Spartan’s metamorphosis is driven by a growing high-grade resource and an existing gold plant

Pic: via Getty Images

At its core, Spartan Resources’ story is the classic tale of a previously struggling company that has achieved a remarkable turnaround and is now positioned to deliver rewards to loyal shareholders.

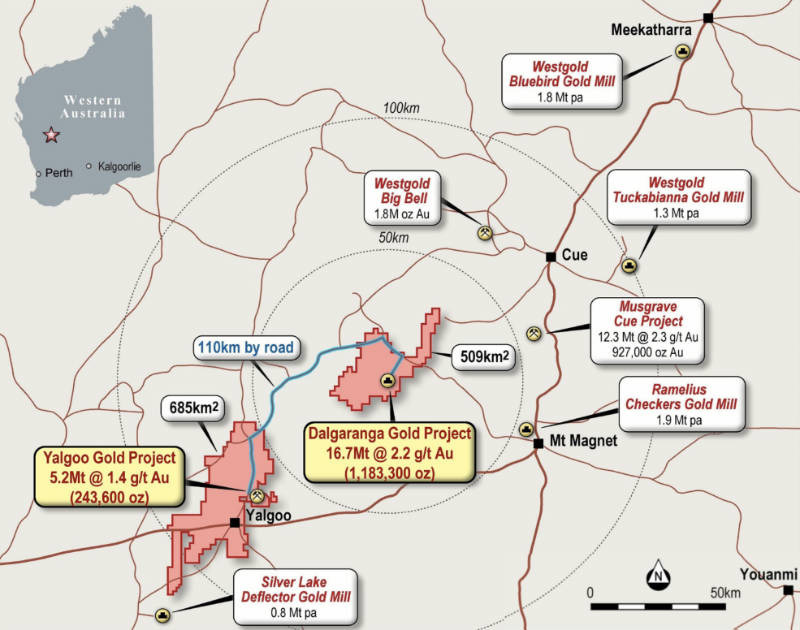

It was only a couple of years ago in the middle of 2019 that the company – then named Gascoyne Resources – went into administration after failing to economically mine and process the (then) sub 1 gram per tonne (g/t) gold resource found within the open pit at its Dalgaranga gold project.

Spartan Resources (ASX:SPR) subsequently recapitalised and resumed trading on the ASX in October 2020 and amidst the excitement of a merger with Firefly Resources, the demerger of its copper-gold and lithium assets into Firetail Resources, and an aborted takeover offer from Westgold Resources, the glimmers of success also started emerging.

While drilling first delivered high-grade gold hits within 1.5km of the processing plant in late 2020 – with subsequent hits delivering intriguing clues for future growth potential (more on this later) – it was the decision to accelerate the strategy to unlock new, higher-grade, near-mine ore sources that led to the discovery of the transformational Never Never deposit.

This strategic rethink led the company to turn the drill rigs around in a different direction in the Gilbey greenstone belt and began to reel in hits of up to 59m grading 12.5g/t, 54m grading 6.55g/t and 32m grading 8.58g/t at Never Never.

Drilling led to the definition of an initial resource of 303,000oz at 4.64 g/t right at the doorstep of its processing plant before further targeted and cost-effective exploration resulted in the July 2023 resource update to a healthy 721,200oz at 5.85g/t gold.

Carving out a new direction

Never Never’s discovery and subsequent enlargement play a key role in Spartan’s turnaround story with managing director Simon Lawson telling Stockhead that having a high-grade gold deposit less than 600m from established infrastructure meant the company was essentially peerless.

Lawson, who was appointed near the end of 2021 and guided the company to establish record gold production in the March 2022 quarter before making the difficult decision to place the plant onto care and maintenance in November 2022 to facilitate the new strategic operating plan and a financial restructure, added that the only comparable pre-development company was Bellevue Gold (ASX:BGL).

There are of course significant differences between the two companies with Lawson noting that Bellevue not only had some 3Moz of gold in resource but was also valued at about $1.6bn while Spartan had a little over 1Moz and a market capitalisation of circa $200m.

“The main difference is that Bellevue only has a high-grade discovery rejuvenation story behind them whereas [Spartan] has a legacy we are still dealing with from when it went into administration in 2018 and sunk a lot of shareholders,” he noted.

However, Lawson noted that while the company was seeking shareholder approval on 18 August to change its name to Spartan Resources, this was in his view, the final step in the company’s turnaround story.

At the time of when Stockhead spoke to Lawson, Spartan was still awaiting its name change from Gascoyne whilst Lawson viewed the transformation as the final step in the company’s turnaround. This change officially came into effect in the tail end of August.

“I don’t change the name and then try and change the future. What we’ve done is changed the future and now we earn the right to change the name,” Lawson said.

“Previously they were mining a marginal circa sub 1g/t deposit and they went into administration because it was uneconomic and then we made the tough decision in November last year to put the plant on care and maintenance and grow the high-grade discovery that we found because I didn’t want to lose control of the assets.”

This now looks to have been the right decision with the company growing its high-grade inventory from 90,000oz to more than 720,000oz in less than 12 months along with the corresponding growth in overall resource to almost 1.2Moz at 2.2g/t within 10km of the plant.

That’s not to say that the company hasn’t already begun to repay investors, given that shares in the company have increased more than 150% since it raised $50m at 10c per share in February 2023.

Lawson points out the key thing for people to look forward to now is the company’s planned restart decision in the middle of 2024 as it had laid out when it had raised the funds.

“For us, it is about continuing to grow that value equation and showing people that the replacement cost of the mill alone is worth more than our market cap right now,” he added.

Second star to the right

So just what is so magical about the Never Never deposit that has changed the company’s fortunes so?

Like the fairy tale land, the Never Never deposit is an anomaly though rather than being a place where no one grows old, it is a high-grade gold deposit in what’s ostensibly a “low-grade” greenstone belt.

It is also a perfect example of how challenging established beliefs can sometimes yield rich rewards.

The belief held by “old geologists” that the Gilbey greenstone belt only hosts low-grade mineralisation is not one that Lawson shares.

“Greenstone belts have the capacity to have low-grade and high-grade gold, lithium, nickel, base metals – all kinds of different types of deposits in them,” he told Stockhead.

“It is just a matter of drilling and thinking about things differently and that’s the approach we took.

“We decided that doing the same thing and trying to find 1g/t orebodies was not our future, so we set about really putting pressure on the geology and we let the statistics of the greenstone belt talk.

“We were lucky enough to find within 300m of an initial discovery extension hole to find that high-grade and now over 400 drill holes later, we have proven that there is a different structural element to this topology, which hosts high-grade gold mineralisation.”

Never Never, which was delineated at a low cost of just $13/oz, has excellent endowment with the underground component averaging 1,590 ounces per vertical metre over a short strike length with favourable geometry.

This typically makes for very profitable mining especially when you consider that the resource confidence is high with 76% sitting in the Indicated category.

And while the company is focused on growing Never Never, it has also identified two or three more lookalike structures in the project from historical data that could host more high-grade zones.

“We are continuing to look into the historical data that supports the basis for drilling these high-grade, lookalike structures which are sitting within the Gilbeys pit,” Lawson added.

“That data set exists, it is about working our way through and putting together all that evidence and then going to drill these things out.”

Well-maintained infrastructure

Spartan’s other big advantage is the well-maintained infrastructure at Dalgaranga, particularly the 2.5Mtpa processing plant.

“The replacement value of the plant is somewhere north of $200m and in terms of time frame, it would take you two years to build this kind of plant because of the lead time on equipment – particularly the power station, mill and crusher, which are very long lead items,” Lawson noted.

“We are very blessed to have that equipment there and we have done study work on that plant, and we’ve worked out that the Never Never orebody is actually better suited to the type of plant we have than the previous orebody.

“It’s a very much a beneficial situation to have that plant sitting there and we have people whose primary role is to ensure that every piece of that plant is being secured and prevented from corroding and we continue to rotate the mill to make sure that it doesn’t rust, keep all the greasing system working. “

He added that having the plant in place meant the company could put the high-grade material from Never Never in and produce gold at far healthier margins than the previous operation was ever capable of achieving.

This combination of a high-grade resource and processing plant could also put the company on the acquisition radar of bigger companies, though Lawson stressed that his focus was on delivering the best outcome for shareholders and that is currently to keep growing Never Never before making the decision to turn the plant back on.

“It is just important that we are able to stand on our own two feet and support our own shareholders because I think there’s a lot of companies out there that kind of set themselves up as acquisition targets and that strategy is their own strategy,” he added.

“I’m not going to put all my eggs in one basket. I am certainly going to make us a viable business first. But if they want to come along and make an offer to my shareholders, then I’m certainly supportive of the best outcome.”

Board driving growth

Lawson himself is a mine geologist who made his name as a key part of the geology team during his year tenure at Northern Star Resources and is focused on building a business first and a mining company second.

He has almost 20 years of operational experience and is particularly passionate about underground mining – which is incidentally what Spartan now has in Never Never.

Non-executive chairman Rowan Johnston is a very experienced mining engineer who spent a lot of time with Bardoc Gold and a number of other companies that are also open pit and underground miners.

Spartan also has Hansjoerg Plaggemars and John Hodder as non-executive directors representing major shareholders Deutsche Balaton and Tembo Capital.

Plaggemars is an accountant while Hodder is a geologist and banker who, along with former finance director and now non-executive director David Coyne, ensure that the company is well looked after from a financial perspective.

“Underneath me, I have a very experienced geologist who is looking after the exploration and drilling activities whilst Nick Jolly, who came from Northern Star as well, has a 20-year experience,” Lawson said.

“Then we have Chris O’Brien, a very experienced mining engineer who basically looks after our project work at the moment and is just starting on the reserves process for the Never Never deposit.

“We’re very comfortable in terms of experience level for where we’re sitting right now and we’re certainly setting up for the future.”

Sydney-based corporate advisory firm Bridge Street Capital certainly believes that the future is bright for Spartan, flagging recently that a net asset value (NAV) per share of between 40c and 60c is perhaps a more accurate assessment of the company’s value and that delivering more success at the drill bit could see its estimates increase further.

This article was developed in collaboration with Spartan Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.