Sweden’s uranium mining ban could be overturned – big news for these ASX players

Uranium mining could be back on the menu in Sweden. Pic: Getty Images

- The Swedish government has proposed legislation to overturn a ban on uranium mining

- Move could allow domestic uranium mining to start from January 1, 2026

- At least two Aussie mining players with Swedish uranium interests could be set to benefit significantly

From January 1 in 2026, Sweden could torch the ban on domestic uranium mining that has been in place since May 2018 in order to secure supplies of the energy metal for its existing (and possibly growing) fleet of nuclear reactors.

The country generates about a third of its electricity from six nuclear reactors, but is entirely reliant on uranium fuel imported from Canada, Australia and Kazakhstan.

On February 2024, the Nordic country launched a government inquiry into abolishing the uranium mining ban that subsequently concluded in December 2024 that Sweden should remove its prohibition on uranium mining.

After the usual arcane processes involved in law making, the Swedish government proposed in late August 2025 to remove the prohibition in the Environmental Code against granting permits for mining or processing facilities that involve uranium-containing material.

It also seeks to make uranium a concession mineral according to the Minerals Act.

Should the law be passed, which is widely expected to occur later this year, domestic mining of uranium in Sweden will then be allowed from January 1, 2026.

With state-owned utility Vattenfall AB also planning to build several new reactors over the next decade to meet expected growth in electricity demand, this is likely to mean that domestic suppliers will find a ready market in Sweden and elsewhere in the European Union.

Speaking to Stockhead, Aura Energy managing director Andrew Grove said Sweden was a big nuclear power generator and having some of their own source of uranium would be quite beneficial on the supply chain.

“Sweden is very concerned about supply chains given the conflict that’s going on with Russia and Ukraine,” he added.

“All of Europe really is looking supply chain risk, given the geopolitical tensions globally as well.

“I think there’s been very positive discussions from the government and the communities in general that securing supply chains is really important for the country and we can hopefully help do that.”

Pro-mining jurisdiction

Outside of the uranium ban, Sweden is recognised as a pro-mining country with a large, long-lived mining industry.

Grove noted that most of the mines were in the country’s north though he did highlight the country’s strict environmental controls and the EU overlay on all the legislative processes and approvals.

“There’s a lot of legislation to get through and approvals. It means that when we get a project and deliver a project, it will be very tightly controlled around the environment and the social and the economic benefit of the local community,” he added.

“It’s good, but it just takes a little bit longer to get through the approvals processes.”

There are about a dozen mines in operation in the country producing a range of metals from gold to copper and to iron ore.

In fact, Sweden is by far the largest iron ore producer in the EU and is a leading miner of both precious and base metals.

Making an impact

Removing the ban on uranium mining will be a clear positive for Aura Energy (ASX:AEE) and its shareholders.

Grove noted that most of Aura’s value was due to its Tiris uranium project in Mauritania, which is being progressed through development with production hopefully starting in 2027.

It contrasts with the company’s Häggån deposit in Sweden, which is not getting a lot of see-through value, despite its large size.

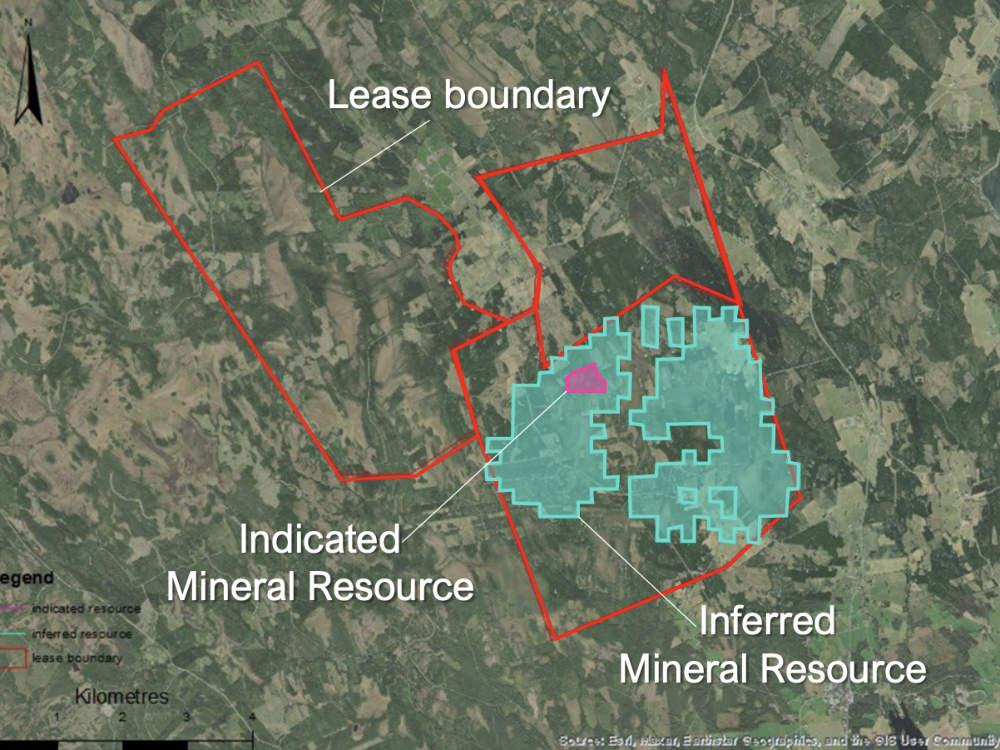

Häggån sits within the AlumShale uranium district, home to one of the largest undeveloped uranium resources globally with an inferred resource of 800Mlbs of contained U3O8.

“Lifting the ban will be good. It will be very positive for Aura and its shareholders,” Grove said.

“We’ve got a very large polymetallic project in central Sweden. It contains very significant resources of uranium.

“Once the ban is lifted, I think it will be very positive for us to reassess Häggån and look at extracting uranium as well as the other minerals and should have a very positive economic benefit to our shareholders but also to Sweden.”

The company has a scoping study for the project’s vanadium and sulphate of potash resources.

“We’re currently applying for an exploitation permit which is like a retention licence, so we’re still quite a distance away from being able to deliver uranium to the nuclear power utilities,” Grove said.

He noted the company would also put a lot more focus back on Häggån and seek to address the project in terms of economics, exploration and concerns of the local community.

“There’s always valid concerns of communities around any mining project. And certainly that gets enhanced a little bit when you talk about uranium mining, but inherently you can, and what has shown all around the world, you can mine uranium safely,” Grove added.

“It’s very low levels of uranium. So the radiation levels of anything we do will be exceptionally low and generally not harmful to any humans.

“We’ll need to do a lot of work around framing that in both these technical studies and all our social engagement.”

Other ASX players

Aura isn’t the only ASX-listed company with uranium assets in Sweden.

While Basin Energy (ASX:BSN) has embarked on a new uranium and rare earths adventure in Queensland, the company remains keen on Swedish uranium with managing director Pete Moorhouse noting in late August that it was anticipating a political shift in the country in favour of uranium mining.

Such a change will allow the company to tuck into its Björkberget, Rävaberget, Trollberget and Virka projects with gusto in the knowledge that mining can actually proceed in the event of a commercial discovery.

During the June 2025 quarter, structural relogging of historical drill core across the Virka, Björkberget and Rävaberget projects found multiple key structures that are clearly associated with known mineralised trends.

This work also confirmed that a polymetallic system that includes uranium grades exceeding 5.9% U3O8 is present in North Sweden, which presents a compelling opportunity for modern exploration in a re-emerging district.

While historical drilling was conducted at these three projects, only Virka had reputable data with assays of up to 9m at 1087ppm U3O8 though some holes could not be re-sampled due to not having enough core remaining.

Sampling has also indicated the presence of separate outcrops of high-grade zinc-lead mineralisation and uranium mineralised veins (with up to 1.43% U3O8), the latter of which outcrops over 8km from the historical drilling.

Sampling at the other projects also returned significant uranium grades with one sample at Björkberget returning U3O8 exceeding the detection limited of >5.9%.

At Stockhead, we tell it like it is. While Aura Energy is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.