Talga leading the charge with European anode product trials

Pic: Tyler Stableford / Stone via Getty Images

Special Report: Switzerland-based Leclanché SA, one of the world’s leading energy storage companies, is testing Talga’s advanced anode products in its lithium-ion batteries ahead of a potential supply deal.

Talga (ASX:TLG), an aspiring low-cost battery anode producer, is set to benefit from its proximity to the “wakening beast” that is Europe’s electric vehicle manufacturing sector.

The company’s vertically integrated graphite anode project in Sweden has the potential to make serious money over its initial 22-year life, according to a May pre-feasibility study.

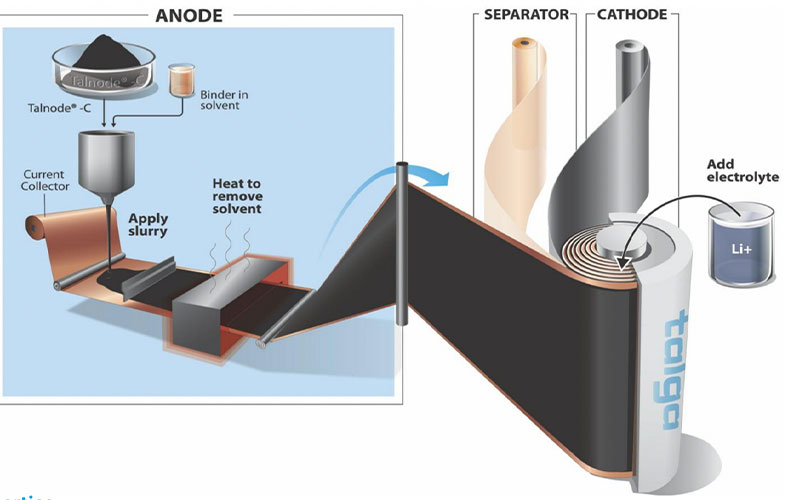

An open-pit mining operation, on-site concentrator and coastal anode refinery will produce about 19,000 tonnes per annum of Talnode-C, the company’s graphite battery anode product.

It will look something like this:

The agreement with Leclanché SA is one of about 40 battery product related engagements – some of which cover offtake and project finance — Talga says “are currently active under non-disclosure agreements”.

Unlike battery metals like lithium, which are traded on the basis of purity, graphite anode is an advanced product that requires testing in batteries by the customer at increasing volumes before long term contracts are signed.

The Leclanché SA trials are expected to run for two to six months, Talga says.

The MoU includes indicative pricing for larger volumes of Talnode-C, which is within 10 per cent of the pricing used in the pre-feasibility study on the integrated project.

It’s going to cost Talga just $US1,852 to produce each tonne of Talnode-C, which they expected to sell to battery makers for roughly $US11,250/t. That’s a substantial profit margin.

After years of R&D, Talga is now very close to becoming Europe’s first anode supplier, says managing director Mark Thompson.

There’s already around 16 large-scale lithium-ion battery cell plants confirmed or likely to come online in Europe within the next four years, according to Benchmark Mineral Intelligence data.

As the industry grows, there’s a coordinated push to establish internal EV supply chains across the EU. That’s where Talga comes in.

“The automotive and cell companies that we are talking to, they actually want European supply starting in 2022 or earlier,” Thompson told Stockhead.

“Local supply isn’t just strategically important but can be mandated by the financiers and local governments.

“Our growth is strategically designed to match the growth of the wider industry. It’s great timing.”

This story was developed in collaboration with Talga, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.