Spartan on the march for more high-grade gold with big 25,000m drill campaign at Dalgaranga

High-grade gold is the objective of Spartan’s 25,000m drill program. Pic: Tassel via Getty Images.

- Aggressive 25,000m drill program aimed at extending high-grade resources at Dalgaranga

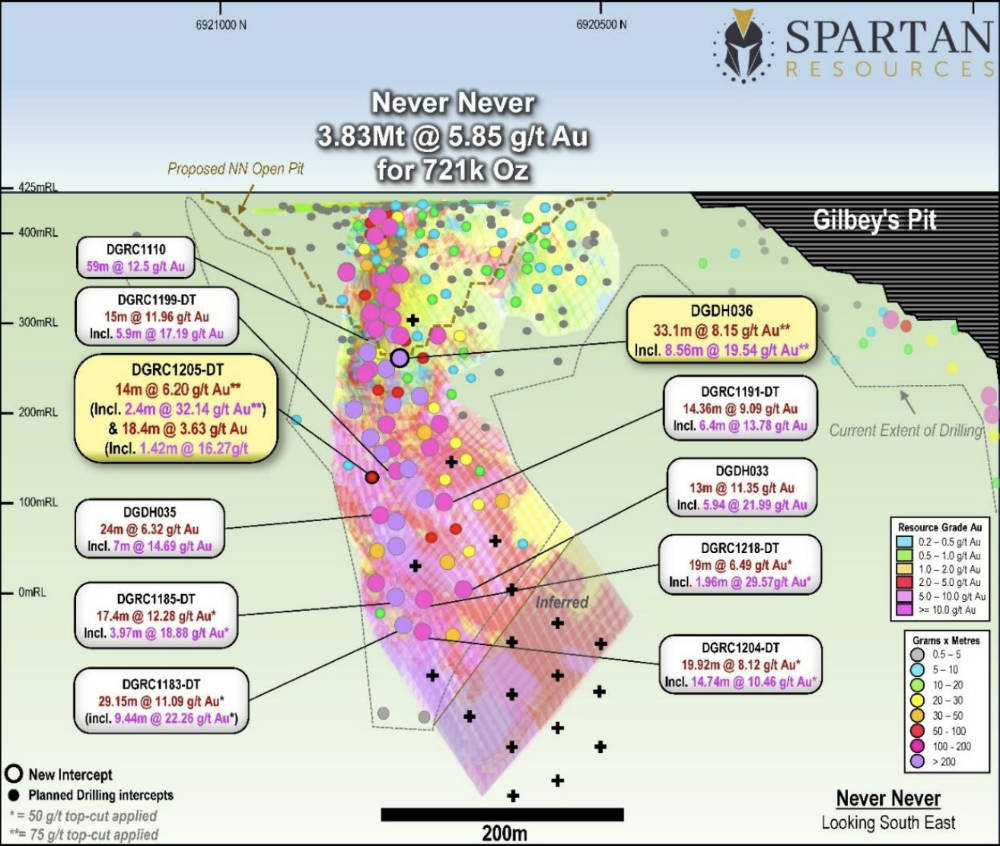

- Drilling to extend existing high grade 721,000oz resource at Never Never

- Spartan will also test Four Pillars and West Winds prospects

Spartan has launched an aggressive 25,000m drill offensive aimed at adding more high-grade ounces to its inventory at the Dalgaranga project in WA’s Murchison region.

Spartan is turning things around at Dalgaranga, a formerly producing project with an existing 2.5Mtpa processing plant.

A game changing moment came in the discovery of Never Never, a high grade (5.85g/t) 721,200oz and growing resource just 1.5km from the plant.

Managing director Simon Lawson previously told Stockhead that “old geologists” might think that Never Never is an anomaly, as the Gilbey greenstone belt it sits in was previously thought to only host low-grade mineralisation.

He doesn’t share this view.

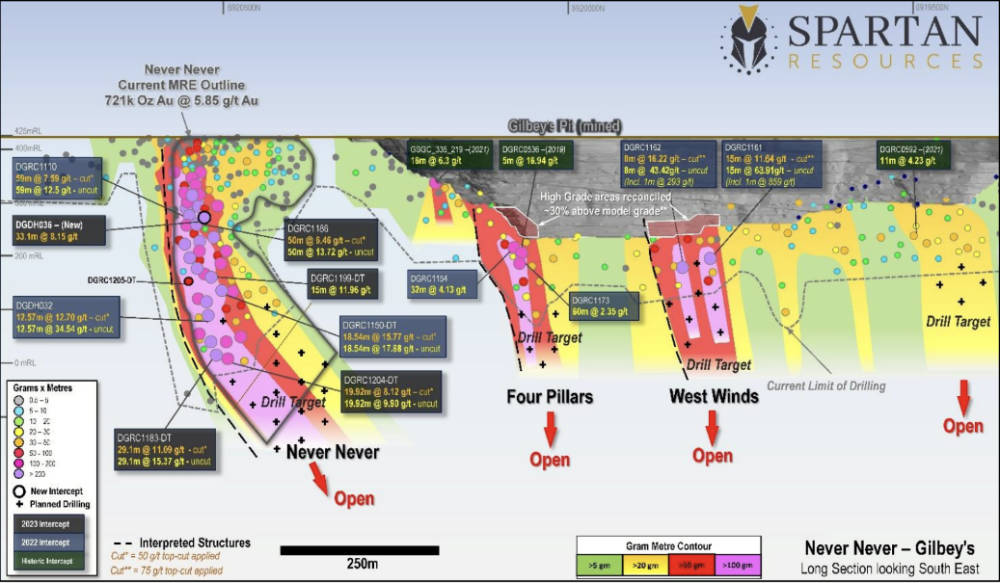

Whilst there is certainly room to keep growing Never Never, Spartan Resources (ASX:SPR) has also identified two or three more lookalike structures in the project from historical data that could host more high-grade zones.

Lawson added that the company was looking into historical data that supports the basis for drilling these high-grade, lookalike structures which are sitting within the Gilbeys pit.

“That data set exists, it is about working our way through and putting together all that evidence and then going to drill these things out,” he said.

Drilling offensive

Spartan has mobilised an army of three diamond rigs and one reverse circulation rig to carry out its 25,000m drill program to strengthen the case for multiple underground mining scenarios and enhance existing open-pit optimisations, including potential Gilbey’s cut-back options.

Drilling will focus on extensions to the high-grade Never Never deposit at depth as well as testing its lookalikes – the Four Pillars and West Winds prospects located along strike to the south.

The very first hole in this campaign, which was drilled to test the base of the conceptual open pit at Never Never, has already delivered a very encouraging result of 33.1m grading 8.15g/t gold from a down-hole depth of 169.4m including 8.56m at 19.54g/t gold.

Four Pillars strikes westward into the hanging-wall of the Gilbey’s stratigraphy and is located at the northern end of the Gilbey’s open pit about 350m south of Never Never.

It is supported by historical drilling as well as re-logging of drilling completed in late 2022m which returned intercepts of 60m at 2.35g/t gold from 141m and 32m at 4.13g/t gold from 40m at Four Pillars.

West Winds also strikes west into the hanging-wall of the Gilbey’s open put about 200m south and parallel to Four Pillars.

It is also supported by historical drill assays as well as the 2022 drilling, which returned hits of 15m at 11.64g/t gold from 224m and 8m at 16.22g/t gold from 256m.

Both Four Pillars and West Winds are open along-strike and down-plunge with the potential to be part of both a “re-shaped” Gilbey’s open-pit cutback scenario as well as an underground resource and mining scenario.

Another significant target to be tested is the Sly Fox deposit, the open pit component of which was mined during 2019/2020.

Sly Fox is situated east of Gilbey’s and strikes parallel to the West Winds and Four Pillars prospects as well as the Never Never deposit.

The underground component of this target is open at depth and supported by numerous unmined high-grade drill assays extending known mineralisation from the base of the open pit to below 500m from surface.

Cracking the code at Dalgaranga

“Never Never has shown that we can find and define substantial high-grade gold resources in the Dalgaranga greenstone belt,” Lawson said.

“What we have learned about the characteristics of the high-grade Never Never gold deposit are strikingly similar to numerous previously isolated observations in existing drilling and production data within and around the Gilbey’s sequence of deposits.

“Our geology team has pieced together that disparate information and now sees incredible similarities in orientation, grade and the structural origin of many of the higher-grade areas within Gilbey’s pit and surrounding deposits.

“Most importantly, in all cases where we have advanced the targets through to current drill follow-up, there are existing high-grade drill assays forming the basis of our targeting rationale.”

He added that West Winds has some of the highest-grade drilling assays seen at Dalgaranga, as well as the best reconciled high-grade gold production figures on record, making it a very exciting (and likely high-grade) resource target.

“I believe that our team has cracked an important part of the code at Dalgaranga and we have already delivered more than 720,000 high-grade ounces in less than 12 months’ work,” Lawson added.

“We are actively defining new high-grade prospects right in front of the mill.”

“We have moved very quickly to drill and leverage those identified opportunities and this team will generate more significant high-grade discoveries across multiple high-priority targets within the next few months as well as into the future.”

Regional targets

Besides these drill targets, the company added that a Sub-Audio Magnetic geophysical survey during the first half of 2023 had generated a vast number of potential targets within 2km of the processing plant.

While the company’s geology team are currently working to rank the targets for drilling with priority to the mining lease, early interpretation of the results had led to the drilling of the Arc target about 1km north of Never Never.

This returned encouraging assays such as 10m at 2.75g/t gold from 79m.

This article was developed in collaboration with Spartan Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.