Sultan’s Rio Tinto-funded nickel hunt takes off

Sultan is undertaking a helicopter-borne Electromagnetic (EM) survey to better assess a conductivity anomaly. Pic via Getty Images

- Sultan kicks off initial phase of exploration on E70/5082 at Lake Grace

- The heli-borne EM survey is being funded by major miner Rio Tinto (ASX:RIO)

- Sultan hopes to confirm the nature and extent of promising geophysical anomaly

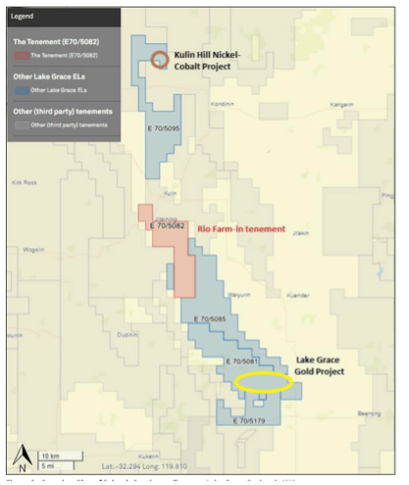

Sultan has kicked off a helicopter EM survey on a portion of ground on its Lake Grace tenure after entering into an option farm-in and JV agreement with RIO in June.

Sultan Resources (ASX:SLZ) will be honing in on a strong, untested conductivity anomaly in the northern part of E70/508, which coincides with a circular magnetic and radiometric anomaly.

This suggests potential for magnetic nickel sulphide mineralisation, it says.

The explorer has engaged NRG to fly a detailed, 100-m lined space helicopter borne time-domain electromagnetic (HTDEM) survey totalling 80km over an area 45km southwest of Kulin, WA.

Electromagnetic surveys are an early-stage exploration technique which can be used to detect and dial in on conductivity anomalies, which could represent a potential mineral deposit.

SLZ hopes to confirm the nature and extent of the conductivity anomaly on E70/5082 before considering the merits of any on-ground exploration to further assess and test the anomaly.

Sultan enters option and JV agreement with Rio

This comes hot on the heels of a recent option and farm-in agreement with Rio Exploration (RTX).

In the hunt for new tier 1 critical mineral discoveries, Rio Tinto (ASX:RIO) has made a move to farm into pre-discovery assets via its mine-finder arm, RTX.

RTX has rights to earn up to 80% of E70/5082 through $2m of exploration expenditure within five years.

The transaction allows Sultan to focus on Kulin Hill where it has been most recently active, while providing upside for its shareholders via exploration work under the option agreement on E70/5082.

For Sultan, the attraction is having a cashed-up joint venture partner to fund much of the expensive exploration and development costs.

These farm in deals remove risk for the small cap partner, in exchange for a hefty project stake – with RIO in position to accelerate any discovery towards a production decision.

Neighbouring Chalice’s Julimar project

SLZ chairman Jeremy King believes Kulin Hill is highly prospective nickel-PGM ground and along with the recently completed placement and acquisition of lithium tenure in Ontario, it is shaping up to be a busy period for the company.

The Kulin project is within the same neck of the woods as Chalice Mining’s (ASX:CHN) Gonneville PGE-nickel-copper-cobalt discovery at the Julimar project.

Chalice announced what it declared the largest nickel sulphide discovery globally in 20 years, and the largest PGE discovery in Australian history back in 2021 in the almost entirely underexplored Western Yilgarn region.

What’s next?

Once quality control has been conducted, SLZ plans to review, interpret the data and releases the results of the survey.

Meanwhile, the company is ‘boots on the ground’ at one of two 100% owned lithium projects in Ontario, Canada.

It has now established a priority exploration target at the Ruddy project, which directly abuts ground to the west held by Green Technology Metals Limited (ASX: GT1).

157 rock samples have been submitted for multi-element analysis including gold.

Sultan intends to use resultant lithium values and geochemical markers to focus additional fieldwork to discover possible covered mineralised LCT pegmatites.

This article was developed in collaboration with Sultan Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.