Stellar rare earth hits set up Meeka to drill for maiden Circle Valley resource

Mining

Mining

Meeka Metals has rolled out more stellar rare earth grades from drilling at its Circle Valley project near Esperance, setting it up to complete resource definition drilling at the start of 2023.

The rapid transition from discovery to resource definition at Circle Valley has been, like last night’s Brownlow Medal count, a joy to behold.

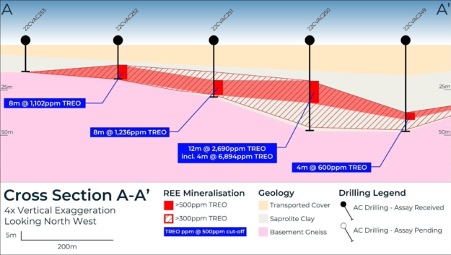

Meeka’s (ASX:MEK) latest round of drilling has returned high rare earth grades of up to 6894ppm total rare earths oxides, with up to 31% NdPr concentration.

NdPr, or neodymium and praseodymium, are the two most important rare earth metals for the energy transition.

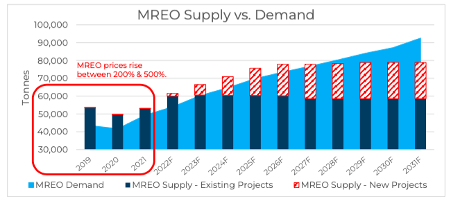

They go into the permanent magnet market, materials used in wind turbines and electric vehicles. A supply deficit of 37% is forecast by 2031 if no new sources of supply come online.

That will still be 15% if every new source of supply so far identified is developed and produces as forecast, with no hiccups.

A good time then to be rolling out results like these:

Those hits of scandium, ranging up to 54g/t, were pretty tasty as well.

Scandium prices generally fluctuate between US$4000 and US$20,000 per kilo on account of its scarcity, though scandium alloys are used in numerous important everyday items like bike frames, fishing rods, golf shafts, baseball bats and in the lamps which replicate sunlight in film and TV.

The 6894ppm TREO hit is the highest grade to date at Circle Valley, occurring in the northwest where the shallow saprolite clay horizon is most highly mineralised beneath shallow transported cover.

It sets up Meeka to infill this area in a new program in January once drilling has wrapped up at Meeka’s exciting St Anne’s gold discovery, part of the 1.1Moz Murchison gold project.

A maiden resource estimate is expected by June 2023.

“Results continue to show a shallowing cover profile to the northwest at Circle Valley, corresponding with a +1,000ppm high-grade component of the rare earth mineralisation, rich in NdPr magnet rare earth elements,” Meeka managing director Tim Davidson said.

“This shallow high-grade mineralisation appears to trend northwest into an undrilled part of Circle Valley, which will be a focus for Mineral Resource infill drilling commencing in early 2023. Delivery of an initial Mineral Resource remains on track for the June 2023 quarter.

“Good progress is also being made on the metallurgical front where we are working to establish methods to upgrade prior to recovery and to optimise the recovery conditions.”

The clay hosted style of rare earths deposit found at Circle Valley is the most commonly mined in southern China, the home of the rare earths industry with the vast majority of global production.

This style of deposit has yet to be developed in Australia, best known for Lynas’ hard rock Mt Weld mine.

But it has a number of advantages, including lower strip ratios and mining costs, simpler processing, shallower orebodies with less waste movement and deleterious elements, making it more environmentally sustainable.

With $75 million capped Meeka’s success in gold and rare earths exploration it’s no surprise to see it catching the eye of investors.

The stock is up 82.5% year to date, and added a very interesting name to its register as a significant shareholder this morning.

A substantial shareholder notice lodged with the ASX by Meeka shows Tony Poli’s Aigle Royal Superannuation Fund has emerged with a 5.44% stake in the highly touted junior explorer.

Poli is well known as a canny investor and dealmaker in the Australian mining industry, notably his sale in 2014 of iron ore and coal company Aquila Resources to China’s Baosteel during the tail end of the last mining boom.

This article was developed in collaboration with Meeka Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.