Stable vanadium prices will propel battery demand to the next level

Pic: Getty/ Amanda Edwards / Stringer

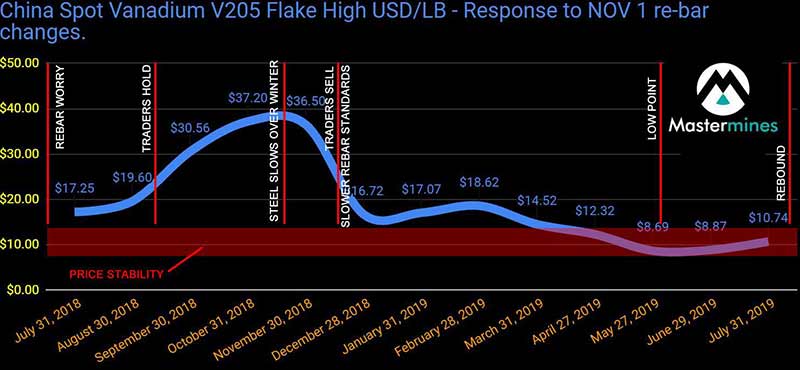

Vanadium players largely fell out of favour with investors after prices nosedived from +$US30/lb ($44/lb) in late 2018.

But for investors, advanced explorers (and even miners), battery makers, and the steel industry; current ~$US10/lb V2O5 prices are a good thing.

That’s because these conditions – smooth, stable pricing up to $US10/lb – are crucial for the fledgling vanadium battery industry to build momentum.

READ: Think high vanadium prices are good news? You’re wrong.

Current global V2O5 production is just ~140,000t a year total, and most of that goes into steel to make it stronger.

But a burgeoning battery sector is important to the success of emerging low cost producers like Vanadium Resources (ASX:VR8), Australian Vanadium (ASX:AVL) or Technology Metals Australia ASX:TMT).

That’s because these batteries soak up an enormous amount of V2O5.

Mastermine’s David Gillam recently returned from a marketing drive to China with advanced vanadium play Vanadium Resources.

This picture shows some containers of electrolyte for a 5 KW/30KWh battery. Two tanks use 280kg of V2O5 alone.

This 5kW/30kWH #Vanadium @battery uses 280 KG (617 L/B) of #V205. (2 of the tanks below) Electrolyte “recipe” can vary consideraly between manufacturers, Excuse the cropped image. There’s a lot of research we’d love to share but can’t as consultants. pic.twitter.com/oJovIFcPG3

— Mastermines (@VanadiumWorld) September 6, 2019

And then there’s the ‘suburb-sized’ Dalian battery in China, which could use almost 8000 tonnes of V2O5 for an 800MWh installation:

“It gives you an idea of the pure usage power of the vanadium battery industry once it gets established,” Gillam says.

With less intense price pressure, Gillam found the Chinese industry was “more upbeat for the future”.

But stable pricing is crucial. That plus-$US30/lb nonsense that got everyone excited last year is a stone-cold battery industry killer.

“The electrolyte is 30 to 40 per cent of the battery cost,” Gillam says.

“We need stability so that these companies are confident putting investment dollars into their products.”

For vanadium battery uptake there’s some important catalysts on the horizon.

One is that ‘suburb-sized’ Dalian battery in China.

The whole purpose of that battery is to not only to provide power for Dalian, but act as a giant ‘role model’ for the industry going forward, Gillam says.

“I don’t think we will see another one that big — but we will see a lot of decent sized batteries following behind.”

But the thing that will truly take the industry to the next level is effective marketing of smaller off-grid vanadium batteries, Gillam says.

Big volumes of smaller off-grid batteries will quickly impact the supply chain, whereas timeframes for grid connected installations are much longer.

“I want to see smaller 10kw/40kwh batteries – the kind that takes a whole farm, a nursery, or an isolated community in Australia or Africa off the grid,” Gillam says.

“That’s where the big market is.

“There’s no doubt vanadium batteries are expensive – but we are talking about a battery that will last 20 years and, after filtering the electrolyte, will go for another 20 years. And so on.

“Lithium can’t compete with that.”

We are going to see a maturation of the vanadium market in the next three years, Gillam says.

“We will see stability in pricing and companies looking for longer term contracts to give them price security,” he says.

“I believe vanadium is the best metal going forward, bar none.”

READ MORE about vanadium:

Are lower vanadium prices triggering a wave of giant new VRFB developments?

How can the battery sector hedge against volatile vanadium prices?

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.