Tech Metals: Rare earths play Pensana spikes 12pc on Longonjo NdPr project study

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Pensana reckons its low capex, high margin Longonjo neodymium and praseodymium (NdPr) project in Angola is on track to be the first major rare earths mine developed since 2012.

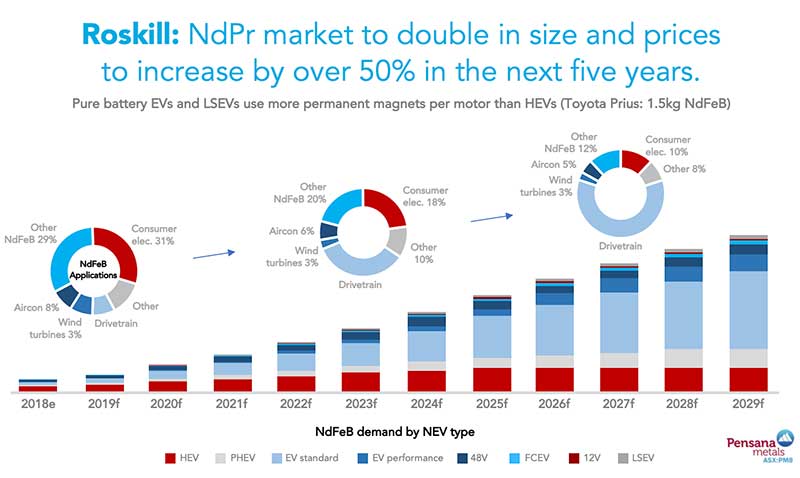

The NdPr market will move into a supply deficit in the next couple of years, analysts say, as demand takes off for things like magnets in EVs, offshore wind turbines, and military applications.

If that prediction pans out, then Longonjo could be entering production at just the right time.

Pensana (ASX:PM8) released a project preliminary feasibility study today on an initial nine-year, shallow open pit mining and two‐phase processing plant development.

It would produce an average 56,000 tonnes per year of NdPr concentrate for export. But there’s scope for the project to grow further.

READ: The government pledges cheap funding for Australian rare earths projects

Producing a concentrate for overseas processors means Pensana doesn’t need to invest in a complex and expensive chemical processing plant, keeping its developments costs down to ~$US131m ($193m).

That includes mine development, process plant and infrastructure, and the all-important 15 per cent cost growth allowance – just in case expenditures blow out during construction.

The other reason costs are so low, Pensana says, is handy access to existing major rail and power infrastructure in the region:

The project’s ‘base case’ forecast (most likely to occur) envisages revenues of $1.984 billion over the initial nine-year life, EBITBA of $1.3 billion and a 13-month project payback period.

But even under a low-price scenario, project revenues would total about $US1.45 billion and EBITDA $782m – and the whole project could be paid back in 17 months. That’s still pretty good.

“Our primary focus has been to take advantage of the world class rail, port and power infrastructure and keep the capital costs low and generate strong early cashflows to ensure that the project can be readily financed,” Pensana chief exec Tim George says.

“We have commenced detailed engineering studies and are looking forward to rapidly advancing the mine to the commencement of construction activities early in 2020.”

Discussions “with a wide range of financiers” are well underway, the company says.

“In addition, the company has received approaches from royalty streamers and other financiers and intermediaries to fund the project,” Pensana told investors.

“Fidelity UK, one the country’s largest fund managers has taken a 10 per cent stake in the company and RFC Ambrian has introduced the company to over 90 institutions in London ‐ a large number of whom have expressed strong interest in funding the company once listed on the LSE.”

Through an advisor, Pensana has also received “in‐principle advice” from three Scandinavian banks — already lenders to the Angolan oil and gas sector — that they are happy to provide debt funds to the project.

NOW READ: Money Talks — This expert’s top commodity picks are gold, diamonds and rare earths

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.