SSR Mining hits the ASX boards after completing $5bn gold merger

Pic: John W Banagan / Stone via Getty Images

SSR Mining (ASX:SSR) listed on the ASX for trading Thursday on the same day the US headquartered gold company finalised its $5bn merger with Turkey-focused gold producer Alacer Gold (ASX:AQG).

The merged company has an annual production of around 720,000 ounces of gold, and 7.7 million ounces of silver from four mines, according to a joint Alacer Gold and SSR Mining presentation.

Early in Thursday’s ASX session, SSR Mining shares were trading at $31 a share.

The company has operations in Argentina, Canada, Turkey and the US that include its Marigold mine in Nevada, and Seabee mine in Saskatchewan.

Approximately half of SSR Mining’s gold production will originate from Turkey.

Cashed-up SSR has strong cash flow

The merged company expects to generate $US450m ($618m) of free cashflow and to have $US700m ($960m) in cash and securities on its balance sheet.

“SSR intends to leverage its strong balance sheet and proven track record of free cash flow generation as foundations to organically fund growth across the portfolio and to facilitate superior returns to shareholders,” said SSR Mining in a statement.

Alacer Gold shareholders exchanged each of their company shares for 0.32 Toronto-listed SSR Mining shares.

At the time of the merger agreement, Alacer Gold had a market value of $US1.8bn, and SSR Mining was worth $US2.3bn.

SSR Mining’s 10 directors include its chairman, Michael Anglin, who held that role at SSR, and company president and chief executive, Rod Antal held the same roles at Alacer.

“The combination of Alacer and SSR Mining will create a diversified portfolio of high quality, long-life mines across four mining-friendly jurisdictions,” Antal said in May.

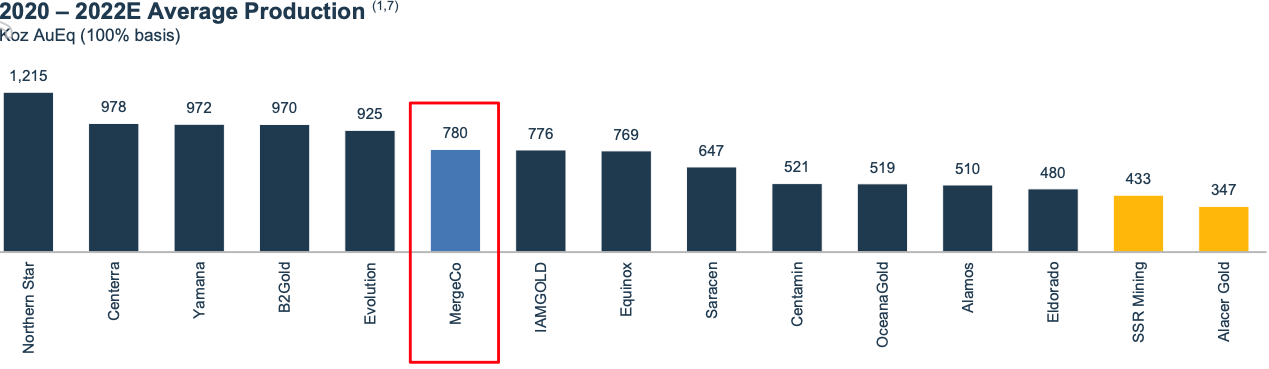

SSR Mining has leap-frogged up the pecking order for gold production

Operations in Canada, Turkey and the US

Pre-merger, SSR Mining was a Vancouver-based US and Canada-focused gold miner with production of 391,000oz/year.

Alacer Gold’s gold production from its assets in Turkey including its flagship Çöpler mine ranged between 300,000-360,000oz/year, and all-in sustaining cash costs were $US735-$US785/oz.

Prior to the merger Alacer Gold had a net debt position of $US23m.

After the merger Alacer Gold shareholders will own 43 per cent of the merged company, and 57 per cent will be held by SSR shareholders.

The merger was on a nil-premium basis, based on the companies’ May 8 share prices.

Trading in Alacer Gold was halted Monday, and it has applied to be delisted from the ASX.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.