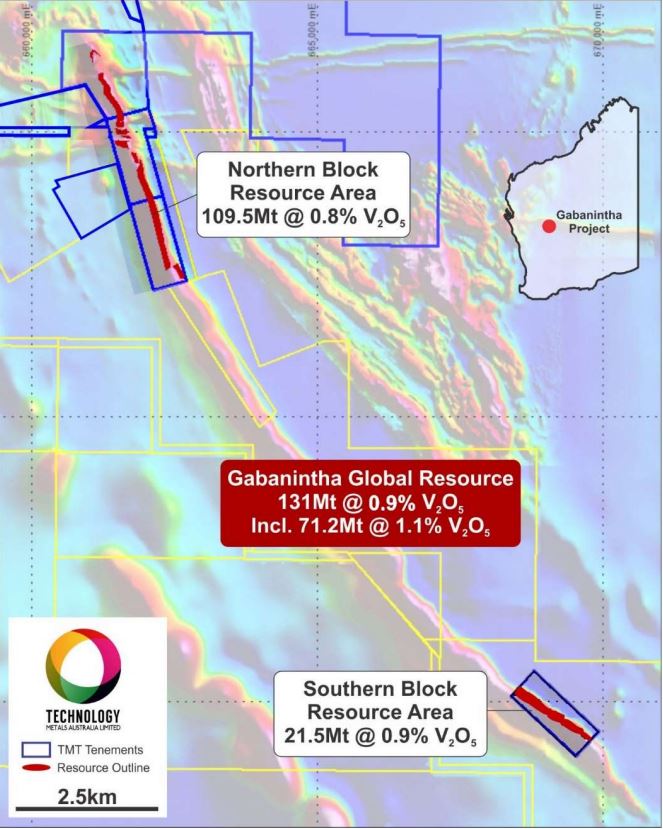

The Gabanintha project near Meekatharra in Western Australia is shaping up to be a large, long-life, low-cost mine.

Technology Metals is confident its DFS will improve on its already excellent base case pre-feasibility study.

As part of its work during the quarter, Technology Metals has not only delivered a substantial 39 per cent increase in the high confidence measured and indicated Northern Block resource, but it has also grown the high-grade resource.

Mineral resources are categorised in order of increasing geological confidence as inferred, indicated or measured.

By moving resources into the indicated category, it means a company has sufficient information on geology and grade continuity to support mine planning.

Resources in the measured category can be converted to reserves — resources known to be economically viable to mine.

The Gabanintha project now hosts a high-grade resource of 71.2 million tonnes at 1.1 per cent vanadium pentoxide (V2O5) within a larger global resource of 131 million tonnes at 0.9 per cent V2O5.

“The resource upgrade highlights the world class scale and economic development potential of the Gabanintha vanadium project,” chairman Michael Fry said.

“A 39 per cent increase to the measured and indicated component of the resource and the very large global high-grade resource position provide further confirmation of the exceptional quality of this vanadium deposit.”

And that is by no means it for Gabanintha, Technology Metals still has a resource upgrade for the Southern Tenement in the works that will include a maiden higher confidence indicated resource as well as an expansion of the overall resource.

The high-grade resource also remains open along the full strike length of the North Pit and Central Pit areas of the Northern Block, providing scope to further expand the total Gabanintha resource.

Pilot plant scale testwork is progressing well, with Technology Metals having produced a magnetic concentrate for salt roast/kiln pilot plant testing in the current quarter.

“Progression of the very important pilot plant scale testwork on the bulk sample is the final building block for delivery of the high-quality definitive feasibility study,” Fry said.

Getting a head start on financing

Technology Metals has been extremely busy setting itself up to secure funding for the Gabanintha project with the appointment of Blackbird Partners and Bridge Street Capital Partners as joint financial advisors.

The financial advisors have started a strategic investor/partner engagement process in parallel with the DFS.

This process, which complements the ongoing end-user/off-take partner discussions being conducted by the company, is designed to target potential investors with a shared long-term view of the vanadium industry and capacity to participate at a meaningful level in the project financing.

Technology Metals has already delivered several draft agreements to a range of potential end users and off-take partners to facilitate discussions with respect to progressing potential partnerships.

Technology Metals wants to have its Gabanintha mine up and running in 2021.

The 2018 PFS estimated that Gabanintha would generate $3.1 billion of total earnings before interest tax, depreciation and amortisation.

It would only take 2.5 years to pay back its initial construction costs of AU$380m.

This is all based on operating costs of just above $US4/lb and a long term V2O5 price of about $US13/lb.

Still plenty of cash in the bank

Funds are definitely not running low for Technology Metals, which had just under $5m in the bank at the end of the March quarter.

Although vanadium prices declined during the quarter, exacerbated by seasonal demand factors in China, they are still very supportive for the development of high-quality greenfields projects such as Gabanintha.

Technology Metals said prices are just coming off the unsustainable highs seen during the December 2018 quarter and prices are expected to improve in the near-term as vanadium consumption in the steel industry stabilises.

>Read: Vanadium stocks guide: Here’s everything you need to know

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This story was developed in collaboration with Technology Metals Australia, a Stockhead advertiser at the time of publishing.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.