IPO Watch: Sustainable graphite player Evolution Energy Minerals lists today on the ASX

Pic: Getty

The rise of the electric vehicle revolution comes with the rise of key raw materials.

And one very important material facilitating the transition to a greener future is graphite, a key element across all commercial battery technologies.

According to Roskill, graphite’s use in lithium-ion battery anodes accounts for 90pc of all the active materials used and its growth is underpinned by demand for both natural graphite (mined) and synthetic graphite (manufactured from a coke precursor).

While China has mainly dominated graphite production over the years, it is increasingly turning downstream and has become a significant importer of raw material flake graphite.

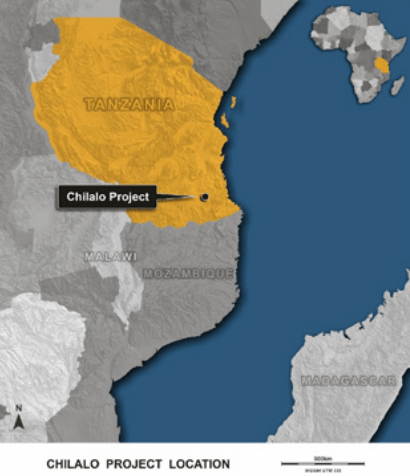

This means that raw material graphite projects outside China could provide an alternative source of supply, like Evolution Energy Minerals’ Chilalo Graphite Project in the southeast of Tanzania, 100km north of the border with Mozambique where it plans to create the first net-zero carbon mine and produce sustainable graphite products for the global green economy.

‘A very high-grade and large flake size deposit’

Evolution Energy Minerals (ASX:EV1), the graphite spin-out of Marvel Gold (ASX:MVL) is set to list on the ASX today at 12:30pm AEDT.

The company is backed by executive chairman Trevor Benson, who has more than 30 years’ experience in investment banking and stockbroking specialising in the resources sector.

In an interview with Stockhead, Benson said the most interesting aspect of the project is its unique graphite signature.

“Chilalo has a globally significant flake size, it is a very high-grade and large flake size deposit – around 60% of the deposit is +80 mesh which is very large natural flake graphite and attracts a premium,” he said.

The mineral resource at Chilalo includes 20.1 million tonnes at 9.9% total graphitic carbon (TGC) for 1,9991 kt of contained graphite and hosts an estimated (proved and probable) ore reserve of 9.2 million tonnes at a grade of 9.9% TGC for 878 kt of contained graphite.

With a definitive feasibility study finalised, environmental approvals, and a mining licence under its wing, Benson said the company will now be focusing on progressing studies, such as the FEED study to bring it towards a construction decision and ultimately, into production.

Exploration work targeting additional high-grade surface material is also on the agenda for the remainder of the year, as part of the company’s overall strategy to increase the current 18-year mine life.

Strong ESG focus

Holding a market cap of $32 million and $10.5m cash in the bank, Benson said Evolution Energy’s top 20 shareholders hold 75pc of the stock.

Major shareholder ARCH Sustainable Resources Fund, out of Guernsey, cornerstoned the company’s $22m initial public offer, with an $8m commitment as part of an overall allocation of up to $25m for ongoing financial support.

ARCH has an environmental, social, and governance focus which not only validates Evolution’s commitment to ESG standards but provides EV1 with critical insight into the expectations of institutional investors.

It is this work with ARCH, Benson said, that is expected to position Evolution as an attractive investment proposition for a wide range of ESG-focused fund managers.

“Being sustainable is everything now for raw materials,” Benson said.

“To be able to sell raw materials into the US and Europe you must have traceability on your product, and you have to be able to prove that you comply to the highest degree of ESG.

“Unless you can produce ESG sustainable raw materials you won’t be able to sell your product and at the end of the day if you don’t comply with ESG, you won’t be able to get funding.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.