Sultan Resources picks up gold and critical mineral projects in Namibia and WA

Sultan Resources expands portfolio on acquisition of three gold and critical mineral projects. Pic: Getty Images

- Sultan Resources acquires three gold and critical mineral projects from Aldoro Resources

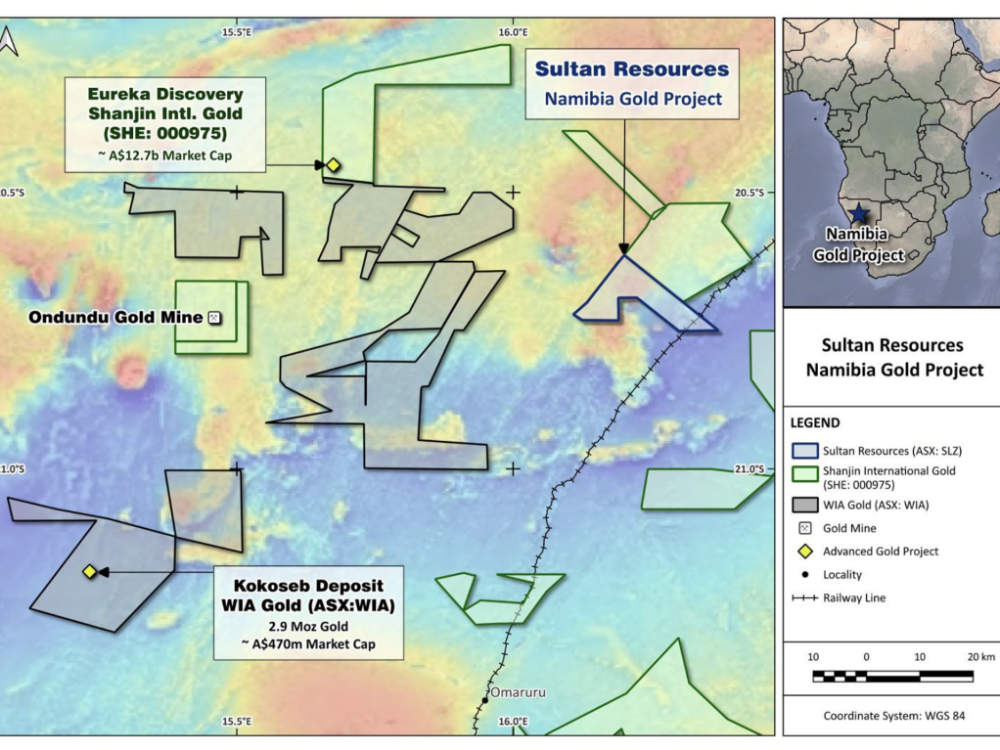

- Namibia gold project covers 152km2 in Damara Gold Belt near existing major gold deposits and discoveries

- Acquisition includes the Niobe rubidium-lithium and Narndee polymetallic projects in Western Australia

Special Report: Sultan Resources is spreading its wings with an agreement to acquire a package of three high-quality gold and critical mineral projects in Namibia and Western Australia from Aldoro Resources.

Chief of these is the Namibia gold project (EPL7895) which covers 152km2 in the highly prospective Damara Gold Belt.

“The projects position Sultan with exposure to both world-class gold opportunities in Namibia and strategically important critical minerals in Western Australia,” Sultan Resources chairman Lincoln Liu said today.

“It’s a step that will strengthen our portfolio across two tier-one jurisdictions and sets us up for meaningful value creation.”

Sultan Resources’ (ASX:SLZ) new project sits in the same domain as WIA Gold’s (ASX:WIA) Kokoseb deposit, which has an indicated and inferred resource of 89Mt grading 1g/t, or 2.93Moz of contained gold.

Notably, WIA achieved this resource at a discovery cost of less than US$3/oz of contained gold, highlighting the region’s mineralisation size and potentially low cost of exploration.

The Namibia gold project also features metasedimentary host rocks similar to those at the nearby acreage held by Osino Resources, which was acquired by Shanjin International Gold for $400m in 2024.

This acreage includes the Ondundu deposit with an inferred resource of 26Mt at 1.13g/t – or 900,000oz contained gold – and the Eureka discovery where drilling returned multiple thick, high-grade intersections.

Orogenic gold mineralisation at Kokoseb, Ondundu and Eureka also shows many similarities to metasedimentary-hosted gold systems known in other major orogenic belts such as the Victorian Goldfields within Eastern Australia’s Lachlan Orogen.

Mineralisation in these systems typically occurs as free gold associated with extensional and shear-hosted quartz‐iron‐carbonate-pyrite veins, commonly with related sericite alteration.

EPL7895 is immediately north of the exposed Cretaceous Etaneo syenite intrusive complex that is part of the Damaraland Igneous Province which formed in response to the rifting of the South Atlantic during the early Cretaceous.

The alkaline and carbonatite intrusions associated with this event are known to host REE mineralisation at the Ondurakorume Complex just 10km southeast of Etaneo.

SLZ notes that an ~8km diameter concentric magnetic ring structure which surrounds the outcropping extent of the Etaneo syenite complex extends well into its project area.

This ring pattern clearly reflects alteration and potentially mineralisation associated with the intrusive complex – and represents a REE target within EPL7895.

It is working on initiating a ground magnetics program aimed at refining exploration targets and positioning for drill-ready prospects.

Other projects

While EPL7895 is a significant project, the company also acquired two projects in Western Australia from Aldoro Resources (ASX:ARN).

The Niobe project in the Dalgaranga Greenstone Belt about 80km by road northwest of Mt Magnet holds an inferred resource of 4.6Mt at 0.17% rubidium and 0.07% lithium associated with a cluster of pegmatite dykes.

While the resource at Niobe provides an early sense of scale and supports ongoing development studies, it is also clear that more drilling could expand it as mineralisation remains open along strike and at depth.

It is held as a prospecting licence that is being transitioned to a mining lease.

Rubidium – a critical mineral used in biomedical research, electronics and defence applications as well as pyrotechnics and specialty glass – commands a premium price of about US$1050/kg on the Shanghai Metal Market.

Meanwhile the polymetallic Narndee project covers 106km2 within the most fertile part of the mafic-ultramafic Narndee Igneous Complex about 100km southeast of Mount Magnet.

This part of the complex has recognised similarities to the host sequences of major WA nickel-copper-PGE deposits such as Chalice Mining’s (ASX:CHN) top tier Julimar discovery and IGO’s (ASX: IGO) Nova-Bollinger mining operation.

The southeast corner of E59/2258 also has recognised potential for stratiform copper-zinc mineralisation within metavolcanic and metasedimentary rocks at the Quandong Well prospect..

This article was developed in collaboration with Sultan Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.