Surefire is on the threshold of a new gold adventure

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: WA-based Surefire Resources could turn its attention toward a high grade gold exploration and development target if results from recent drilling play out.

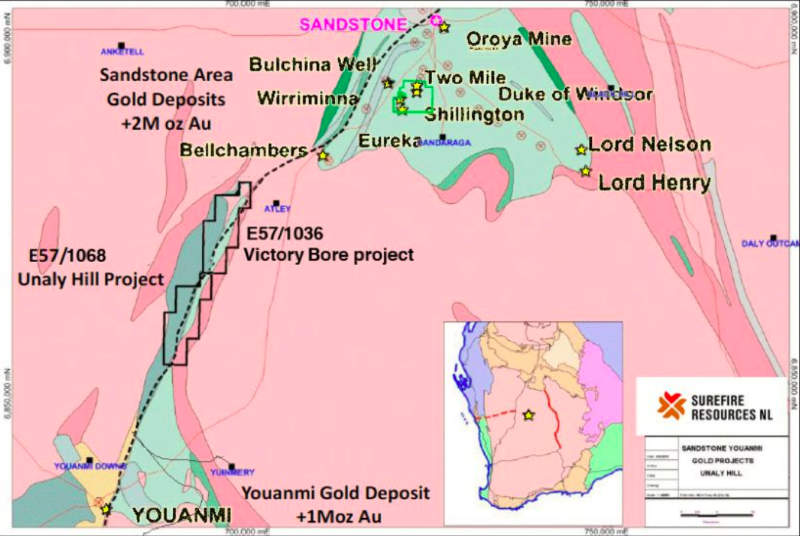

Surefire (ASX:SRN) is currently waiting on assays from a maiden drilling campaign targeting extensions to historical ore-grade gold drilling intercepts on the eastern flank of its Victory Bore project near Sandstone, WA.

Victory Bore is located between the Youanmi and Sandstone mining centres, both of which were substantial gold producers in the past.

Surefire has been progressing a promising vanadium project at the site, but recently drilled 29 holes over several parallel mineralised corridors to test possible extensions to high-grade gold hits made more than 20 years ago by Battle Mountain Australia.

Battle Mountain had returned notable results, including a metre grading 25.67 grams per tonne (g/t) gold within a broader intercept of 6m at 5.41g/t gold from a depth of 59m; and 4m at 20.38g/t gold within an 8m zone grading 10.2g/t gold from 20m.

Anything above 5g/t is generally considered high grade.

Executive director Vladimir (Roger) Nikolaenko told Stockhead –

“Subject to the assay results – and I remain quite optimistic – we will carry out a follow-up campaign of further drilling,” he said.

“There are not many ore deposits that have been found at shallow depths in the last 20 years, they are quite rare.”

Holes in the recently completed program were drilled to a maximum depth of 96m.

Nikolaenko said that if the drilling hit the anticipated gold zone, there would be sufficient encouragement for the company to drill deeper.

“We really need to get down to between 100m and 150m at least in the next campaign,” he added.

He also flagged the potential for the company to focus on the gold play if the results warranted it.

There is further gold potential within the Victory Bore tenements, with the company identifying a number of other targets further to the north that warrant further exploration.

Vanadium and other projects

That is not to say that Surefire has forgotten its other projects.

The company is still planning to conduct a scoping study on its Victory Bore vanadium project, which currently has a resource of 237 million tonnes at 0.43 per cent vanadium pentoxide at the Unaly Hill and Victory Bore deposits.

“We have had interest from London and China for our vanadium and while the market has slipped in last 18 months, vanadium will have its day in the sun. It is a commodity that will be required in the future,” Nikolaenko said.

Vanadium is expected to see greater use as uptake of renewable energy sources increase.

Vanadium redox flow batteries (or VRFBs) are better suited to large scale applications (stationary storage), such as network support for electricity grid operators and telcos looking to power off-grid communications towers and utility scale installations.

This is due to being safer than lithium-ion batteries and having life spans of more than 20 years, or 25,000 cycles, which completely dwarfs lithium-ion batteries that typically have much lower life spans.

“It is for the big end of town at the moment, but in time as technology advances, it will become more affordable for your domestic housing markets,” Nikolaenko added.

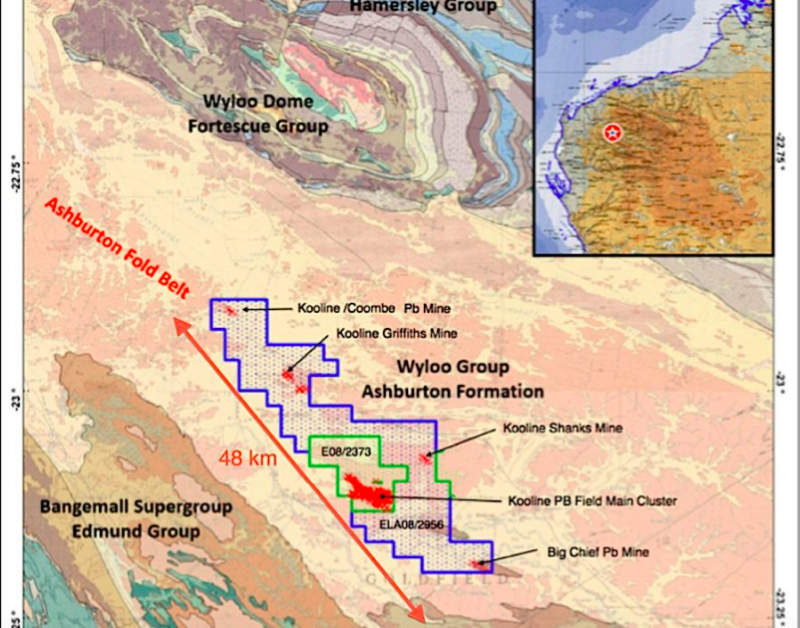

Surefire also owns the Kooline lead-silver-copper-gold project in WA’s Ashburton Province.

It consists of 48km of contiguously striking licences that link a number of clusters of historic artisanal lead workings and mines.

Exploration activity to date has consisted of two reviews to determine the style of mineralisation and generate targets for future work.

“At Kooline, we have almost completed a plan of attack, which is subject to our available funds,” Nikolaenko said.

He added that the company was hoping that the upcoming gold results could deliver enough of an uptick to trigger the exercise of options priced at 1.8 cents at the end of November.

“If that all comes to pass, it will be in order of $7m, which then allows us to expand our technical personnel and advance Kooline and the vanadium project.”

This will also help fund further work on the gold target.

The company as of close last week, had a market cap of $6.28 million with $800k cash in the bank.

This story was developed in collaboration with Surefire Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.